An Introduction to Equity Derivatives

Theory and Practice

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Everything you need to get a grip on the complex world of derivatives

Written by the internationally respected academic/finance professional author team of Sebastien Bossu and Philipe Henrotte, An Introduction to Equity Derivatives is the fully updated and expanded second edition of the popular Finance and Derivatives. It covers all of the fundamentals of quantitative finance clearly and concisely without going into unnecessary technical detail. Designed for both new practitioners and students, it requires no prior background in finance and features twelve chapters of gradually increasing difficulty, beginning with basic principles of interest rate and discounting, and ending with advanced concepts in derivatives, volatility trading, and exotic products. Each chapter includes numerous illustrations and exercises accompanied by the relevant financial theory. Topics covered include present value, arbitrage pricing, portfolio theory, derivates pricing, delta-hedging, the Black-Scholes model, and more.

- An excellent resource for finance professionals and investors looking to acquire an understanding of financial derivatives theory and practice

- Completely revised and updated with new chapters, including coverage of cutting-edge concepts in volatility trading and exotic products

An accompanying website is available which contains additional resources including powerpoint slides and spreadsheets. Visit www.introeqd.com for details.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

| Rule | Result | Example: from 15 January 2012 to 13 March 2015 |

| 1. Count the number of whole years | Y | 3 (from 15 January 2012 to 15 January 2015) |

| 2. Count the number of remaining whole months and divide by 12 | M/12 | 1/12 (from 15 January 2015 to 15 February 2015) |

| 3. Count the number of remaining days (the last day of the month counting as the 30th unless it is the final date) and divide by 360 | D/360 | 28/360 (under the 30/360 convention there are 16 days from 15 February 2015 to 1 March 2015 at noon and 12 days from 1 March 2015 to 13 March 2015) |

| TOTAL | Y + M/12 + D/360 | 3 + 1/12 + 28/360 = 3.161111… |

| Semester (half year) | 0.5 year |

| Quarter (three months) | 0.25 year |

| Month | 1/12 year |

| Week | 7/360 year |

| Day | 1/360 year |

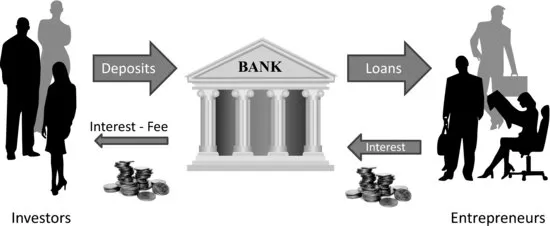

- Investors, who have money and want to get richer while they remain idle;

- Entrepreneurs, who don't have money but want to become rich using the money of others.

- €10 of interest paid over one year on a capital of €200 corresponds to a 5% annual gross interest rate.

- $10 of interest paid every year for five years on a capital of $200 corresponds to a 25% gross interest rate over five years, which is five times the above annual rate.

Table of contents

- Cover

- Title Page

- Copyright

- Foreword

- Preface

- Addendum: A Path to Economic Renaissance

- Part I: Building Blocks

- Part II: First Steps in Equity Derivatives

- Part III: Advanced Models and Techniques

- Solutions

- Appendices

- Index