![]()

PART I

MEET THE REIT

![]()

CHAPTER 1

REITs: What They Are and How They Work

“Buy land. They ain’t makin’ any more of the stuff.”

—Will Rogers

What’s your idea of a perfect investment? That’s a trick question—there is no perfect investment! Greater returns come with greater risk. But those looking for above-average current returns, along with reasonably good price appreciation prospects over time—and with only modest risk—will certainly want to consider apartment communities, office and industrial buildings, shopping centers, and similar investments. In other words, commercial real estate that can be leased to tenants to generate reliable streams of rental income.

Sure, you might say, but only if there were an easy way to buy and own real estate, where an experienced professional could handle the business of owning and managing it well and efficiently, and give you the profits. And only if you could sell your real estate—if you wanted to—as easily as you can sell a common stock like General Electric or Intel. Well, read on. This is all possible with real estate investment trusts, or REITs (pronounced “reets”).

REITs have provided investors everywhere with an easy way to buy major office buildings, shopping malls, hotels, and apartment buildings—in fact, just about any kind of commercial real property you can think of. REITs give you the steady and predictable cash flow that comes from owning and leasing real estate, but with the benefit of a common stock’s liquidity. Equally important, REITs usually have ready access to capital and can therefore acquire and build additional properties as part of their ongoing real estate business.

Besides that, REITs can add stability to your investment portfolio. Real estate as an asset class has long been perceived as an inflation hedge and has, during most market periods, enjoyed fairly low correlation with the performance of other asset classes.

REITs have been around for nearly 50 years, but it’s only been in the past 20 that these appealing investments have become widely known. From the end of 1992 through the end of 2010, the size of the REIT industry has increased by more than 20 times, from just under $16 billion to $389 billion. But the REIT industry, having so far captured only about 10 to 15 percent of all institutionally owned commercial real estate, still has plenty of room left for growth.

Stan Ross, former managing partner of Ernst & Young’s Real Estate Group, defined REITs by saying, “They are real operating companies that lease, renovate, manage, tear down, rebuild, and develop from scratch.” That helps define a REIT, but investors need to know what they can expect from it in terms of investment behavior. That’s really what this book is about.

REITs provide substantial dividend yields, which have historically exceeded the yields of most publicly traded stocks, making them an ideal investment for an individual retirement account (IRA) or other tax-deferred portfolio. Their actual dividend yields tend to be somewhat correlated with—and generally higher than—yields on 10-year U.S. Treasury bonds. But, unlike most high-yielding investments, REIT shares have a strong likelihood of increasing in value over time as the REIT’s properties generate higher cash flows, the values of their properties increase, and additional properties are added to the portfolio.

REITs Are a Liquid Asset

A liquid asset or investment is one that has a generally accepted value and a market where it can be sold easily and quickly at little or no discount to that value. Direct investment in real estate, whether it be a shopping mall in California or a major office building in Manhattan, is not liquid. A qualified buyer must be found, and even then, the value is not clearly established. Most publicly traded stocks are liquid. REITs are real estate–related investments that enjoy the benefit of a common stock’s liquidity.

TIP

REITs own real estate, but when you buy a REIT, you’re not just buying real estate, you’re also buying a business.

When you buy stock in Exxon, for example, you’re buying more than oil reserves. And with REITs, you own more than its real estate. The vast majority of REITs are public real estate companies overseen by financially sophisticated, skilled management teams who have the ability to grow the REIT’s cash flows (and dividends) at rates in excess of inflation. Adding a 4 percent dividend yield to capital appreciation of 4 percent, resulting from 4 percent annual increases in operating cash flow and property values, provides for total return prospects of 8 percent annually.

A successful REIT’s management team will accept risk only where the odds of success are high. REITs must pay out most of their earnings in dividends to shareholders, and thus must be very careful when they invest retained earnings. REITs operate their properties in such a way that they generate steady income; but they also have an eye to the future and are interested in growth of the property portfolio, its values and its cash flows, and in taking advantage of new opportunities.

Types of REITs

There are two basic categories of REITs: equity REITs and mortgage REITs.

An equity REIT is a publicly traded company that, as its principal business, buys, manages, renovates, maintains, and occasionally sells real estate properties. Many are also able to develop new properties when the economics are favorable. It is tax advantaged in that it is not taxed on its income and, by law, must pay out at least 90 percent of its net income as dividends to its investors.

A mortgage REIT is a REIT that makes and holds loans and other debt instruments that are secured by real estate collateral.

The focus of this book is equity REITs rather than mortgage REITs. Although mortgage REITs have higher dividend yields and can, at times, deliver spectacular investment returns, equity REITs are less vulnerable to changes in interest rates and have historically provided better long-term total returns, more stable market price performance, lower risk, and greater liquidity. In addition to that, equity REITs allow the investor to determine not only the type of property he or she invests in, but also, quite often, the geographic location of the properties.

General Investment Characteristics

Performance and Returns

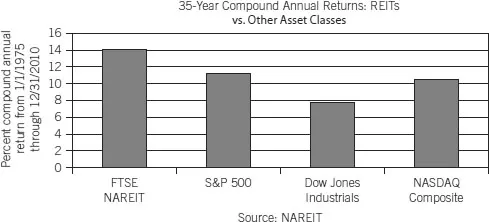

Although the long-term performance of equity REITs varies with the measurement period used, they have, during most time horizons, compared quite well with that of broader stock indices such as the S&P 500 index. For example, according to data provided by the National Association of Real Estate Investment Trusts (NAREIT), shown in Figure 1.1, during the 35-year period ending December 31, 2010, equity REITs delivered an average annual total return of 14.0 percent. This compares quite well with the returns from various other indices during the same time period.

However, if REITs’ performance was merely comparable to the Standard & Poor’s (S&P) 500, you wouldn’t be reading a book about them. And the performance of many high-risk stocks has substantially exceeded the returns provided by the broad market. Here’s the difference: REITs have provided total returns comparable to the S&P 500 index despite having benefits not usually enjoyed by stocks that keep pace with the market, including only modest correlation with other asset classes, less market price volatility, more limited investment risk, and higher current returns. Let’s look at each of these.

Lower Correlations

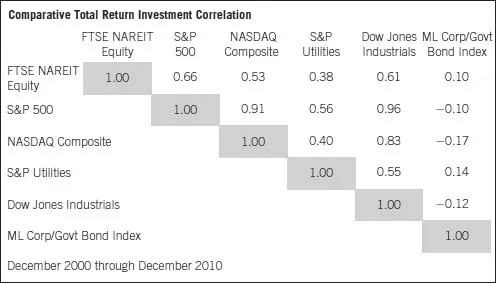

Correlations measure how much predictive power the price behavior of one asset class has on another to which it’s compared. In other words, if we want to predict what effect a 1 percent rise (or fall) in the S&P 500 will have on REIT stocks, small caps, or bonds for any particular time period, we look at their relative correlations. For example, if the correlation of an S&P 500 index mutual fund with the S&P 500 index is perfect, that is, 1.0, then a 2 percent move in the S&P 500 would predict that the move in the index fund for the same period would also be 2 percent. Correlations range from a perfect +1.0, in which case the movements of two investments will be perfectly matched, to a –1.0, in which case their movements will be completely opposite. A correlation of 0.0 suggests no correlation at all. Correlations in the investment world are important, as they allow financial planners, investment advisers, and individual or institutional investors to structure broadly diversified investment portfolios with the objective of having the ups and downs of each asset class offset one another as much as possible. This, ideally, results in a smooth increase in portfolio values over time, with much less volatility from year to year or even quarter to quarter.

According to NAREIT, as summarized in the graph in Figure 1.2, REIT stocks’ correlation with the S&P 500 during the period from December 1980 through December 2010 was just 0.55. Thus, price movements in REIT stocks have had only a 55 percent correlation with the broad market, as represented by the S&P 500, during that period. Accordingly, in markets where stocks are rising sharply, REITs’ relatively low correlation suggests that they may lag relative to the broad stock market indices. This happened in 1995, when REIT stocks underperformed the popular indices—but still provided investors with total returns of 15.3 percent—and in 1998 and 1999, when REITs’ returns were actually negative despite strength in the technology-led S&P 500. Conversely, during many bear markets in equities, such as in 2000 and most of 2001, lower correlating stocks such as REITs tend to be more stable and may suffer less. And yet there are some markets, as in 2008 and 2009, when virtually every investment, including REITs, will drop by similar amounts. When investors decide to unload everything, there is no place to hide!

A study of correlations by Ibbotson Associates completed in 2001 and updated in 2003 concluded that the correlation of REITs’ stock returns with those of other equity investments has declined significantly when measured over various time periods since 1972, when NAREIT first began to compile REIT industry performance data. Nevertheless, correlations will vary over time—particularly during short time frames—and REIT stocks have been more closely correlated with other stocks during the market turmoil of the past few years. However, because commercial real estate is a distinct asset class, and due to the unique attributes of REIT investing as discussed in this chapter and elsewhere in this book, it is reasonable to expect that REIT stocks will maintain fairly low correlations with other asset classes over reasonably long time periods.

Lower Volatility

A stock’s “volatility” refers to the extent to which its price tends to bounce around from day to day, or even hour to hour. My observations of the REIT market over the past 35 years have led me to the conclusion that REIT stocks are, most of the time, simply less volatile, on a daily basis, than other equities. Although REITs’ increased size and popularity, particularly over the past 5 years, has brought in new investors with different agendas and shorter time horizons, and thus created more volatility, REIT stocks should remain less volatile than their non-REIT brethren.

TIP

REITs’ higher current yields often act as a shock absorber against daily market fluctuations.

There is a predictability and steadiness to most REITs’ operating and financial performance from quarter to quarter and from year to year, and there is simply less risk of major negative surprises that can stoke volatility.

Another factor that should help to dampen the volatility of REIT stocks is their higher dividend yields. When a stock yields next to nothing, its entire value is comprised of all future earnings, discounted to the present date. If the perceived prospects for those earnings decline just slightly, the stock can plummet quickly. Much of the value of a REIT stock, however, is in the REIT’s current dividend yield, so a modest decline in future growth expectations will have a more muted effect on its trading price. The volatility of REIT stocks spiked from 2007 through 2009, due to concerns about REITs’ balance sheets and our nation’s space markets, but those issues were pretty much resolved by 2010, and a reasonable assumption for REIT investors is that REIT stock volatility will, in the future, as in most of the past, be lower than that of other equities.

This is important because our biggest investment mistakes tend to be the result of fear. When our stocks are going up, it’s human nature to ignore risk in our pursuit of ever greater profit...