![]()

CHAPTER 1

Start Small, Finish Big—Discover Big Profits in Small-Cap Stocks

“If I was running $1 million today, or $10 million for that matter, I’d be fully invested. Anyone who says that size does not hurt investment performance is selling. The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money. I think I could make you 50 percent a year on $1 million. No, I know I could. I guarantee that.

The universe I can’t play in has become more attractive than the universe I can play in. I have to look for elephants. It may be that the elephants are not as attractive as the mosquitoes. But that is the universe I must live in.”

—Warren Buffett, 1999, discussing small-cap stocks

An old saying claims that big shots are the little shots who just keep shooting.

In the case of the stock market—in particular, the world of small-cap stocks—that maxim is decidedly true. And that is terrific news for you. Over the last decade, I’ve developed a system for consistently finding outstanding small-cap stocks that deliver big gains to early investors. Throughout this book, I’ll share everything you need to know to achieve similar results in your own investment portfolio.

All great companies start out small. They are built by entrepreneurs who invest their time and money, raise capital privately, and turn their dreams into reality. Many of the world’s greatest innovations come from small, entrepreneurial companies, and very few come from the behemoths. In recent decades, smaller companies have increasingly been investing in research and development, helping fuel the growth of the overall economy. To illustrate: In 1981, 71 percent of corporate research and development dollars in the United States was spent by companies with more than 25,000 employees, while companies with fewer than 1,000 employees spent just 4 percent. By 2006, the large companies’ share had dropped to 38 percent, while the small companies’ share had risen to 23.7 percent; it is a trend that has continued to shift.1

Why? Charles Matthews, executive director of the Center for Entrepreneurship Education and Research at the University of Cincinnati, has observed that smaller firms historically employ a large percentage of computer analysts, engineers, and scientists. This drives an interest in innovation and research; today, most new jobs are generated among small companies, where the growth rate is going to be rapid in comparison to their larger competitors.

Small businesses are excellent incubators of innovation, especially technology-driven innovation. With generally flatter organizational structures, these leaner, hungrier companies can cut through the red tape, remain focused, and drive innovation with passion and efficiency.

The best of these young, innovative companies become publicly traded small-cap stocks. This allows individual investors like you to buy a piece of the action, and participate in the future growth and profits of these companies.

Small-Cap Investor: Eight-Step Process for Big Profits from Small Stocks

Throughout this book, I share with you my eight-step system for finding great small-cap stocks with big potential for financial out-performance and share price gains. I will show you exactly what you need to do to become a small-cap guru and profitable investor in small-cap stocks.

There are eight simple steps to follow in order to find, research, and analyze small-cap stocks that could put big gains in your portfolio.

Step 1: Growth Trends: Identify growth trends and market sectors positioned for rapid growth in the years to come.

Step 2: Finding Potential Winners: Screen more than 7,000 publicly traded companies to find those companies that are unknown performers positioned to grow.

Step 3: Fundamentals Matter: Understand the fundamentals of the potential investment, including products, services, and management’s ability to run the business.

Step 4: Financial Performance: Review and evaluate key metrics in a company’s financial statements to understand historical financial performance.

Step 5: Earnings Quality: Look for red flags that indicate financial manipulation or fraud to avoid investing in a small-cap lemon.

Step 6: Growth Outlook: Develop an understanding of expectations for growth to make valid valuation comparisons.

Step 7: Technical Analysis: Understand the technical indicators of share price movements to help timing of investments, and maximize profits while limiting losses.

Step 8: Pulling the Trigger: Determine the optimal timing for entering new positions by using effective trading strategies.

Using my system for finding, researching, analyzing, and ultimately buying and selling small-cap stocks will make it easy for you to find those companies with huge potential upside, and determine when and how to maximize your profits.

Throughout the book, I show you exactly how to use these eight simple steps for consistently finding and profiting from great small-cap stocks before their shares take off.

Small Caps as Generators of Growth

Many of the smaller, innovative growth companies that are publicly traded fit the definition of small caps. Market capitalization is a measure of the total value of a company, calculated by multiplying shares outstanding by share price. As the term “small cap” suggests, these are the smaller companies, those with a market capitalization below $2 billion (mid caps range in size between $2 billion and $10 billion, and large caps are those with market caps exceeding $10 billion).

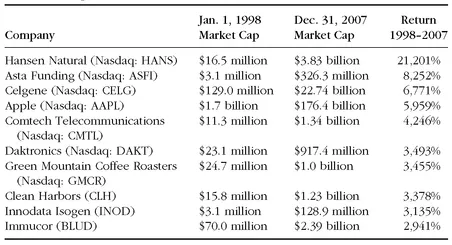

On my investment website, SmallCapInvestor.com, I focus on the small-cap stocks with market capitalization below $2 billion, and often those below $500 million. It is often the case that the smaller the better when trying to find companies poised to deliver big gains. Table 1.1 shows a list of the 10 best performing stocks and their returns for the decade ending December 31, 2007.

The returns are impressive. But look at the market capitalizations of these companies in 1998; nearly all of them are below $100 million. The smallest of the small caps tend to perform best—those unknown gems that have not yet become the darlings of Wall Street.

How many of these companies had you heard of in 1998, or even today after their significant growth? With the exception of Apple, probably not many. This is because most of the best small-cap opportunities are not well known today, and the key is to find them right before they become huge successes and their shares have risen significantly. This is the challenge.

TABLE 1.1 Top 10 Best Performing Stocks: 1998-2007

Source: Capital IQ, www.capitaliq.com

What is most appealing about small-cap stocks? There are a number of attributes. An investment-worthy small cap is often a young company experiencing its fastest period of growth. The company introduces new products or services, launches strategic partnerships, or enters a new market while still flying under the radar of its larger competitors, remaining unnoticed by Wall Street analysts and investors. With fewer employees and lower expenses compared with larger companies, small caps have the unrestrained flexibility to pursue growth and have the ability and desire to take risks that are often avoided by the dominant industry players. This situation can catapult a small, unknown company into a roaring success, and in doing so, create millionaires out of early shareholders who stay the course.

Want proof? Let’s examine a few examples of some of the best performing stocks in the history of the stock market. While I’m sure you’re familiar with each of these companies, perhaps you are less aware that all started as entrepreneurial, small-cap companies that grew into well-known businesses, making big gains for early investors:

• Cisco Systems (Nasdaq: CSCO): An investment of $10,000 in 1990 grew to $34.5 million by 2008, a gain of over 34,000 percent. The company’s IPO valued the tech company at $224 million, and 18 years later the company was valued at $180 billion. The reason that Cisco has grown in an explosive arc is due to yet another trend identified early and ridden from there on: computer networking. The brainchild of husband and wife Len Bosack and Sandy Lerner, the company got its start by developing and selling routers, but not just any other router like those already on the market. Theirs was the first to support multiple network protocols; although that technology was eventually supplanted, Cisco had its foothold. The company later branched out with careful insight, moving into Ethernet, switching, security, ATM networking, and other areas. Although Cisco was, in fact, the most valuable company in the world at the peak of the dot-com boom of the late 1990s and into the early 21st Century, it has since declined in value but remains one of the icons of the American technology community.

• Dell (Nasdaq: DELL): went public in June 1988 as a small-cap valued at $200 million. As of the end of 2008, market cap was more than $20 billion. An investment of $10,000 in June 1988 grew to $2.8 million in 20 years. Why the meteoric rise? The most revolutionary aspect of Dell’s operation was its direct sales marketing strategy. Rather than using re-sellers to sell its products, Dell established a one-on-one relationship with its customers. But that meant more than just direct selling. It spelled the beginning of a highly personal form of interaction with Dell customers. For instance, in 1985 Dell began establishing customer service as the bedrock of the company’s philosophy and approach, offering a risk-free return policy and next day in-home professional support. Three years later, Dell raised $30 million in its initial public offering, and the company was off and running.

• Microsoft (Nasdaq: MSFT): An investment of $10,000 in 1986 was worth $3.4 million by 2008, as the company’s market capitalization soared from $488 million at the time of its IPO to over $200 billion. An idea whose time had come—the personal computer in every household—quickly established Microsoft as the premier provider of user-friendly software. Although the company is now synonymous with its line of Windows products, its first real commercial success derived from its DOS operating systems (remember those?). Microsoft beat out IBM because its Windows system was simply easier to use—in fact, much easier. The company debuted in the public market with a share price of $21. Thanks to these and other innovations, by December 1999 the price per share (adjusted for stock splits) topped over $17,000.

•

Wal-Mart (NYSE: WMT): An investment of $10,000 in 1972 was worth $7.61 million by 2008. Like other small companies that blossomed, Wal-Mart captured and leveraged a revolutionary idea—in Wal-Mart’s case, discount retailing. The company went public with a market capitalization of only $21 million, and it was worth $200 billion by 2008. Prior to opening his first store in Rogers, Arkansas, in 1962, Sam Walton exhaustively researched the prevailing consumer market and determined that shoppers could live better by saving on a broad variety of goods and products. For Walton, that was in large part a bottom-up proposition; as the company grew, Walton still tried to visit each store at least once a year, asking employees for their input and singular perspective of what consumers wanted and valued most. (This direct market research style is employed by Starbucks founder Howard Schultz and other retail executives.)

Although Wal-Mart has come under fire for labor practices and other issues, its success is undeniable. By 2009, 7,390 Wal-Mart stores (and its adjunct Sam’s Club operations) were open for business, employing more than two million people and making the company the largest retailer and private employer in the world.

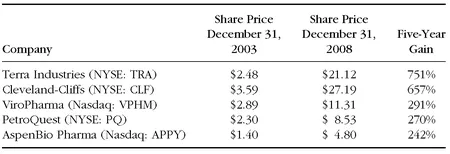

These are all extraordinary success stories, but they’re by no means exceptions to the rule, particularly when you look at the long term. While these are the big name winners that every investor aspires to duplicate with his or her investments, buying Cisco Systems in 1990 and holding it until today isn’t the norm. But for every Cisco Systems or Microsoft, there are hundreds of lesser-known small-cap companies providing early investors with gains of 100, 300, 500, and even more than 1,000 percent. Even if the company doesn’t become a household name, investors can bank major gains from the appreciation in share price. And the best part is that most people, active investors included, have never heard of many of these companies, even after they have posted huge returns. Table 1.2 identifies some of these lesser-known success stories over the past five years.

Small-cap stocks fit nicely into just about anyone’s investment portfolio. No matter if you’re in your twenties, saving for your children’s college education, or currently retired, small caps have a place in a well-diversified plan, along with mid- and large-cap equities and fixed income securities. The growth that can be achieved with small-cap stocks is significant, and can help boost the returns for a diversified portfolio. For this reason alone, small caps must be on the table for every investor.

TABLE 1.2 Top Five Best Performing Stocks: 2003 to 2008

Source: The Motley Fool, www.fool.com

An Example of Small-Cap Success

The companies highlighted in the previous sec...