Forecasting in Financial and Sports Gambling Markets

Adaptive Drift Modeling

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

A guide to modeling analyses for financial and sports gambling markets, with a focus on major current events

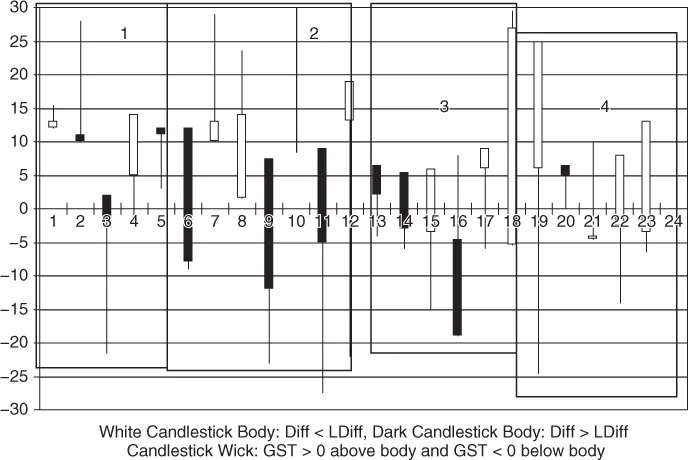

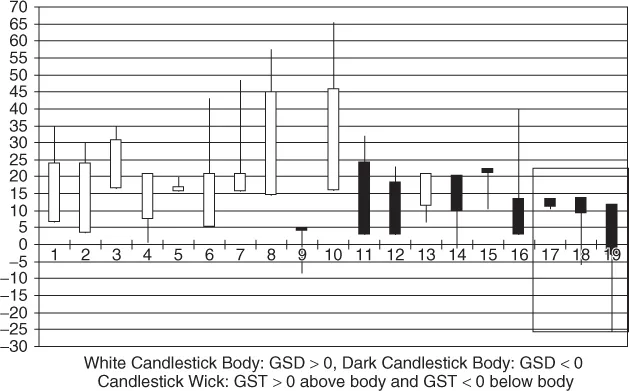

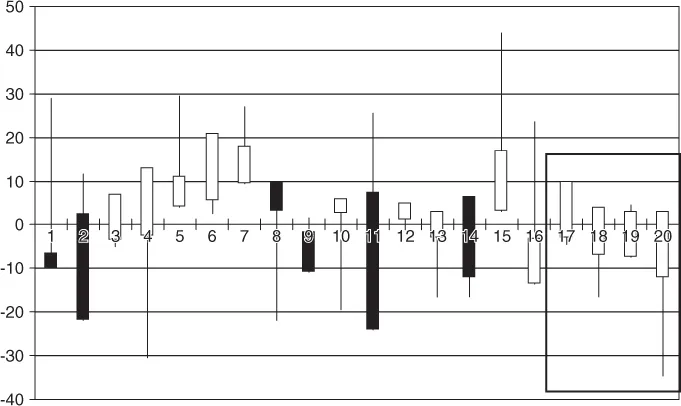

Addressing the highly competitive and risky environments of current-day financial and sports gambling markets, Forecasting in Financial and Sports Gambling Markets details the dynamic process of constructing effective forecasting rules based on both graphical patterns and adaptive drift modeling (ADM) of cointegrated time series. The book uniquely identifies periods of inefficiency that these markets oscillate through and develops profitable forecasting models that capitalize on irrational behavior exhibited during these periods.

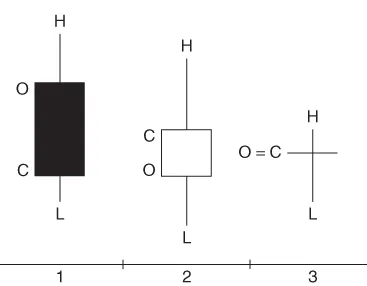

Providing valuable insights based on the author's firsthand experience, this book utilizes simple, yet unique, candlestick charts to identify optimal time periods in financial markets and optimal games in sports gambling markets for which forecasting models are likely to provide profitable trading and wagering outcomes. Featuring detailed examples that utilize actual data, the book addresses various topics that promote financial and mathematical literacy, including:

-

Higher order ARMA processes in financial markets

-

The effects of gambling shocks in sports gambling markets

-

Cointegrated time series with model drift

-

Modeling volatility

Throughout the book, interesting real-world applications are presented, and numerous graphical procedures illustrate favorable trading and betting opportunities, which are accompanied by mathematical developments in adaptive model forecasting and risk assessment. A related web site features updated reviews in sports and financial forecasting and various links on the topic.

Forecasting in Financial and Sports Gambling Markets is an excellent book for courses on financial economics and time series analysis at the upper-undergraduate and graduate levels. The book is also a valuable reference for researchers and practitioners working in the areas of retail markets, quant funds, hedge funds, and time series. Also, anyone with a general interest in learning about how to profit from the financial and sports gambling markets will find this book to be a valuable resource.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

| Outcome | Odds to $1 | Probability |

| Patriots to win by more than 7 points | $2.01 to 1 | 0.33 |

| Game decided by at most 7 points | $13.3 to 1 | 0.11 |

| Giants to win by more than 7 points | $0.79 to 1 | 0.56 |

| Outcomes for D(MSFT, t) | Odds to $1 | Probability |

| > $6 | $19.0 to 1 | 0.05 |

| [$6, $2) | $11.5 to 1 | 0.08 |

| [−$2, $2] | $7.33 to 1 | 0.12 |

| (−$2, −$6] | $3.00 to 1 | 0.25 |

| < − $6 | $1.04 to 1 | 0.49 |

Table of contents

- Cover

- Title Page

- Copyright

- Preface

- Acknowledgments

- Chapter 1: Introduction

- Chapter 2: Market Perspectives: Through a Glass Darkly

- Chapter 3: Opacity and Present-Day Dynamics

- Chapter 4: Adaptive Modeling Concepts in Dynamic Markets

- Chapter 5: Studies in Japanese Candlestick Charts

- Chapter 6: Pseudo-Candlesticks for Major League Baseball

- Chapter 7: Single-Equation Adaptive Drift Modeling

- Chapter 8: Single-Equation Modeling: Sports Gambling Markets

- Chapter 9: Simultaneous Financial Time Series

- Chapter 10: Modeling Cointegrated Time Series Associated with NBA and NFL Games

- Chapter 11: Categorical Forecasting

- Chapter 12: Financial/Mathematical Illiteracy and Adolescent Problem Gambling

- Chapter 13: The Influenza Futures Markets

- References

- Index