- English

- ePUB (mobile friendly)

- Available on iOS & Android

Tips, Tricks, Foreclosures, and Flips of a Millionaire Real Estate Investor

About this book

Want to cash in on real estate investing? A millionaire tells you how.

Tips, Tricks, Foreclosures, & Flips of a Millionaire Real Estate Investor features ideas and techniques from millionaire real estate investor, Aaron Adams. Inside, he details the strategies he's repeatedly used to make money—and shows you how to do the same.

Incorporating advice from Adams's mentors and experienced investors who taught him the pros and cons of investing, he details how he learned to pick an individualized strategy based on where he was living... so that you can do the same.

•Harness the techniques that have made Aaron Adams millions

•Discover insiders' tips on real estate investment

•Implement proven strategies with cash rewards

•Get started right away with confidence

For those with real estate investing experience, this book offers new ways to use old ideas in the contemporary market—backed by Adams's experience purchasing hundreds of properties over the years.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

1

Using Public Records to Find Home Run Deals

- Public tax records can reveal a lot about a property.

- Search records to find addresses that are different from the physical address and the mailing address.

- Search records to find owners who have owned properties for a long time.

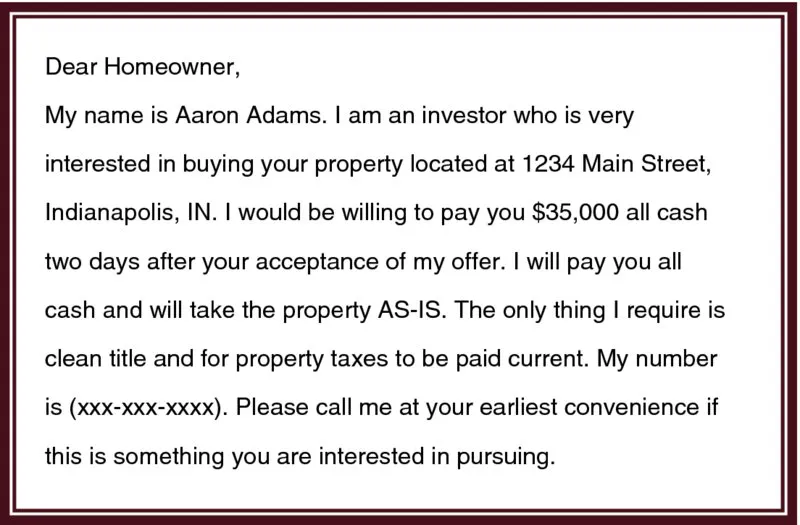

- Politely and proactively reach out to these owners and offer them a specific amount for their property.

- Consider going by the investor’s home and leaving a hand- written note so your letter isn’t viewed as junk mail.

- Develop a network of investors who you can flip deals to for a quick profit.

2

Using Hand-Delivered Letters to Get Deals

- Pre-Foreclosure: Owner is behind on his mortgage payments.

- Foreclosure: Property is auctioned off at public auction.

- REO: Property is not sold at auction, goes back to the bank (Real Estate Owned) and is usually listed with an REO broker.

Table of contents

- Cover

- Praise for Tips, Tricks, Foreclosures, & Flips of a Millionaire Investor

- Titlepage

- Copyright

- Dedication

- From Employee to Investor

- 1 Using Public Records to Find Home Run Deals

- 2 Using Hand-Delivered Letters to Get Deals

- 3 Using Yard Signs to Find Motivated Sellers

- 4 Finding Where All the Real Investors Hang Out (It’s Not at Real Estate Investing Clubs!)

- 5 Using Property Management Companies to Find Deals

- 6 Creatively Selling Properties to Other Investors

- 7 Finding Motivated Buyers

- 8 Selling to Tenants: Working Backward to Find a Buyer

- 9 Selling to the Tenants Be the Bank

- 10 How to Get Money to Invest When You Are Broke

- 11 Buying Properties in the U.S. at Foreclosure Auctions

- 12 Flipping Properties to Homeowners

- 13 Active vs. Passive, High Value vs. Low Value

- 14 Understanding the Four Cs of Real Estate Investing

- 15 Four Factors That Make a Great Market

- 16 The Five Fs

- 17 PPP

- 18 Key Points for the International Investor

- 19 Five Glass Ceilings

- 20 Glass Ceiling #1: Finding and Supplying a Product to Sell

- 21 Glass Ceiling #2: Selling a Product

- 22 Glass Ceiling #3: Building a Team of Employees and Partners

- 23 Glass Ceiling #4: Raising Capital to Fund and Grow Your Business

- 24 Glass Ceiling #5: Developing Systems to Accelerate Growth

- 25 Finding, Flipping, and Financing Mobile Homes for Quick Cash

- Acknowledgments

- About the Author

- Index

- End User License Agreement