![]()

CHAPTER 1

SETTING THE STAGE

“I never failed once. It just happened to be a 2,000-step process.”

—Thomas Edison

Since you turned the page from the introduction, I am assuming that you have either decided to raise outside funding for your venture or you first want to learn more about the whole process so that you can make that determination. But since I don’t know your current starting point, let’s just start at the beginning.

BOOTSTRAPPING

With as little as it costs to get a software startup off the ground these days, many entrepreneurs start off as bootstrappers rather than fundraisers. Bootstrapping is when your company supports itself on existing or personally available resources rather than external sources of capital. Many startup ventures are initially bootstrapped until a sufficient business plan is developed and some minimal level of validation exists in order to attract investors. There’s nothing wrong with bootstrapping, but staying in that mode for too long can carry some consequences that you should understand if you’re just getting started and later plan to raise money from investors.

There are many different methods of bootstrapping. For example, living off your savings account so you can work full-time on your startup venture is bootstrapping. Borrowing against your 401(k) retirement account to pay your bills while working full-time on your startup venture will cause you to incur debt and might not be recommended by your financial advisor, but it is bootstrapping. Working on your startup venture during nights and weekends while funding it with income from a day job is bootstrapping. Selling your car, leasing out your garage apartment, and auctioning off your valuable comic book collection to pay for your business expenses is bootstrapping. Secretly selling your spouse’s car and auctioning off his sentimental family heirloom paintings might cause a divorce, but if you use the proceeds to fund your venture, it is bootstrapping. Convincing others to work on your venture for no cash compensation while combining with any of the previous options is badass ninja bootstrapping.

What about investing your own capital to fund the engineering work to build a prototype of the product? That’s not bootstrapping; it’s self-funding.

What about friends and family funding? Borrowing money from Aunt Sally and Uncle Fred or convincing some sorority sisters to make a small investment to help you out is not bootstrapping. Instead, it’s an external investment just like borrowing money from a bank or convincing an investor to write a check. I mention this because I often hear entrepreneurs brag about bootstrapping all the way to their product launch, only to later discover prior investments from friends and family. I tip my hat to their accomplishment and then inform them about my definition of bootstrapping.

OK, you get the idea. It’s less important to have an official definition than it is to evaluate and understand the commonalities among the various methods and approaches to bootstrapping. We often refer to bootstrapped ventures and bootstrap-minded founders as scrappy. There are definitely benefits of being scrappy in the early days while you’re still trying to figure things out. But there are downsides that need to be understood as well, especially if the bootstrapping continues for a long period of time.

BENEFITS OF BOOTSTRAPPING

Many of the successful entrepreneurs that I respect the most are consummate and repeat bootstrappers. In fact, they take great pride in letting you know they’re bootstrappers. If you look, you’ll find them in your own community.

Before we talk about how long to bootstrap, let’s review some of the biggest benefits of bootstrapping. Some of you will be able to skip the bootstrap phase altogether for one reason or another, and that’s great. But you’ll miss out on at least some of the benefits.

Bootstrapping forces founders to find and attract other team members that have genuine passion for the problem being solved versus those looking for a paycheck. It causes hyper-focus on making rapid and sufficient progress to either be able to get funded or start bringing in revenue from product sales. It forces a detailed understanding of exactly where every dollar is being spent and its specific value to the mission.

Bootstrapping fosters maximum creativity, flexibility, and instincts for survival. It avoids investors telling you what to do, giving you a hard time about the decisions you’re making, or asking for a bunch of updates. Future investor prospects will be impressed by your passion and personal commitment to the venture as evidenced by your bootstrapping phase.

It is also true that a phase of bootstrapping comes with no dilution. In other words, you and your co-founders get to divvy up 100% of the equity. But there’s a reason that I mention the dilution benefit last. Please don’t extend your bootstrap phase as long as possible just to avoid dilution. If your business venture is best developed and grown by taking on some investment, you will be happier and richer in the long run if you do so. One of my favorite sayings is “Optimize for growth, not dilution.” You would much rather have a single-digit equity stake in a venture that eventually exits via acquisition or IPO at a valuation of $1 billion than having double-digit equity in a venture that crashes and burns or exits for $2 million, $10 million, or even $50 million.

DEFINITION: DILUTION

Dilution is the result of an activity that causes a shareholder’s equity to be reduced (diluted). Since equity is calculated by dividing a shareholder’s quantity of shares by the total shares held by the company, the most common causes of dilution involve issuing additional shares of stock into the company. This could happen as a result of raising an equity round of funding or needing to create a new stock option pool with available shares of stock. In both cases, the number of issued shares increases, and this causes each of the previous shareholders’ equity positions to be diluted.

HOW LONG SHOULD YOU BOOTSTRAP?

To answer this question, I need to set aside ventures that are planned to organically become profitable and sustainable on their own. Instead, I want to describe the more traditional tech startup scenario of pursuing multiple rounds of funding over time to grow aggressively and eventually reach a big exit.

I usually recommend bootstrapping at least long enough to gain sufficient evidence that your solution is desirable, which means your target customer wants it bad enough that they’re willing to pay for it. It’s also beneficial if you’re able to prove that the solution idea is feasible, which means it can be built to deliver the intended benefit. That doesn’t necessarily mean you will end up with a v1.0 product ready to launch after the bootstrapping phase, but rather that you should have enough proof that there’s minimal technical risk.

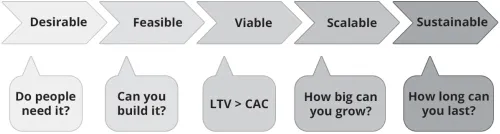

With both desirability and feasibility validated (or mostly validated), you still have a long way to go before you’ve grown a great company that’s both scalable and sustainable, as you can see from figure 1.1, but you are considerably less risky than before desirability and feasibility were validated. And that means you could be ready to pursue a round of funding. There are dozens of reasons why you still might not be successful getting funded, but that’s a topic for a future chapter.

Most startups that follow this approach will raise their first round of funding to launch the product and seek hints or proof of viability. Viability means the customer acquisition model yields a customer lifetime value (LTV) that is greater than the customer acquisition cost (CAC). Not just a little greater, but sufficiently greater to cover the costs of the other functions that aren’t related to customer acquisition, as well as various other operational overhead.

Figure 1.1. Levels of startup viability

THE DANGERS OF BOOTSTRAPPING TOO LONG

From time to time I come across startups that have been in bootstrap mode for a seemingly long time. You might be thinking that with all of the bootstrapping benefits I listed earlier, why not stay in this mode as long as possible? There are a few reasons to consider if you plan to raise funding from investors.

SLOW PROGRESS FOR TOO LONG

While in bootstrap mode, your financial resources are limited enough that your progress is also limited. If that goes on too long, investors might ask, “How is it that you’ve been working on this for almost two and a half years and only have ___ customers and ___ revenue?” Investors like to connect many dots, but when they connect yours over a long period of time, the slope of the curve isn’t very interesting.

MINDSET

The processes, culture, and general mindset of bootstrappers is fairly different from those that are funded and dialing in a big outcome. Staying in the bootstrap mode too long can cause that mindset to sink in to the point that investors are forced to wonder if you’ll be able to shift multiple gears directly into a...