![]()

CHAPTER 1

Pricing Concepts

The pricing method preferred by the Federal Acquisition Regulation (FAR) is cost-based—in other words, the detailed, grassroots, or bottom-up approach. This method segregates activities with costs into their smallest component tasks, which are then supported with details such as bills of materials, hours (based on history), or work-measurement standards and rates based on historical rates. Price proposals based on cost estimates require an evaluation by the government customer—in the Department of Defense (DoD), by either the Defense Contract Audit Agency (DCAA) or the Defense Contract Management Agency (DCMA). Government evaluations of price proposals are frequently referred to as audits and are based on the FAR—Part 15 for pricing, Part 30 for cost, Part 30 for Cost Accounting Standards, and Part 31 for cost allowability.

Pricing encompasses all of a contractor’s activities in offering a price to the government customer. Pricing considerations include market research, cost estimates, market conditions, market objectives, long-range contractor plans, and contractor workload. The focus of this book is on the cost-estimating aspect.

Cost-based pricing is used in all cost-reimbursement contracts, where the price is based on an after-the-fact audit of actual cost. Variations of cost-type contracts include cost-plus-fixed-fee, cost-plus-incentive-fee, cost-plus-award-fee, cost sharing, cost (only), and the “materials” portion of a time-and-materials contract. Cost-based pricing also is used in negotiated fixed-price contracts, where the price is determined not by competition but by negotiation based on estimated cost (or on actual cost if the work has already been performed). Variations of fixed-price-type contracts include firm-fixed-price, fixed-price-incentive-fixed, fixed-price-award-fee, fixed-price with successive targets, fixed-price redeterminable, labor-hour contract, and the “labor” portion of time-and-materials contracts.

COST-BASED PRICING

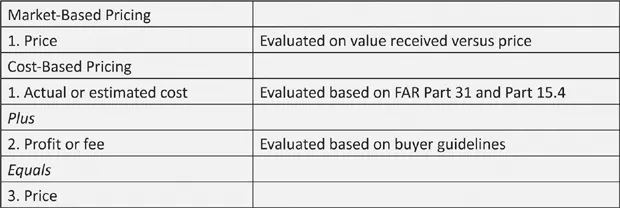

Cost-based pricing differs from other pricing techniques in several ways. Cost-based pricing uses actual or estimated costs to determine the price of a government contract. Price is established by adding a profit or fee to these actual or estimated costs. Compared with market-based pricing, cost-based pricing is much more difficult to perform and subject to many more regulations. For example, the cost principles in FAR Part 31 apply when using cost-based pricing. Profit or fee is not significantly subject to regulation but is more prominently influenced by federal agency guidelines on negotiating profit or fee. Some legislated fee limits exist for cost-plus-fixed-fee contracts and for architect-and-engineering contracts; existing regulations do not address what fee a contractor may request but do provide guidelines to the government contracting officers. In market-based pricing, cost allowability and profit levels are irrelevant in that the price is assessed by the potential customer in terms of value received by purchasing the goods or services rather than by the cost (or estimated cost) to the seller.

By contrast, market-based pricing consists of a single figure for the price, which the buyer evaluates based on the perceived benefit or value received. The estimated cost and the amount of profit are irrelevant to the buyer’s decision; the value of the goods is simply assessed and compared to the price by the buyer. Prices of competitors’ products and services might be also compared in this decision process. In addition, completely different alternative solutions can be compared to one another.

Exhibit 1-1 shows the distinction between market-based and cost-based pricing.

EXHIBIT 1-1:

Market-Based Pricing and Cost-Based Pricing

In accordance with FAR Part 15, cost-based pricing is a structured pricing approach that is based on FAR-determined cost elements. Cost elements are the components of an estimated cost and consist of direct labor (Chapter 2), materials and subcontracts (Chapter 3), indirect costs (Chapter 4), other direct costs (Chapter 5), and facilities capital cost of money (Chapter 5). Chapter 7 addresses the topic of profit or fee.

Need for Cost-Based Pricing

Cost-based government contract pricing has its origins in World War I. Before that time, the federal government purchased goods and services mostly available to the general public—horses, guns, wagons, foodstuffs, and so on. The need to design and build advanced, technological, and highly specialized war machinery—such as tanks and airplanes—not sold to the general public caused a shift to cost-based pricing, for good reason. If a company had had to accept a firm-fixed-price contract to design and build the first United States government–purchased tank, the price would have been exceptionally high due to the uncertainties of production cost, technological feasibility, production quantity, and price stability of materials. Sellers would have had to include substantial contingencies to be assured of a profitable contract. Setting the price at allowable cost plus a fixed fee removed enough risk from the seller that the total price was much less than that for a fixed-price contract.

Note the use of the word allowable to describe reimbursed costs in the previous paragraph. Clearly, the government did not want to give any contractor a blank check. Certain costs were considered to be not reimbursable due to public policy. Thus, FAR Part 31 now provides detailed guidance on what costs are unallowable. For example, entertainment costs are unallowable because “entertaining” government officials is not allowed; thus, taxpayer money should not be paid to contractors to cover costs of entertainment.

Often cost-reimbursement contracts are rightly criticized as not providing an incentive for a contractor to reduce costs, because cost reductions result in a lower price for the next sale and less profit. This is a valid criticism, but this contract type still has value for certain procurements where the risk under a fixed-price contract is so great that the resulting prices would be extremely high.

Work Breakdown Structure

When cost-based pricing is used, the work breakdown structure concept is often needed to adequately apply cost-based pricing techniques. This concept was developed in 1957 by DoD as part of the program evaluation and review technique (PERT). PERT did not use the term work breakdown structure. However, PERT was the forerunner of the work breakdown structure; PERT-Cost was the forerunner of earned value management systems, and PERT-Time was the forerunner of the critical path method. The term work breakdown structure was first used in 1968 in a DoD document, “Work Breakdown Structures for Defense Materiel Items” (MIL-STD-881). The general purpose of these various techniques was to allow accurate and timely estimating of the cost of a program at completion. DoD in particular has been plagued by programs experiencing surprise cost overruns. The DCMA Web site (www.dcma.mil) contains useful information on the government review of earned value management systems.

A work breakdown structure is developed by starting with the end objective and successively subdividing it into manageable components (i.e., in terms of size, duration, and responsibility) that include all steps necessary to achieve the objective. The work breakdown structure provides a common framework for the natural development of the overall planning and control of a contract and is the basis for dividing work into definable increments from which the statement of work or statement of objectives can be developed and technical, schedule, cost, and labor-hour reporting can be established. A work breakdown structure permits summing of subordinate costs for tasks, materials, and so on into their successively higher-level parent tasks and materials. For each element of the work breakdown structure, a description of the task to be performed is generated.

A work breakdown structure is organized around the primary products (or planned outcomes) of the project instead of the work needed (or planned actions) to produce the products. Since the planned outcomes are the desired ends of the project, they form a relatively stable set of categories in which to collect the costs of the planned actions needed to achieve them. A well-designed work breakdown structure makes it easy to assign each project activity to one—and only one—terminal element. In addition to its function in cost accounting, the work breakdown structure also helps map requirements from one level of system specification to another.

PARAMETRIC ESTIMATING

Parametric estimating techniques use a statistical relationship between historical data and other variables (e.g., square footage in construction or lines of code in software development) to calculate an estimate. Parametric estimates of cost-to-cost relationships have been used for many years. Some examples are scrap costs to a priced bill of materials, non-touch labor to touch labor, sustaining engineering to initial engineering, and even other direct costs to direct labor costs.

In the mid-1950s, Rand Corporation in Santa Monica, California, developed the most basic tool of the cost-estimating discipline, the cost-estimating relationship, and merged this concept with the learning curve (discussed in Chapter 10) to form the foundation of aerospace parametric estimating. Rand derived cost-estimating relationships for aircraft cost as a function of such variables as speed, range, and altitude (known as AMPER Weights).

In the late 1970s, parametric models were expanded into two additional aspects. First, models were developed based on relationships of cost to noncost variables, such as feet of wiring in an aircraft. The mathematics and logic are basically the same as for cost-to-cost relationships. Second, models were developed to estimate the cost of an entire product rather than individual elements of cost for that product. For example, the speed of an aircraft, the weight of the aircraft, expected labor escalation, complexity compared to previous aircraft, and so on would be entered into the “black box” of a parametric model and the resulting answer would be a bottom-line estimate for the product. Proponents of this technique believe this approach can produce higher levels of accuracy, depending on the sophistication of the model and the underlying data built into the model, than the traditional grassroots buildup approach.

A popular initial software package called RCA Price was developed in the late 1960s by PRICE Systems, a cost-analysis unit of RCA. Through mergers and acquisitions, PRICE Systems successively became part of GE Aerospace, Martin Marietta, and Lockheed Martin. A management buyout from Lockheed Martin in 1998 formed the independent company known today as PRICE Systems, LLC. Other parametric software is available from several companies: SLM-Estimate; WinEstimator, Inc.; CostWorks RSMeans; SmartBidNet; PlanSwift; SEER; and d-tools.

The DCAA believes that parametric estimating techniques based on cost-estimating relationships are acceptable in the appropriate circumstances for proposing costs on government contracts and issued audit guidance on parametric systems as early as 1978. The DCAA criteria for a valid parametric estimate are:

Logical relationships. Contractors are expected to demonstrate that cost-to-noncost estimating relationships are logical. DCAA’s primary concern in this area is that contractors consider all reasonable estimating alternatives and do not use only the first apparent set of variables. Contractor analysis may disclose multiple alternatives that appear logical; statistical testing should be used to help identify the best choice.

Significant statistical relationships. Contractors are also expected to demonstrate that a significant statistical relationship exists among the variables used in a parametric cost-estimating relationship. Several statistical methods, such as regression analysis, graphic analysis, statistical sampling, and learning curves, can be used to validate a cost-estimating relationship; however, no single uniform test can be specified. Statistical testing may vary depending on an overall risk assessment and the unique nature of both a contractor’s parametric database and the related estimating system. Proposal documentation should describe the statistical analysis performed, including the contractor’s explanation of why the cost-estimating relationship is statistically valid.

Verifiable data. There must be a system in place for verifying data used for parametric cost-estimating relationships. In many instances, the reviewer will not have previously evaluated the accuracy of noncost data used in parametric estimates. To monitor and document noncost variables, contractors may need to modify existing information systems or develop new ones. Information that is adequate for day-to-day management needs may not be reliable enough for contract pricing. Data used in parametric estimates must be accurately and consistently available over a...