- 154 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

As rental property is now the dominant form of tenure in the UK, there are more and more investors coming into the residential property market. As is the case with many types of investment, you have the professionals and the smaller investors. This book is intended to equip the smaller would-be investor with the skills needed to build a profitable portfolio, not least the management of properties and the different property types, such as houses in multi-occupation.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Building And Managing A Residential Property Portfolio by in PDF and/or ePUB format, as well as other popular books in Betriebswirtschaft & Immobilien. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

DECIDING TO INVEST IN PROPERTY-GENERAL POINTS TO CONSIDER

Investing in Property

The overall demand for private rented property is now stronger than ever, with the mortgage market restricted for purchasers and house price inflation, particularly in the south east, creating the need for high deposits which people cannot find. Lending has become far more stringent, owing to the onset of the credit crunch and the banks unwillingness to loan money, particularly to property investors. Essentially, accessing finance has become a big issue. The banks favor those with large cash deposits. This is the same in the buy-to-let sector as for domestic mortgages.

However, if finance can be arranged then the yields that one can expect from buy-to-let properties are high by comparison, currently standing at 6%. Of course, this depends on where the property is located. See overleaf for a table indicating the best buy to let areas in the UK. A yield is a portfolio’s annual rental income as a percentage of total value. The reason is that demand for private rented property is high, particularly as first time buyers cannot get a toehold in the market. They are instead turning to the private rental sector. Therefore, investing in property, for the longer term, as opposed to investing for short-term gain, is still a viable option.

See overleaf-best and worst buy to let areas in the UK.

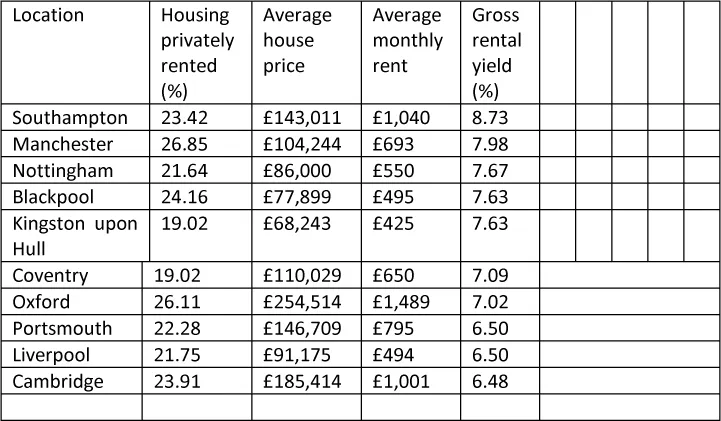

BUY-TO-LET -RETURN BY AREAS -January 2015

The towns that offer the best buy-to-let returns

Rental returns on buy-to-let are biggest in regional centres like Southampton, Manchester and Nottingham - where one in four homes are now privately rented.

Property investors are looking way beyond London and identifying regions where yields are almost three times as high as in the capital. Cities offering the greatest yields - rental income measured against the property cost - include Southampton, Blackpool, Nottingham and Hull.

The latest data on buy-to-let returns, from lender HSBC, also shows the proportion of property in each area already owned by landlords. And in many of the top-yielding areas private landlords already own one in four properties, or more.

Southampton, with rental yields of 8.73pc, currently tops the list for rental returns. Manchester, Nottingham, Blackpool and Hull complete the top five locations with the best rental yield at 7.98pc, 7.67pc and 7.47pc respectively. In all of those areas, except Hull, private landlords already own one in five properties, or more.

These areas also offer the characteristics that make for excellent buy-to-let investment, the experts say: relatively low house prices coupled with strong demand for rental property from large student and young professional populations.

See overleaf.

Top 10 buy-to-let hot spots by rental yields.

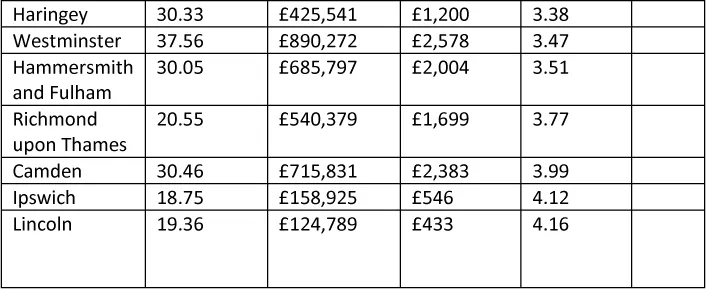

The lowest yields were registered in areas such as London where recent price rises have been large and rapid, outpacing the growth in rents.

In London in particular, there is a higher proportion of rental property than elsewhere, with 38pc of property in Westminster, for example, being privately rented.

Worst 10 buy-to-let areas by rental yields

Rental yields

Investment properties which are rented out receive an income from tenants. In order to calculate the gross rental yield the annual rental income is divided by the purchase price of the property (annual rent÷price) × 100 = Gross rental yield)

So, if the property was purchased for £75,000 (total) and the rent received is £450 per month the yield would be:

£5400 (annual rent) ÷ £75,000 × 100 which equals an annual yield of 7.2. This is a very respectable return on your capital. Of course if you are a landlord then you will want to factor in the costs of being a landlord, such as maintenance, insurance, loan costs, empty periods etc.

Capital yields

If and when a property increases with time, this is known as capital growth. A simple example is if you buy a property for £75,000 and it increases by 25% there will be a capital appreciation of £18,750. It is a rule of thumb that low price properties might produce a high rental yield and low capital growth and vice-versa, although this is not always the case. Again, each case differs and many factors will play a part but as long as you know what you want then you should be safe with your investment.

If you are interested in averages, landlords receive £678 in rent each month as a national average. However, as always, averages don’t give the whole picture. Landlords in London and the South East collect the highest rents, with £1,079 and £816 respectively. In the west Midland rents average £678 and in East Anglia £676. Approximately 60% of this is spent on borrowing and management costs, leaving landlords with a healthy 40% profit on average. With buy-to-let mortgage rates so cheap (at the moment) now is the time to expand your portfolio releasing equity and raising deposits to buy new properties. However, when expanding your portfolio it is important to be realistic and ensure that you invest in properties that can be sold on easily, as there may come a time when you need to get your hands on the capital that you have tied up.

As with everything, property is a good investment as long as it is managed well. Too many would-be landlords buy property and neglect it which has a negative impact on the environment and also a negative impact on the investment as a whole. A run down property will decrease in value and the possibility of renting it out for a full market rent will also diminish. That is what this book is all about-how to become a good landlord and a good property manager and how to maximize the returns on your property.

What kind of property is suitable for letting?

Obviously there are a number of different markets when it comes to people who rent. There are those who are less affluent, young and single, in need of a sharing situation, but more likely to require more intensive management than older more mature (perhaps professional) people who can afford a higher rent but require more for their money. The type of property you have, its location, its condition, will very much determine the rent levels that you can charge and the clients that you will attract.

The type of rent that a landlord might expect to achieve will be around ten per cent of the value of the freehold of the property, (or long leasehold in the case of flats). The eventual profit will be determined by the level of any existing mortgage and other outgoings.

If you are renting a flat it could be that it is in a mansion block or other flatted block and the service charge will need to be added to the rent. When letting a property it is necessary to consider profit after mortgage payments and likely tax bill plus other outgoings such as insurance and agents fees (if any). Of course there are other factors which make the profit achieved less important, that is the capital growth of the property. See further on in the book for a breakdown of taxation and allowances.

The importance of having a clear business plan

As a (would be) private landlord, a person considering letting a property for profit, or already doing so, it is vital that you are very clear about the following:

• What kind of approach do you intend to take as a landlord? Do you intend to purchase, or do you have, an up market property which you are going to rent out to stable professional tenants who will pay their rent on time and look after the property (hopefully!).

• What are the key factors that affect the value of a property in rental terms? Is the property close to public transport, does it have a garden, what floor is it on and what size are the rooms? Is it secure and in a crime free area? If you are acquiring a property you should set out what it is you are trying to achieve in the longer term, i.e. the type of person you want and match this to the likely residential requirements of that hypothetical person. You can then gain an idea of what type of property you are looking for, in what area, and you can then see whether or not you can afford such a property. If not, you may have to change your plan.

• Do you intend to let to young single people, perhaps students, who will occupy individual rooms achieving higher returns but causing potentially greater headaches? Are you aware of the headaches? It is vitally important that you understand the ramifications of letting to different client groups and the potential problems in the future.

• Are you clear about the impact on the environment, and to other people, that your activities as a landlord may have? For example, do you have a maintenance plan which ensures that not only does your property look nice and remain well maintained but also takes into account whether the plan, or lack of it, will have an impact on the rest of the neighborhood? Will the type of tenant you intend to attract affect the rest of those living in the immediate vicinity

• What are the aims and objectives underpinning your business plan? Do you have a business plan or are you operating in an unstructured way? Taking into account the above, it is obviously necessary that you have a clear picture of the business environment that you intend to operate in, the legal and economic framework that governs and regulates the environment.

• It is vital that you are very clear about what it is you are trying to achieve. You should either understand the type of property that you already own or have an idea of the property you are trying to acquire to fit what client group. These goals should be very clear in your own mind and based on a long-term projection, underpinned by knowledge of the law and economics of letting property.

• As an exercise you should sit down and map out your business plan, before you go any further. Whether you are an existing property owner, or wish to acquire a property for the purpose of letting, the first objective is to formulate a business plan.

Now read the main points from chapter one overleaf.

***************

Main points from chapter one

• Letting residential property for investment has become more and more common and has replaced owner occupation as the ma...

Table of contents

- Cover

- Title

- Copyright

- Contents

- Introduction

- 1. Deciding to invest in Property-points to consider

- 2. Developing Your property Portfolio-Costs

- 3. Finding Suitable property -Buying a property

- 4. Buying a property at an auction

- 5. Sourcing Suitable Tenants

- 6. What should be provided under the tenancy

- 7. The law and Landlord and Tenant

- 8. Understanding Rent and Sources of Rent

- 9. Repairs and improvements

- 10. Taking back your property

- 11. Private tenancies in Scotland

- 12. Income tax and financial management

- Useful websites- Glossary of terms

- Index

- Sample tenancy agreements and notices