![]()

CHAPTER 1

INTRODUCTION TO PRIVATE CAPITAL

Let’s start at the very beginning … What is private capital? People have different understandings of it, and there are various definitions and nuances of this term out there in the real estate investing world. For this book, we will define it as follows:

Private capital is a source of money that comes from an individual, not a bank or other financial institution. It is positioned in two ways, as a loan (debt) or ownership (equity).

It’s important to define this up front so that we are on the same page. There are a few things that private capital is not and won’t be treated as such in this book. The first on the “not” list is a loan from a bank or other financial institution. It perhaps goes without saying that a bank loan isn’t private capital, but the same goes for other sources of loans from financial institutions, like credit cards and business lines of credit. These can be good sources of money if they are handled properly, but they don’t qualify as private capital.

The next is hard money lenders or other financial institutions that are in the “business of lending money.” These are companies that do offer loans and equity on real estate deals. The difference is, they are most likely not lending their own money. They have their own investors and have to pay a return to them while also making a profit for themselves. For that reason, interest rates and fees can be higher than they would be if you were dealing directly with the investor. These lenders are also probably not flexible on their rates and terms, which is something you want to consider when dealing with true private capital.

You may get a hard money lender to agree to provide money as equity by giving it a percentage of the upside of the project, at which point it would be viewed as private capital, but I would be very careful in these circumstances. These institutions are used to lending their money at high interest rates with lots of fees and will want a large percentage of your project to achieve the same rate of return on their money.

The last source that I would disqualify as private capital is similar to a hard money lender, but the money is coming from an individual who is a professional money lender. This person is lending his or her money, but the rate and terms are more similar to those of hard money, and they’re typically not negotiable. If you’ve been around the real estate investing world long enough, you’ve met these professional lenders. I worked with one lender who had a chain of record stores all around New Jersey and Pennsylvania. He saw the market changing with the advent of the iPod, sold all his stores, and was then lending his money to real estate projects. While I give him credit for being a good businessman, his rates weren’t that different from hard money rates and included points and fees on top, just as a hard money lender would do. Don’t get these folks confused with private capital.

Unique Factors of Private Capital

There are a few differentiating factors from the sources mentioned previously to the ones we will discuss in this book. In my eyes, private capital has three characteristics that make it unique.

DIFFERENTIATOR NO. 1 Negotiability

Have you ever asked a bank whether you can defer the interest payments until the end of the loan? How about asking hard money lenders whether they would consider waiving a significant amount of their fees? You may be able to make this happen if you are a repeat customer of theirs, but odds are you are going to receive a big no on that request. If they do work with you, I predict that their flexibility will be minor and that they will still do their best to overprotect themselves from the downside of risk.

A private capital partner will most likely work with you and be open to back-and-forth negotiations. The reason for this is that it’s their money. If you are borrowing from a bank or other source, the people you are dealing with are not putting their own cash into the deal, so their hands are tied. They are limited by either banking laws or lending standards that they must adhere to, and that’s because they are playing poker with someone else’s chips, and that someone has already told them what terms they are allowed to lend at.

This is not so for a private capital partner. It’s their money, so they can work with you to come up with loan terms that work for you both. If you want to pay the interest at the end of the loan or negotiate a lower rate, ask for it. If you don’t want to pay points or a fee if you need to extend the loan, ask for it. Because it’s their money, they can say yes or negotiate until you come up with something that works for you both.

DIFFERENTIATOR NO. 2 Win-Win

Banks’ and other lenders’ primary goal is to turn a profit for their organization. I know that most want to see you also succeed, but meeting their lending and profit goals for their organization is far and away their number one priority. That said, you can’t work with them to show how alternative terms are just as favorable. Their hands are tied, so even if you have a solution that makes them more money, such as offering a small chunk of the profit on a fix-and-flip as part of their return, they can’t do it.

A private capital provider is all about win-win. In this book, I will teach you how the more you win as a real estate investor, the more they win as your source of capital. They become tied to your success, creating a true strategic partnership.

DIFFERENTIATOR NO. 3 The Source of the Money

As I said before, banks and other financial institutions are playing with someone else’s money. That money belongs to either Wall Street or the Federal Reserve or, in the case of hard money lenders, their investors. They are getting the money at a cheaper rate, marking it up, and selling it to you. They make their money on the markup and the fees in originating that loan or equity in your deal.

Private capital providers are giving you their money, which came from either their retirement account or their own pocket. The more capital you give back to them with a return, the more they win and feel inclined to invest again and again with you on future deals, and the more their long-term wealth grows. As a side note, they could be getting the money from a real estate loan, like a home equity line of credit (HELOC), which is somewhat similar to a bank’s position, but we will get there later in this book.

In my eyes, there are two very specific parties in a private capital transaction. They both have their roles, responsibilities, and risks they take on in the deal. I have terms I use for these two roles that will be used throughout this book: the Deal Provider and the Cash Provider.

Introduction to the Deal Provider

The Deal Provider is the one who goes out and finds opportunities such as fix-and-flips, rental rehabs, and other real estate investments that require an investment using private capital. The Deal Provider is also the one who is willing to put in the sweat equity to make the deal happen. This may include building a brand and reputation in the marketplace, finding and negotiating the purchase, dealing with banks, hiring and managing contractors and supervising vendor relationships, and dealing with real estate agents on the purchase (and sale) of flips. Deal Providers are the center of all the action of the deal and handle 99.999 percent of the “doing” that needs to happen. Deal Providers may also put in their own cash, or they can earn their share of the deal strictly through sweat equity. We will get into what it takes to be a great Deal Provider to your investors later in this book.

Introduction to the Cash Provider

The Cash Provider is the investor or lender of the private capital for the project. Most of the time, Cash Providers are passive investors making a return on their money. They have little or no active involvement in the deal aside from properly vetting it and the Deal Provider before making the investment.

A word of caution to my budding Deal Providers reading this book: Be careful of the willing Cash Provider who wants to have an active role in the project. I send my investors regular updates on our progress and allow them to walk my jobsites. I also make it clear who the operator of the project is and who is making the day-to-day decisions. Make sure that your Cash Providers trust you to make decisions on their behalf and work in their best interest without having a say in the day-to-day operations. If they have an issue with this, my bet is that they will slow down progress on your projects or, even worse, try to shut your deal down if they don’t agree with a decision you make. We will get into many factors of Cash Providers in this book, including how to find those who truly want to be “passive” investors.

Private Capital Uses

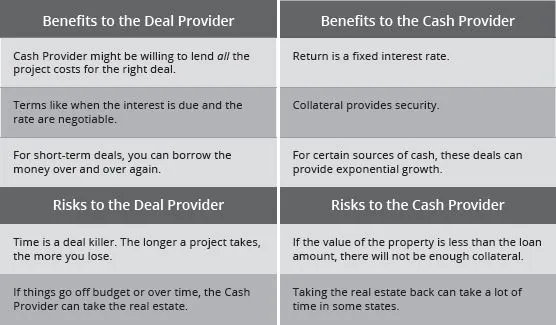

Now that we are clear on what private capital is (and isn’t), let’s talk about how to put private capital to work in your business. Next I will review the different uses for private capital in a real estate business and how each use benefits the Cash and Deal Providers, along with the risks. In a later chapter, we will get into how to structure these types of deals and create win-win situations for both sides.

USE NO. 1 Real Estate Debt

This is the most common use of private capital and perhaps the one most sought-after by investors. Quite simply, this is a loan to the Deal Provider from the Cash Provider. The loan is secured by a mortgage or lien on a specific piece of real estate. The Cash Provider agrees to put in a certain amount of cash, and the Deal Provider agrees to loan terms defined in the written loan agreements. If these written loan agreements are not met, the Cash Provider can come to take the real estate. The right that the Cash Provider has to come to take the real estate is called collateral. Collateral is security for the Cash Provider, and it answers the question, “What if you don’t pay me back?” If the deal is fairly structured, the real estate that Cash Providers have a claim to is worth more than their loan amount, so if they do need to take it from the Deal Providers, they can sell it and get their loan proceeds. We will get into how to structure these loan agreements in a manner that’s fair to both sides in a later chapter.

The terms of the agreement are defined in a promissory note and a mortgage agreement (some states call this second document a deed of trust). The loan generates an interest payment due to the Cash Providers, which is their main profit on their investment. The amount of this interest payment and all other loan terms are defined in the loan documents.

Real estate equity is the most misunderstood tool to use in financing transactions, but it can be the most creative. Equity is ownership, either in the real estate itself or in the company that owns the real estate. It’s a claim to the profits that are made and a responsibility to support the losses if they come up. In my experience, these types of deals are attractive to more savvy Cash Providers who think that the Deal Provider is making lots of money on the project, and they want in on the action. The arrangement between the Cash and Deal Providers can be complex, like a syndication on a large commercial or apartment project. These deals may involve the Securities and Exchange Commission (SEC) because selling an interest in your company to people who have no active role can be viewed as selling a security. This isn’t a showstopper, but arrangement of these types of deals can be expensive. It could also be much simpler. We have given a small chunk of profits on our fix-and-flips to our Cash Providers as an incentive to get into a deal, and we have formed a small limited liability company (LLC) with one or two silent partners to go out and buy some single-...