- English

- ePUB (mobile friendly)

- Available on iOS & Android

Equity Asset Valuation

About this book

Navigate equity investments and asset valuation with confidence Equity Asset Valuation, Fourth Edition blends theory and practice to paint an accurate, informative picture of the equity asset world. The most comprehensive resource on the market, this text supplements your studies for the third step in the three-level CFA certification program by integrating both accounting and finance concepts to explore a collection of valuation models and challenge you to determine which models are most appropriate for certain companies and circumstances. Detailed learning outcome statements help you navigate your way through the content, which covers a wide range of topics, including how an analyst approaches the equity valuation process, the basic DDM, the derivation of the required rate of return within the context of Markowitz and Sharpe's modern portfolio theory, and more.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

CHAPTER 1

Overview of Equity Securities

Learning Outcomes

- describe characteristics of types of equity securities;

- describe differences in voting rights and other ownership characteristics among different equity classes;

- distinguish between public and private equity securities;

- describe methods for investing in non-domestic equity securities;

- compare the risk and return characteristics of different types of equity securities;

- explain the role of equity securities in the financing of a company’s assets;

- distinguish between the market value and book value of equity securities;

- compare a company’s cost of equity, its (accounting) return on equity, and investors’ required rates of return.

1. Introduction

- What distinguishes common shares from preference shares, and what purposes do these securities serve in financing a company’s operations?

- What are convertible preference shares, and why are they often used to raise equity for unseasoned or highly risky companies?

- What are private equity securities, and how do they differ from public equity securities?

- What are depository receipts and their various types, and what is the rationale for investing in them?

- What are the risk factors involved in investing in equity securities?

- How do equity securities create company value?

- What is the relationship between a company’s cost of equity, its return on equity, and investors’ required rate of return?

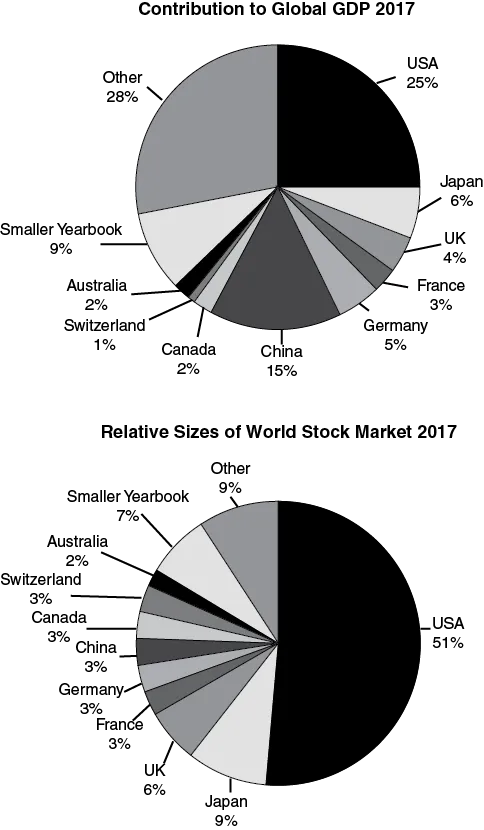

2. Equity Securities in Global Financial Markets

Table of contents

- Cover

- Series

- Title Page

- Copyright

- Preface

- Acknowledgments

- About the CFA Institute Investment Series

- Chapter 1 Overview of Equity Securities

- Chapter 2 Introduction to Industry and Company Analysis

- Chapter 3 Equity Valuation: Concepts and Basic Tools

- Chapter 4 Equity Valuation: Applications and Processes

- Chapter 5 Return Concepts

- Chapter 6 Industry and Company Analysis

- Chapter 7 Discounted Dividend Valuation

- Chapter 8 Free Cash Flow Valuation

- Chapter 9 Market-Based Valuation: Price and Enterprise Value Multiples

- Chapter 10 Residual Income Valuation

- Chapter 11 Private Company Valuation

- Glossary

- About the Editors

- About the CFA Program

- Index

- End User License Agreement

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app