eBook - ePub

Diagnosing Greatness

Ten Traits of the Best Supply Chains

- 296 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Diagnosing Greatness is the first supply chain book targeted at all levels and functions of business management. It explains how business performance can be enhanced through a concerted effort to implement improvements across a full supply chain network. Using a significant amount of academic studies, published literature and documentation from annual global surveys among supply chain and logistics professionals conducted by Supply Chain Management Review magazine, Computer Sciences Corporation and Michigan State University, the authors combine their first-hand experiences to present a clear and impressive substantiation of what industry leading firms are accomplishing through supply chain efforts. Specifics are given across a wide variety of industries of how a limited number of firms have achieved positions of greatness as their supply chain efforts have matured and industry-best practices have emerged. The authors' basic approach was to isolate the best supply chains through documented accomplishments and then diagnose what led to their superior execution. Findings enabled the authors to articulate the top ten sustainable competencies or traits of greatness that distinguish the leaders from the followers. Each chapter within this book covers a trait which firms in any business can calibrate itself against and initiate a plan for achieving similar progress. Diagnosing Greatness shows how to achieve the greatest return, while better satisfying investors, suppliers, business customers and consumer groups. Using many case examples and actual action stories, the authors bring a new and higher dimension to business success by explaining how to optimize the process steps across an extended business enterprise; bring value to all constituents of a business enterprise, especially the end consumer; and achieve and maintain industry best business results.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Diagnosing Greatness by Charles Poirier,Francis Quinn,Morgan Swink in PDF and/or ePUB format, as well as other popular books in Business & Operations. We have over one million books available in our catalogue for you to explore.

Information

TRAITS OF THE BEST SUPPLY CHAINS: AN OVERVIEW

Our premise is basic: A concerted effort to find optimized conditions across an extended supply chain network will yield superior business returns. These gains can be sustained and enhanced if those directing the effort set their sights on achieving a high level of competence on each of 10 traits that distinguish the best supply chains. We take a broad view of the supply chain that incorporates the firm’s downstream and upstream partners and relationships. The 10 supply chain traits serve as standards against which any firm in any business can calibrate itself, determine the current gaps in performance, and develop a strategy for gaining parity. By reaching excellence across the traits, a firm will improve its business performance and position in the marketplace.

To validate our premise, we must provide convincing evidence that sustained attention to supply chain management (SCM) as a business improvement tool will yield substantial results and that pursuing the 10 specific traits will move a business consistently forward. The required validation can best be met by answering these questions:

•Does SCM bring significant, measurable results?

•How much better are the supply chain leaders than others? What is the impact of the opportunity for the lagging firms?

•Who are these leaders in terms of industry? Companies? And why will they remain leaders?

•What traits characterize the top supply chains?

•How will adoption and execution of these traits lead to improvements for my business?

RESULTS CONFIRM THE VALUE OF SUPERIOR SCM

To begin, SCM is not just a business fad or the latest application du jour. The results of our Global Survey of Supply Chain Progress repeated over the years, coupled with other recent research, confirm that a serious supply chain improvement effort can reduce costs while increasing revenues and raising customer satisfaction. Overall profitability, earnings per share, shareholder value, and stock price performance are among the metrics positively impacted by SCM. A typical concerted supply chain initiative will provide two to four points of new profit after approximately three years. The leaders, in fact, have recorded as much as seven to eight or more points of new profits after a decade of implementation and some have doubled earnings per share.

But not everyone is achieving these results. There is a wide spectrum of performance, ranging from those businesses that fail to reap any supply chain benefits to those that have significantly enhanced their balance sheets and profit-and-loss statements. Across this spectrum, our accumulated evidence of the actual benefits achieved has revealed a tripartite segmentation of firms that can be categorized as leaders, followers, and laggards. Leaders consistently report greater progress with their SCM efforts and lead the other two categories in all 10 traits of supply chain excellence. Followers are in the middle, having achieved some progress in some of the traits, but not to the extent of leaders. Laggards are generally focused on cost-reduction only and fall behind the other two categories in all of the traits. Our survey findings show that operational and financial benefits nearly double as a firm moves up from one category to the next—that is, from laggard to follower to leader.

THE SURVEY AND SUPPORTING RESEARCH PROVIDE THE BASIS FOR OUR CONCLUSIONS

Let’s begin by explaining the survey methodology, our annual reports on the survey findings, and other sources we have used to form our conclusions. The year 2009 marked the seventh consecutive year of conducting the Global Survey of Supply Chain Progress, which is jointly prepared and executed by Computer Sciences Corporation (CSC), Supply Chain Management Review (SCMR), and the Eli Broad Graduate School of Management at Michigan State University (MSU). Initially, the survey respondent base came from subscribers to SCMR and CSC’s client base in North America. In 2008, the Council of Supply Chain Management Professionals (CSCMP) also extended the survey to its global membership, which was particularly helpful in increasing the number of respondents from non-U.S. companies. CSC’s European and Asia-Pacific operations also have been helpful in recent years in expanding the survey’s global reach.

Most of the data we report in this book come from the 2007 and 2008 surveys sent to professionals with supply chain and logistics positions in companies around the world. Respondents rated their progress on a five-page questionnaire. Together, the data from the two surveys represent input from more than 450 responding companies. Notable for its larger and more global respondent base, the 2008 survey included 192 respondents from North America, 42 from Europe, 41 from Asia-Pacific, and 19 from other sectors of the world—a total of 294 respondents representing 22 industries in 32 countries.

The 2008 survey contained multiple questions for each of the 10 competency areas listed below. These data, along with other qualitative and quantitative observations, helped us to identify the traits that differentiate the best supply chains. Later in this chapter we enumerate these as the Ten Traits that Characterize Leadership Abilities. The competency areas we examined to help us identify the leadership traits were:

•Alignment with corporate strategy

•Strategic customer integration

•Strategic supplier integration

•Cross-functional internal integration

•Supply chain responsiveness

•Supply chain rationalization/segmentation

•Planning and execution process and technology

•Global supply chain optimization

•Innovation management

•Risk management

CSC subject matter experts and MSU faculty analyzed the data from the survey questionnaires. Using a statistical technique known as cluster analysis, the MSU researchers identified the three groups or categories of respondents: leaders, followers, and laggards. The respondents’ scores within each group reflect a distinct pattern of competence achievement. Leaders’ scores on all 10 traits are superior to and statistically significant from the scores of followers and laggards. Similarly, followers outperform laggards on all 10 traits. These achievement-based groupings serve as the foundation for comparisons reported throughout this book.

The research team also compared our survey results to data from comparable surveys conducted by reliable organizations such as AMR Research, Gartner, Forrester, and Accenture. To corroborate our findings, we reviewed documents and results published by other sources, which are cited in the text. Using a variety of materials and professional opinions, we substantiated the gains reported and established a pattern that identified the 10 traits critical to sustained success.

FINANCIAL IMPACTS OF SUPPLY CHAIN SUCCESS ARE SIGNIFICANT

Now let’s turn to the demonstrated impacts of superior SCM. Year after year, the results from our survey validate what can be accomplished through a concerted supply chain effort. As shown in Figure 1.1, the 2008 survey data indicate that 78 percent of firms reported some level of three-year cumulative cost savings as a result of their supply chain initiatives. Sixteen percent reported savings in a range from 1 to 5 percent, with nearly 60 percent indicating that their savings were in the 1 to 10 percent range. These data suggest that the potential positive financial impact from supply chain improvement efforts is significant. Most importantly, the results reveal substantial differences among the leaders, followers, and laggards.

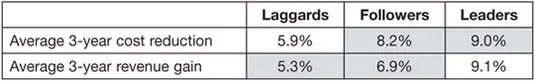

Table 1.1 shows average gains from the combined 2007 and 2008 data. Leaders on average reported 9.0 percent cost savings for a three-year period, whereas laggards show only 5.9 percent gains. The revenue gain for leaders during the same three-year period was 9.1 percent as compared with only 5.3 percent for laggards. We consider these estimates to be highly reliable because the data come from more than 450 companies reporting over two different periods. The evidence further showed that Europe appears to have taken the lead in cost reduction, with one-fourth of the 2008 respondents showing 11 to 15 percent improvement.

These results clearly confirm the value that can be added through supply chain improvements. If we consider that supply chain costs most likely represent 40 percent or more of a company’s total costs, a 10 percent reduction represents four points of potential new profit. Even if we conservatively use a 5 percent improvement on only 30 percent of total costs, a minimal gain of 11½ points of new profit is available, something that virtually any business would desire.

Figure 1.1 Impact on supply chain costs

Table 1.1 Cost savings and revenue gains across groups—2007 and 2008 combined data

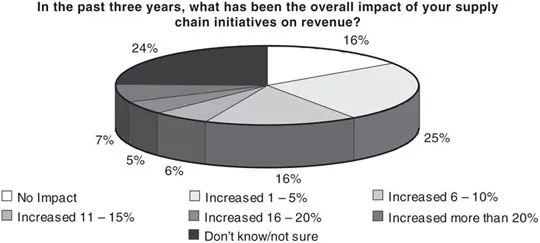

There is a second element to the reported improvements. While cost reduction remains the primary supply chain focus, the 2008 survey also confirmed substantial upward movement in revenue growth influenced by the supply chain (see Figure 1.2) When we asked respondents whether or not supply chain improvements led to new revenues, they again reported increases from 1 to 5 percent to more than 15 percent. In all, 60 percent of the respondents reported some amount of revenue gains attributable to supply chain initiatives. What about the other 40 percent? One fourth of them said they didn’t know or were unsure of such gains, and 16 percent said they saw no impact. In the area of cost savings, 24 percent again said they didn’t know or were unsure of any savings, and 7 percent of the 2008 respondents reported no impact. That means about one third of our global sample is missing the boat when it comes to making the kind of cost gains available. They are missing out on the supply chain’s powerful dual potential of both top line (revenue) and bottom line (cost) improvement.

Figure 1.2 Impact on revenues

The leaders’ superiority in using the supply chain to drive both revenue growth and cost savings is reflected in such advantages as shorter cycle times, higher productivity, greater visibility across the network, and lower operating costs. Interestingly, the followers are closer to the leaders in cost savings achieved, yet closer to the laggards in revenue gains. The implication is that a company can realize cost benefits relatively early in its SCM maturity—for example, as it moves from laggard to follower status. However, the substantive top-line revenue gains come from graduating from follower to leader. Overall, the realized results continue to validate what can be accomplished in both the top and bottom line performance through a concerted supply chain effort.

Not all of the findings were as positive, however. Part of the survey focused on how well firms pursuing supply chain improvement were making the connections between products, customers, and profitability. When we asked respondents if their companies recognized that specific products contribute to profits differently (a characteristic of the leading firms), we were surprised at the results. Specifically, there was some serious backsliding from the 2007 survey. On a scale of 1 to 5 ( 5 being to a high degree) 24 percent gave themselves a rating of 4 (compared to 47 percent in 2007). Another 7 percent rated themselves a 5 (down from 37 percent in 2007). Clearly, these replies indicate a lack of appreciation in some quarters for the strong connection that is possible in this area.

So does SCM produce measurable results? The answer is that it certainly can. At the very least, it can add one to th...

Table of contents

- COVER

- TITLE

- COPYRIGHT

- DEDICATION

- CONTENTS

- PREFACE

- ABOUT THE AUTHOR

- ACKNOWLEDGMENTS

- WEB ADDED VALUE

- CHAPTER 1 TRAITS OF THE BEST SUPPLY CHAINS: AN OVERVIEW

- CHAPTER 2 SUPPLY CHAIN MATURITY: HYPOTHESES BEHIND THE SUPPORTING RESEARCH

- CHAPTER 3 TRAIT 1 SUPPLY CHAIN SUCCESS STARTS WITH A SOUND STRATEGY SUPPORTED BY SOLID LEADERSHIP

- CHAPTER 4 TRAIT 2 FOCUSING ON FINANCIAL IMPACT TO ACHIEVE SUPERIOR RESULTS

- CHAPTER 5 TRAIT 3 A PORTFOLIO APPROACH TO INNOVATION AND PROCESS IMPROVEMENT

- CHAPTER 6 TRAIT 4 SELECTIVE COLLABORATION WITH TRUSTED BUSINESS PARTNERS

- CHAPTER 7 TRAIT 5 EXCELLENCE IN STRATEGIC SOURCING

- CHAPTER 8 TRAIT 6 WORLD-CLASS LOGISTICS EXECUTION

- CHAPTER 9 TRAIT 7 PROFICIENCY IN PLANNING AND RESPONSIVENESS

- CHAPTER 10 TRAIT 8 High CUSTOMER INTEGRATION AND SATISFACTION

- CHAPTER 11 TRAIT 9 ABILITY TO ANTICIPATE AND MANAGE RISK

- CHAPTER 12 TRAIT 10 GLOBALLY OPTIMIZED OPERATIONS (COMPLETING THE EFFORT)

- CHAPTER 13 ADVICE FOR MOVING FORWARD

- BIBLIOGRAPHY

- GLOSSARY