eBook - ePub

Business Driven Project Portfolio Management

Conquering the Top 10 Risks That Threaten Success

- 320 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Business Driven Project Portfolio Management

Conquering the Top 10 Risks That Threaten Success

About this book

Official reference material for the Portfolio Management Professional (PfMP) Credential Examination Project portfolio management (PPM) is a term that is used to describe methods for analyzing and collectively managing groups of projects based on numerous factors and considerations. The fundamental objective of PPM is to determine the best projects to undertake in support of the goals, objectives, and strategies of the organization. Business Driven Project Portfolio Management covers the top 10 risks that threaten PPM success and offers practical alternatives to help ensure achievement of desired results. Written from a business perspective, it contains the executive insights, management strategy, tactics, processes and architecture needed for the successful implementation, ongoing management, and continual improvement of PPM in any organization.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Business Driven Project Portfolio Management by Mark Perry in PDF and/or ePUB format, as well as other popular books in Negocios y empresa & Gestión de proyectos. We have over one million books available in our catalogue for you to explore.

Information

1

PPM Risk #1:

Shared Vision, Mission,

Goals, and Objectives

Shared Vision, Mission,

Goals, and Objectives

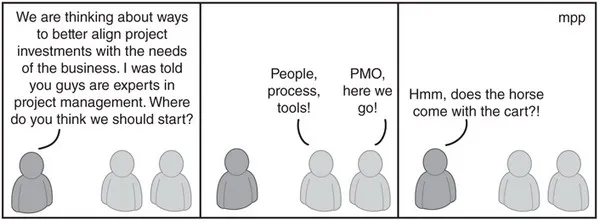

For many, seeking to better align the project investments with the needs of the business, the cartoon in Illustration 1.1 paints an all too familiar picture. No sooner is the word out that the executive team is considering ways to improve upon things than a runaway freight train leaves the station fully loaded with opinions and ideas. Nearly always, the cart is put in front of the horse, and lost in the debate is any understanding of the vision, mission, goals, and objectives for which any discussion of organizational change must be a predicate. Project portfolio management (PPM) is not immune to this premise. To the contrary, one could easily argue that due to the collaborative, analytical, and dynamically changing nature of PPM, any attempt to do it without reasoned and tempered business planning will assuredly be met with failure.

Take the case of a rapidly growing midsize enterprise seeking to better align project investments with corporate strategy and to do all of the work that such an aspiration entails. Without giving a great deal of thought to the shared vision, mission, goals, and objectives required to drive such a change, the company hastily hired a project management office (PMO) manager who immediately turned his attention to people, processes, and tools. After the first year, the PMO had been staffed, a project management methodology aligned to the leading standard for project management had been developed, and a PPM application had been deployed. Additionally, nearly everyone in the organization, from the executive team to the agile developers, was unsatisfied with the progress of the PMO and unhappy with its manager; each person had his or her own varied reasons.

Illustration 1.1 PPM comics—putting the cart before the horse

In hindsight, the problem was clear to everyone involved. The PMO manager and the leadership team did not take the time to establish the vision, mission, goals, and objectives for the change envisioned. The first-year goals of the PMO manager, which were approved by management, were to staff the PMO, develop a single project management methodology to be used by everyone, implement a PPM application, and develop a project management-training program. These things were accomplished. But these things are not goals. They are not objectives. They are not even strategies. At best, these are component needs of a strategy of some kind. Although the efforts of the PMO manager were herculean, the end results achieved were not. The organization fell victim to the number one PPM risk: commencing activities without first establishing a shared vision, mission, goals, and objectives.

People, process, tools—how many times have we heard these three words? We hear them in presentations at PPM conferences. We hear them from the PPM consulting firms. We hear them from PPM training companies. And yes, we hear these words from well-intended PMO managers all too eager to get things going.

What could be wrong with wanting to staff the organization (people) rapidly, wanting to develop a world-class methodology (process), and wanting to implement the latest and greatest PPM application (tools)? If driven by the needs of the business, nothing is wrong with these desires. But if driven by any other reason or set of convictions or simply at the wrong time, a better question to ask might be, “What could possibly be right with wanting these things?” People, process, tools—these three words have been overused, introduced prematurely, and have caused more problems for PMOs and organizations seeking to manage their project portfolio than any other three words in the English language.

Project Portfolio Management Is Not Easy

Why is it that so many organizations jump right into PPM without the requisite business planning? And by business planning, I don’t mean a project charter document developed and carried out by the organization responsible for managing the project portfolio. Rather, I mean a business plan to introduce organizational change as validated by reasoned and tempered goals, measurable objectives, cross-functional measurements, expectations, and consequences. Could it be that the concept of PPM is easy to grasp? Some people seem to think so, but nothing could be further from the truth.

There are many who claim that the concept of PPM is an easy concept to grasp, and they compare management of a project portfolio to the management of a financial portfolio. According to IBM’s Ashok Reddy (2004, p. 1), “In essence, PPM allows you to manage a portfolio of projects much as you would manage a portfolio of diverse investments, such as stocks, bonds, real estate, and so forth.” Commenting to the same effect is Computerworld’s Melissa Solomon (2002, p. 1), “As its name implies, PPM groups projects so they can be managed as a portfolio, much as an investor would manage his stocks, bonds and mutual funds.” Also making this comparison are PMO gurus Kendall and Rollins (2003, p. 208), “Just as a stock portfolio manager looks for ways to improve the return on investment, so does a project portfolio manager.”

This comparison, for some people, seems to work. But for others, including me, this comparison is hard to envision, and it generates more questions than answers. Perhaps in trying to understand the concept of PPM, I am being too analytical, but let’s take this comparison of it to the management of a financial portfolio. Three assumptions are quite problematic: (1) how the portfolio manager works, (2) how the customers of the portfolio manager work, and (3) the nature of the portfolio investments.

First, do financial portfolio managers and project portfolio managers work the same way or even remotely similar to each other? I happen to know a financial portfolio manager, Hunter Cade, an expert in financial services and wealth management. He is my cousin’s husband, and he helps enlarge and preserve the wealth of many clients, including the parents of his wife, my uncle and aunt, and a retired Mississippi State University department head and loving wife. With over four decades of experience, Mr. Cade is a highly trusted and highly skilled advisor equipped with tools, information, and deep, deep domain knowledge. When he offers advice, it is wise to take heed of it. In fact, such advice is usually received with a certain amount of appreciation and even thankfulness. Does this sound similar to the environment of a project portfolio manager? When a project portfolio manager brings to the attention of the customer, the steering committee, a non-performing asset, a project, and a recommendation to make changes to the portfolio, is that advice taken in a similar fashion? Or has an invitation to a debate, and possibly an organizational turf battle, just been informally given?

Next, do customers of the financial portfolio manager and customers of the project portfolio manager work or behave the same way? When the customer of the financial portfolio manager is told that one of the assets is not performing and should be dropped from the portfolio, does the customer take that advice or engage in an impassioned defense of the nonperforming asset? Most customers are all too happy and eager to drop the nonperforming financial asset. Now, is this the same kind of behavior that customers of the project portfolio manager exhibit? When told of a nonperforming asset (a project) are they eager to kill the project? Or is it more likely that one or more folks step forward to defend the merits of their project or to perhaps offer a transformation recommendation of the project to protect it. At the least, there will be folks who want to fully understand the science and rationale of why their project is a candidate for termination. These PPM behaviors and interactions are all valid and, in fact, desired and necessary. Advanced transparent economic democracy within the confines of a business organization—that doesn’t sound like the management of a financial portfolio, nor does it sound easy to do.

Finally, is the nature of the portfolio investments the same? That is, can financial investments and project investments really be viewed similarly? A few years ago, Gantthead, the online community for IT project managers, was seeking the answer to that very question and thought it would be a good idea to ask an expert. They boldly and enthusiastically invited Dr. Harry Markowitz, credited as one of the creators of portfolio management theory, to an interview. In the 1950s, Markowitz introduced the concept that a portfolio of diverse investments will reduce risk and provide a higher return than individual investments. His work, known as Modern Portfolio Theory (MPT), changed the way investments were viewed and earned him the Nobel Prize in economics. When Dr. Harry Markowitz was asked in a Gantthead interview with Paul Harder (2002, p. 1) about the application of financial portfolio management to corporate project management, Dr. Markowitz did offer that the notion of treating project investments like financial investments was attractive, but he expressed caution and concern over the idea. “All I know is that in the typical investment situation one can finely subdivide one’s funds among many fairly liquid assets. The same cannot be said of portfolios of projects.”

In summary, if the leading expert in MPT can’t quite grasp the concept of managing a portfolio of projects much as you would manage a portfolio of diverse investments, then perhaps the concept of PPM is not that easy to grasp after all. But what do the project management and PPM experts have to say? Is the concept really as simple as doing the right projects and doing projects right?

Harvey Levine (2005, p. 11) makes it sound rather easy, “Project portfolio management is not a highly scientific, theorem-oriented concept. It is just plain common sense. It is easy to implement and practical to employ.” Of course, Mr. Levine is an expert in PPM and his book, Project Portfolio Management—A Practical Guide to Selecting Projects, Managing Portfolios, and Maximizing Benefits is a must read and one of my favorites. Although Mr. Levine comments on the need to keep PPM practical, this doesn’t quite suggest the level of difficultly that it really entails. What may seem easy to Mr. Levine and all those who are invited to speak at the various PPM conferences, events, and venues, may be a bit more difficult for the rest of us.

Ironically, it is the PPM providers who have tremendous experience, practical insights, and wisdom to lend to this topic, but regrettably, they are far too often called vendors and treated as such. That is, they are invited and welcomed to sponsor and fund an event such as a conference, professional development day, or local chapter meeting within the project management community, but heaven forbid, let’s not let them actually speak to the attendees. This vendor mindset may be suitable for the relationship one might have with a soda-dispensing machine, but in the context of the project management community, such a mindset is difficult to understand. But let’s get back to what other PPM experts within the project management community have to say about the concept.

In Levine’s PPM book, contributors Cohen and Englund (2005, p. 185) warn, “Establishing formal PPM provides a framework within which better decisions can be made and results in numerous related benefits to the organization. Nevertheless, it inevitably involves implementing significant changes that can be met with initial resistance.”

Also contributing to Levine’s PPM book is K. C. Yelin (2005, p. 217) who cauti...

Table of contents

- COVER

- TITLE

- COPYRIGHT

- CONTENTS

- FOREWORD

- ACKNOWLEDGMENTS

- ABOUT THE AUTHORS

- CONTRIBUTORS

- PREFACE

- INTRODUCTION

- WEB ADDED VALUE

- CHAPTER 1 PPM RISK #1: SHARED VISION, MISSION, GOALS, AND OBJECTIVES

- CHAPTER 2 PPM RISK #2: EXECUTIVE LEVEL SUPPORT

- CHAPTER 3 PPM RISK #3: FUNCTIONAL CHAMPION

- CHAPTER 4 PPM RISK #4: BIG BANG VS. INCREMENTAL ADOPTION

- CHAPTER 5 PPM RISK #5: THE EFFECTS OF CHANGING PROCESSES AND MEASURES

- CHAPTER 6 PPM RISK #6: TIMEFRAME FOR ANALYSIS AND DECISION MAKING

- CHAPTER 7 PPM RISK #7: QUANTIFYING BUSINESS VALUE

- CHAPTER 8 PPM RISK #8: ENSURING DATA INTEGRITY

- CHAPTER 9 PPM RISK #9: TOOLING AND ARCHITECTURE

- CHAPTER 10 PPM RISK #10: SUSTAINING VALUE

- EPILOGUE