eBook - ePub

Aircraft Finance

Strategies for Managing Capital Costs in a Turbulent Industry

- 408 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Aircraft Finance

Strategies for Managing Capital Costs in a Turbulent Industry

About this book

One of the largest assets that an airline has are aircraft, therefore it is critically important to develop a methodology that estimates an aircraft's value, and which also determines efficient utilization to ensure an acceptable rate of return on the asset. Aircraft Finance provides a comprehensive review of aircraft finance and valuation and presents a detailed methodology for accurately valuations. The methodology measures return on investment, improves the efficiency of managing operating costs and more effectively determines revenue analysis.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Aircraft Finance by Bijan Vasigh,Reza Taleghani,Darryl Jenkins in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

The Globalization and Evolution of the Commercial Aircraft Industry

With a short dash down the runway, the machine lifted into the air and was flying. It was only a flight of twelve seconds, and it was an uncertain, wavy, creeping sort of flight at best; but it was a real flight at last and not a glide.—Orville Wright, on the first flight of a heavier-than-air aircraftIn the aircraft business, as in a Trollope novel, things are often not what they seem. In the 1980s, Boeing still reigned supreme. Its airplanes covered the market. Its product support was exemplary. Boeing was universally judged one of America’s best and most admired companies, partly because its sales of large commercial airplanes were the country’s biggest export, and partly because it had learned to build those airplanes better, faster, and cheaper than anyone else had done... Today, things have turned around. Boeing and Airbus are the sole suppliers of big airliners, but over many of the past twenty years, the two companies were moving in opposite directions. Boeing’s multiple troubles, most of them self-inflicted, signaled an end to its dominance and pointed up Airbus’ methodical rise.—John Newhouse, Writer and Correspondent

Aircraft manufacturing is a vital industry that greatly influences the entire economy of a nation. The industry receives significant attention from policymakers and industry analysts. Nowadays, the commercial aircraft industry is dominated by two companies, primarily due to high barriers to entry and high degrees of operating and financial leverage.

Those two companies are Airbus and Boeing. In 2010, Airbus delivered 510 aircraft and received net orders for 574 new planes.1 During the same period, Boeing delivered 460 aircraft and received net orders for 530 jets.2 In 2011, Boeing deliveries rose 3% to 477 from 462 the year before.3 Total orders for Boeing commercial aircraft surged 52% to 805 in 2011, after 116 cancellations.

Development of new commercial aircraft requires massive initial investment in labor, capital, equipment, and technologies. Historically, this has led to the formation of large, consolidated firms with financing from public and government sources. For example, the A380 development cost was more than $14 billion, with one-third of the cost financed by European members of the Airbus consortium. France, Britain, Germany, and Spain have each invested heavily in the A380 program. The Boeing 777 cost approximately $5.5 billion to develop, of which $3 billion was used toward overcoming production delays.4 While there were several aircraft manufacturers, including Ford in North America and Junkers in Europe, from the early 1900s through the late 1980s that made significant contributions, the industry has undergone considerable consolidation in the past two decades, resulting in the emergence of a relatively stable duopoly for narrow-and widebody commercial airliners: Boeing Company in North America and Airbus S.A.S. in Europe.

This chapter presents a brief history and overview of the product offerings of major commercial aircraft manufacturers, as follows:

Early Contributions to Commercial Aircraft Manufacturing

- Ford Tri-Motor

- Junkers German Transport

Commercial Aircraft Manufacturing

- North America

- Western Europe

- Russia and Eastern Europe

- Asia

- Regional Jet Markets

At the end of the chapter is a Summary for chapter review and a Bibliography for further study.

Early Contributions to Commercial Aircraft Manufacturing

The commercial aircraft industry requires a large investment to develop and manufacture aircraft, avionics, and engines. Economic problems may significantly impact profitability. Many aircraft manufacturing companies have gone out of business or merged with peers. The industry is littered with the reminiscences of unsuccessful commercial aircraft endeavors. The three-engine Ford Tri-Motor aircraft series produced during the 1920s and 1930s were classic planes of that era. In Europe, Junkers was a major German aircraft manufacturer, manufacturing some of the best-known aircraft over the course of its 50-plus years in business. The Lockheed L-1011 was a wide-body aircraft that entered into commercial operations following the launch of the Boeing 747 and the McDonnell Douglas DC-10. However, Lockheed withdrew from the commercial aircraft business due to poor sales.5 Subsequently, in 1997, McDonnell Douglas faced a financial crisis and merged with its rival, Boeing.6

Ford Tri-Motor

In the early 1920s, Henry Ford and his son Edsel, along with a group of 19 others, invested in the Stout Metal Airplane Company. The first Ford/Van Auken airplane, powered by a Model-T engine, arrived in 1909, only six years after the Wright Brothers’ first flight. It would not be until 1927, however, that Ford would enter the commercial aviation arena with the first of the 4-AT series Ford Tri-Motor, referred to as the Tin Goose. Previous Ford-manufactured aircraft, like the model 2-AT Air Transport, had been used by Ford to ship auto parts, mail, and personnel between Denver, Detroit, and Cleveland.

The Ford Tri-Motor was the first plane primarily designed to carry passengers instead of mail. The aircraft could carry 14 or 15 people, possessed a cabin high enough for passengers to walk without stooping, and had room for a flight attendant. 7 The Tin Goose’s three engines made it possible to fly as high as three miles at a speed of about 130 miles per hour. Its sturdy appearance and Ford name had a reassuring effect on the public’s perception of flying (Ingells, 1968). The Tri-Motor had a range of approximately 500 miles and was not capable of crossing continents without refueling. Ford, unlike his cars, did not manufacture the engines for these airplanes.

From 1926 through 1933, there were 199 Ford Tri-Motors built.8 The Tri-Motor sales dropped from a peak of 86 per year in 1929 to only two sales in 1932.9 The Ford Motor Company ceased manufacturing this aircraft in 1932 (Larkins, 2007). The end of Ford’s contribution to commercial aircraft manufacturing was likely due to a combination of various issues at the time: the tightened market and economy of the Depression era, the overall loss incurred in the production of the airplanes, the diminished need for a three-engine aircraft, an increased need for a faster and more economical design for airline use, and Henry Ford’s diminishing interest caused by the deaths of three test pilots in crashes.

Junkers German Transport

“Junkers” is a name that quickly became associated with important aerodynamic and structural advances in aircraft in post-World War I Germany. The company was founded by Hugo Junkers. In 1919, Junkers began designing aircraft that would become the world’s first all-metal airliner and also the forerunner of all commercial transport aircraft. The single-engine, low-wing, cabin monoplane was of particularly small dimensions since it was necessary to work within the onerous restrictions forced upon Germany. It was in production for 13 years and in commercial use for about 20 years (Kay & Couper, 2004).

Junkers produced the F13 commercially, and the aircraft was made entirely of Duralumin. It was designed to be dismantled into sections for easy shipment to export markets.10 The F13 first flew on June 25, 1919, and the first order for an F13 came from an American businessman named John Larsen, who planned to sell it as a JL6 in North America. A total of 322 F13s were produced, mainly between 1923 and 1925; most went into service in Germany and Russia (Kay & Couper, 2004).

Commercial Aircraft Manufacturing

As historical data on the commercial aircraft industry shows, the entire industry was influenced by a few major companies. Today, the industry enjoys a tight duopolistic, or oligopolistic, market structure due to significant barriers to entry. Since the merger of Boeing and McDonnell Douglas in 1997, the industry is dominated by two major players: Boeing in North American and Airbus in Europe.

North America

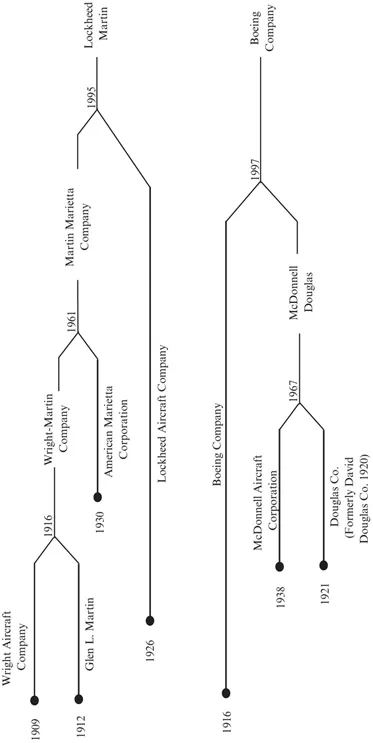

Worldwide aircraft manufacturing was, and to a large measure continues to be, dominated by North American manufacturers. After World War II, four prominent players emerged in the business of building commercial jets: Boeing, McDonnell, Douglas, and Lockheed. McDonnell and Douglas merged in 1967, and the combined entity remained a long-standing competitor to Boeing until its ultimate merger with Boeing in 1997.

Lockheed merged with Martin Marietta in 1995, and the combined entity later refined its focus to primarily military aircraft manufacturing (Sandler & Hartley, 2007). Both Boeing and Lockheed Martin competed for American defense contracts, and it has been claimed that Boeing used its defense division to crosssubsidize its commercial airline development.

Boeing and Lockheed dominated the North American aircraft manufacturing landscape both in terms of civilian and military aircraft. Together with McDonnell Douglas, Boeing was a world leader in commercial aircraft manufacturing into the 1980s, when Airbus Industrie evolved into a major competitor that would eventually surpass Boeing in market share. Figure 1.1 chronicles the mergers of commercial aircraft manufacturers in the U.S. over the last century, with omission of military aircraft manufacturer mergers for the sake of clarity.

Boeing Aircraft Company

Boeing has been a dominant player in the commercial aircraft market for the greater part of the last century. Recent loss of market share to Airbus does not diminish the fact that Boeing is a strong company and a leader in commercial aviation. While this section will focus on commercial aircraft history, it is important to note that Boeing’s start and its success came from the sale of military aircraft. In 1916, William Boeing (founder and namesake) built his first seaplane, which he sold to the New Zealand government. The following year, Boeing sold 50 seaplanes to the U.S. Navy and continued to receive military and defense contracts from the U.S. government, including a $35 billion contract to build a new generation of refueling tankers for the Air Force.11 The financial success of military aircraft projects allowed the company to enter into high-risk commercial aircraft projects that may not have been profitable. Having the financial ability to undertake high-risk commercial aircraft projects is one of the reasons that Boeing is at the forefront of aircraft development.

Boeing began to learn the aircraft manufacturing trade by first building and modifying existing designs from other manufacturers. In 1918, founder Boeing was contracted to build the Curtiss-designed HS-2L, a military patrol plane. Later, in 1919, he modified the de Havilland DH-4 (Heritage of innovation, 2009). These modifications allowed Boeing to take apart and rebuild aircraft in order to relocate the fuel tank. As most engineers know, being able to take apart and re-assemble a manufactured product such as an airplane allows one to see how the item is constructed and how it works, providing insights into how to make the item. The process of designing something through the deconstruction and reconstruction of a similar item is called reverse engineering. The use of reverse engineering helped Boeing to develop its own planes, including its first commercial aircraft, the B-1 mail plane, which was launched in 1919, beginning a 90-year history of building commercial airplanes.12

Figure 1.1 U.S. commercial aircraft manufacturer mergers

Source: Compiled from Boeing and Lockheed Martin data.

Boeing’s real start into the commercial aviation business came through the U.S. mail network. The U.S. Postal Service awarded Boeing a contract to transport mail by air between San Francisco and Chicago in 1927. Boeing founded...

Table of contents

- Cover

- High Praise for Aircraft Finance

- Title

- Copyright

- Dedication

- Contents

- About the Authors

- Acknowledgments

- Foreword

- Preface

- Prologue

- Web Added Value™

- Chapter 1 The Globalization and Evolution of the Commercial Aircraft Industry

- Chapter 2 Aircraft Variants and Manufacturing Specifications

- Chapter 3 Aircraft Efficiency: Operating and Financial Metrics

- Chapter 4 A Methodology for Aircraft Valuation

- Chapter 5 Aircraft Valuation and Sensitivity Analysis

- Chapter 6 The Principles of Effective Cost Management and Capital Structure

- Chapter 7 Aircraft Secured Bond Transactions and Securitization

- Chapter 8 General Aviation Aircraft and Appraisal

- Chapter 9 Aircraft Leasing and Finance

- Chapter 10 Airline Fleet Selection Process

- Chapter 11 Export Credit Agencies and Aircraft Finance

- Appendices

- Glossary