![]()

SECTION 1

PROJECT PORTFOLIO BASICS

Section 1 introduces project portfolio management (PPM) and lays the foundation for the book. It answers the questions of what PPM is and why it is needed. It defines a portfolio, program, and a project and shows the differences between the three. A portfolio model, referred to as “Funnel & FiltersSM,” is also introduced in this section. The model illustrates how the project life cycle fits into a portfolio and how project and portfolio management interact and interface with each other. This section also presents a discussion on similarities and differences between financial and project portfolios. More important, it highlights the financial portfolio management principles that can be effectively applied to PPM.

![]()

1

INTRODUCTION

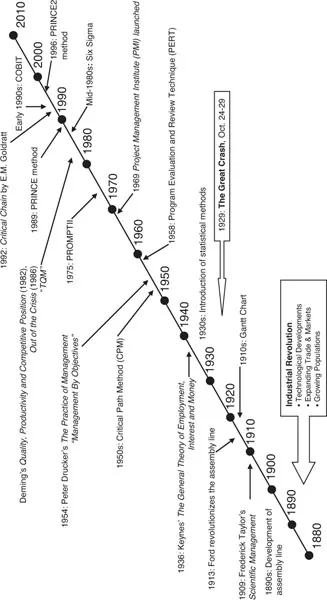

As the speed of change in the business environment has accelerated over the years, organizations are continuously striving to stay competitive in the marketplace. They are shifting strategies, driving innovation, releasing new products and services, expanding into new global markets, reorganizing management structures, and so on. These actions are commonly managed through large strategic initiatives that are ultimately translated into projects. While many major projects are driven by strategic initiatives, others are a result of operational needs and demands. Furthermore, irrespective of whether or not your organization has generated profits, you will undertake projects to comply with ever-changing technology, health, safety, environmental, and other mandates. Thus, projects have become the lifeblood of every organization to respond to change, and project management has been adopted as a formal process to complete these projects “better, faster, and cheaper.” Today, it is one of the hottest topics in business. As a management process, project management has reached—or even surpassed—the heights of total quality management and six sigma. Figure 1-1 shows the advent of project management (represented by a Gantt chart, PERT, critical chain, PRINCE, etc.) juxtaposed with the other major business and management theories and techniques of the past century.

The focus of project management has always been on managing individual projects to achieve scope, time, and cost targets. As organizations reach higher levels of maturity in managing projects as disparate entities, they shift their focus to managing them collectively as project portfolios using a formal project portfolio management (PPM) process. This transition seems to occur when the organization realizes that projects are investments, not expenditures. Investments require sustainable returns over the long haul. They must align with the strategy and goals of the organization providing the resources—both monetary and human. Most important, they must create value for the organization’s owners as well as other key stakeholders (conjointly referred to as stakeholders hereafter). Project managers and sponsors may be more interested in their project cost targets, but executive managers are more focused on creating collective returns for the stakeholders from various project investments. They want to ensure that organizational resources are allocated to the best investments. Therefore, it has become paramount that projects are managed under a portfolio with a well-defined investment strategy that will help the organization create long-term sustainable value for the stakeholders. The purpose of this chapter is to define a project portfolio, introduce the portfolio management process, and set the stage for the book. In this chapter, you will also learn about my intent in writing the book and the audience I have in mind.

Figure 1-1 Project management and other management theories (Resch, 2011)

WHAT IS A PROJECT PORTFOLIO?

A project portfolio is a collection of strategically aligned, value-generating projects that help achieve organizational goals.

I will discuss this definition in detail in Chapter 2, but before going further, we need to establish a few basics. Any project portfolio by definition contains projects. But a “true” portfolio has projects that: 1) are aligned with the strategy of the organization sponsoring the portfolio, 2) help the organization achieve its goals, and 3) ultimately generate value for the stakeholders. This means that every project in the portfolio must, at a minimum, meet these requirements. The candidate projects for the portfolio must be evaluated for their alignment with the organization’s strategy and goals and value creation potential, among other characteristics. This exercise is generally called “business case” analysis. Projects that meet the portfolio requirements showing a strong business case will stay in the portfolio and receive investment. As projects in the portfolio go through their respective life cycles, they are reevaluated periodically to ensure that they continue to meet the portfolio requirements. If they do not, their scope/time/cost targets may be revised or they are terminated.

WHAT IS PROJECT PORTFOLIO MANAGEMENT?

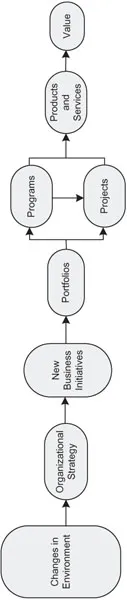

Project portfolio management—simply referred to as portfolio management—is a complex process that starts at the very top of the enterprise. It helps you convert the enterprise strategy into desired results. It is a key step in the overall strategy execution process (Figure 1-2). The external business environment is constantly changing. It may be a general shift in the economic conditions, or it may be changes driven by competition, customer needs, technology breakthroughs, new markets, regulatory controls, or a myriad of other causes. The changes may even be internal to the organization such as bloating bureaucracy and deterioration of employee morale. In response to the changes, the executive managers revise the enterprise strategy and formulate organizational goals. In the case of visionary leaders, transformational strategies and goals are introduced proactively. To achieve the desired results, new business initiatives are created. Programs and projects are the building blocks of these initiatives. They produce products and services that ultimately help achieve the organizational goals by creating value. Through a portfolio, the PPM process offers a vehicle to turn the strategy into value. PPM collectively brings coherence to implementing the business initiatives. It ensures that the right organizational resources are allocated to the right project priorities at the right time. PPM can be applied at any level of the enterprise. The principle is the same. Consider any organizational unit, for example, a division or a function. It must have its own strategy and goals. The PPM process will help you translate its strategy into value through projects at that organizational unit.

Whether you are a profit-driven, nonprofit, or government entity, your stakeholders expect the organizational resources to be invested in the right projects to deliver maximum value for them. They also expect you to invest in the right mix of projects balancing the benefits-cost-risk equation. PPM is tantamount to management of project investments to deliver value for your stakeholders. It translates to efficient allocation of organizational resources to the right project priorities. It involves evaluation, prioritization, and selection of projects integrated with investment decision checkpoints. The checkpoints include the initial invest/no-invest as well as the ongoing continue/ cancel decisions, collectively called go/no-go decisions, spanning the life cycle of each project in the portfolio. The process behind the decision-making framework is the backbone of PPM.

Figure 1-2 Role of PPM in strategy execution

WHY PORTFOLIO MANAGEMENT?

Successful organizations are those that are able to bring innovation to the market fast, alter their course swiftly to adapt to changes, leverage technology to gain competitive advantage, and manage risk effectively in today’s uncertain world. This translates to first making the right strategic choices, investing in the right projects that align with those choices, and completing them successfully for the desired outcomes. All this at super speed! Portfolio management is about effectiveness (doing the right thing or selecting the right projects for investment), whereas project management is about efficiency (doing it right or implementing the projects faster, cheaper, and better). For PPM to be successful in your organization, you must first have a strong project management process in place. This is why, as mentioned at the outset, organizations typically initiate a PPM process as they reach higher project management maturity. The interconnectedness between the two processes will become clearer as we move through the book. Furthermore, if your projects are collectively managed under a program umbrella, an effective program management process will also be a requisite for a successful portfolio.

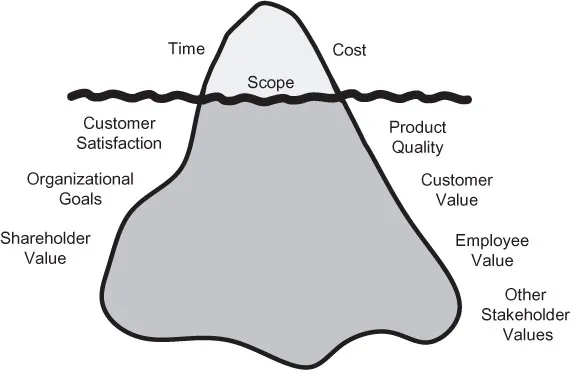

Project Iceberg

Organizations at the lower project management maturity spectrum manage individual projects focusing only on the well-known project triple constraint that includes scope of work, schedule, and cost. You may have completed a project meeting this constraint and concluded it was successful. But it is not truly successful if you delivered an inferior product or left the customer unhappy. On the other hand, let’s say you not only met the constraint but also delivered a superior product and delighted the customer. This may not turn out to be a success for your organization, however, if no shareholder value was created in the long run. Then, what if you created enormous wealth for them, but in the process, damaged the environment, made fatal safety mistakes, destroyed employee morale, or violated laws or ethics? So the important question is whether the project ultimately produces value for the concerned stakeholders without destroying value for others.

PPM considers the project triple constraint just the tip of the iceberg (Figure 1-3). It helps you plow into the iceberg and assess a project from various facets, so you make the right investment that generates value for all the key stakeholders. Moreover, an enterprise-wide coherent PPM process provides you with an overarching strategy to manage the various icebergs in your organization. By assessing, monitoring, and managing the project icebergs collectively, PPM navigates your organization in the right direction for the distant future.

Figure 1-3 Project iceberg

HOW CAN YOUR ORGANIZATION BENEFIT FROM PORTFOLIO MANAGEMENT?

As I alluded at the outset, today’s organizations are evolving from project management maturity to portfolio management maturity. If your organization has already reached maturity in project management practice, you are more likely to complete your projects meeting the scope, schedule, and cost targets. But this does not necessarily mean that the project deliverables or outputs have indeed helped you generate value for your stakeholders and achieve your organizational goals. It is entirely possible that you selected and invested in a project not (or poorly) aligned with the organizational goals in the first place. Or, perhaps the original organizational goal the project was supposed to serve has changed before project completion. Apart from alignment, the value creation potential of the project may have been weak (or even nonexistent) to begin with or turned weak before the project was completed. These scenarios are somewhat characterized by a “right solutions to wrong problems” syndrome resulting in a waste of organizational resources. Invest in enough of such projects, and watch your competitiveness evaporate in no time, potentially leading to extinction of your organization. The following paragraphs illustrate how your organization can benefit from PPM.

Organizational Change Management

Rapid changes in the economy, markets, technology, and regulations are forcing organizations to formulate new strategies or fine-tune the current ones more frequently than ever. As these strategies are translated into new initiatives supported by new programs and projects, portfolio management offers a framework to manage the change effectively. It helps you make the right investment decisions to generate value for stakeholders. It provides you with the right tools to rapidly alter the course of action in response to fast changes in the environment.

Clear Alignment

A well-designed and managed formal portfolio management process ensures that projects are aligned with the organizational strategy and goals at all times. New project ideas are evaluated for their alignment with the strategy and goals, and no projects are funded unless there is clear alignment. In addition, the degree of alignment is continuously monitored as the selected projects go through their individual life cycles. If an ongoing project no longer shows strong alignment, it may be terminated and the resources allocated to other higher priority projects.

Value Creation

Portfolio management helps you deliver value to your stakeholders by managing project investments through a structured and disciplined process. The justification for the projects is clearly identified by quantifying the expected benefits (both tangible and intangible) and costs. Only those projects that promise high value and rank high against the competing ones throughout their life cycles are funded. Portfolio management gives you a bigger bang for your investment buck in the long run because you are managing the investments in a systematic fashion.

Value Balancing

For a profit-driven company, the organizational goal may be to generate the maximum financial returns possible for the owners or shareholders. But if the projects selected for investment are based solely on financial value generation potential, interests of other key stakeholders may be compromised. PPM will help you create a balance among the projects to deliver not only financial value but other value forms as well.

Long-Term Risk Management

When projects are initiated and implemented without the portfolio framework, project sponsors and managers typically focus on the short-term risks related to the completion of the project and do not pay enough attention to the long-term ris...