7 Successful Stock Market Strategies

Using market valuation and momentum systems to generate high long-term returns

- English

- ePUB (mobile friendly)

- Available on iOS & Android

7 Successful Stock Market Strategies

Using market valuation and momentum systems to generate high long-term returns

About this book

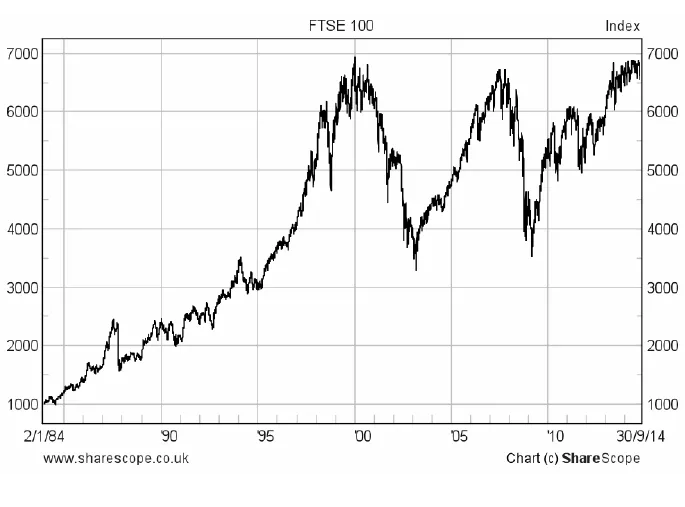

Successful strategies for high long-term returnsThe long-term benefits of investing in the stock market are clear. For periods of ten years upwards, equities have delivered higher returns than any other non-physical UK asset class. Those investing for the long term should put their money to work in the stock market.In this easy-to-follow practical guide, Glenn Martin introduces seven strategies for index investment in the FTSE 100 and FTSE 250. These strategies can be followed by anyone willing to adopt a systematic approach and accept short-term risk in exchange for long-term rewards. Incredibly, even the most advanced strategy requires no more than an hour per week of your time.The seven strategies involve varying levels of risk. For those who want to commit the minimum time and take on less risk, there are two passive buy-and-hold strategies. Those wanting to commit a little more effort and take on higher risk - with the potential for higher rewards - can use a proven system to time when to invest in the stock market and when to hold funds as cash. The most advanced strategies, which carry higher short-term risk with the potential to achieve spectacular long-term returns, make use of the gearing offered by spread trading. Each strategy has a set of clear and simple instructions, plus there are historic performance tables and the expectations for future returns.Unique features of this innovative book include:- How to construct a spreadsheet to produce a valuation of the FTSE 100 and the expected returns from a five-year investment in the index. These valuations constitute buy/sell signals which have delivered a profit for every historic period in the market.- How to extend the spreadsheet to calculate post-tax returns tailored to your own tax circumstances.- A Market Momentum System that uses simple moving averages to signal when you should exit the market to minimise the impact of major market crashes.- 30-year track records for all the investment strategies.- A system for creating a synthetic tax-free FTSE 100 tracker using FTSE 100 spread trades.- A FTSE 100 spread trading simulator that enables you to test the historic returns you would have achieved according to your appetite for short-term risk. At the highest level of short-term risk, £1,000 would have grown to more than £12,300,000 over 30 years, with all of the gains being tax-free.Leaving your cash in a deposit account could see its real value whittled away by poor interest rates and inflation. If you are looking for a way to grow your money significantly over time by following a straightforward investment plan, then this book shows you how.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

PART B.

SEVEN STRATEGIES

Chapter 4. Strategy 1 – Long-Term Investment In The FTSE 100

How to maintain a long-term investment in the FTSE 100

- A FTSE 100 tracker in the form of a unit trust or OEIC (see the glossary in the Appendix).

- A FTSE 100 exchange traded fund (ETF).

- Running a synthetic FT...

Table of contents

- Contents

- PART A.BACKGROUND THEORY

- PART B.SEVEN STRATEGIES

- PART C.PRACTICAL CONSIDERATIONS

- Epilogue