Teaching Money Applications to Make Mathematics Meaningful, Grades 7-12

- 168 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Teaching Money Applications to Make Mathematics Meaningful, Grades 7-12

About this book

"GREAT content, GREAT activities, GREAT explanations!"

—Joyce Deer, Math Teacher, North Pike High School, Summit, MS

"A valuable addition to the literature on the practical use of mathematics in the real world. This book will contribute to the improvement of monetary connections within secondary mathematics as well as financial literacy in our country."

—Edward C. Nolan, Mathematics Department Chair, Albert Einstein High School, Kensington, MD

Use real-life money issues to raise students? mathematical and financial literacy!

Research has solidly established the importance of teaching mathematics in contexts that capture student interest and involvement. Weaving real-world financial issues into secondary mathematics instruction, this highly practical book offers teachers engaging ways to infuse personal money management into NCTM standards–based math lessons.

Using authentic material from daily life, the authors illustrate instructional strategies that connect required mathematical concepts with basic money matters, giving students a solid understanding of financial realities essential to successful everyday living. This resource meets the expanding demands for equity and accountability and:

- Relates math to credit cards, paying taxes, stocks & bonds, mortgages, buying a car, and much more

- Expands teachers? knowledge of basic financial concepts

- Provides suggestions for projects to extend the concepts learned

- Includes a math locator, glossary of money terms, comprehensive index, and summary of formulas

This valuable guide gives teachers, math coaches, and curriculum specialists the resources they need to make math come alive in the classroom and to develop financially savvy students.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

1

Cars, Cars, and More Cars

Paying for Your Wheels

NCTM STANDARDS APPLIED IN THIS CHAPTER

- Number and Operations. Understand meanings of operations and how they relate to one another; compute fluently and make reasonable estimates.

- Algebra. Understand patterns, relations, and functions; represent and analyze mathematical situations and structures using algebraic symbols; use mathematical models to represent and understand quantitative relationships.

- Data Analysis and Probability. Select and use appropriate statistical methods to analyze data.

- Problem Solving; Reasoning and Proof; Communication; Connections; Representation

BACKGROUND: BASICS OF BUYING CARS

TEACHING EXAMPLE 1.1

- Calculate the total cost of owning a car

- Calculate monthly car loan payments

- Calculate the depreciation of cars over time

ABS, Air Conditioning, Cruise

Control, Single Compact Disc, Dual

Front Airbags, FWD, Power Door

Locks, Power Steering, Power

Windows, AM/FM Stereo,

Tilt Wheel,

Only 40,000 miles,

Original Owner, Kept in Garage,

Service Records Available

Monthly Auto Expenses

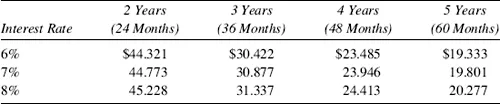

- $270 per month for the car loan. (Assuming $10,000 loan for 48 months: Range: good credit, 4% rate, and $226 a month or, if bad credit, 21% rate and $310 a month; let’s say somewhere in between, about $270 a month)

- $200 per month for auto insurance. (On average, about $2,400 annually or $200 a month, although it could be as high as $5,000 a year or $417 a month)

- $80 per month for maintenance. (On average, about $80 a month—oil change, tires, etc.)

- $107 per month for fuel. (On average, 1,000 miles a month for teens and assuming regular gas at $2.68 per gallon and MPG of 25)

- $7 per month for registration/license/inspection.

- Buy a car with a clean history and a brand name known for reliability.

- Make as large a down payment as possible (at least 20%) and take a loan for at most 48 months (so you never owe more than the car is worth).

- Maintain a history of safe driving so insurance will be minimized.

- Avoid speeding, rapid acceleration, and braking. In addition to putting you and others at risk, driving carelessly can increase MPG by 5% around town and by 33% at highway speeds.

- Each car reaches its optimal fuel economy at different speeds, usually decreasing after 60 MPH.

- Remove excess weight—an extra 100 lbs in your car could reduce MPG by as much as 2%.

- Use cruise control on the highway—maintaining a constant speed saves gas.

- Keep your tires filled at proper pressure and your car engine tuned.

| First Year | 30% |

| Second Year | 25% |

| Third Year | 20% |

| Fourth Year | 15% |

| Fifth Year | 10% |

Table of contents

- Cover Page

- Title Page

- Copyright

- Contents

- Foreword Charlotte Danielson

- Introduction

- Math Locator: By Chapter and Teaching Examples Within Chapters

- About the Authors

- 1. Cars, Cars, and More Cars: Paying for Your Wheels

- 2. Savings: Reality Check and the Difference Between Needs and Wants

- 3. Credit Cards and Debt Management: Using Credit Seems Unreal

- 4. Investments: The Basics and More

- 5. Buying a House Versus Renting: How Much Will It Cost?

- 6. Taxes: How They Work

- 7. Economics: Supply and Demand, Inflation, and the GDP

- 8. In Business for Yourself: Business Plan and Break-Even Analysis

- Selected List of Formulas

- Excel Spreadsheet Hints

- Money Glossary

- Index