![]()

1. Alone Together

“For many of us—we silent sufferers who cannot speak about our financial tribulations—it is our lives, not just our bank accounts, that are at risk.”

– Neal Gabler

“Nothing is so bitter that a calm mind cannot find comfort in it.”

– Seneca

Money life

Money courses through both daily decisions and grand contemplations. It acts as the oil in the engine of everyday life, without which metal grinds metal. With it, the engine operates, which isn’t to say it drives in the right direction.

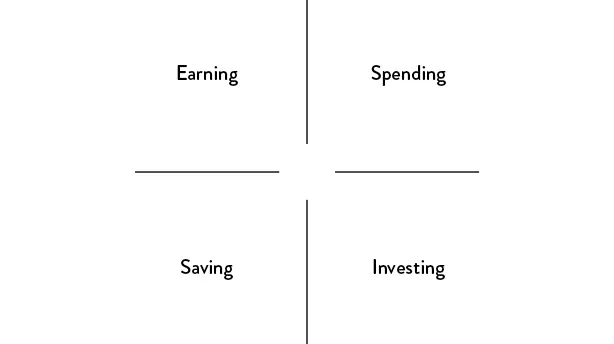

Money life, a term I’ll use many times, has four dimensions: Earning, spending, saving, and investing.

It starts with a paycheck. The phrase “Making a living” is heavily loaded with the gravity of holding a job whose first but not sole purpose is to sustain ourselves and our families. Absent the ability to earn, the future is dim. Paycheck in hand, we then must figure out how to navigate a vast array of decisions. The first and largest batch of decisions relates to spending. Beyond the monthly bills, there are consumption choices that have grown more and more plentiful. The remainder of unspent earnings, if any, creates the opportunity to save. Lastly, there is investing, the process of putting our financial capital at risk to grow it at a higher rate than what it would make sitting in cash. Regardless of income level or inherited riches, the matrix of our money lives is complex and stressful.

While we all share similar concerns and pose similar questions, we don’t figure it out collectively. Money is an isolated—and isolating—affair. We figure it out on our own.

What are we all up against? I see three broad challenges currently:

- We have more control over our own finances.

- We are wired to make bad money decisions.

- We have less room for error.

I’ll address each of these in turn.

The first challenge: You’re in charge—like it or not

The zeitgeist of modern times is defined by a deluge of information and choice, a thinning of deep social ties despite unprecedented digital connectedness, and a do-it-yourself approach to just about everything. In our world of lonesome crowds, we harbor great discretion and responsibility. Through technology, we now have it in our grasp (or so we think) to be media moguls, culinary experts, travel agents, medical practitioners, meteorologists, instant scholars of ________ (choose a Wiki page), and, yes, market experts and portfolio managers. We have more autonomy across more domains than ever before. We live in an age of information. We live in an age of anxiety.

In the domain of money, we’re being put to the test in unprecedented ways. The burden of managing your long-term financial health has shifted over recent generations. In particular, the nature of retirement is changing, in no small part due to the steady demise of the traditional pension plan. There are few more powerful structural forces driving the “democratizing” of our money lives and investing specifically.

Keep in mind that “retirement” wasn’t really a thing all that long ago. Modern civilization is several thousand years old, so the idea to voluntarily stop working at some point and live off of savings and investments is relatively new. The reason for this is simple: Through most of history, people worked until they died. And those who outlived their human capital relied on traditional family structures for support. In Willy Wonka and the Chocolate Factory, bedridden Grandpa Joe and Grandma Josephine weren’t pensioners, nor did they have Social Security or some other government largesse to rely upon; they were the wards of Charlie Bucket’s mom.

Starting in 19th century Europe and then later spreading to America, governments set up social safety nets for aging populations, while employers arranged benefits packages aimed at sustaining their workers in old age. In the United States, for example, a large percentage of the American private and public workforce participated in defined benefit plans for a good portion of the post-World War II era. In practical terms, that translated to a paycheck for life during retirement.

Over the past few decades, however, these collective retirement plans have been frozen or shut down altogether. They’ve largely been replaced by do-it-yourself investment programs, such as the 401(k). Since the 1980s, for example, workers with pension fund coverage shrunk from 62% to 17%, while those who had access only to 401(k) plans grew from 12% to 71%. As we’re now mostly all responsible for our own retirement investing, experts have concluded that the golden age of retirement security is over.

Our collective confidence in being able to enjoy a comfortable retirement is low. In 2017, only 18% of workers were “very confident” about having enough money after they stopped working. About one-fourth of Americans are not confident in a financially secure future, and the balance are somewhere in between. The questionable future of government benefits further undermines confidence. Though never designed or intended to be the sole paycheck in retirement, Social Security has become just that for millions.

As the social safety net weathers into a frayed hammock, the lack of retirement confidence is justified. The data on retirement preparedness are troubling. Nearly 40% of American workers have not saved for retirement. Let me repeat: Tens of millions of Americans do not h...