The Naked Trader's Guide to Spread Betting

How to make money from shares in up or down markets

- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Naked Trader's Guide to Spread Betting

How to make money from shares in up or down markets

About this book

REVISED AND UPDATED 2ND EDITION OF THE NO.1 BESTSELLER!Have you dabbled in shares or the stock market? And wondered what spread betting was all about and whether you should be doing it? Perhaps you thought it all looked a bit complex or was just for City boys? The no. 1 bestselling beginner's guide that explains - in plain English - how to do it, and how to make money from it, is back and better than ever!Spread betting shares can be dangerous: most people lose - some even lose their shirts. But it's not a world populated by pinstriped men waiting to rob you, steal your savings and do nasty things to small kittens. You can win. (And you never have to pay a penny in tax!) This book shows you how.Robbie Burns, bestselling author of The Naked Trader and Trade Like a Shark, has been spread betting for years. He explains why it's an indispensable tool to use alongside normal investing or trading. Especially as you can make money even if the market goes down.Robbie takes you through everything from how it works, to managing your risk, working out exposure, and how, often, doing nothing is the best move!He explains the ins and outs of successfully betting on shares in his trademark down-to-earth style, covering all you need to know. From the simple stuff through to proven strategies, including those that can be used in different markets - it's all here. There are also tons of real-life trading examples from his own account.But it's a big, bad old world out there, and there are a whole heap of mistakes you can make, an awful lot of money you can lose. Rounding up spine-chilling traders' tales of spread bets gone wrong, and using all he has learnt from making silly mistakes himself, Robbie also helps you learn what NOT to do.This is the ultimate guide to spread betting - how to do it, have fun and hopefully make a few quid. You can't afford to spread bet without it!

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

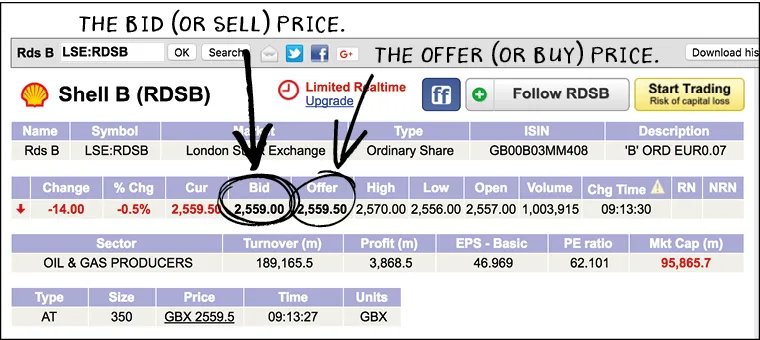

- the offer (the price at which you can buy)

- the bid (the price at which you can sell)

Table of contents

- Contents

- Praise for The Naked Trader’s Guide to Spread Betting first edition

- New to The Naked Trader?

- About the Author

- Welcome to the World of Spread Betting

- Part I: Learning It

- Part II: Doing It

- Conclusion

- Publishing details