Chapter 1: An Introduction to IPOs

In this chapter I start with a discussion of the life cycle of companies and how some of them move towards an IPO. The next section discusses why companies may decide to conduct an IPO and the potential disadvantages of such a decision. A discussion of how companies prepare for an IPO follows.

1.1 The life cycle of companies

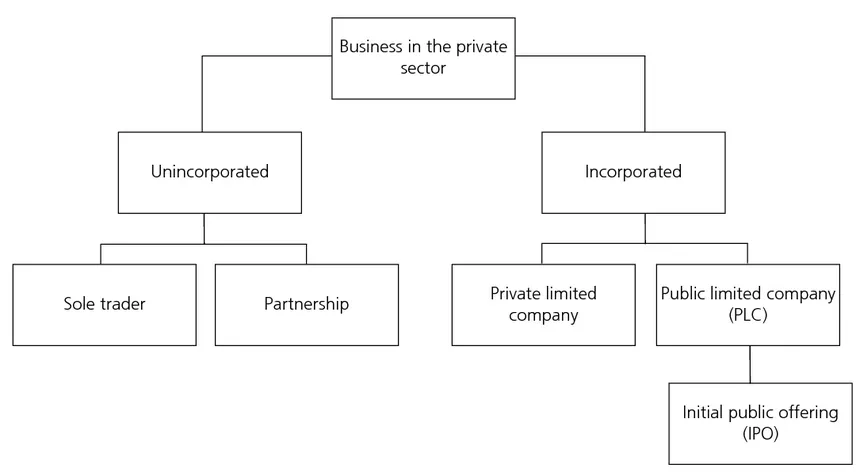

Businesses in the private sector are started either as unincorporated or incorporated concerns. Unincorporated businesses fall into two types depending on whether there is a single owner (sole trader) or several owners (partnership). With an unincorporated business there is no legal distinction between the business and its owner(s).

Incorporated businesses have a separate legal identity from their owners. Of these, the commonest form are companies limited by shares. They can be private or public limited companies. Private limited companies can only sell their shares or debentures privately but public limited companies (PLCs) can raise capital from the public at large through an IPO.

Both the unincorporated and incorporated businesses are initially funded by the founder owners and as these firms grow they need more capital. The owners may first turn to their friends and family when they need additional funds. Later they may borrow from a bank either as a fixed-term loan or through an overdraft facility. When such sources are exhausted the firms may turn towards private equity providers such as business angels and venture capitalists (VCs).

For those firms which do not have such an option (VCs have preferences for certain types of firms in certain industry sectors), an alternative is to list the company on a stock exchange through an IPO. Even for VC-backed firms, there may come a time when the VC would like to exit the firm in order to capitalise on its investment. On the occasion of such an exit of the VC from a firm, one of two usual methods is used – trade sales or, again, an IPO.

For any firm to conduct an IPO, it has to be a public limited company (PLC). So if a firm was started as a sole trading firm, it would need to incorporate itself as a PLC before it would be allowed to go public. Figure 1.1 provides an illustration of the situation as described so far for UK private enterprise.

Figure 1.1 – UK businesses in the private sector

Not all companies choose the path of an IPO. In fact, in any country only a small fraction of firms end up doing an IPO. For example, in the UK, of the 2.1 million firms registered for VAT and/or PAYE in March 2010, only around 2700 or so are listed on the London Stock Exchange (LSE).

1.2 Why companies conduct IPOs

Companies might conduct an IPO for a variety of reasons. For instance, growing companies need capital for expansion. If internal sources such as retained earnings and friends and family, or external sources such as bank loans or private equity, are either unavailable or do not generate sufficient capital then usually the only option left for a firm that needs funding is to conduct an IPO.

An IPO helps the company in more than one way. Through an IPO a firm can raise capital to finance its current and future capital requirements. A part of this capital can be used to retire debt by paying off overdrafts or loans which are close to maturity. Also, once an IPO has been completed, companies can further raise capital in the future by conducting seasoned equity offerings (called rights issues in the UK). Thirdly, companies that have conducted an IPO can expect to borrow on better terms in the market because of the better transparency surrounding the company’s business and accounts that comes from its listing on the stock exchange.

Another reason why firms may wish to go public is for employee compensation. A large number of firms believe that by offering employees a formal stake (shares with a market price) in the company, they are offering an incentive to work hard. Share ownership may also help the firm to retain high quality staff. When MoneySupermarket, conducted an IPO in July 2007, it offered free shares to its employees. In an interview a spokeswoman for MoneySupermarket said:

Indeed, one of the core reasons for the flotation is to be able to offer the employee share schemes in respect of listed securities. This will not only allow staff to enjoy the success of the business, but will help to attract and retain employees.

The chief executive of MoneySupermarket went on to add:

Every single member of staff is getting free shares worth a minimum of £3000. Even a receptionist who has been in the business for two months.

A similar theme was attached to The Admiral Group IPO in 2004 in which the employees had an 8% stake. Alastair Lyons, chairman of Admiral, said:

Flotation is a key stage in the group’s development, enabling us to provide a public market for Admiral shares, increasing the profile of the group and enabling employees to see the benefit of their work.

There are strategic advantages that occur once an IPO has been completed. When a firm goes public, its reputation and visibility are enhanced, thus giving it a vital competitive edge over its unlisted competitors. When a firm is private, its operations are usually constrained by limited capital as potential acquirers simply do not know of the firm’s existence. A public listing makes it easier for companies to notice and evaluate the firm for potential mergers or acquisitions.

Going public also has benefits for a company’s founder owners. A public listing provides a good opportunity for the entrepreneur to sell some of his or her stake in the company so as to consume some of the capital tied up in the business. An IPO is also a chance for the proprietor to reduce the risk of their investment portfolio by diversifying into a wider spread of investments.

Not all reasons why businesses conduct IPOs are of equal importance. In a survey of firms that listed during the early 2000s, LSE found that for 71% of the firms that listed on LSE, the main reason for listing was the need to raise funds for growth. It was found that 11% of the surveyed firms mentioned enhancement of the company’s profile and credibility as the main reason for their listing. A similar percentage mentioned exit of VC investors as the main reason for seeking a stock market flotation. Only 5% of the firms felt that the main reason for an IPO was to provide share options to directors and staff. Another 5% mentioned future acquisitions as the main motive for conducting an IPO.

When looking at an IPO, it is important to check what the raised funds will be used for – at different times it might be best for companies to use capital in certain ways. For example, at times when the wider economy is contracting (as during the credit crunch and falling stock markets of 2007-2009), investors may not wish to invest in an IPO firm that has no good plans for growth and instead intends to use most of the cash raised from the IPO to pay its debt.

IPO companies that are a management buyout (MBO), or firms which have had VC backing, usually borrow money to pay a dividend to pre-IPO shareholders such as the VCs, buyout firms and banks. This borrowed money is then repaid using the proceeds of the IPO. An example of such a case is Verso Paper, which did an IPO on NYSE in May 2008. Verso mentioned in its listing prospectus that almost 99% of the proceeds of the IPO would be used to pay the debt incurred in making payments to its equity holders.

Similarly, RHI Entertainment, which went public on NASDAQ in June 2008, also used the funds raised to repay debt. Verso Paper and RHI Entertainment have both been poor performers when compared to other IPOs. On the first day of trading, shares of Verso Paper closed nearly 17% below their offer price. In early January 2011, Verso’s shares were trading nearly 70% below the offer price. RHI had problems in finding buyers for its IPO shares and its offer price was set below the expected range.

If a firm says that it is planning to use most of its proceeds from an IPO to retire debt then close attention should be paid to the company’s financial data, its business plan (once the issue proceeds have been used to pay off the debt) and the overall growth prospects for the firm’s industry. There is more discussion on this in Chapter 5.

A note on primary and secondary shares

In an IPO a business will typically sell two types of shares: primary and secondary. Technically there is no difference between these two types of shares. The difference only lies in their source.

Though the financial requirements of the business are a strong motivation for going public, the sale of existing shares (secondary shares, owned by the owners of the business) does not affect the business financially – the proceeds from the sale of secondary shares go only to the owners of the shares. It is only the sale of newly created shares (primary shares) that bring money to the firm’s accounts at the time of the IPO. As stated, most IPOs offer a mix of both primary and secondary shares.

It is important to note that this combination of primary and secondary shares differs from market to market. Jenkinson and Ljungqvist report that 67% of Portuguese IPOs involve shares sold by insiders in the business only, while for Germany the proportion is 23%. This means that in nearly seven out of ten IPOs in Portugal (and two out of ten in Germany) the IPO is only done in order for the entrepreneur to exit (or partially exit) from the firm. In these cases no money is raised on behalf of the firm as all the shares that are sold are secondary.

By contrast, 98% of US IPOs involve at least some primary equity while 56% sell only primary equities. The average split between primary and secondary equity of the US is 85% and 15% respectively. For the UK market, Brennan and Franks report the split between primary and secondary equity to be around 54% and 46%. In Finland 73% of equity sold in IPOs is primary.

The mix of primary and secondary shares being sold by a firm in an ...