eBook - ePub

The Sterling Bonds and Fixed Income Handbook

A practical guide for investors and advisers

- 356 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Sterling Bonds and Fixed Income Handbook

A practical guide for investors and advisers

About this book

The Sterling Bonds and Fixed Income Handbook aims to fill the knowledge gap for sterling-base investors and their advisors. Whilst investors in the equity markets can rely on numerous resources to select stocks and build portfolios, there is little information available for those who wish to buy bonds. This book takes the reader through the key features of gilts and sterling corporate bonds and offers a practical guide to putting money to work in this important and profitable asset class.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Sterling Bonds and Fixed Income Handbook by Mark Glowrey in PDF and/or ePUB format, as well as other popular books in Negocios y empresa & Negocios en general. We have over one million books available in our catalogue for you to explore.

Information

PART I: The Basics

Chapter 1: What’s a bond? Some key concepts

Everybody knows what shares are – buy a share and you own a small stake in a company. If the company does well and makes a profit, this may be distributed to shareholders as dividends. If the company continues to do well, these dividends will rise. Meanwhile, the capital value of your share, driven by other investors in the market, will likely rise.

That’s the plan.

But as most investors will tell you, it doesn’t always work out like that. Dividends may be conspicuous by their absence. Even reliable blue chips such as BP (or indeed most of the world’s banks) can be knocked for six by disaster, and dividends withheld for many years.

Bonds are different. A bond holder does not own the company – he or she is lending it money, and that loan comes with the usual package of conditions: a fixed annual or semi-annual coupon and agreed date of repayment. In a nutshell, a bond is this; a tradable security with a fixed interest payment and (usually) a pre-determined repayment date. The key point is this: the forward cash flows of the investment are known.

What is more, in the majority of situations the company does not have the option to withhold such payment and the bondholder has a prior claim on the issuer’s assets in liquidation.

Bonds can be issued by a government, company or many other types of organisations. Effectively they are marketable loans, or IOUs, issued by these entities and bought by investors such as banks, insurance companies and fund managers.

Tip

It is worth mentioning at this point that there are numerous retail-targeted investment products marketed as “bonds”. These include fixed term (typically 2, 3 or 5 year fixed term deposits from banks and building societies) and packaged equity-linked products from life insurers etc, again often with a fixed life. This is sloppy nomenclature on the part of the financial service industry and I, for one, would like to see the term “bond” reserved exclusively for fixed income securities.

Investors are often heard to say “I don’t understand bonds”, but the truth is that these instruments are much simpler than equities.

Key features

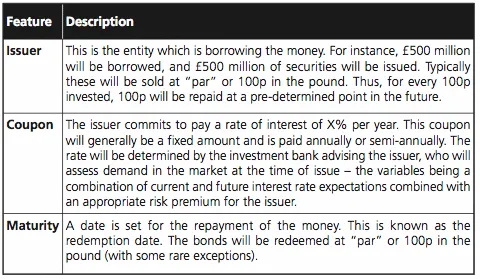

The key features can be broken down as follows:

At launch, bonds are sold to investors (typically institutional) via an investment bank or broker. This is known as the primary market. Gilt issues are also offered directly to the general public. After this primary phase, bonds are then free to trade between investors and/or market counterparties. However, unlike equities that trade through a centralised stock exchange, bonds generally trade on a peer-to-peer basis from one institution (such as an investment bank) to another (such as broker).

This global market in bonds is enormous. Figures released by the International Monetary Authority in 2002 estimated the total amount of debt securities as around 43 trillion US Dollars. At the time this was nearly twice the total of the world’s stock market capitalisation. The number of bonds in circulation is considerable, and a large and regular issuer such as the European Investment Bank or General Electric may have several hundred issues trading at any one time. These bonds will be issued in a variety of currencies and may differ greatly from each other in terms of coupon or coupon type, date of maturity and other features such as imbedded puts and calls.

This book is primarily concerned with the sterling bond market, and even in this relatively small subset of the international bond markets, a quick check on my Bloomberg Terminal reveals over 6,000 issues outstanding. Bear in mind that this number is constantly changing (bonds are issued and redeemed all the time).

Although the bond market is considerable in size, one point to bear in mind is that the secondary market is less consistent than that seen in equities. Many bonds are bought on a buy and hold basis as new issues, and this investor behaviour has a tendency to reduce secondary market turnover. Government bonds remain highly tradable with very tight bid-offer spreads for large size deals. However, the liquidity situation in corporate bonds is variable with only a proportion of the huge number of new issues that are readily tradable in the secondary market or accessible at any given time. The skills required to deal with this variable liquidity picture make bond dealing a slightly more complex art compared to the highly transparent equity market, and I address this issue over the course of the book.

Chapter 2: Why buy bonds? The risks and rewards of investing in bonds

The last four decades have seen the emergence, growth and eventually the almost total domination of equity investing. Prior to this, pension funds had invested mainly in bonds, the view being that fixed income securities were a logical and safe home for the money. All this was to change in the 1950s, in a move largely credited to the then fund manager of Imperial Tobacco, George Ross Goobey. Mr Goobey, an actuary by profession, reached the conclusion that equities were undervalued and started switching the fund into the then unfashionable stock market.

He was right. Over the coming decades, inflation destroyed the real return from fixed income securities and equities proved the place to be. This view, sometimes known as the “cult of the equity” is now almost a universal belief with equities widely considered to be the first choice for investment.

But is this the whole story?

When an investment approach is almost universally adopted, it’s often time to worry. Certainly, the bear market in the early 2000s eroded the longer-term outperformance of stocks against bonds; undermining the theory that bonds are simply an antiquated asset class, suitable for only the most unadventurous or complacent investors.

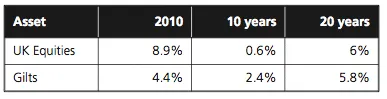

At the time of publication of this book, the argument for equities looks somewhat weaker than usual. The highly respected 2011 Barclays Equity-Gilt study (now in its 56th year of publication) shows that UK Government bonds have outperformed equities over a ten year period and are virtually level-pegging over a twenty-year period.

The figures shown below are “annual real returns” (i.e. inflation adjusted). Income is assumed to be re-invested.

Table 2.1: comparative performance of UK equities and gilts

What is more, the performance that bonds have provided over the last couple of decades has been delivered with far fewer heart-stopping moments than the thrills and spills experienced by equity holders over the 1987 crash, the millennium technology boom and bust, the flash crash of 2010 etc. (I could go on!)

Consider also that a balanced portfolio with a mixture of equity and bond holdings will show lower volatility than a pure equity portfolio.

Of course, past performance does not dictate future performance but these statistics somewhat undermine the theory that bonds are simply an antiquated asset class, suitable for only the most unadventurous or complacent investors.

The rewards

Before we move on to consider the potential risks and rewards of different types of bonds, here are seven good reasons why every portfolio should contain bonds:

1. Security

Government bonds have historically offered the investor unparalleled security. Even in the current credit crisis, the risk of the UK or other major governments being unable to repay their debts is comparatively low. Of course, we live in a changing world, and the Greek financial crisis and growing indebtedness of the Western world means that investors should not be complacent. An asset class that has been historically safe may not be safe in the future. Nevertheless, higher-quality government bonds should theoretically be considered superior in credit quality to a bank deposit. Why? Basically because governments have the power to levy taxation in order to service their debt.

High-grade, multi-national government agencies (such as the World Bank) also offer an extremely safe home for the investor holding bonds to maturity. Of course, not all bonds are issued by governments or their agencies. Many bonds are issued by companies and other organisations whose ability to service the debt may be less certain. However, even corporate debt can be considered a safer investment than the company’s equity. In the event of bankruptcy, bondholders are ranked above shareholders in their claim on the company’s assets.

2. Return of capital

Bonds also differ from equities in one other very important aspect. In order to realise your profit (or loss...

Table of contents

- Cover

- Publishing details

- Acknowledgements

- About the Author

- Foreword by Dr Stephen Barber

- Preface

- Introduction

- PART I: The Basics

- PART II: Bond Markets

- PART III: Practical Matters

- APPENDICES

- Investing books from Harriman House