Chapter 11. Picking Sectors

So far we have looked at dividend investing mainly from the point of view of analysing companies to find the ones that look to be solid or promising investments.

Choosing companies, then seeing if there are any problems with the type of product they offer, or the sector they are in, or the markets they serve, is known as a bottom-up approach.

As a whole, this approach tends to suit private investors. The less sophisticated you are as an investor, the easier it is for you to grasp the merits or flaws of an individual company rather than an entire sector or market. It is fine if this is your approach – many highly experienced fund managers, possibly the majority, are bottom-up investors.

Some fund managers, however, prefer a top-down approach, looking at the most promising geographical areas first, then finding the best types of products and gradually narrowing the search down to the best company producing the best product in the best sector in the best market.

As always in investing, stick with what you feel most comfortable with.

The danger of bottom-up investing is that you may end up with several companies in the same sector and your income will suffer if that sector is hit by adverse economic conditions.

A top-down approach steers you away from this danger because, having picked the best company in one particular sector, you look at other sectors.

Whatever your approach, you should be aware that some sectors are more suitable than others for longer-term investing.

Cyclicals v Defensives

Cyclicals

These are the sectors whose fortunes ride up and down in line with the economy, increasing their profits and dividends in the good times but suffering in the downturns. They are called cyclicals because they follow the economic cycle.

Examples are manufacturing, leisure, most retailing especially furniture, and house building.

Cyclical sectors are for:

- shorter-term traders

- investors looking to spot opportunities for capital gains to augment dividends

- those who do not yet need a steady stream of income

- investors who are less averse to taking risks.

Defensives

These sectors sell pretty much the same amount of goods and services whatever the state of the economy. They do not enjoy the boom times as cyclical sectors do but neither are they set back so badly in tougher times. They are referred to as ‘defensive stocks’ because they are seen as a line of defence when your portfolio is under attack from falling share prices. Examples would include pharmaceuticals, tobacco, food, utilities and household goods.

Defensive sectors are for:

- less active investors

- those who need a steady stream of income

- investors who prefer to hold shares for the long term

- those who are averse to taking risks.

Dividend data by sector

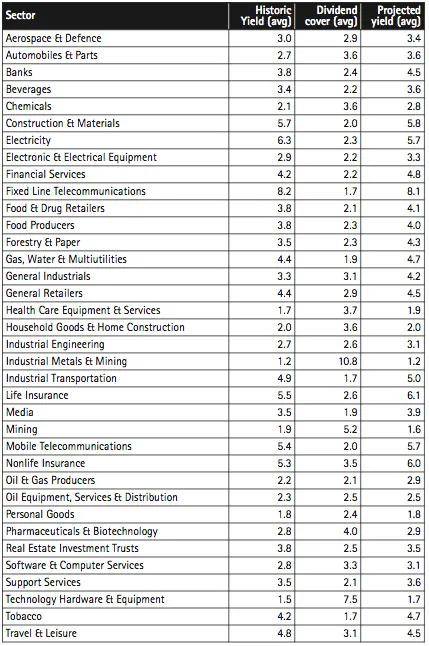

Table 11.1 – Sector dividends (28 Aug 2011)

We can see that in the most recent financial year there were enormous variations in yields, ranging from a stingy 1.5% in Technology Hardware & Equipment to a juicy 8.2% in Fixed Line Telecommunications.

Dividend cover varied to an even greater extent, with five sectors averaging less than the two times what is normally regarded as comfortable. Industrial Metals & Mining looks safe but boring with cover way up in super-cautious double figures.

Most sectors are predicted to increase their dividends in the current financial year with the projected yield figures generally higher than those for historic yield. Electricity and Mining are two exceptions that should have us taking a cautious approach to companies in those sectors. Fixed Line Telecommunications is also projected to ease back but the yield will still be easily the best on offer.

We must bear in mind, however, that these are average figures. We need to look at individual companies to see whether they fit into the sector pattern.

Visibility of earnings

Some companies have what is referred to as ‘good visibility of earnings’. That means you can see where the income is coming from for months or, preferably, years ahead.

A defensive company will tend to have good visibility of earnings. You know that contracts have been signed to provide work over a period of time so the income is guaranteed (provided the client does not go bust). Where those contracts are for government and local authority schemes you can be pretty sure that they will be honoured.

For instance, a contract to build a school will provide work for a building company for several months; a contract to maintain the school will provide work for several years.

Other companies live more hand-to-mouth. Generally speaking they sell to the general public whose spending patterns are more susceptible to economic change. In particular, items that we can manage without will be postponed indefinitely and possibly even be cancelled.

If we normally change our car every three or four years we can choose instead at the end of this period to have our car serviced and soldier on. If we delay long enough we can actually skip the new car purchase and buy after six or seven years, so the intervening purchase we would normally have made is lost forever.

Lumpy earnings

Sectors where earnings and expenses are lumpy should send a warning signal to dividend investors. This is especially so where costs and profits are largely outside the control of the companies operating in those sectors.

Two that spring immediately to mind are insurance and gambling.

Who knows when a natural disaster will break or when an outsider will win the Derby? Indeed, these sectors depend heavily on the elements of chance that bedevil or brighten up our daily lives.

Yet these operations need the occasional highly publicised heavy payout to tempt punters to hedge their bets or chance their arms.

Insurance

The 2010 calendar year proved to be a particularly tough one for insurers – with Lloyd’s of London, the major reinsurance market, reckoning claims had topped £10 billion – and 2011 began with more of the same as an earthquake shattered the New Zealand city of Christchurch.

The Chilean earthquake that left 33 miners trapped underground for weeks may have been ultimately a stirring triumph of human endeavour over the forces of nature but it was still the costliest disaster of 2010 for insurers at the best part of £1 billion.

Elsewhere, in what was a disastrous year for many in the Southern Hemisphere, there were floods and fires in Australia. Then there were hurricanes in the Northern Hemisphere and the BP oil rig blow out in the Gulf of Mexico.

Events in New Zealand demonstrated how uncertain the insurance industry can be. A larger earthquake in September was deeper underground and caused no loss of life while a lesser aftershock five months later killed dozens of people because it was nearer the earth’s surface and happened at midday when more people were out and about.

Consequently the second earthquake was likely to cost more than the first – and by that stage estimates of the cost of the September disaster had already risen to £3.5 billion.

And here is another point about insurance: initial estimates are always too low. Insurance companies seem to prefer to start with unrealistic optimism rather than assess a worst-case scenario that gives scope for scaling back estimates rather than ratcheting them up.

Then came the highly destructive tsunami in Japan, with whole towns washed away and a nuclear power station going into meltdown. It was obvio...