- 248 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

This book looks at company announcements, focussing on those issued through the London Stock Exchange by listed companies.Almost all these announcements - such as annual results, share buying by directors, profit warnings and updates on current trading - are required under stock exchange rules or European Union directives. This book explains these rules and shows how to make sense of the announcements; enabling investors and others to take informed decisions.The book is divided into three sections:Section A looks at what the rules are, why they have been imposed and how they have evolved to give private investors a much fairer opportunity of competing with professional investors.Section B lists and explains the routine statements that all companies issue on a regular basis: trading statements and profit figures. It tells readers what to look for, explains company jargon and shows how to read between the lines when all is not as well as it seems.Section C considers important announcements, such as profit warnings and directors' share dealings, that are issued on an irregular basis as they arise. It explains which announcements are likely to affect the share price and why.'Understanding Company News' is for all those baffled shareholders who throw communications from their companies straight into the bin and any investors who read company pronouncements but perhaps naively take everything they see at face value. And anyone working in related industries looking to untangle these company announcements will also find this book extremely valuable.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Section C – One-off Statements

Chapter 7. Alerts

False alarms

Share price movement

To the point

Statement re share price increase

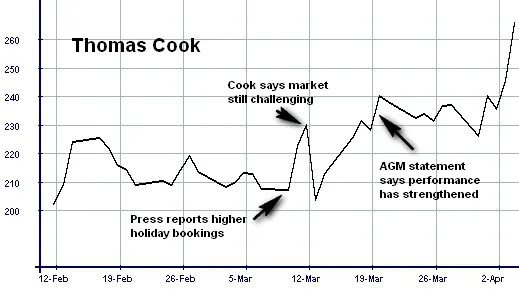

Case study: Thomas Cook

Thomas Cook notes the recent press comment and share price movement

- Thomas Cook notes that the performance of the Group overall continues to be in line with the performance outlined at the time of releasing its Interim Management Statement on 12 February 2009. Whilst the market continues to be challenging, the Board remains confident in achieving its expectations for the year as a whole and believes that the Group remains well positioned for the future.

Figure 7.1: Thomas Cook

- Despite the challenging trading environment we are pleased the business performance has strengthened.

- Winter: The clear trend towards later bookings continues. Despite the distorting impact of a later Easter, bookings have improved significantly in the last four weeks, particularly in our Continental and Northern European segments. Average selling prices are up year on year and load factors on departed flights remain at least at last year’s levels.

- Summer: Summer trading in the UK has been robust. Cumulative bookings are tracking in line with capacity reductions of 11%, and we have now sold 52% of our capacity, in line with the prior year. Having successfully focused on selling the months on either side of the July/August peak, we now have 14% less left to sell than last year in these shoulder months. Given that mix we are pleased to have driven average selling prices up 9% overall.

Ups and downs

Response to share price movement

- The Board of Brixton notes the recent movement in the Company’s share price.

- Given the ongoing challenging market conditions in the real estate and financial markets, the Board of Brixton is pursuing a range of options to provide additional financial flexibility, including disposals from its investment portfolio, as well as considering an equity raising. No decision on any course of action has been taken at this stage.

- A further announcement will be made as and when appropriate.

Figure 7.2: Brixton

Strategic review

- Claimar Care confirms that it is in the early stages of undertaking a strategic review to consider how best to take the business forward.

- The strategic review has been initiated by the Board as it is disappointed with the Company’s depressed share price, which it feels does not fairly reflect the Company’s strong market position and growth prospects.

- As part of this review, the Claimar Care Board will be considering a number of options available to the Company to maximise shareholder value including the possible sale of all or p...

Table of contents

- Cover

- Publishing Details

- Disclaimer

- About The Author

- Preface

- Introduction

- Section A – The Rules

- Section B – Regular Statements

- Section C – One-off Statements

- Appendix