The Life Cycle Hypothesis

Groundbreaking new research into the regular rhythms and recurring patterns that underpin financial markets, the economy and human life

- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Life Cycle Hypothesis

Groundbreaking new research into the regular rhythms and recurring patterns that underpin financial markets, the economy and human life

About this book

The Life Cycle Hypothesis provides evidence of an ordered process behind the apparent randomness of financial asset price movements, economic fluctuations, and social trends. It shows how genuine information will have a dramatic effect on any system into which it is inserted, and will generate reactions that are essentially pre-programmed.These reactions involve the processes of advance and decline, and therefore embrace a set of specific lower-order fluctuations. Financial and economic analysts have long been familiar with the resulting phenomena, but have had difficulty providing a satisfactory explanation. The Life Cycle Hypothesis builds on the findings of Tony Plummer's previous book, The Law of Vibration, and shows that nature itself contains the answer. There is a universal blueprint that manages growth, that organises evolution, and that contends with decline.In effect, the shock of fresh information creates a new organism whose energy travels along a natural pathway between birth and death. It is this pathway that generates such widely diverse phenomena as personal mid-life crises, the swarming of innovations, recurring patterns in financial markets, and rhythmic oscillations in national economies. It is this pathway that produced the Great Depression of the 1930s, the inflation trauma of the 1970s, and the global financial crisis of 2007-08. The same pathway now suggests that there may be a major global crisis in the early years of the next decade. The Life Cycle Hypothesis has the potential to change the way that we understand the world. It will therefore have a natural appeal for investors, economists, and social scientists. It will also be of great interest to those who sense a connection between the diverse social and political upheavals that are currently impacting us, and who want to understand the forces at work.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Table of contents

- Contents

- About the author

- Acknowledgements

- Preface

- 1. William Gann’s Hidden Pattern

- 2. The Symbolic Enneagram

- 3. The Life Cycle Hypothesis

- 4. The Human Life Cycle

- 5. Cyclical Behaviour

- 6. The Life Cycle In US Equities, 1907–74

- 7. The Life Cycle In US Equities, 1970–Present

- 8. Lower-Level Life Cycles

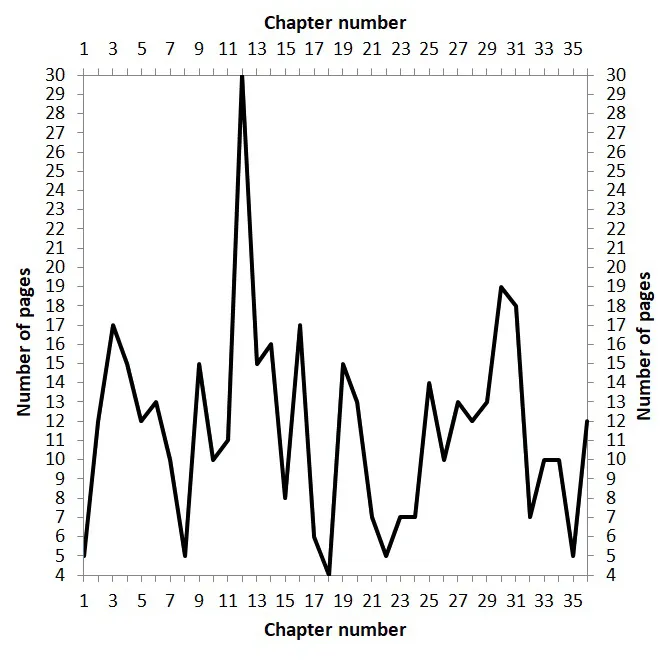

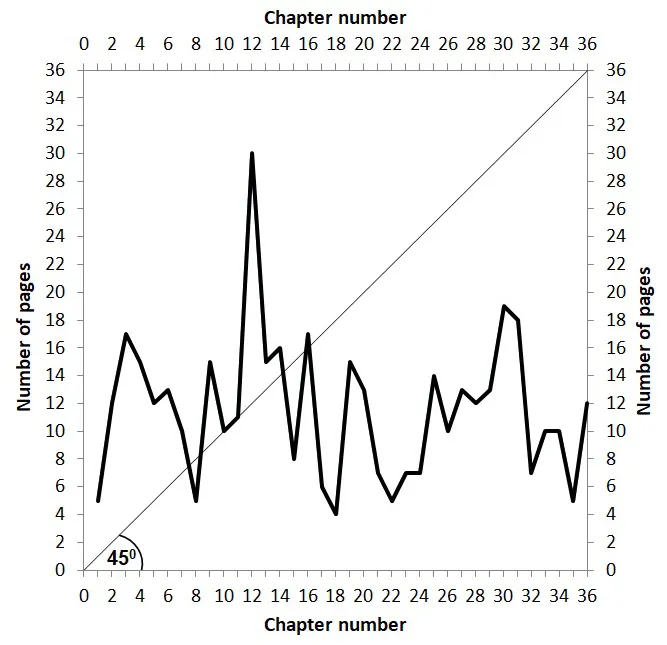

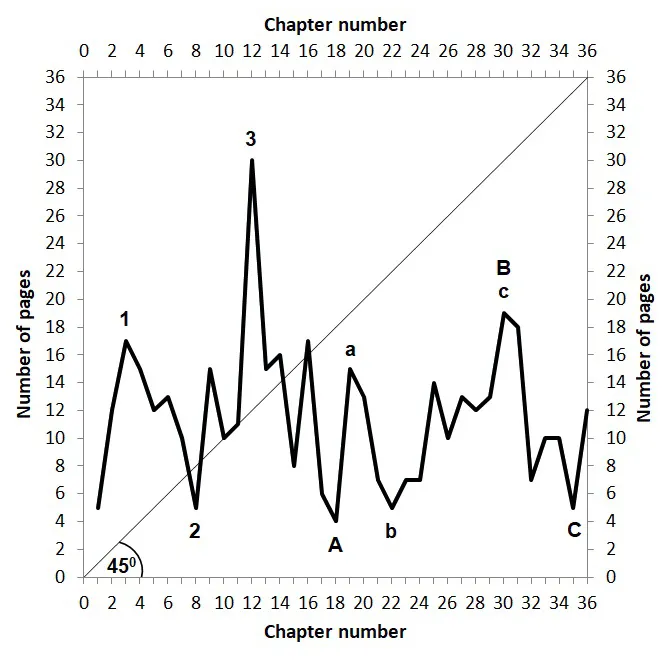

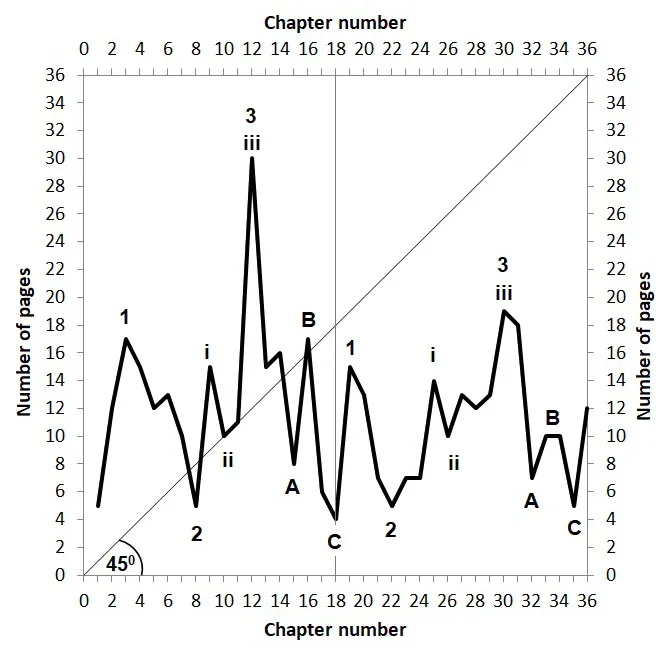

- 9. The 36-Year Cycle In Industrial Production

- 10. The Era Of The Great Depression

- 11. 10-Year US Treasury Notes

- 12. The 54-Year Kondratyev Price Cycle

- 13. The Future Of The Euro

- 14. The Pattern Of Innovation

- 15. West And East

- 16. A Summing Up

- Appendix I. The Circle Of Nines

- Appendix II. Critical Ratios

- Appendix III. Data For Innovation

- Appendix IV. The S-Shaped Learning Cycle