- 280 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Short-term interest rate futures (STIR futures) are one of the largest and most liquid financial markets in the world. The two main exchange-traded contracts, the Eurodollar and Euribor, regularly trade in excess of one trillion notional dollars and euros of US and European interest rates each day.STIR futures have some very unique characteristics, not found in most other financial products. Their structure makes them very suitable for spread and strategy trading and relative value trading against other instruments such as bonds and swaps.STIR Futures is a handbook for the STIR futures market. It clearly explains what they are, how they can be traded, and where the profit opportunities are. The book has been written for both aspiring and experienced traders looking for a trading niche in a computerised marketplace, where all participants trade on equal terms and prices.This fully revised and updated second edition now includes:- Details on the effects of the financial crisis on STIR futures pricing and trading.- An in-depth analysis of valuation issues, especially the effects of term and currency basis when relatively traded to other financial products.- A new section on using STIR futures to hedge borrowing liabilities.- An in-depth analysis of relative value trades against bond and swap derivatives.- Trading synthetic FX swaps using STIR futures.Plus updated case studies and examples throughout and an even better explanation of the basics.This book offers a unique look at a significant but often overlooked financial instrument. By focusing exclusively on this market, the author provides a comprehensive guide to trading STIR futures. He covers key points such as how STIR futures are priced, the need to understand what is driving the markets and causing the price action, and provides in-depth detail and trading examples of the intra-contract spread and strategy markets and cross-market relative value trading opportunities.An essential read for anyone involved in this market.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

1. STIR Futures

Introduction to STIR Futures

What are futures?

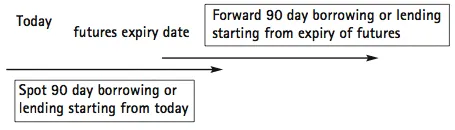

What are STIR futures?

- a legally binding contract

- notionally to deposit or borrow

- a given amount of a specified currency

- at an agreed interest rate

- on a specific date in the future

- for a specified period.

- a legally binding contract

- notionally to deposit or borrow €1m

- at an agreed interest rate

- on the delivery date

- for a nominal 90-day period.

Similarities with other futures contracts

- traded on regulated futures exchanges that provide the legal framework, contract specifications and the trading mechanism

- settled via a central counterparty to remove credit risk between market participants

- characterised by a unit of trading, tick size and settlement procedures.

Differences with other futures contracts

- have multiple delivery cycles, sequential to several years, covering a broad spectrum of the near-dated yield curve; this means that STIR futures have many different expiries trading simultaneously within the same contract, which allows a unique trading perspective

- have highly similar risk characteristics between delivery cycles

- include spread trading and other trading strategies, allowing many different trade permutations and ideas, with different risk profiles

- are arguably the most liquid class of futures by nominal value.

Derived from interest rates

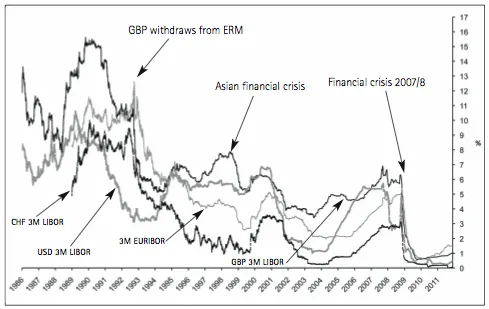

LIBOR

EURIBOR

- panel of around 44 of the most active banks in the euro zone area

- this leads to a greater ratio of smaller banks to larger banks in comparison to LIBOR

- computed as an average of quotes for 15 maturities with the top and bottom 15% rejected (rather than top and bottom 25% as with LIBOR)

- published at 11am (CET) daily.

Movement of interest rates

Traded on exchanges

Where and how are they traded

Table of contents

- Cover

- Publication details

- About the Author

- Preface

- Introduction

- 1. STIR Futures

- 2. Mechanics of STIR Futures

- 3. Trading STIR Futures

- 4. Trading Considerations for STIR Futures

- Endgame

- Ten Rules for Trading STIR Futures

- Appendices