Introducing “The Wave Principle”

Since the beginning of time, rhythmic regularity has been the law of creation. Gradually man has acquired knowledge and power from studying the various manifestations of this law. The effects of the law are discernible in the behaviour of the tides, the heavenly bodies, cyclones, day and night, even life and death! This rhythmic regularity is called a cycle.

Historical Significance

The first great advance in the scientific application of the law was made in the time of Columbus by Leonardo da Vinci in his illuminating study of the behavior of waves. Other great men followed with special applications: Halley with this comet, Bell with sound waves, Edison with electrical waves, Marconi with radio waves, and still others with waves of psychology, cosmic waves, television, etc. One thing in common that all these waves or forms of energy have is their cyclical behavior or ability to repeat themselves indefinitely. This cyclical behavior is characterized by two forces – one building up and the other tearing down. Today Hitler is said to be timing his conquests in accordance with this natural law as interpreted in the movement of the stars – but the destructive forces are accumulating and at the proper time will become dominant – completing the cycle.

Because of this phenomenon of repetition or rhythmic recurrence, it is possible to apply the lesson learned from other manifestations of the law in a very practical and profitable way. The trade cycle and the bull and bear movements of the stock market are also governed by the same natural law. Some fifty years ago Charles Dow through his observations of the important changes in the stock market gradually built up the Dow Theory, which now is accepted in many quarters as having special forecasting significance. Since Dow’s studies, the store of information regarding market transactions has been greatly multiplied, and important and valuable new forecasting inferences can be drawn from certain behavior.

Through a long illness the writer had the opportunity to study the available information concerning stock market behavior. Gradually the wild, senseless and apparently uncontrollable changes in prices from year to year, from month to month, or from day to day, linked themselves into a law-abiding rhythmic pattern of waves. This pattern seems to repeat itself over and over again. With knowledge of this law or phenomenon (that I have called the Wave Principle) it is possible to measure and forecast the various trends and corrections (minor, intermediate, major and even movements of a still greater degree) that go to complete a great cycle.

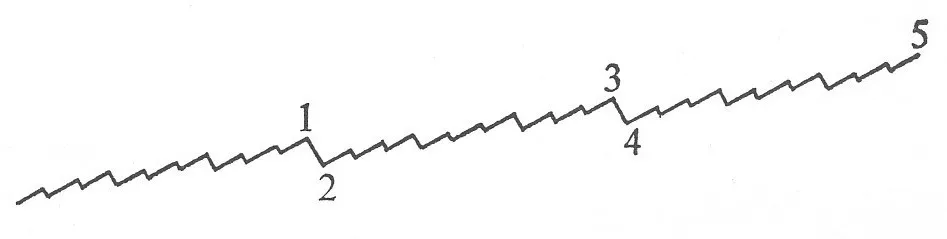

Figure 1

This phenomenon is disclosed in Figure 1. The full wave or progressive phase of the cycle consists of five impulses: three moving forward and two moving downward. Waves 1, 3 and 5 are in the direction of the main trend. Wave 2 corrects Wave 1 – and Wave 4 corrects Wave 3. Usually the three forward movements are in approximately parallel planes; this may also be true of Waves 2 and 4.

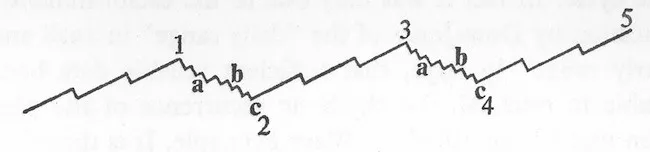

Figure 2

Each of the three primary waves that together make a completed movement is divided into five waves of the next smaller or intermediate degree. This subdivision is shown in Figure 2. Note carefully that there are five smaller or intermediate waves making up the Primary Wave 1, five in Primary Wave 3, and five in Primary Wave 5. The Primary Wave 2 corrects the completed Primary Wave 1 consisting of five intermediate waves; Wave 4 in turn corrects the five intermediate waves that make up Primary Wave 3.

Figure 3

Each intermediate forward wave is in turn divided into five minor waves as shown in Figure 3. When the fifth minor wave of the fifth intermediate phase of the fifth primary movement has spent its force, a formidable top has been constructed. Upon completion of a movement of this magnitude, the destructive forces become dominant; the primary trend turns downward and a bear market is in progress long before the economic, political or financial reasons for the change in outlook are clearly apparent.