The Trading Playbook

Two rule-based plans for day trading and swing trading

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Traders have a tendency to over-complicate. Many search for the latest new indicator that will give them an edge, or a new trading strategy to deliver bigger wins. The message of The Trading Playbook is to forget all of this and concentrate on three solid foundations to improve your trading performance: Simplicity - focus on price action alone.Probabilities - take trades where the odds are in your favour.Hard work and screen time - put in the effort to build up your trading experience.Hard work and screen time is down to you, but The Trading Playbook will guide you towards simplifying your trading and thinking in terms of probabilities.Michael Gouvalaris describes two straightforward trading plans that eschew complicated indicators and focus on probable outcomes. The first of these two plans - the day trading playbook - is based around ten different daily situations that can occur in the futures market. Between these ten daily setups, every single scenario is accounted for. You are shown how to determine what day type is in progress by studying that day's open and gap, and then high probability and low probability price action for each day type are given. Alongside the ten day types, the simple technical analysis tools of support and resistance and measuring market volatility are employed.The second trading plan - the swing trading playbook - describes effective ways to identify the trend, how to find ideal spots to enter trades in the direction of the trend, and also how to identify signals that warn of potential trend failure or reversals. You will learn simple and highly effective tools for spotting high probability entries and exits for trades. Again, basic technical analysis tools are employed, including measured moves, box theory and A-B-C waves.The key benefits of both playbooks are that they give you a well-defined plan to follow. This alleviates many of the big mistakes traders make, such as over-trading and cutting winners too early, or sitting in losing trades too long. If you are on the lookout for some trading ideas to simplify your analysis and refine your approach, The Playbook is for you.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Day Trading

Playbook

Introduction

The structure of a market day

- Day type

- Gap type

- Open type

1. Day type

Up day

Down day

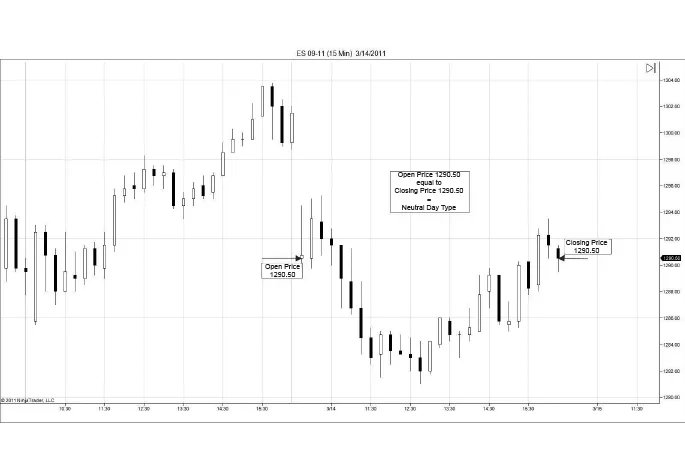

Neutral day

Table of contents

- Contents

- About the author

- Disclaimer

- Trading Playbook Live

- Preface

- Risk Management

- Day Trading Playbook

- Swing Trading Playbook

- Additional Trading Tips

- Conclusion

- Glossary of Terms