- English

- ePUB (mobile friendly)

- Available on iOS & Android

Active Investing in the Age of Disruption

About this book

Outperforming the market—or "alpha creation" as it's sometimes called—is very possible with the proper investment discipline and methodologies. But the market-beating strategies that will work today are not the same as those that worked in the past.

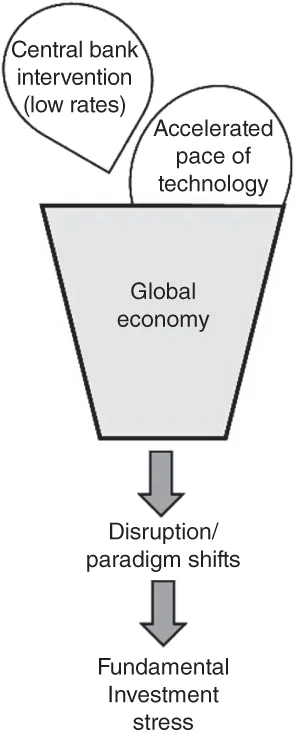

Central bank intervention and the accelerated pace of technology have caused an increase in the disruption of traditional business models across many industries. These industry paradigm shifts combined with macro-driven financial markets have created one of the toughest environments for active investment managers in history. Active Investing in the Age of Disruption details the disruptive forces in the market today and how to navigate them to outperform.

This book discusses winning equity investment strategies with lofty goals of alpha creation. Understanding the limits and potential of each unique investment methodology and portfolio strategy will allow you to generate higher returns. Even when your luck runs out or the market works against you, the ideas and disciplined approach in this book will keep you one step ahead of the market.

· Understand the disruptive forces affecting the market today

· Discover equity investment strategies uniquely targeting alpha generation—beating the market

· Understand which features of active investing need to be implemented and stressed from a risk perspective to outperform the market

· Learn which previously solid investment tenets may no longer hold true in the age of market disruption

· Hone the craft of active investing—identify markets with the greatest profit potential, hedge against strategy limitations, and more

It has been a very tough decade for active investment managers, but this book will inspire you to think differently about risks and opportunity. A deeper understanding of the forces affecting the market and a commitment to refining your investment process using the techniques in this book will help you step across the margin of error between under and outperforming.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

PART I

MARKET ENVIRONMENT: THE 2010S AND 2020S

Note

- The bolded words are present in the glossary

CHAPTER 1

CHALLENGES TO ACTIVE INVESTING

- Active investing alpha has been falling

- Self-reinforcing cycle driving poor performance

- Why do these forces pressure investment decisions?

- Key investment tenets

Active investing alpha has been falling

During my 87 years I have witnessed a whole succession of technological revolutions. But none of them has done away with the need for character in the individual or the ability to think.—Bernard Baruch, investor

In an efficient market at any point in time the actual price of a security will be a good estimate of its intrinsic value.—Eugene Fama, economics professor and Nobel laureate

Table of contents

- COVER

- TABLE OF CONTENTS

- ABOUT THE AUTHOR

- ACKNOWLEDGMENTS

- PREFACE

- PART I: MARKET ENVIRONMENT: THE 2010S AND 2020S

- PART II: CREATING ALPHA

- PART III: THE BIGGER PICTURE

- GLOSSARY

- INDEX

- END USER LICENSE AGREEMENT