![]()

The Value of Advice That Sticks

It’s shocking, really

Every day in my work as a financial psychologist, I am reminded of Van de Graaff static-electricity generators, those basketball-sized metal globes that are a regular fixture in physics labs and science museums. Reach out your hand and touch them, and your hair rises up in a sphere all around your head. I have found that money, for most people, acts in a similar way. It carries an incredible emotional charge.

What else would explain the weird things that financial professionals encounter in their line of work? There’s the gazillionaire business owner, howling with outrage over an $8 courier charge for the last-minute documents she demanded from her accountant. There’s the dumbfounded overspender, staring at the bankruptcy application the credit counsellor warned he’d be facing if he didn’t rein in his spending. There’s the fighting couple, arguing about whose idea it was to hide their income from the government, and looking to their financial planner to both referee and rescue them from the consequences.

Just as you can only see the results of electricity (and not electricity itself), so it is that you can only see the results of people’s emotions and beliefs around money. It shows up in their spending habits, job choices, and relationships. It shows up in their investment decisions and in their charitable giving. It shows up in the tone and the content of the conversations they have with you and other people in their life when money gets discussed. One of the challenges you face as a financial advisor is how to work with the financial equivalent of live electrical wires. How do you do your work without getting ‘zapped’ by those hidden emotional charges that can thwart the best of advice?

You are uniquely positioned to be the ground wire for clients with emotionally charged financial histories. Doing so requires a firm commitment to not add to the problem through shaming, blaming, or firing them unnecessarily. You are more likely to succeed at this if you have examined the people and events that have influenced your own financial values and beliefs over your lifetime. You also need to ensure that you’re not a financial ‘live wire’, yourself!

Good advice that’s hard to take

As a species, humans can be an ornery lot. When faced with complex decisions, we want advice about what is the right thing to do, and generally we want to do it. Except, of course, for those times when we’d rather do something else. Something easier. Something more understandable. Something more fun. Regrettably, something else seems to crop up with surprising frequency when it comes to money.

Helping people do sensible things with their money is just as hard as getting people to do the right things for their health. As a result, financial professionals can feel like the spoilsports at the party of life, urging prudence and moderation while the fun guys are rolling out the kegs of beer and trays of nachos.

In addition to its tendency towards dullness, prudent financial advice has the problem of being radically counterculture. Think about it. Aside from the professions of health care and finance, what other secular forces in society routinely promote self-restraint and long-term thinking instead of immediate gratification? I’ll tell you this with some confidence: 1-click ordering was not invented by a financial advisor!

Good advice that’s unskilfully given

If financial professionals are already fighting an uphill battle because of the nature of the advice they give and the broader culture in which they are giving it, then their lack of training in the personal side of their trade surely makes the battle that much harder. They make preventable mistakes, including the following ones:

Assuming that people who solicit and pay for their advice are ready to take action.

Using incomprehensible jargon.

Disregarding the emotional side of the client experience.

Being blindsided by predictable problems in follow-through.

Overestimating how much people are capable of taking on when they’re undergoing major life transitions.

Acting as though the client lives in a social vacuum.

Allowing disapproval, disappointment or disdain to taint the relationship.

Many years ago, medical training was in the same state that most fields of financial training are in today. One oft-cited survey of physicians in the 1970s found that only 25% of them acknowledged the possibility that they had anything to do with patient non-compliance.1 The emphasis was entirely on the technical correctness of the advice given to patients. But all too often, patient non-compliance undermined any hope that the otherwise excellent medical advice would improve clinical outcomes.

Although patient-blaming has long been a beloved pastime for doctors and nurses, eventually a critical mass of people grew tired of the sport. Discerning eyes were turned towards the medical schools. Professors were challenged to explain what good was being served in teaching students how to select the correct hypertensive or antibiotic if the prescription never was purchased or taken properly. Or where the value was in teaching state-of-the-art surgical techniques if the patient failed to do post-surgical exercises or make important lifestyle changes. And so it was that research began in earnest about how to deal with non-compliant patients. There are now four decades of studies that have dug deeply into this problem.

The results have been rather startling. It turns out that the problem lies as much with the advice-giver and with the nature of the advice itself as it does with the advice-taker. The archetypal ‘non-compliant’ client does not, in truth, exist.

A sticky problem – or, rather, a problem of stickiness

As a result of such findings, the very terminology used to describe the problem has changed. Medical professionals are encouraged to use the term ‘non-adherence’ rather than ‘non-compliance’. The former is seen as being less judgmental, not as entrenched in the power differential between doctor and patient.

Ironically, there has been a lot of non-adherence in the medical community around the use of the word ‘non-adherence’! I understand the reluctance to change words. The term itself is a little awkward. ‘Non-adherence’ sounds less like a human problem and more like a manufacturing challenge for the glue industry. (‘Hey boss – this self-adhesive wallpaper isn’t very adherent.’ ‘Yeah, I know. That’s a special run sponsored by divorce lawyers.’)

Over time, the term ‘non-adherence’ has grown on me. I like the mental association with stickiness. It helps me avoid the all-too-easy path of exasperated client-blaming – ‘Why won’t she just LISTEN to me?’ – and nudges me to consider a broader view of the problem: namely, that the advice is not ‘sticky’ enough, and that the client and I need to figure out what we could do about that.

But there’s been more than just a change in terminology. The field of adherence research has led to a revamping of medical education. Since the 1980s, students have been taught to consider why certain advice is harder to take than other kinds, and what would make it easier for patients to do the right thing under difficult conditions. Lectures on this topic – and even entire courses – are now embedded into the curricula of medical schools and mental health training programmes. Adherence research informs virtually every aspect of primary medical care as well as preventative health campaigns and rehabilitation efforts.

Financial advisor training, alas, has not kept pace with this field of knowledge. One advisor lamented to me, ‘The only advice I got with respect to ‘soft skills’ was to have a firm handshake and to use mouthwash.’

Well, that’s a start, I guess.

A broader perspective

For the purposes of this book, adherence will be broadly defined as the extent to which a person’s actions align with agreed-upon recommendations from practitioners. Note the element of co-creation that exists in this approach: The recommendations must be agreed upon.

This broader perspective comes from no less august an organization than the World Health Organization. In 2003, the WHO issued an influential report outlining five main factors that influence such alignment.2 As I began moving from my work as a neuropsychologist in health care into the emerging fields of financial psychology and behavioural economics, I saw that the same five factors were at work in influencing the likelihood of adherence to financial advice.

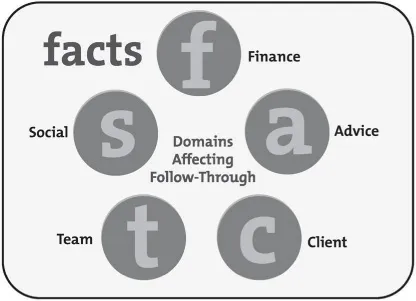

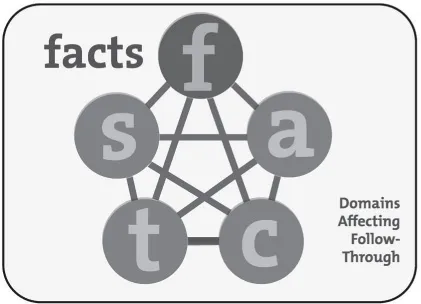

Throughout this book, I will be using the acronym FACTS to help you remember those five main contributors to financial adherence. The following graphic shows what those dimensions are, moving clockwise from the top:

The sections below provide just a brief summary of how each of the five domains influences the likelihood of follow-through with your advice.

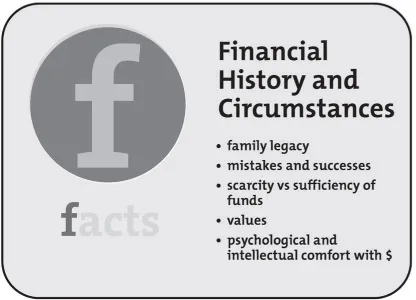

Financial History and Circumstances: The specific domain of finance has associated challenges that are not seen in other fields. Clients come to you with a lifetime of individual and collective experiences with money, experiences that have contributed to their sense of relative financial competence and confidence. The challenges in this domain include dealing with factors largely internal to the client (e.g. family legacies, personal values, financial literacy) as well as external realities (e.g. access to funds, market cycles, changing life circumstances).

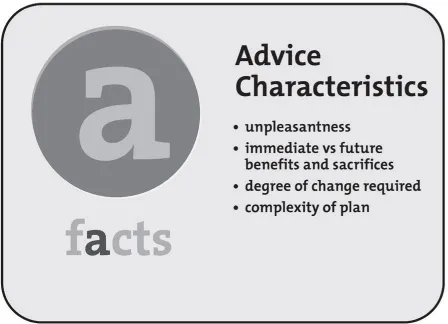

Advice Characteristics: No matter what area of behaviour change we might be considering, there will be certain features of the advice that will influence people’s willingness to follow it. Adherence is greatly affected by such things as the pleasantness or complexity of the tasks we prescribe, the time requirements for implementation, and any associated need to delay gratification. As you will learn, much financial advice can be hard to swallow because of some of these general advice characteristics.

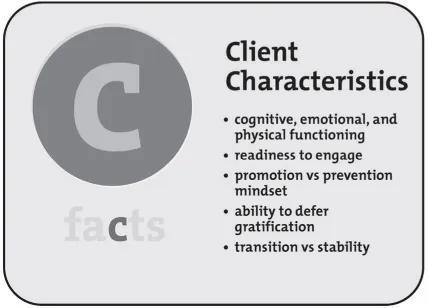

Client Characteristics: The same piece of advice that one client finds easy to implement may require gargantuan effort from another. This is because of differences in such things as energy levels, motivation, outlook, and intellectual abilities. By understanding such influences and tailoring your advice accordingly, you can play a large role in ensuring that clients are truly ready to begin and to persist with their change attempts.

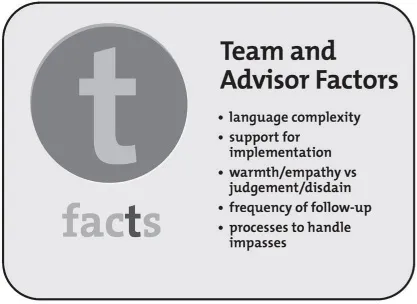

Team and Advisor Factors: How you behave with clients will have a direct bearing on their receptivity to your recommendations. By learning about such things as the need to reduce language complexity, listen more attentively, and relate with greater warmth and less judgment, you and your team will come to understand the critical role you play in increasing adherence.

Social and Environmental Factors: Our clients do not function in a vacuum – they are part of a complex social and cultural network that greatly influences their behaviour, often to a far greater degree than we do. It is important for both client and advisor to try and identify such influences so that they can be harnessed or mitigated accordingly.

Each one of these five dimensions of adherence exerts its own influence on follow-through, but none of them exists in isolation. Each domain interacts with the others, increasing or decreasing the likelihood that your clients will act in alignment with agreed-upon recommendations. In real-world practice, then, the FACTS model of adherence looks less like a uni-directional clock, and more like a spider web or a dream catcher:

There is a tendency for professionals from all walks of life to place heavy emphasis on the factual correctness of their advice, and to then blame the client when things don’t happen. The FACTS model corrects that unhelpful oversimplification. My hope is that you will return to this diagram with a spirit of curiosity and openness any time that you encounter adherence challenges in the future.

Refuse to be surprised

Upon learning that I am a psychologist, it is not uncommon for people to say something along the li...