eBook - ePub

The Definitive Guide to Blockchain for Accounting and Business

Understanding the Revolutionary Technology

- 412 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Definitive Guide to Blockchain for Accounting and Business

Understanding the Revolutionary Technology

About this book

Blockchain: a disruptive technology, or a new chance for the business world? The answer is both. With potential to change how economic transactions are recorded, stored, and verified, blockchain is changing the very face of the accounting industry. Despite its ramifications, business students of today and the practicing accountants of tomorrow are not being adequately trained in this new technology, due to a lack of resources exploring it from an accountant and business expert's perspective.

Through its discussion of real-world and 'use-cases' The Definitive Guide to Blockchain for Business and Accounting distils an abstract technology into relatable experiences for business professionals. Including chapters from practicing professionals in the blockchain industry, The Definitive Guide shows readers how this innovative technology is changing the fundamentals of the business world. With international subject matter experts, this exciting new book includes perspectives from accountants, auditors, CEOs and CTOs on how blockchain is rewriting the future of the business and accounting world.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Definitive Guide to Blockchain for Accounting and Business by Saurav K. Dutta in PDF and/or ePUB format, as well as other popular books in Business & Accounting. We have over one million books available in our catalogue for you to explore.

Information

1

INTRODUCTION

A decade back, the words cryptocurrency, Bitcoin, blockchain, etc., were relatively unknown; however, over the past decade, cryptocurrency has gained popularity in both academia and popular culture. As one of the most successful cryptocurrency, Bitcoin’s market capitalization in early 2020 was around $120 billion. It had reached a maximum of $237 billion in the fourth quarter of 2017, up from $70 billion the previous quarter. The almost 300% gain in value over that quarter didn’t go unnoticed and public interest in cryptocurrency and its technology grew. Since then, in about two years,1 the number of blockchain wallet owners increased from less than 17 million in third quarter 2017 to around 45 million worldwide.

With increased popularity of Bitcoin, blockchain the infrastructure supporting Bitcoin also received extensive attention. The features of blockchain in maintaining detailed and trusted records were recognized to have many useful features. Over the past few years, 2017 onwards, blockchain-based applications are proliferating in many industries, and not just in financial industry. While there still remain challenges to be overcome, blockchain’s potential currently seems unbounded, as evidenced by increased worldwide investment in its development.

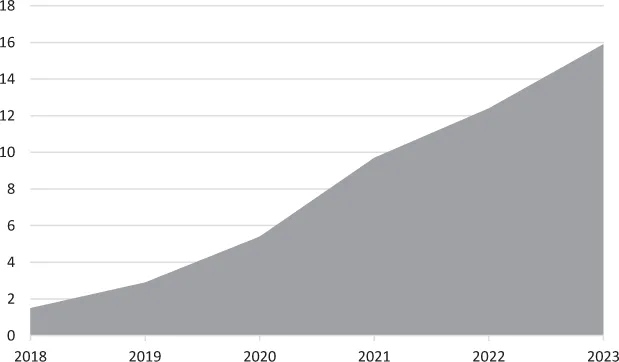

Worldwide, the spending on blockchain solutions almost doubled from $1.5 billion in 2018 to $2.9 billion in 2019. The spending on blockchain development is expected to continue to grow at the same pace, projected to be about $15.9 billion by 2023 (see Fig. 1.1).2 The financial sector leads the spending in blockchain solutions by investing more than $1.1 billion in its development, followed by the manufacturing sector and the distribution sector, each investing upwards of $600 million. The United States had the largest blockchain spending at $1.1 billion, followed by Western Europe and China. In October 2019, President Xi Jinping gave a speech saying China needs to “seize the opportunities” presented by blockchain, in what appeared to be one of the first instances of a major world leader backing the technology. Xi said blockchain is an “important breakthrough in independent innovation of core technologies.”4

Fig. 1.1: Projected Worldwide Investment in Blockchain (Billions of US$).3

This great interest and large investment in blockchain technology is not without prospects. According to a leading research firm, Gartner, “by 2025, the business value added by blockchain will grow to slightly more than $176 billion, then surge to exceed $3.1 trillion by 2030.”5 Reflecting the same sentiment, more than half of business leaders surveyed by Deloitte in 2019 placed blockchain in the five most critical strategic priorities and an additional 27% noted that it was important though not critical.6 In the same survey, over 80% of respondents believed there was a compelling business case for blockchain and that it will eventually be adopted by mainstream businesses.

Considering the above trend, it is imperative for business leaders and professionals to obtain a non-technical understanding of blockchain, how it works, what are its advantages and limitations, what are the security and privacy issues and the financial and regulatory hindrances, if any. This book is written to provide a non-technical explanation of the underlying technology and the features of blockchain for accounting and business professionals.

Blockchain is a recordkeeping system in which events termed as transactions are stored in a block. The blocks are appended to previous blocks, forming a chain. The uniqueness of the technology is that it ensures the way the blocks are added forms a chain and not a tree, in that there are no forks or major branches. The record or ledger is maintained at multiple locations and no single entity has control over the records, giving it the feature of being distributed. The mathematical discipline of cryptography and computer technique of hash function is widely used to help code the data for easier storage. The key characteristics of blockchain are decentralization, persistency, anonymity and auditability. One of the key advantages of blockchain is that it facilitates monetary exchanges between untrusting strangers without the services of a financial intermediary or a “trusted third party.” This feature enabled transactions in cryptocurrencies and transfer of digital assets between unknown and untrusting parties.

One of the key features of blockchain is its immutability, which implies that when records are inscribed on blockchain those could not be erased or altered. Business functions or processes that require high reliability and honesty are therefore prime beneficiaries of blockchain adoption. Moreover, business processes that incur immense resources in cumbersome recordkeeping where authenticity of records is suspect, blockchain provides a solution.

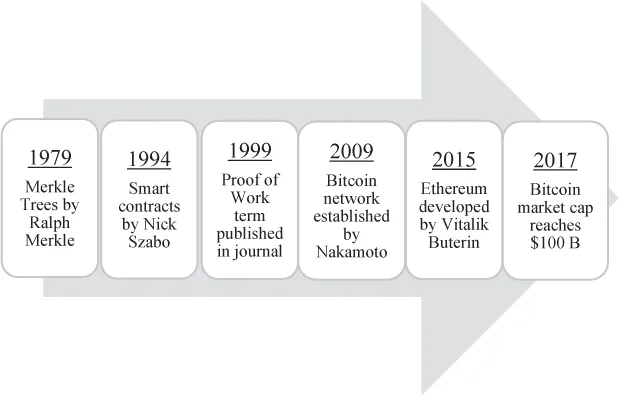

Though gaining recognition, as of past decade, some computer science theories and algorithms that underwrite the functionalities of blockchain were proposed decades ago. Fig. 1.2 provides a timeline of the introduction of various computer science developments that support the functioning of blockchain.

A fundamental part of blockchain technology is what is known as the Merkle trees. Merkle tree is a structure that allows for efficient and secure verification of content in a large body of data. This tree provides blockchain the key property of auditability and verifiability. The concept of Merkle tree was developed by Ralph Merkle (1979) as his Ph.D. dissertation at Stanford University, USA. Merkle trees will be further discussed in Chapter 3. Independent of Merkle trees and research on data storage techniques, Nick Szabo (1994) proposed a concept which later came to be known as the “smart contract.” Szabo defined smart contracts as machine readable transaction which creates a contract with pre-determined terms.7 Smart contracts are discussed in detail in Chapter 5. In 1999, the term “proof-of-work” was coined in an academic journal article.8 Satoshi Nakamoto launched Bitcoin on January 3, 2009, and the coin gained immense popularity. The white paper published by Satoshi Nakamoto is discussed in the next chapter. Vitalik Buterin, a Canadian teenager,9 published a white paper that led to the launching of Ethereum in 2015. In August 2017, the market capitalization of Bitcoin surpassed $100 billion for the first time, and soon thereafter the market capitalization of Ethereum also exceeded $100 billion.10

Fig. 1.2: Key Event Dates in Blockchain History.

The remainder of the book is organized in three parts. In Part 1, Chapters 2–6, we develop the basics of blockchain technology for non-technical readership. We start by discussing the linkage between Bitcoin and blockchain and why the infrastructure of blockchain was essential for enabling cryptocurrency transactions. In Chapter 3, we present the terminology and nomenclature of blockchain, we provide precise definitions of the words and contrast those with the common usage of that word in accounting and business terminology. Some of the confusions and over-selling of blockchains can be attributed to coining of terminology in blockchain by using well-known terminology in accounting and business and using those in broader or different context. In Chapter 4, we explain the consensus mechanism. In Chapters 5 and 6, we describe smart contracts and tokenization, respectively.

In Part 2, Chapters 7–11, we present use cases of blockchain applications outside of cryptocurrency. These are contributed chapters to the book by experts in the field. Chapter 7 develops the framework to evaluate whether blockchain is appropriate for a business application. In Chapter 8, a live case study of blockchain-based security offering of Curzio Research is presented. It describes the process, the launch, the experience of the issuer and the advantages over traditional offering of securities. In Chapter 9, blockchain application in tracking of conflict minerals is presented. In Chapter 10, tokenization and blockchain trading of Japanese real estate is discussed. Chapter 11 provides a few additional interesting use cases of blockchain.

In Part 3, Chapters 12–14, we present the technical implications of blockchain for business and accounting. Chapter 12 discusses how the internal control processes would be impacted by incorporation of blockchain to record business processes. Chapter 13 presents the ramifications for auditing of financials when a business engages in transactions on blockchain. Chapter 14 concludes w...

Table of contents

- Cover

- Title

- 1. Introduction

- 2. The Infrastructure Supporting Bitcoin: Blockchain

- 3. Basic Primer on Blockchain Terminology

- 4. The Consensus Mechanism

- 5. Smart Contracts

- 6. Tokenization

- 7. A Framework to Evaluate Blockchain Use-Cases

- 8. Financing Corporate Expansion through Tokenization

- 9. A Transparent New World: Ethically Sourced Mineral Supply Chain

- 10. Tokenization of the Japanese Real Estate Market

- 11. Blockchain-Supported Business Innovations

- 12. Internal Controls

- 13. Future Opportunities and Challenges

- Bibliography

- Index