eBook - ePub

Research on Professional Responsibility and Ethics in Accounting

- 280 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Research on Professional Responsibility and Ethics in Accounting

About this book

This edition of Research on Professional Responsibility and Ethics in Accounting includes articles from a distinguished group of authors. The topics cover many aspects of professional responsibility and ethics in accounting, including whistleblowing, professional skepticism, earnings management, cognitive style and ethics.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Research on Professional Responsibility and Ethics in Accounting by C. Richard Baker, Charles Richard Baker in PDF and/or ePUB format, as well as other popular books in Business & Accounting. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

UNDERSTANDING PROFESSIONAL SKEPTICISM THROUGH AN ETHICS LENS: A RESEARCH NOTE

ABSTRACT

This chapter examines the relationship between four variables indicating ethical disposition – ethical sensitivity, ethical reasoning, concern for others, and egocentrism – and trait professional skepticism (PS) (Hurtt, 2010) among 119 first-year auditors. While there has been research addressing the link between ethical dispositional factors and state PS in auditors (e.g., Shaub & Lawrence, 1996), there is a lack of research into the link between ethical dispositional factors and trait PS (Hurtt, 2010). The results indicate that trait PS is higher in first-year auditors with higher levels of ethical reasoning, concern for others, and egocentrism. More ethically sensitive auditors do not demonstrate higher levels of trait PS, however. The results provide evidence that auditors’ ethical dispositions influence their ability to have the mindset necessary to carry out the investor protection role that requires adequate PS.

Keywords: Professional skepticism; ethical sensitivity; ethical reasoning; concern for others; egocentrism; ethical disposition

INTRODUCTION

While professional skepticism (PS) is often discussed as a necessary characteristic for auditors, there has been some disagreement about its nature, and its appropriate use in the audit. However, two basic approaches have been taken to understanding it, the neutral approach and the presumptive doubt approach. Nelson (2009, p. 1) defines PS using a presumptive doubt approach as:

[…] indicated by auditor judgments and decisions that reflect a heightened assessment of the risk that an assertion is incorrect, conditional on the information available to the auditor….This definition reflects more of a “presumptive doubt” than a “neutral” view of PS, implying that auditors who exhibit high PS are auditors who need relatively more persuasive evidence (in terms of quality and/or quantity) to be convinced that an assertion is correct. Depending on how an auditor’s decisions are evaluated, it is possible under this definition for an auditor to exhibit too much PS, in that they could design overly inefficient and expensive audits.

Presenting the contrasting neutral view, Hurtt (2010, p. 151) defines PS “… as a multi-dimensional construct that characterizes the propensity of an individual to defer concluding until the evidence provides sufficient support for one alternative/explanation over others.” Through a rigorous process of scale development described in Hurtt (2010), she identifies six sub-constructs that make up this “neutral” PS: a questioning mind, suspension of judgment, a search for knowledge, interpersonal understanding, autonomy, and self-esteem.

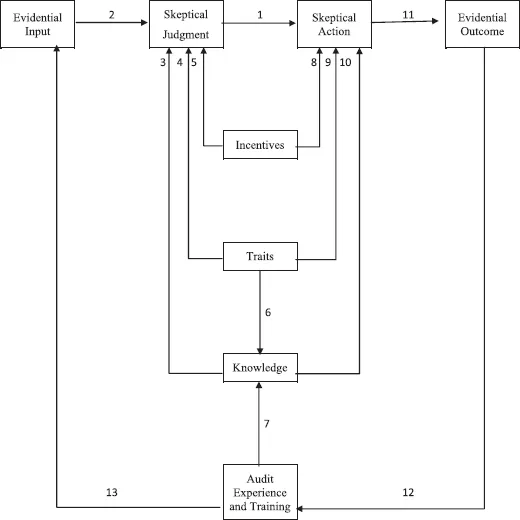

Nelson (2009) develops a conceptual framework for understanding PS (see Fig. 1) that indicates, in part, that skeptical judgment and subsequent skeptical actions are a function of pre-existing knowledge, traits, and incentives in the context of evidence gathering. He indicates that research related to the traits falls into three categories: ethics/moral reasoning, problem-solving ability, and skepticism (Nelson 2009, pp. 8–11; Quadackers, Groot, & Wright, 2014, p. 641).

Fig. 1. Model of Determinants of PS in Audit Performance. Source: Nelson (2009, p. 5).

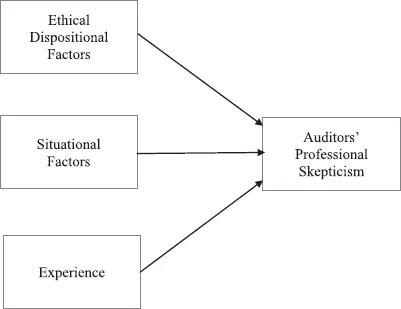

Shaub and Lawrence (1996) propose a model (see Fig. 2) based on Kee and Knox (1970) that hypothesizes PS as a function of ethical dispositional factors, situational factors, and experience. However, Hurtt’s measure of trait PS may not be influenced by situational factors if it is indeed inherent to the individual. Trait PS would be another dispositional factor that could potentially be linked to state PS, or the experienced state of skepticism in a given situation that results in skeptical thinking and skeptical action. It could, however, be influenced by other traits, and this might particularly be important if trait skepticism evolves over time, or if other traits temporally precede the development of trait skepticism.

Fig. 2. Model of Auditors’ PS. Source: Shaub and Lawrence (1996, p. 127).

The presumptive doubt approach to PS presumes that the auditor’s primary responsibility is an ethical one: to protect the public from harm. This requires the auditor to assume somewhat of a defensive posture that arises from a duty to prevent damage, rather than a purely neutral approach that reflects simply cognitive complexity. It implies that PS is ethical in nature. Thus, in testing the theory, an examination of the relationship between ethical disposition and PS is warranted.

This chapter examines the impact of four variables indicating ethical disposition – ethical sensitivity, ethical reasoning, concern for others, and egocentrism – on trait PS (Hurtt, 2010), among 119 first-year auditors, consistent with Shaub and Lawrence’s (1996) model. While there has been research addressing the link between ethical dispositional factors and state PS in auditors (e.g., Shaub & Lawrence, 1996), there is a lack of research into the link between ethical dispositional factors that likely precede the development of trait PS, and trait PS itself (Hurtt, 2010).

The results indicate that ethical dispositional variables indeed have a significant impact on the trait PS demonstrated by the first-year auditors in this study. Trait PS is higher in first-year auditors with higher levels of ethical reasoning, concern for others, and egocentrism. More ethically sensitive auditors do not demonstrate significantly higher levels of trait PS, however.

The rest of the chapter is organized as follows. The next section reviews the findings of prior research and discusses theory relevant to auditors’ PS. The following section elaborates on the research method and discusses the instruments used to measure the theoretical constructs. The next section provides results and the final section discusses those results, and discusses implications, limitations, and suggestions for future research.

LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT

Professional Skepticism

Hurtt (2010, p. 150) pictures the skeptical mindset as influenced by both trait and state skepticism. Trait skepticism is inherent to the individual, multi-dimensional, and thought to be stable over time. State skepticism is “a temporary condition aroused by situational variables” (Hurtt, 2010, p. 150). Presumably, this condition is unobservable, but the skeptical mindset can be measured by asking auditors what they think. That thinking is linked to behavior, but behavior can also be influenced by situational variables, including time pressure on the audit, and the opinions of influential others such as firm superiors (Cohen, Dalton, & Harp, 2017) and client management.

Nelson’s (2009, p. 5) more complete “Model of Determinants of Professional Skepticism in Audit Performance” proposes that both skeptical judgment and skeptical action are functions of incentives, traits, and knowledge. Knowledge arises from traits, audit experience, and training. Skeptical judgment is also state-based, a result of evidential input. Incentives are largely state-based as well, though some incentives are similar across many clients, and even across auditors within a firm. Finally, skeptical judgment influences skeptical action.

Nelson (2009) identifies two primary approaches to PS, neutrality and presumptive doubt, which have been subject to recent research and used to characterize skepticism in professional practice. The neutrality view of PS is characterized as “… the propensity of an individual to defer concluding until the evidence provides sufficient support for one alternative/explanation over others” (Hurtt, 2010, p. 151). Hurtt rigorously designed a 30-item instrument that uses a multidimensional approach to measure PS, and identifies the following six sub-constructs that define neutrality trait PS: questioning mind, suspension of judgment, search for knowledge, interpersonal understanding (of motives), autonomy, and self-esteem (Hurtt, 2010). This approach to PS is consistent with US and international standard setting (Nelson, 2009, pp. 2–3).

The presumptive doubt form of PS has been characterized by Cohen et al. (2017, p. 3) as assuming “… that some level of dishonesty or bias is inherent in management’s assertions.” This approach is consistent with prior research (McMillan & White, 1993; Shaub, 1996; Shaub & Lawrence, 1996), auditing standards directed toward fraud detection, and the views of regulators, including the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB) (Nelson, 2009, p. 3). Society expects presumptive doubt out of auditors (Bell, Peecher, & Solomon, 2005; Quadackers et al., 2014).

Quadackers et al. (2014) examine the relationship between auditors’ skeptical perspective (meaning, their endorsement of eithe...

Table of contents

- Cover

- Title

- Chapter 1. Understanding Professional Skepticism Through an Ethics Lens: A Research Note

- Chapter 2. CSR Performance: Governance Insights from Dual-Class Firms

- Chapter 3. Will Cognitive Style Impact Whistleblowing Intentions?

- Chapter 4. Do American Accounting Students Possess the Values Needed to Practice Accounting?

- Chapter 5. Increasing Student Engagement Using Giving Voice to Values and Peer Feedback

- Chapter 6. Law Versus Ethics in Accounting

- Chapter 7. Socialization and Professionalism

- Chapter 8. A Comparative Study of the Whistleblowing Activities: Empirical Evidence from China, Taiwan, Russia, and the United States

- Chapter 9. Earnings Management Ethics: Stakeholders’ Perceptions

- Chapter 10. An Evaluation of Methods for Teaching Auditing Students Auditor Independence Compliance Rules

- Index