- 256 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Shaping Air Transport in Asia Pacific

About this book

This title was first published in 2000: A comprehensive assessment of the markets and outlook for the air transport industry in the Asia-Pacific region. The book examines options for improvement of the regulatory system and industry structure, drawing on experience within and outside of the region. It includes the short- and long-term effects of the current economic crisis on Asian airlines and air transport markets and differs from other works due to its description and analysis of all major aspects of the Asian air transport industry and airlines.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Shaping Air Transport in Asia Pacific by Tae Hoon Oum,Chunyan Yu,Tae Oum in PDF and/or ePUB format, as well as other popular books in Social Sciences & Sociology. We have over one million books available in our catalogue for you to explore.

Information

1 Introduction

The airline industry is vital for the Asia Pacific economies. An increasingly large portion of high value products and intra-regional and inter-continental trade and business rely on air transport services. The volume of international scheduled air passenger traffic in the Asia Pacific reached over 135 million passengers in 1995, and is expected to increase to nearly 400 million passengers by year 2010 (IATA, 1997). As a results of high economic growth, and as many countries relax control on foreign exchange spending and travel restriction, the Asia Pacific region has recorded the highest air traffic growth rates in the world during the last twenty years. Despite the recent economic crisis in Asia, the high economic growth and air traffic growth will resume within a few years.

The single European aviation market, which came into existence on April 1, 1997, has begun to shape the structure of European airlines and their networks as it brings major changes to the European air transport market. Also, the United States and Canada signed their open skies agreement in February 1995, and the U.S. and Mexico signed one of the most liberalized bilateral air service agreements in 1988. As a result of the essentially North American open skies arrangement, the North American continental airline networks are being formed, using the U.S. super-hubs as the basis for traffic collection and distribution. On the other hand, the air transport markets in the Asia Pacific region continue to be fragmented by national boundaries, thus limiting the airlines’ options for network development in the region.

On inter-continental front, the U.S. has been promoting ‘open skies’ agreements with individual nations in Europe. After signing its first open skies agreement with the Netherlands in 1992, the U.S. had managed to strike similar ‘open skies’ arrangements with nine other European Union nations (Belgium, Luxembourg, Sweden, Norway, Denmark, Austria, Switzerland, Iceland, and Finland) by the end of 1995. In February of 1996, the U.S. also persuaded Germany on board, to sign an ‘open skies’ agreement. Although the U.S. government is mandated by law to promote competition in the international air transport markets, it is also an important strategic move to secure U.S. carriers’ advantage in Europe, by indirectly disturbing the collective actions of the EU nations on international air transport matters. Having succeeded in Europe, the U.S. shifted its focus to Asia in 1996 in pursuit of similar strategies towards Asian countries. The U.S. has already signed open skies agreements with Singapore, Brunei, Malaysia, New Zealand, Taiwan, Korea and Pakistan. In March 1998, Japan signed a substantially liberalized air treaty with the U.S. via which the ‘incumbent’ U.S. carriers (United, Northwest and FedEx) were reaffirmed their unlimited fifth freedom rights beyond Japan, which was stipulated in the 1952 U.S.-Japan Air Service Agreement while other U.S. carriers doubled their access to Japan. China has recently signed a somewhat liberalized agreement with the U.S. The U.S. strategy will help its carriers continue to play leading roles in the global air transport market.

Although the international airline markets have been substantially liberalized over the last fifteen years or so, it is impossible for a carrier to set up an efficient traffic collection/distribution system in a foreign territory or foreign continent. Therefore, from the early 1990s, most major carriers have been developing their global service networks via strategic alliances with major carriers in other continents that have fairly complete continental coverage. However, a foreign carrier, when seeking to expand its global network, would need to align with more than one Asia Pacific carriers to effectively cover the entire Asia Pacific region. This poses a strategic challenge to all Asian carriers because it is difficult for them to cooperate with other Asian carriers within a global alliance family while competing with each other in intra-Asian markets.

Thanks to the earlier deregulation and introduction of competition, during the last two decades the U.S. airlines have been able to set up efficient hub-and-spoke airline networks, improved operational efficiencies, and managed input prices effectively. As a result, they have become the most efficient carriers in the world (see Oum and Yu, 1998). European airlines have also been busy in setting up efficient service network, and improving operational efficiency.

On the other hand, the airlines based in the Asia Pacific region have relied heavily on their lower input prices to compete in the international market. Until the recent Asian economic crisis, these carriers have been losing fairly steadily their input price advantages vis-a-vis the U.S. and European carriers because of the rapid income growth, general inflation and exchange rate appreciation in those countries. Experts are unanimous that Asian economies will recover its high growth mode within a few years. When the high growth returns, however, the airlines in those countries are likely to face the similar problems they were facing prior to the economic crisis: rapid increase in input prices.

During the last decade or so, most of the Asia Pacific countries have reorganized their airline industries by deregulating or liberalizing their domestic markets, increasing the number of carriers in the market place, and privatizing national carriers. For example, Japan allowed All Nippon Airways (ANA) and some small carriers to enter the international markets to compete with Japan Airlines (JAL). In Korea, Asiana was allowed to enter both the domestic and international markets in competition with Korean Air. The Chinese government divided the Civil Aviation Administration of China (CAAC) into six trunk carriers, and allowed a large number of regional carriers to enter the market. Australia deregulated its domestic markets and privatized and merged the two national carriers (Australian and Qantas). The pluralization of air transport industry creates both consumer and carrier pressures for the liberalization of airline markets.

Most of the Asia Pacific countries have attempted to develop continental super-hubs within their respective territories. All of the new large scale airports such as Hong Kong International Airport (Chek Lap Kok), Seoul’s Inchon, Shanghai’s Pudong, Osaka’s Kansai, Taipei’s CKS airport, Singapore, Bangkok, and Kuala Lumpur, are attempting to become the super-hub of the region. This poses a considerable dilemma for the governments in Asia. Developing a regional super-hub airport in a country necessitates the government to liberalize its bilateral air treaties with as many countries as possible, and allow many foreign carriers to build mini-hubs at the airport. However, this means that the government will no longer be able to protect its own flag carriers from competition with aggressive foreign carriers.

These internal and external factors are likely to bring major changes to the Asia Pacific air transport industry, and the air transport policies of the governments. The main objectives of this book, therefore, are to examine the factors that make changes inevitable, to predict what is likely to happen as a result of such changes, and to suggest what can be done by both airline management and governments in order to improve anticipated outcomes. In the process, we will also examine what changes have occurred so far in the air transport industry in Asia as a result of the recent economic crisis in Asia, and what are the likely impacts of the economic crisis on air transport scenes in the long run. Throughout the book, Asia Pacific refers to the entire Asia and South Pacific. However, our focus will be on Northeast Asia, Southeast Asia, and South Pacific.

In order to accomplish the objectives, the rest of this book is organized as follows. Chapter 2 describes the current status and future prospects of the air transport markets in the Asia Pacific region. In this chapter, the past, present and future traffic growth in the Asia Pacific region are compared with those of the European and North American markets. Chapters 3 and 4 review the development of the airline industry and major carriers in selected countries in Northeast Asia, Southeast Asia, and South Pacific. Chapter 5 discusses the current regulatory approaches in Asian countries and points out their major flaws.

Chapter 6 focuses on the issues and problems associated with liberalizing air transport markets in the Asia Pacific. It also provides a brief overview of international air services regulation, bilateral air treaties, and some liberalization initiatives including ‘open skies’ agreements by the United States and creation of a single European market. Chapter 6 also examines what the U.S. open skies initiatives mean to the Asia Pacific airlines and governments.

Chapter 7 discusses external and internal challenges that the Asia Pacific airlines and governments are currently confronting, including the process of global alliance network formation and diminishing input price advantages. It also discusses the approaches to liberalization of the Asia Pacific air transport markets.

Chapter 8 examines the current and future airport capacity issues and the logistic hub development efforts of the Asian governments. The short-run impacts and long run consequences of the recent economic crisis in Asia are examined in Chapter 9. Finally, Chapter 10 presents a short summary and conclusion.

2 Current Status and Future Prospects of Air Transport Market in Asia Pacific

In 1998, the Asia Pacific region accounted for 20.8 percent of the world’s total air passenger volume, 21.8 percent of the world’s total revenue passenger kilometres, and 31.5 percent of the world’s total freight tonne-kilometres.1 This chapter reviews the region’s traffic growth over the last two decades, and discusses its growth potentials and its future importance in the world air transport market.

2.1 Past, Present and Future Traffic Growth

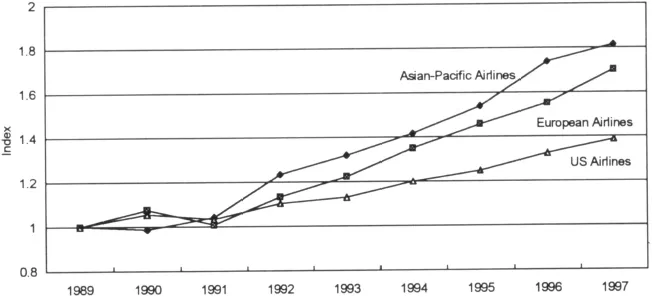

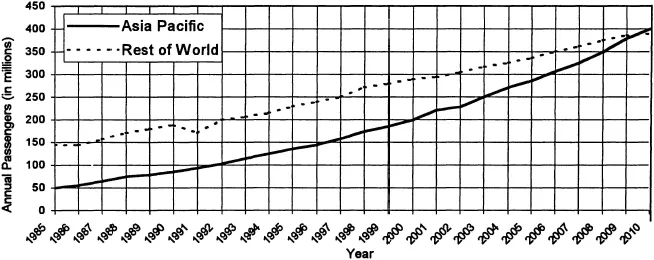

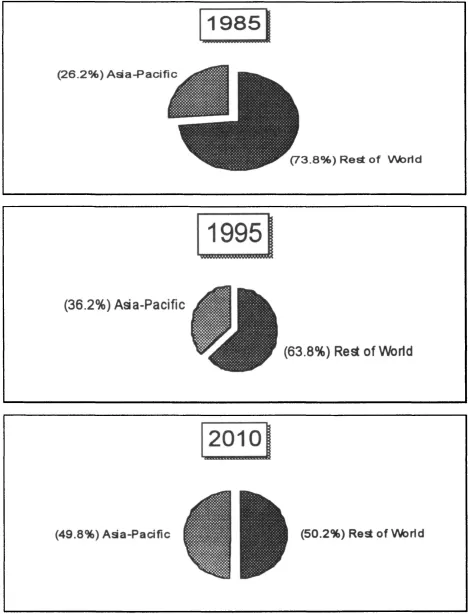

The Asia Pacific market has enjoyed the highest growth in commercial air traffic over the past two decades. Exhibit 2-1 shows that Asia Pacific airlines’ international traffic experienced average growth of 12.1 percent per year over the 1991-1997 period. During the same period, traffic grew at an average of 11.6 percent per year for European airlines, and 5.7 percent for U.S. carriers (Boeing, 1998). In early 1997, IATA forecasted that Asia-Pacific passenger traffic would grow 7.4 percent per annum between 1995 and 2010, more than twice as high as the growth rate for the rest of the world (3.4 percent). In terms of volume, IATA expects that international scheduled passenger traffic in Asia-Pacific will grow from 112 million passengers in 1993 to 200 million in 2000, and further to 398 million by 2010 (see Exhibit 2-2). Two thirds of this will be travel within the region. Asia-Pacific’s share of worldwide international scheduled traffic increased from 26.2 percent in 1985 to 36.2 percent in 1995 and was forecasted to reach 49.8 percent by 2010 (Exhibit 2-3). However, a successive wave of financial and economic turbulence since 1997 has significantly affected the current level of profitability and prospective growth for carriers based in the region. Consequently, IATA has revised its passenger forecast for the 1997-2002 period to reflect the impact of the economic crisis (IATA 1998).2 The revised estimates suggest a reduction in the 1997-2002 average growth rates for Asia-Pacific traffic, from 7.7 percent to 4.4 percent for passengers and 9 percent to 6.5 percent for cargo traffic.

Exhibit 2-1

World Passenger Traffic RPK Growth, 1980=1.0

World Passenger Traffic RPK Growth, 1980=1.0

Source: Boeing 1998 Current Market Outlook

Exhibit 2-2

International Scheduled Passenger Traffic 1985-2010

International Scheduled Passenger Traffic 1985-2010

Source: Asia-Pacific Air Transport Forecast 1980-2010, 1995

Exhibit 2-3

Asia-Pacific Share of Total World

International Scheduled Passengers

Asia-Pacific Share of Total World

International Scheduled Passengers

Source: Asia-Pacific Air Transport Forecast: 1980-2010. Geneva: IATA, 1997

According to early IATA forecast, Asia Pacific’s economies will be similar in size to North America or Europe by 2010, and will account for one half of the world’s international air travel. Normally, short-term economic downturns do not alter long term growth forecast in a significant way. However, the current Asian crisis has gone beyond a normal business cycle. The growth lost during the downturn is unlikely to be recovered fully, and forecasts for future growth are somewhat reduced. Asia’s revised GDP forecast for 2018 is almost 16 percent lower than the forecasts before the crisis (Boeing, 1999). GDP growth accounts for two-thirds of air travel growth. Trends of increasing trade, lower airfares, and more flights explain the other third. Air travel growth is expected to exceed GDP growth. Accordingly, Boeing expects air traffic in the Asia Pacific region to grow faster than average despite their current economic difficulties. Within Asia Pacific, total air travel is expected to grow at an average rate of 8.0 percent per year in the next 10 years for China, 6.0 percent for Northeast Asia, and 6.4 percent for Southeast Asia (see Exhibit 2-4).3 Further, as shown in Exhibit 2-5, Asia-Pacific’s fast-growing economies are nearly twice as important in growth a...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- List of Exhibits

- About the Authors

- Preface

- 1 Introduction

- 2 Current Status and Future Prospects of Air Transport Market in Asia Pacific

- 3 Aviation Development in Northeast Asia

- 4 Aviation Development in Southeast Asia and South Pacific

- 5 Current Regulatory Approaches

- 6 International Aviation Reform and the U.S. Open Skies Initiatives

- 7 Challenges for Airlines and Governments and Approaches to Liberalization

- 8 Infrastructure and Logistics Hub Development

- 9 Asian Economic Crisis and its Impact on Air Transport

- 10 Summary and Conclusions

- Bibliography

- Glossary

- Index