- 704 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Corporate Fraud

About this book

Fact: Barings was an excellent company, with professional managers. Their careers were devastated by fraud. How many other managers are now in the same position without knowing it? Fact: The average company loses between 2 per cent and 5 per cent of its turnover as a result of dishonesty. When Mike Comer's book first appeared it quickly established itself worldwide as the standard work in its field. This third edition is a radical revision reflecting the world of EDI, electronic commerce, derivatives, computerization, empowerment, downsizing and other recent developments. Ironically, many of these have exposed companies to an alarming range of new risks. With the help of real-life case histories the author identifies the main types of fraud, the circumstances in which they occur and the telltale signs that give them away. He examines internal control systems and the attitudes and practices that allow fraud to flourish. He explains in detail how fraud can be prevented and detected, and shows why it is that many fashionable management techniques can also potentially pave the way to corporate disaster.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

PART I

THE NATURE OF CORPORATE FRAUD

THE BLIND LEADING THE BLIND

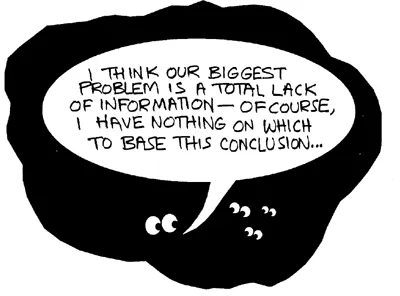

Fraud is badly misunderstood. Managers are educated in universities and business schools in a vacuum, isolated from the possibility that their careers could be devastated by the dishonesty of others. For example, in January 1996, of the fifteen or so MBA and top management programmes at the London Business School, not one contained any mention of fraud. Is it any wonder that managers are ambushed by dishonesty?

The management gurus are no better and maybe even worse than the universities. Thousands of managers have read Tom Peters’s books, In Search of Excellence and Thriving on Chaos1 and revelations by other leading management gurus. Although what they say is brilliant, thought-provoking and occasionally relevant, the gurus appear to assume that all their wonderful management techniques flourish in a sterile environment of unbridled honesty. Experienced managers know that this is not the case and that whatever the gurus and the longhaired smellysocks say, dishonesty is an ever present danger in all businesses and sometimes it can be catastrophic.

A little paranoia goes a long way

1In Search of Excellence (1982), New York: Harper and Row; Thriving on Chaos (1987), New York: Alfred A Knopf.

1

ATTITUDES AND MISCONCEPTIONS

EMPOWERMENT

Empowerment is supposed to mean giving more responsibility and job satisfaction to employees and managers. Although this may be commercially efficient, it is often no more than an abdication of management’s willingness to exert control. Too many organizations that empower, downsize, re-engineer or go through other of the contortions recommended by the gurus merely cut out the resources necessary to maintain control. Whoever saw the empowered audit department?

It is ironic that in 1995 and 1996 many of the companies Tom Peters extolled as excellent have suffered through poor controls.

The greater the extent of empowerment, the tougher and more effective internal audit must be

PLAYING AWAY FROM HOME

Isn’t it strange that Western companies are investing the most money in countries which are recognized as being the most corrupt. The explanation may be that they have discovered some magic bribery by-pass or more likely that they follow different standards when they are playing away from home. At seminars senior managers often say to me that ethical standards are unrealistic; that not paying bribes is ‘uncommercial’ and that if under-the-counter payments are not made, there is no hope of business in emerging or transitional economies. Equally, they argue, there is no point in looking to the civil or criminal law for a remedy when fraud is discovered, because the police and courts are corrupt and judges always find against the large multinational.

To such managers there seems to be a great deal of difference between outgoing facilitating payments, which result in sales, and incoming bribery, which corrupts their own employees. Dual standards of this sort will not be easily changed but they raise serious control and legal issues; these are discussed in Part IV.

WHEN IT’S YOUR MONEY AT STAKE

Karl Marx, arguably the Tom Peters of his day, maintained that theft and fraud were essential tools for redistributing wealth to the proletariat. This is all well and good if you happen to be a proletarian, but Mr Marx would have seen things quite differently had someone just stolen his bike, purloined Mrs Marx’s Gucci handbag or kidnapped his daughter, Griselda.

The mindset that encourages ambivalence towards dishonesty is truly amazing, universal and historically consistent. If Mr Marx had been asked where the line between the fat cats and the proletariat should be drawn he might, reverting to type, say immediately above him. This would mean that he was entitled to other peoples’ money, while his own would be unavailable for redistribution to those less well off.

Attitudes change when it’s your own money at stake. The cow grows fat under the eyes of the owner

JUST WHOM CAN YOU TRUST?

In the summer of 1995, illicit photocopies of the Cadbury Code of Best Practice – crossed through with the word ‘BULLSHIT’ – were found in the discarded jacket pocket of a very senior, blue-blooded English banker the day after his Hugo Boss suit, Valentino shirt, crocodile shoes and Dunhill tie, but not his Cartier watch nor his American Express Gold card, were found on Brighton beach. Police assumed he had taken his own life and that the unfortunate suicide had been triggered by the banker’s discovery of a catastrophic fraud by a junior clerk in Treasury.

It was a grievous day for the banker’s present wife, four ex-wives and five of his mistresses. His sixth mistress knew better as she sat with him on the balcony of the Ritz Hotel in Paris, licking Ben and Jerry’s ‘Chunky Chops’ ice cream off his toes.

For every credibility gap, there is a gullibility fill

A LITTLE PARANOIA DOES NO HARM

One of the purposes of this book is to alert those managers and their advisers who are interested to the dangers and mechanics of corporate fraud, to indicate where and how it will strike, how it can be detected, prevented and investigated.

Over 30 years of dealing with criminals of all shapes, sizes, sexes and nationalities has obviously coloured my views; so has the reluctance of otherwise sensible managers to keep their ey...

Table of contents

- Cover Page

- Corporate Fraud

- Copyright Page

- Contents

- List of Figures

- List of Tables

- Foreword

- Preface

- Part I The Nature of Corporate Fraud

- Part II Detecting Corporate Fraud

- Part III Investigating Corporate Fraud

- Part IV Controlling Corporate Fraud

- Appendices

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Corporate Fraud by Michael J. Comer in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.