- 158 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Originally published in 1972, this volume, supplemented extensively with maps and tables, and employing sophisticated institutional and empirical analyses, discusses a number of important issues relating to the viability of the Trans-Alaska Pipeline and the natural environment. The author concludes that exploiting North Slope oil was justifiable as a calculated risk, although an alternative route and transport mode to the Midwest of eastern market would be more attractive than TAP.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Alaskan Oil by Charles J. Cicchetti in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

1

An Economic Analysis of the Trans-Alaska Pipeline

The controversy surrounding the Trans-Alaska Pipeline (TAP) extends beyond environmental matters since the proponents of this project—like those of similar development projects that will have admitted environmental consequences—point to its economic advantages. Their arguments imply that various economic benefits, if sufficiently large, can be used to justify the deleterious effects of the pipeline on the environment.

For any project of this kind, a comparison of benefits and costs can be used to illustrate the major economic issue of whether to develop or to preserve an environment in its undisturbed state. The first step, which has been used in other analyses of this kind,1 is to discuss the environmental and other possible consequences of a development project in a qualitative manner. When possible, such effects should be quantified in nonmonetary units (see chapter 2). The second step is to convert the nonmonetary units into economic measures of environmental damages or costs in order to compare them with the benefits of the project. Generally, this conversion is not possible, given the present state of the art of benefit-cost analysis. Accordingly, a different line of analysis is suggested—one that utilizes the methodology of benefit-cost analysis but finesses conversion—and the analytical question becomes: How great do the environmental damages have to be in order to make the choice between preservation or development a matter of social indifference?

While this framework includes the important methodology of benefit-cost analysis, it has a serious disadvantage because the analyst’s level of objectivity—i.e., biases resulting from his affiliations or convictions—is left unspecified. In the analysis below I use a systematic set of calculations to evaluate the economic benefits and costs of TAP. Since the economic issues are complex, I do not present initially what I believe the final benefit and cost comparisons should be. Instead I begin with the simplest case and successively introduce more complications to illustrate the effects of changing assumptions about the relevant present and future conditions in order to elucidate these many issues.

THE COST OF THE TRANS-ALASKA PIPELINE

The first step in assessing the economic benefit of TAP is to determine the cost of constructing and operating this oil transportation system. Its cost depends on the amount of oil that is transported, since both the capital and operating costs are functions of the pipeline’s throughput. Table 1 shows the projected throughput schedule that has been suggested by Alyeska,2 the pipeline service company formed by the oil companies that plan to develop Alaska’s North Slope oil. Alternatively, a throughput schedule of 2 million barrels per day (MMb/d) is sometimes assumed.3 In my comparison of these two schedules, I refer to the latter one as the accelerated throughput schedule.

TABLE 1. Projected Alyeska Throughput Schedulea

| Year | Barrels per day |

| 1975 | 350,000 |

| 1976 | 900,000 |

| 1977 | 1,200,000 |

| 1978 | 1,400,000 |

| 1979-2000 | 2,000,000 |

SOURCE: Arlon R. Tussing, George W. Rogers, and Victor Fischer, Alaska Pipeline Report: Alaska’s Economy, Oil and Gas Industry Development, and the Economic Impact of Building and Operating the Trans-Alaska Pipeline, ISEGR Report no. 31 (Fairbanks: University of Alaska, Institute of Social, Economic, and Government Research, August 1971), table IV-1.

NOTE: Richard Nehring, in Future Developments of Arctic Oil and Gas: An Analysis of the Implications of the Possibilities and Alternatives, Department of the Interior, Office of Economic Analysis (May 10, 1972), reported that a more rapid three-year buildup has been described by Alyeska. Under this schedule, the first and third years would average 0.6 MMb/d and 1.6 MMb/d respectively. This schedule falls between the two used in the remainder of this monograph and therefore will not be referred to again.

a Implied total over 25 years equals approximately 16.7 billion barrels.

Capital investments represent opportunities forgone in several time periods. Therefore, a second determinant of the project’s cost is the rate of time preference. There is some agreement among economists and government officials that this social rate of discount is currently 10 percent.4 Since benefit and cost comparisons are generally very sensitive, however, to the value of the discount rate that is selected, I also use rates of 8 and 12 percent to test the sensitivity of the conclusions related to this important parameter.

The present value of the costs of a pipeline depends on the rate of utilization of the system, that is, the time stream or scheduling of throughput. This means that the analysis also depends on several interdependent factors: (1) the project’s life, or time horizon; (2) the total amount of oil transported by the project; and (3) the amount of oil that is produced in any given year.

A comparison of benefits and costs can be made in the conventional manner if the amount of oil transported each year is equal and the value or benefits per barrel remains constant over time. Under such conditions the capital costs are ‘annualized’5 and annual operating costs are added to calculate the annual cost. This is divided into the annual benefits, which are also assumed to be constant in each time period, to calculate the benefit-cost ratio.

The schedule shown in table 1, however, does not have constant annual throughputs, and the accumulated throughput suggested by the Alyeska and accelerated schedules differ. The annualized capital cost approach is unsuited for such circumstances. In an earlier benefit-cost study in which there was unequal physical use over time, Davidson, Adams, and Seneca6 recommended an alternative approach—calculating the present equivalent of use and dividing it into the capital cost to find average capital cost per unit of use. In the present analysis capital cost will be on a per barrel basis.

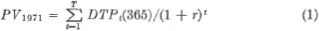

Adopting this approach, I derive the present equivalent of pipeline utilization by using the following equation:

where

| PV1971 = | the present equivalent of the throughput, |

| DTPt = | the aver... |

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Preface

- Acknowledgments

- Table of Contents

- Introduction

- Chapter 1. An Economic Analysis of the Trans-Alaska Pipeline

- Chapter 2. Some Environmental Considerations

- Chapter 3. An Economic Analysis of Alternative Overland Pipeline Routes Through Canada

- Chapter 4. Some Further Economic and Institutional Comparisons of Alternative Transport Systems

- Chapter 5. Supply and Demand Imbalances

- Chapter 6. The Case Against Tap: Conclusions of the Analysis Summarized

- Appendix A. Recent Trends in the U.S. Crude Oil Industry

- Appendix B. Summary of Expected Environmental Impacts of the Trans-Alaska Pipeline

- Appendix C. A Comparison of the Employment Impact of Alternative Routes on the State of Alaska, by George W. Rogers