I. The Budget

THE normal development of Poland’s financial economy only began in 1924, after the introduction of a stable currency. In the immediately preceding period of post-war inflation the new Polish Administration had only succeeded in unifying the four separate financial systems inherited from the Powers which formerly ruled the country. On account of the immense expenditure required for the rebuilding of the war-devastated areas, the annual Budgets showed huge deficits, which had to be covered by means of note-printing. The financial reforms carried through during 1924 assured in principle a balance between Revenue and Expenditure, but the economic crisis which set in after the stabilization of the currency created new difficulties, and by upsetting the budgetary balance the years 1924 and 1925 closed with considerable deficits which were only met by the issue of token coins and Treasury notes.

The first surplus of revenue over expenditure was achieved in 1926, thanks to increased yields from taxes and other duties, and the increasing prosperity of State undertakings and monopolies. During the same year important reforms in the administration of finance were introduced. A new system of budgeting was decided upon and the financial year started from April 1st, instead of from January 1st as hitherto. The following two financial years (1927-28 and 1928-29) brought important surpluses of revenue, thanks to the fact that actual revenue was considerably higher than was provided for in the estimates.

Towards the end of 1929 the world crisis reached Poland. As the crisis hit agricultural production first, reaching its greatest intensity in this industry, Poland, as a predominantly agricultural country, found herself among the countries most exposed to those devastating effects which in various degrees affected all other world countries. Nevertheless, the year 1929-30 closed with a surplus of revenue amounting to several tens of millions of zloty. The acuteness of the economic depression which, however, set in during the following year caused a considerable decline of revenue. The year 1930-31, for example, closed with a deficit amounting to 63 million zloty, though this could still be easily covered from the reserves of the Treasury accumulated during preceding years. Moreover, during the year in question considerable sums of money were expended in the form of subsidies granted to various threatened enterprises and of grants for the maintenance of the growing numbers of unemployed. At the same time it may be mentioned that the decline in revenue was accentuated by various tax reliefs which the Government accorded to private enterprises when their difficult position was fully appreciated.

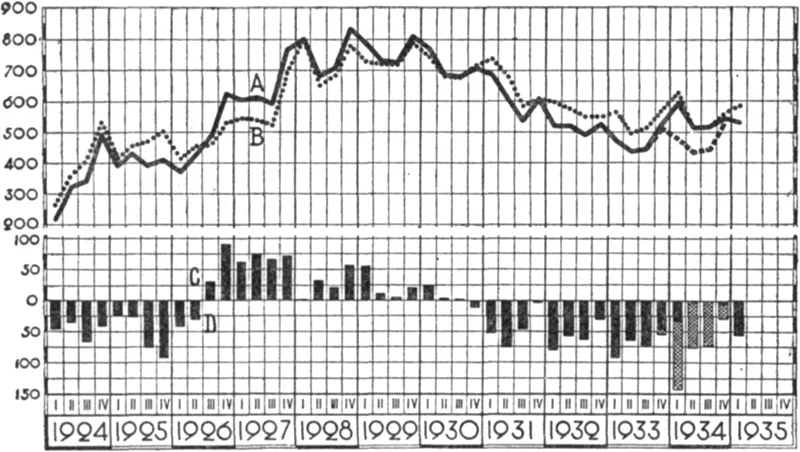

The National Budget

(In Million Zloty)

A. Revenue (the broken line in the IV quarter of 1933 and in 1934 indicates budgetary revenue exclusive of the proceeds of the National loan)

B. Expenditure

C. Surplus of Revenue

D. Deficits (the cross-line sections indicate Budget deficits covered from the proceeds of the National loan)

As soon as it became apparent that the economic crisis was of exceptional severity and had assumed a lasting character, the Polish Government came to the conclusion that in the existing circumstances the surest, though the least popular, means of overcoming such a crisis was the introduction of far-reaching but reasonable economies in the national husbandry in order to safeguard the country from acute convulsions.

Not all countries adopted this difficult and unpopular path from the outset, and indeed many of them at first had recourse to public credits in order to prop up the failing revenues of their Treasuries. In view of the prolongation of the crisis, even these countries were obliged in the end to discontinue incurring further indebtedness and to reduce their budgetary expenditures. For even in economically strong countries the growing indebtedness of the Treasury threatened with grave difficulties not only the economic life of the countries in question but began to affect adversely the money and capital market.

As from 1931 the financial policy of the Polish Treasury is characterized by economies and reductions of expenditure affecting in the first place investments and supply services and afterwards civil service salaries. How cautiously this policy was applied may be seen from the fact that in spite of a considerable contraction of expenditure during the financial years 1931-32 and 1932-33, the budgetary deficits were not sufficiently reduced; and the decline in revenue proceeded at a quicker rate than the reductions of expenditure, hampered as such attempted reductions were by the necessity of assisting private undertakings, principally farmers, by means of taxation reliefs or emergency credits granted for the purpose of propping up the disastrously falling price of grain. Budget deficits during those two years were covered partly from Treasury reserves and partly from profits made on the issue of token coins.

It was only in 1933 that the situation was eased. The decline of revenue from taxation diminished, and during the second half-year certain revenues began to show slight upward tendencies. In view of this favourable revenue tendency the Government decided to discontinue the further contraction of expenditure, the more so as a continuation of a policy of drastic cuts might have adversely affected private enterprises. It was therefore decided to cover the deficit by means of credit operations. The following two considerations influenced the Government to have recourse to credits :

(1) The improvement in the economic situation which inter alia showed itself in the absence of a further decline in revenues of the Treasury.

(2) The increasing liquidity of the Polish capital market.

Thus the Government were able in 1933 to begin the issue of Treasury bills, which by the end of 1934 reached a total of 200 million zloty. In the autumn of 1933 the Government issued a ten years’ 6 per cent internal loan, which at the issue price of 96 was more than three times over-subscribed. The Treasury accepted the whole sum subscribed, i.e. 350 million zloty. The proceeds of this loan furnished the means for balancing the Budget during the last few months of 1933 and the whole of 1934. The success of this loan, which was issued as a “National Loan,” has been regarded as proof that the Polish people entirely approve the economic policy of the Government and repose full confidence in their methods for overcoming the crisis.

The general trend of Budget Revenue and Expenditure during the years following the stabilization is indicated in the table on page 39.

The Budget figures quoted below show that before the present crisis became acute State expenditure was increasing very considerably, although pari passu with the increase of revenue. This growing expenditure was justified by the great need for investments on the part of the Government rendered necessary by the neglect which Poland had suffered in many spheres at the hands of alien Powers. It also appears from the table below that the Government did not consume all its revenues, but built up reserves which enabled it subsequently to overcome the most dangerous periods of crisis. The reduction of expenditure during the financial year, i.e. during the Budget year 1934–35 as compared with the year 1929–30, amounts to no less than 27 per cent.

NOTE.—(1) Including the allotment of the National Loan amounting to 120 million zloty. The total revenue amounted to 1,989 million zloty, and the deficit, covered from proceeds from other non-recurring revenues (mainly the issue of Treasury bills), has been reduced to 217 million zloty.

(2) The total revenue includes proceeds from the National Loan, amounting to 175 million zloty.

The revenue of the Polish Treasury is obtained from proceeds of taxes and various duties, revenue from State monopolies and the profits from State undertakings which have been commercialized by being separated from the general administration. Among those undertakings are State Railways, State Forests, the General Post Office, and the Mint. The State owns also three financial institutions, namely, The National Economic Bank, the State Land Bank, and the Post Office Savings Bank, as also a number of industrial undertakings which are either of basic importance to the economic structure of the country or which are working mainly for purposes of defence of the country. The following industries are organized into State monopolies: Tobacco, Alcohol, Salt, Matches, and Lotteries. The Match Monopoly has been let on lease to a private company which continues to operate it.

2. National Debts

The public finances of almost every country are usually burdened considerably with the service of national debt. The indebtedness of the Polish Republic, however, is very small when compared with that of other countries. On January i, 1935, the total of Polish national indebtedness amounted to 4,691 million zloty, or about 140 zloty per head of population. Considering that the national wealth of Poland amounts to 137,000 million zloty, the total indebtedness of the Polish Treasury amounts to less than 3½ per cent of the national wealth.

It follows that the expenditure required for the service of debts does not represent a very big item in the State Budget. It amounted in 1930–31 to 267 million zloty, in 1931–32 to 243 million zloty, in 1932–33 to 188 million zloty, and in 1933–34 to 175 million zloty. The decline in the total expenditure for the service of the debts during the last few years is explained by the suspension of the payment of war debts since the proclamation of the Hoover moratorium. After the expiry of the moratorium Poland, acting in solidarity with other States, suspended the service of war debts until the question should be definitely settled.

Of the total indebtedness, amounting to 4,691 million zloty, 1,346 is represented by internal debts, while 3,345 represents debts incurred in foreign countries. The internal debts increased during the last year mainly by the amount of the issue of the National Loan of 350 million zloty and also by the increased issue of Treasury bills, the total amount of which reached the sum of 200 million zloty by the end of 1934. On the other hand, the total amount of foreign debts has declined, partly owing to payments of redemption instalments, but mainly owing to the fall of the foreign currencies such as the dollar and sterling in which the loans were contracted. The major part of the foreign debts consists of credits obtained in kind from the Allied and Associated Governments during the initial period when the young Polish State was fighting in defence of its regained independence. All Poland’s obligations towards foreign countries, with the aforementioned exceptions, are being met punctually without any restrictions that might operate to the disadvantage of her creditors.

Such foreign debts as Poland contracted were carefully planned beforehand, and thanks to this policy, in spite of the crisis, the country was able to meet her obligations without having recourse to any sort of transfer moratoria or currency restrictions. In this way Poland has enhanced her reputation as one of the most reliable debtors.

The indebtedness of the Polish local government authorities is of equally moderate dimensions. The total of debts owed by them amounted at the end of March 1934 to 945 million zloty. Foreign loans represent a relatively small part of the total indebtedness of the local government authorities. Such as there are have been contracted for purposes of profit-making investments and consequently their repayment does not impose any special difficulties. During the present crisis certain of the local government authorities found themselves in straitened circumstances and the amelioration of their finances has not yet been completed. Recently the Central Government came to the assistance of the local authorities by decreeing the reduction of the charges on internal debts of the local government bodies and offering them the possibility of converting their short-term obligations. Considering their low indebtedness, the local government authorities will be able, as soon as general conditions improve, to resume again their investing activities, and considering the high returns on such investments it may be confidently assumed that both Polish and foreign capital will take an interest in those activities.

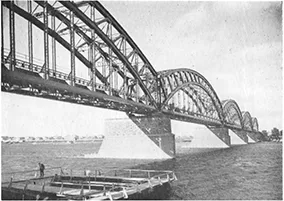

VII.—Regulation of the Vistula

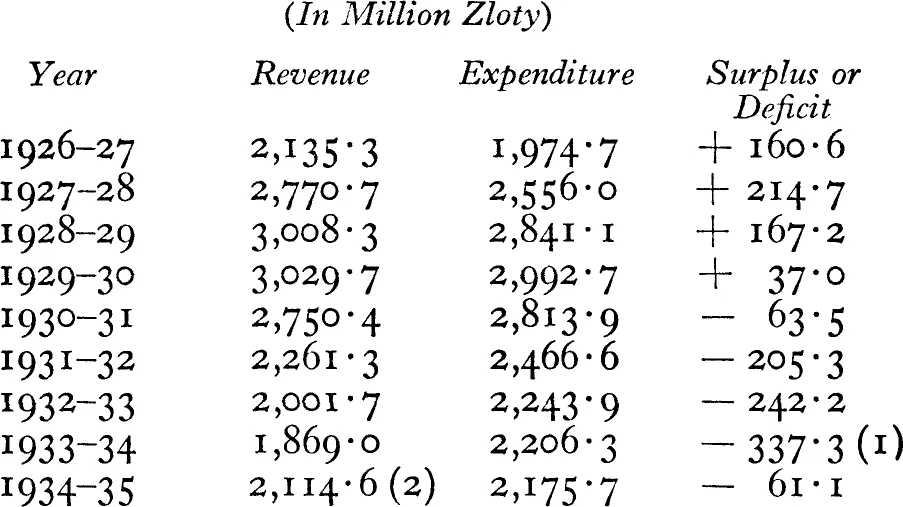

VIII.—Warsaw: New Railway Bridge Across the Vistula

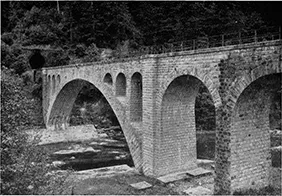

X.—Railway Bridge at Jamna