- 265 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

First published in 1999, this volume investigates the causes and consequences of globalization of international financial markets, including all types of private sector capital for 121 countries over the period 1980-1990. This includes portfolio investment, bank capital and FDI. Hak-Min Kim identifies pronounced patterns in short-term capital flows along with effective means of stimulating capital, including the provision of new financial instruments, advanced telecommunication networks, and improved country risk management. Kim suggests that collective international efforts from organizations are necessary to develop financial markets and improve global equity.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Globalization of International Financial Markets by Hak-Min Kim in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

1 Introduction

Issues on Globalization

The most significant development in the world economy in recent decades is the increasing globalization1 of economic activities. The capitalist system now should be understood as global rather than national since the major forces that are restructuring both domestic and international economic systems are globalization processes. The integration2 of global financial markets, facilitated by regulatory changes and by technological innovations in the information economy is one of the most important factors contributing to this globalization (Ross, 1983; Obstfeld, 1986; Kane, 1988; Walter, 1989; Honeygold, 1989; O’Brien, 1992).

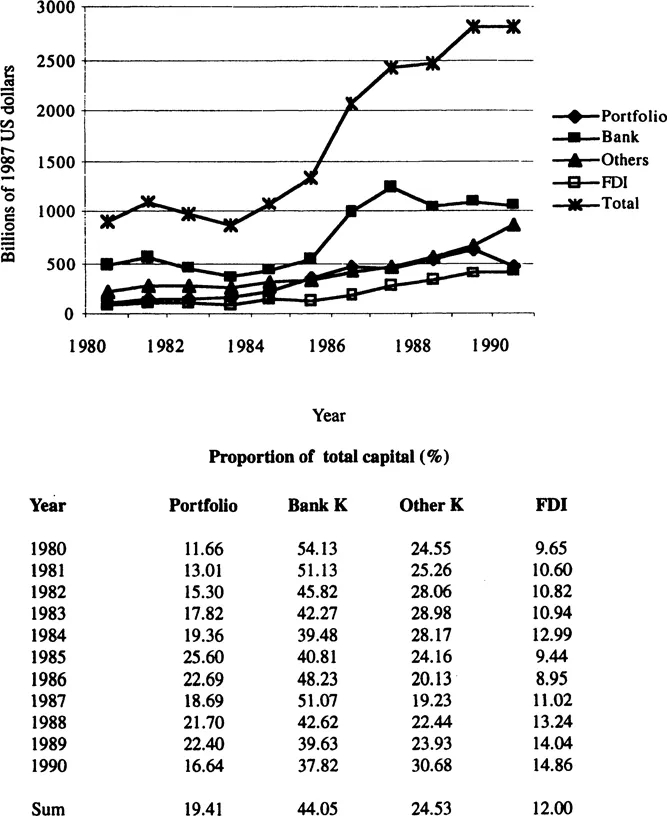

As a result of the globalization process in financial markets, global transactions of total private capital tripled during 1980-1990.3 The integration of global financial markets has been primarily promoted by increased financial market activities as well as multinational enterprises. Arguing that information technology and regulatory revolution have resulted in the integration of global financial markets, O’Brien ( 1992) maintains that we have reached the ‘end of geography’. This pattern is most marked in the portfolio and non-bank capital markets. Portfolio and non-bank financial institutions’ capital transactions increased by approximately five times and four times respectively during 19801990. Efficiency-seeking multinational enterprises transfer capital, technology and managerial skills to the most profitable places (Hood and Young, 1979, pp. 2-3) and thus integrate the global economy (Casson, 1986; Dunning, 1988, pp. 43, 258-61). During the same period, the global transactions of foreign direct investment increased more than four times. These three financial products became more important global financial resources, increasing their proportion to total capital transactions from 46 per cent in 1980 to 62 per cent in 1990. Although the traditional bank capital doubled its global transactions, the proportion to total capital transactions decreased.

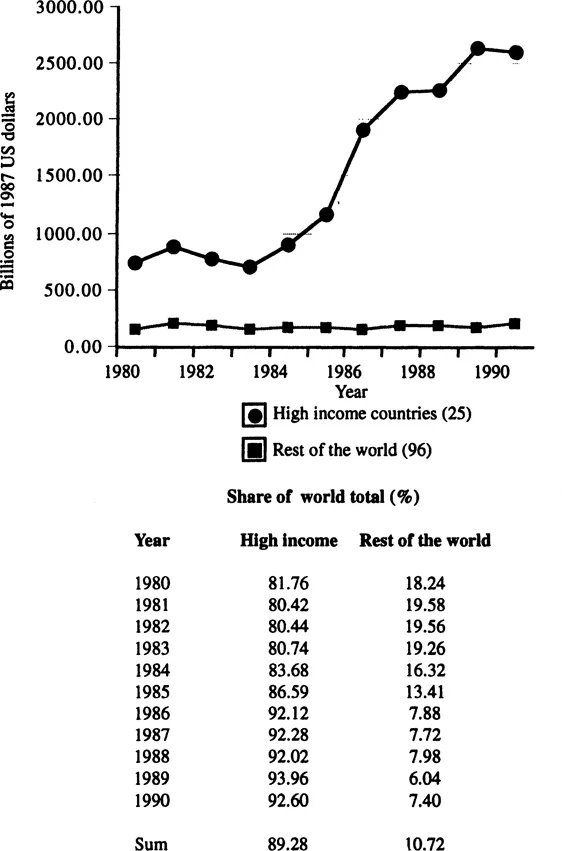

In this integrated world economy, the developed countries and a small number of developing countries have experienced substantial industrial growth, but other countries have experienced deep financial difficulty, widening the development gaps between the rich and poor. During 1980-1990, almost 90 per cent of global capital transactions were carried by 25 high income countries out of 121 countries.4 The low income countries’ share of global capital transactions was less than 1 per cent. As more information technologies and financial instruments were provided by the high income countries in recent years, the gap between the high income countries and the rest of the world became wider; the high income countries’ share of global capital transactions increased from 82 per cent to 93 per cent during 1980-1990. Gill and Law (1988, p. 127) see this pattern as the ‘transnational stage’ in the development of capitalism. Since the capitalist system in the transnational stage separates the production process over space and national boundaries, capital moves in the most efficient way seeking more profits.

Figure 1 Global capital transactions by financial item (121 countries in 1980-1990)

Source: Balance of Payments Statistics Yearbook (IMF).

Figure 2 Global capital transactions by level of income (high income countries vs rest of the world in 1980-1990)

Source: Balance of Payments Statistics Yearbook (IMF).

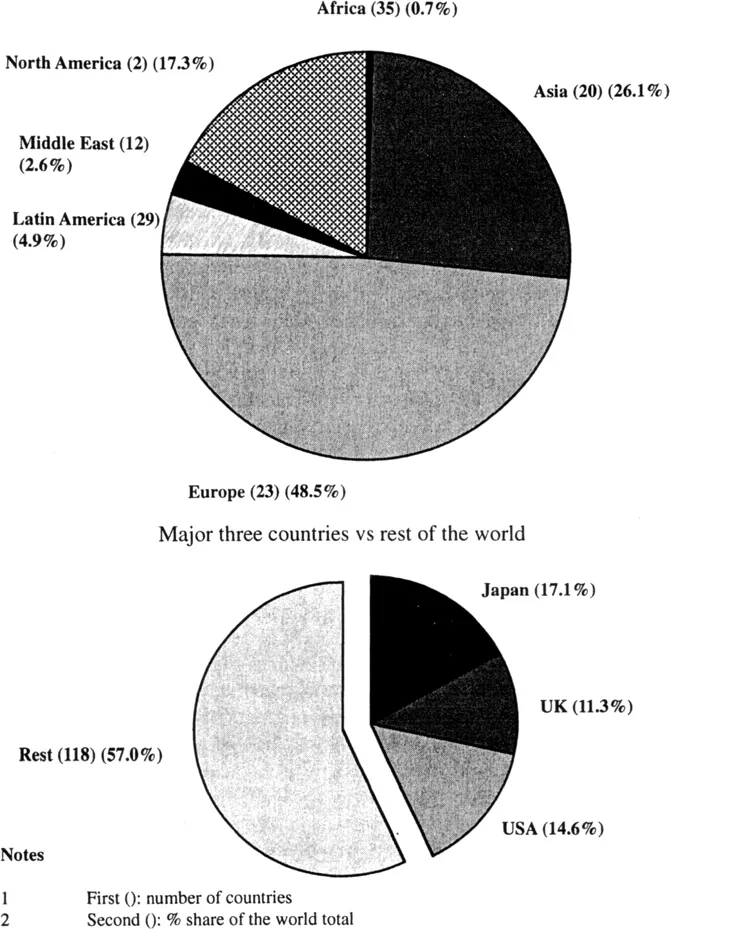

The parallel integration of finance and economies, O’Brien (1992, pp. 90-7) argues, is followed by the process of integration at the political level. Persson and Tabellini (1992, pp. 696-700) show that flexible capital mobility creates more competition, which results in similar monetary policy among countries. As a result, the government type, Persson and Tabellini argue, becomes similar as voters react to international competition. Indicative of financial market integration, about half of the global capital transactions were conducted by the European countries during 1980-1990. What has happened in Europe in recent decades is the future of the rest of the world as further globalization of international financial markets occur.

Omae (1985) sees the resultant global economy consisting of the ‘triad of economic powers’ of three regional blocs: North America, the European Community, and a Japan-dominated Asian bloc. These three regional leaders together contributed 43 per cent to global capital transactions and 56 per cent to global portfolio transactions during 1980-1990. The US and Japan were leaders in their regions while the UK was accompanied by neighbours as the European countries moved to the stage of regional integration. The same process is now under way in North America and Asia.

What has happened in the world economy in the last decade is a revolutionary change - a change in fundamental ways. It raises many research questions about the causes and consequences of globalization. Effects of ideological and environmental changes in world politics and institutional and technological innovations in the world economy should be analyzed, as should the impacts of the integrated world economy on political and economic activities. Social scientists and policy makers need to understand this new stage of transnational capitalism to prepare for a new global order. As a first step to providing this understanding, this study explores global capital flows, one of the key contributors to the integration of global financial markets and thus to the integration of global economic activities.

Figure 3 Global capital transactions by region and major countries: sum of 11 years (1980-1990)

Source: Balance of Payments Statistics Yearbook (IMF).

Statement of Research Problem

Despite the fact that the theoretical literature on the globalization of international financial markets has grown rapidly in recent years, it has not properly answered what has caused this globalization. It is also important to investigate what the consequences of this globalization are for international capital flows. Since the first question has not been properly answered, neither has the second.

International capital flows have been analyzed from three theoretical perspectives: flow theory, portfolio theory, and the monetary approach to the balance of payments. Flow theory postulates that a given interest rate differential induces capital flows. Portfolio theory asserts that capital flows are dependent not only on interest rate differentials but also on risk estimates and capacity of investors. The monetary approach claims that a monetary policy based on the condition of balance of payments and the control of domestic credit determines international capital flows. The portfolio balance model incorporates portfolio theory and the monetary approach.

Since flow theory tries to measure the degree of integration of international financial markets by comparing real interest rates across countries, it cannot address the determinants of international capital flows. Portfolio theory and the monetary approach partly answer the question by examining portfolio factors and monetary factors separately. The portfolio balance model is effective in explaining both financial and monetary factors together. However, most studies have neglected the impact of recent developments in financial markets such as technological innovations and regulatory changes. In addition, the impacts of international political factors have been ignored in explaining international capital flows. It is necessary to investigate not only the traditional financial and monetary factors but also technological and regulatory developments in international financial markets along with international political environments, if we are to see the whole picture of globalization of international financial markets.

Most empirical studies have focused at best on small groups of countries, with the result that the determinants of international capital flows at a global level have not been illuminated. It is necessary to include a large number of countries to understand the globalization process. In addition, each empirical study has analyzed one financial product, focusing on portfolio flows, foreign direct investment flows, and bank loan flows separately. In doing so, interactions of these financial products cannot be examined in the context of total capital inflows to a country or total capital outflows from a country. It is necessary to analyze all of these financial products together in one system to investigate these interactions. This procedure will provide a more complete picture of global capital flows.

Purposes of the Study

This study includes international portfolio flows, bank capital flows, foreign direct investment flows, and other private sector capital flows of 121 countries for the period of 1980-1990 and draws flow, portfolio and monetary theories into a single framework. The purposes are:

- to investigate causes of the globalization of international financial markets;

- to examine consequences of this globalization for international capital flows; and

- to explore interactions among all private capital flows in the globalized financial markets.

From these analyses, the study develops policy options for developing countries needing external financial resources. Thus it may suggest more focused, efficacious strategies for international development organizations which seek to assist these developing countries in their economic development efforts.

Research Questions

The specific research questions that are examined are as follows:

- I What are the causes of the globalization of international financial markets?

- 1 Do instrumental innovations in financial markets accelerate globalization?

- 2 Do technological innovations in telecommunication accelerate globalization?

- 3 Do relaxed monetary regulations accelerate globalization?

- 4 Do increased international economic relations accelerate globalization?

- II What are the consequences of the globalization of international financial markets for international capital flows?

- 1 What types of capital flow (inflow or outflow) and which type of capital (portfolio, bank, foreign direct investment or other sector capital) are influenced by instrumental innovations in financial markets?

- 2 What types of capital flow or type of capital are influenced by technological innovations in telecommunication?

- 3 What types of capital flow or type of capital are influenced by regulatory changes?

- 4 What types of capital flow or type of capital are influenced by international economic relations?

- III What are the interactions among different financial items as a result of globalized financial markets?

- 1 What types of capital flow or type of capital are closely related?

- 2 What types of capital flow or type of capital are sensiti...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- List of Figures

- List of Tables

- Acknowledgments

- Preface

- 1 Introduction

- 2 Review of Literature

- 3 Research Methodology

- 4 Empirical Findings

- 5 Overview

- Appendices

- Bibliography