Marketing Planning in a Total Quality Environment

- 486 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Marketing Planning in a Total Quality Environment

About this book

Marketing Planning in a Total Quality Environment is a how-to book designed for the marketing practitioner. It provides detailed information on how to prepare and implement a marketing plan based in a total quality environment.For the last twenty years, the authors, as marketing practitioners and educators, have been deeply involved in the planning processes of many corporations. This book, Marketing Planning in a Total Quality Environment, is the product of what they've learned over the years from working with these diverse corporations and their executives. The authors provide readers with each step in the total quality planning process, complete with check sheets and plan formats. After readers finish the book, they can prepare a quality-driven marketing plan that will be used and followed throughout the year--instead of becoming a shelf item.This book is for you and the many other marketing professionals who are faced with one or more of these situations:

- You're doing a good job, but you'd like to do even better.

- You're spending valuable time putting out fires. You lack time to do the things that need to be done.

- You're always having a hard time coordinating major marketing programs.

- You're faced with a major discrepancy between where you are and where you'd like to be; you've got a planning gap.

- You realize that you've got to offer your customers more quality if you're going to be competitive in the new market environment.

- You'd like to have a professional annual marketing plan--one that will be well received by management and will also keep you and your staff focused throughout the year.

Because each step on how to develop a marketing plan is covered, Marketing Planning in a Total Quality Environment is ideal for presidents of smaller firms, marketing directors and planners, product managers, and planning specialists. The authors include a sample fact book which can be used to store and analyze data, planning forms which help convert data into information, and marketing plan formats which ensure that the plan will get used.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

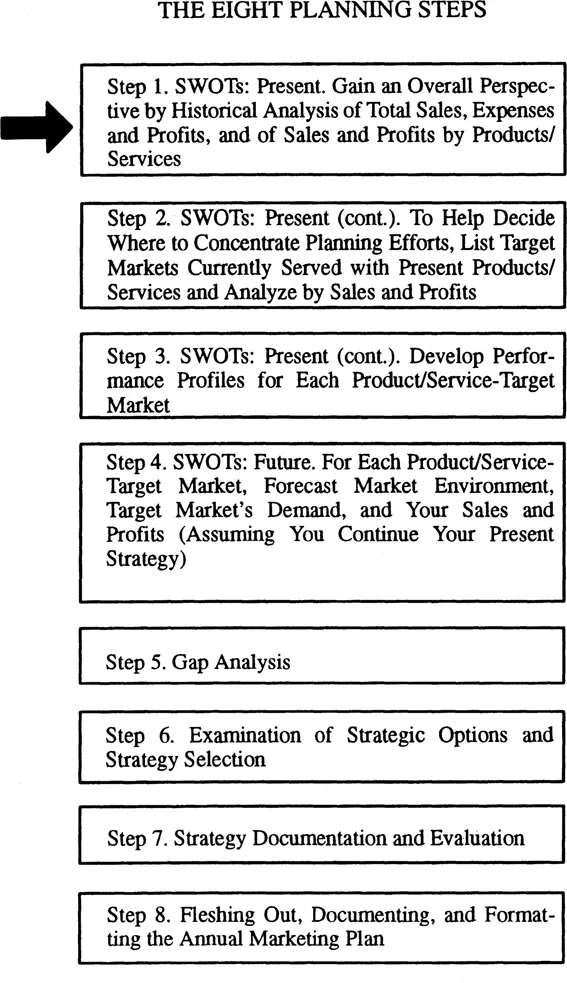

SECTION II

The Eight Planning Steps

Step 1. SWOTs: Present

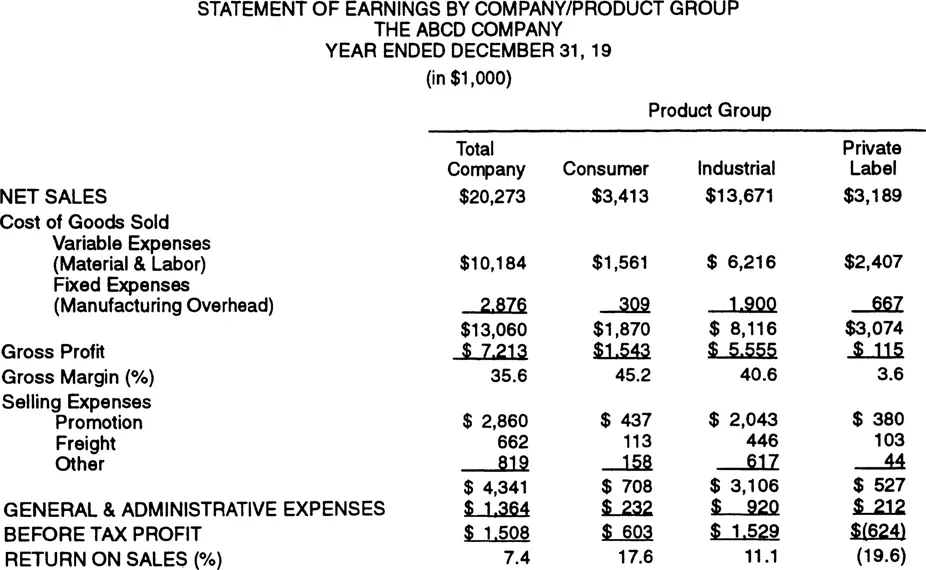

Gain an Overall Perspective by Historical Analysis of Total Sales, Expenses and Profits, and of Sales and Profits by Products/Services

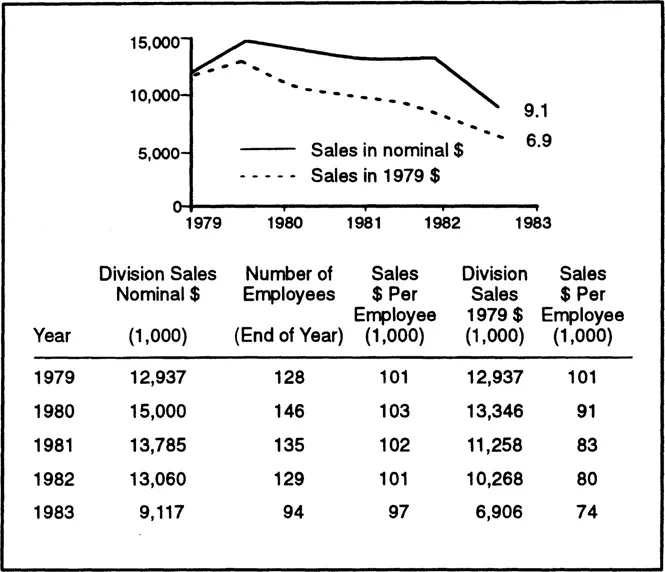

Business-Unit Analysis

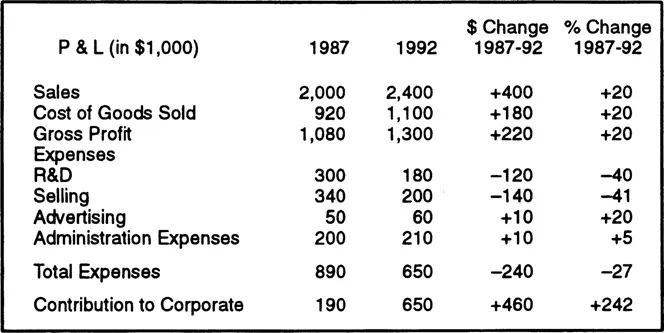

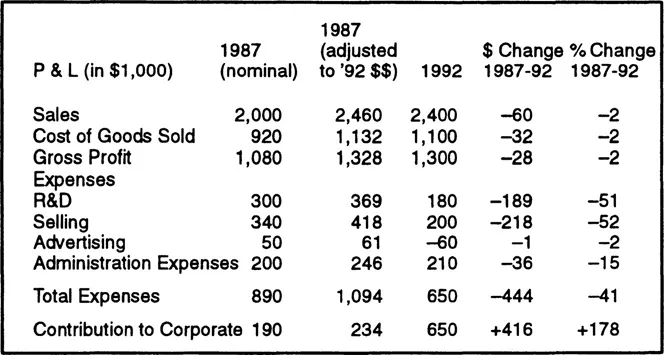

Examine Financial Statements

Make Industry Comparisons

Adjust Financial Statements for Inflation

Product/Service Analysis

How Accurately Does Your Organization Measure Costs?

Sales | |

– | Cost of Goods Sold (Purchases of components, raw materials and direct and indirect manufacturing costs) |

= | Gross Profits |

– | Operating Expenses (Including general and administration overhead allocation) |

= | Pretax Income |

Activity-Based Costing (ABC)

- A system that focuses on activities as the fundamental cost objects and uses these building blocks for compiling the costs of products and other cost objects.1

Table of contents

- Cover

- Half Title

- Haworth

- Title Page

- Copyright Page

- Table of Contents

- Preface

- Acknowledgements

- SECTION I: INTRODUCTION

- SECTION II: THE EIGHT PLANNING STEPS

- SECTION III: RETROSPECT AND EXPECTATION

- SECTION IV: APPENDIXES

- Notes

- Index