eBook - ePub

Sustainable Growth and Resource Productivity

Economic and Global Policy Issues

- 360 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Sustainable Growth and Resource Productivity

Economic and Global Policy Issues

About this book

Written by international experts in their respective fields, Sustainable Growth and Resource Productivity provides a comprehensive overview of global issues of raw materials supply and resource use. It also introduces new views and perspectives on the sustainable growth of emerging economies and develops a rationale for a new resource economics. This book emphasises why resources are back on the agenda: firstly, because of their fundamental economic role in technological progress and long-term prosperity; secondly, because deficits in raw material markets are now intertwined with deficits in the financial markets; and, thirdly, because the sustainable management of natural resources is a crucial element in responses to new global challenges such as climate change. Sustainable Growth and Resource Productivity analyses raw materials supply and resource use in a global context. The contributions present state-of-the-art results and perspectives on the availability of resources and discuss factors such as limited supply, demand from emerging and other economies and the critical shortage of some materials – particularly some metals – that are essential inputs in many high-tech processes and may put certain industries at risk. Sustainable Growth and Resource Productivity sheds new light on the economics of sustainable growth. Linking the current financial crisis with stock market pricing and innovation dynamics, it argues for reforms in international macro-economic policies. It also critically discusses the implications of valuing labour productivity over capital and resource productivity and argues that policies favouring capital productivity will increase both social and economic sustainability. Further contributions are made on the business dimensions of material efficiency as well as on policy recommendations. The book examines the overall empirical trend towards decoupling resource use from economic growth. It undertakes a rigorous cross-country comparison and looks in more detail at the cases of Finland and Greece, as well as at emerging economies and their role in the global governance of natural resources. A key focus is placed on China, with discussion of recent findings regarding Chinese domestic policy on energy, climate and resources as well as on developing Chinese foreign policy in Africa. The book concludes with the positing of a new theory of resource economics: an emerging sub-discipline that puts resources at its heart but clearly aligns with other fields of economics, and transcends the borderlines of geology, geography, material science, recycling and waste, as well as elements of other social sciences. This important new book will be essential reading for economic researchers, governmental officials, businesses and NGOs with an interest in understanding the policy links to sustainable growth and in learning more about the emerging field of resource productivity.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Sustainable Growth and Resource Productivity by Raimund Bleischwitz,Paul Welfens,ZhongXiang Zhang in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

Part I

Raw materials supply and resource use from a global perspective

1

Will the mining industry meet the global need for metals?

Magnus Ericsson

Short preface in light of the financial crisis

This chapter was written before the financial crisis became obvious in September 2008. Although metal prices have fallen dramatically since then and metal demand growth has slowed down and will possibly even contract, it is important to keep in mind that metal prices were in the first quarter of 2009 in general at a higher level than they were during the first years of the new millennium. Three metals—gold, copper and iron ore—account for 50–60% of the total value of all metals produced at the mine stage. All three remain at comparatively high levels: gold prices are at record levels, iron ore prices are expected to fall but only to the 2007 level which was the second highest for some 30 years, and copper, in spite of a sharp decline, remains at the 2004 level, which is considerably above the consistently low levels of 1999–2003. Most of the problems highlighted in the review still remain and the conclusions reached still hold even if some developments will be slowed down and others pushed into the future.

The fundamentals are still the same. Emerging economies will go through a period of high metal intensity when they reach development levels between US$5,000 and 10,000 per capita per year. The supply of these metals is inflexible: to find and develop new mines takes at least 10 years. The mining industry hence continues to face a host of problems which can be solved only by increased R&D expenditure and shifted priorities: to increase exploration with a higher success rate and to reduce production costs with more energy and water efficient processes are but two examples.

Even if the mining industry is not that badly hit by the financial crisis, the exploration sector has been almost crushed. The so-called junior companies which have no cash flow but rely on the capital markets for their funding have been devastated by the lack of capital. Exploration in 2009 is expected to be perhaps only half of what it was in 2008, which admittedly was a record year, but given the increasing difficulties in locating new ore deposits, this is perhaps not enough in the long run. With exploration down, the likelihood is high that we will see a repeat of the metals price boom in a few years’ time when economic growth resumes. The mining industry is cyclical, but in this economic period it remains on an upward trend.

Introduction

The new moon of early February 2008 ushered in the Chinese Year of the Rat, an auspicious year even if not so good as the previous year’s Pig. Furthermore, 2008 is an ‘Earth Rat’ year—one which requires care in business undertakings. Given the importance of China in world metal markets such matters need to be taken seriously. But, while Chinese traditions and thinking will play a more important role in understanding future metals markets, there are also several hard fact indications of a continuing ‘super cycle’ (G. Burke, quarterly review of metal prices, personal communication, Canberra, 2008).

Metal prices remained high due to supportive supply/demand fundamentals, not only in China and India but also in Russia, Kazakhstan, Brazil and others. In the next few years it seems most likely that metal use will continue to grow at a faster pace than it did during the end of the 20th century and hence the cyclical swings will be on an upward trending curve. Metal use is solidly underpinned by both personal demand when standard of living is increasing and infrastructure investments in several countries, not only China and India. The present boom has already lasted longer than all others since the Second World War and the ‘super cycle’ is a fact (Radetzki 2008). There is no imminent threat to the boom by the beginning recession in the US, but the risk of indirect effects due to decreased demand for Chinese and other emerging countries’ exports is real. The effect of the US financial recession in the second half of 2007 and first part of 2008 saw base metals performing worst across the commodities spectrum. Merger and acquisition activity suggests producers are still convinced of the continuity of this bullish cycle. China remains the main driver of growth.

The supply response is slow, owing to the long-term nature of exploration and mining investment, and it will take years to make up for earlier under-investment. But at the same time it is important to underline that mining is and remains a cyclical business; supply will gradually catch up with demand even if metal use continues to grow at a faster pace than it did during the end of the 20th century. For the next one or two years demand growth is expected to slow down but not to crash, while the supply increase is expected to speed up. Therefore the mining companies will continue to generate good if not record profits.

Implications for the mining industry

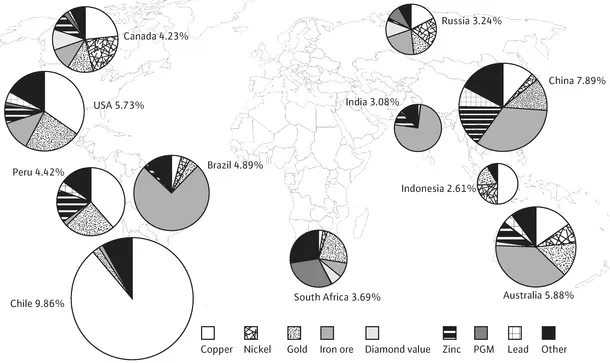

During the present extended boom not only is metal and mineral production increasing rapidly, but a new corporate landscape is also emerging. Established transnational corporations (TNCs) in the field of mining are meeting increasing competition from new mining companies based in China, India, the Commonwealth of Independent States (CIS) and other developing economies and from junior companies. In 2006, China became the world’s largest mining country and the so-called BRIC countries (Brazil, Russia, India, China) are among the top 11 mining producers (Fig. 1.1).

At the same time society’s expectations of the exploration and mining industry are growing quickly and the industry is increasingly receiving new political attention. Barely has the industry started to get to grips with its image and environmental footprint when new issues arise: in the industrialised countries metal and mineral supply is becoming a concern; and stakeholders other than investors want a larger share of profits.

Despite cost increases of many inputs, and hence operating cost increases in most mines, the profitability of mineral producers has exploded. The Fortune Global 500 companies in the extractive industries (including oil) reached an exceptionally high profitability in both 2005 and 2006, compared with large companies in other sectors, as well as historically. The average profit measured in percentage of revenues was between 25 and 30% in 2006 compared with 5% as late as 2002 and less than 20% for the pharmaceutical industry, for example (Crowson 2008).

The global mining industry faces one main challenge: to deliver sufficient volumes of metals and minerals at prices that do not fuel inflation or encourage substitution, while ploughing back a reasonable share of profits into local and national host economies.

If it is possible to meet this challenge there is a need for a new type of international cooperation to facilitate the use of minerals as a lever for economic and social development in developing countries. This is necessary to ensure that the

FIGURE 1.1 Global mine production 2006 (% of total value of all non-fuel minerals) Source: Raw Materials Data, Stockholm 2008

mistakes of the past are not repeated, when an insufficient share of profits flowed back to host countries and local communities. Many countries experience largescale mining investments for the first time and their governments have no history on which to build policies. Cooperation between developing countries, between rich and poor countries, between ‘old’ and ‘new’ mining countries is important, as is cooperation between governments and industry (UN ECA 2007).

Governance and transparency remain key concepts for all participants, both new and old, in this process. Positive experiences from countries that have successfully developed, economically and socially, based on natural resources should be systematically transferred to weak governments. The same strict demands on transparency, conduct and operational practices from reporting standards to health and safety routines should be put on all exploration and mining companies in principle regardless of origin or size. There is also an important role in this fight for the broader international community. ‘Mining for development’, modelled on the successful Norwegian programme known as ‘Oil for Development’ (NORAD 2007), is but one idea presently discussed between Nordic and developing countries (Ericsson 2008).

Corporate concentration

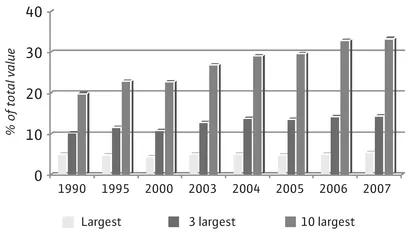

The mining industry has been going through a consolidation phase during the last couple of years. As mentioned above, the supply response is, by nature, slow and it will take years to make up for earlier under-investment. Therefore the mining companies will continue to generate good if not record profits and hence the pressure for mergers and acquisitions (M&A) will continue at a high level. The fragmented structure of mining is slowly disappearing (Fig. 1.2).

As the mining industry gradually becomes less fragmented, a limited number of companies control an increasing share of the mining industry globally. This trend has both positive and negative aspects. On the one hand, the mining industry, new players included, needs to consolidate to create larger and stronger corporate entities. Larger companies are necessary to fund and pursue increasing volumes of R&D including expanded exploration. Skyrocketing energy, water and environmental costs must also be addressed. On the other hand, proper checks and balances must be in place to ensure that monopolistic powers are not created. The recent case of BHP Billiton making a hostile bid for Rio Tinto is one example of a situation where the market domination in iron ore, copper and aluminium for the proposed new entity would be unacceptable and the seaborne iron ore market no longer free and competitive.

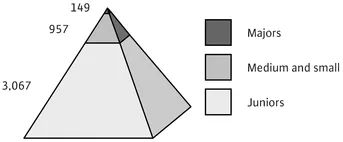

There are over 2,000 mines producing metal ores using mechanised methods around the world if small manual and artisanal operations are excluded. There is a huge spread between the largest and smallest mines (Fig. 1.3).1 The largest 150 companies are, somewhat arbitrarily, called majors and together they represent only a small percentage of the total number of companies in the sector globally. When looking at the value of the production controlled by these com

FIGURE 1.2 Corporate concentration in the mining industry (% of total value of all non-fuel minerals production) Source: Raw Materials Data, Stockholm, 2009

FIGURE 1.3 Num...

Table of contents

- Cover

- Half Title

- Title

- Copyright

- Contents

- Introduction

- Part I: Raw materials supply and resource use from a global perspective

- Part II: The economics of resources and sustainable growth

- Part III: Empirical analysis of resource productivity: trends and drivers

- Part IV: Global policy issues

- Conclusions: towards a new resource economics

- About the contributors

- Index