- 170 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Originally published in 1988. Copper is one of the most actively traded commodities. It is a crucial commodity for industrialised countries, most of which depend on imports for their supplies. Copper is also the single most important export for many of the producer-countries. Changes in the patterns of the world trade in copper therefore have an important impact on many countries. This book surveys the state of the world copper industry as it was in the 1980s. It discusses the state of production, demand and trade and assesses trends. Special emphasis is given to the outlook for over capacity, prices and competitive structure.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Global Copper Industry by Raymond F. Mikesell in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

SURVEY OF THE WORLD COPPER INDUSTRY

BRIEF HISTORY

Man has used copper for making weapons and tools as early as the fifth millenium BC. Copper metallurgy (smelting ore) was introduced sometime in the fourth millenium BC, followed by the discovery of bronze (a copper/tin alloy) early in the third millenium BC.[1] Bronze became the dominant metal for production of weapons and tools in the West until replaced by steel in the first millenium AD. [2] Some of the ancient copper mines—those in the Timna Valley in Israel (dating from 4000 BC), the Cyprus Mines (dating from 3000 BC) which supplied the Phoenicians, Greeks and Romans, and the Rio Tinto mines in Southern Spain (dating from 1500 BC)—have been rediscovered and are operating today.[3]

During the Middle Ages and the early modern period, Continental Europe was the center of the world copper industry. The munitions industry was the principal consumer for the production of brass cannon and other military items. By the end of the eighteenth century Britain was the world’s largest copper producer, with most of the production in the Cornish and Devon areas. (These ores were exploited by the Phoenicians as early as 1500 BC and later developed by the Romans .) When the demand for copper exceeded Britain’s mine capacity, it began importing ore from various parts of the world for smelting. British advances in smelting technology gave that country a near monopoly on copper output, which continued to the middle of the nineteenth century. Britain’s position in the industry declined rapidly in the second half of that century with the growth of output in Chile and later in the U.S., Canada and Mexico. Meanwhile, world demand for copper began to double every few years due to the growth in the use of electric power for lighting and communications. World output, which was estimated at 100,000 metric tons (mt) in 1860, reached 1 million mt by 1912; 2 million mt by 1929; and nearly 8 million mt by the mid-1970s.

The rapid growth in world demand for copper was accompanied by a series of important discoveries of deposits in North and South America, Africa and later in the Far East. The first large deposits exploited in the U.S. were in the Lake Superior region of northern Michigan, an area where American Indians had been recovering native copper for centuries.[4] For a time after the Civil War, northern Michigan was the largest U.S. source of copper, but later in the century its output was exceeded by mines discovered at Butte, Montana. From 1850 to 1880 Chile was the world’s largest copper exporter. A number of relatively small mines had been producing copper in Chile since the early part of the nineteenth century, but output was small compared to what it became in the twentieth century.[5]

Prior to development of technology for large-scale mining and processing of low-grade deposits, mining was limited to the extraction of rich underground veins containing 6 to 10 percent or more copper. Some of the early mines were able to operate profitably without smelters in isolated areas many hundreds of miles from a railroad because they produced ores containing 10 to 20 percent copper. The accessible high-grade ores were rapidly depleted, but far more mineable copper was available with grades under 2 percent. In 1905 an American engineer, Daniel C. Jackling, introduced mass production in an open pit mine which contained only 2 percent copper. About the same time, there were improvements in the concentrating process. The new mining and processing technologies made possible the creation of a number of large open pit mines in several Western states, including Nevada, Arizona, Utah and New Mexico. By 1910 U.S. mines were producing three-fifths of the world’s copper output. In the early twentieth century large-scale mining was also introduced in Mexico, Chile and Canada, and later in Zaire, Zambia, Union of South Africa, Australia, Philippines, Papua New Guinea (PNG), U.S.S.R., and several Western European countries.

The shift from relatively small-scale underground mining to large-scale, open-pit mining with ore extraction of 50,000 to 100,000 tons per day determined the size of copper mines in the U.S. and in most other countries of the world. Large amounts of capital and a variety of technical skills are required to mine and process low-grade ore. Although there were once 3,000 copper mines in the U.S. alone, by 1923 eight large firms produced 64 percent of world output. Large-scale underground mining of strataform deposits in the African Copper Belt also replaced the small initial mines in this area.

WORLD RESERVES AND RESOURCES

Minerals in the earth’s crust that are potentially extractable are classified in various ways, but this book is mainly concerned with three concepts as defined by the U.S. Bureau of Mines (BOM), namely, reserves, the reserve base, and resources of copper. Reserves are those materials identified and estimated by specified minimum physical and chemical criteria related to current mining practices that can be economically extracted at the time of determination. The reserve base includes those materials that are (1) currently economic to mine (reserves); (2) marginally economic (marginal reserves), and (3) currently subeconomic but with reasonable potential for becoming economically available within the next few decades. All the materials in the reserve base have been identified in that their location, grade, quality and quantity are known or estimated from specific geological evidence. Mineral resources is a broader concept that includes, in addition to identified resources, inferred resources based largely on the geologic character of deposits but for which there may be no samples or measurements. Resources include only those materials for which economic extraction is currently or potentially feasible.[6]

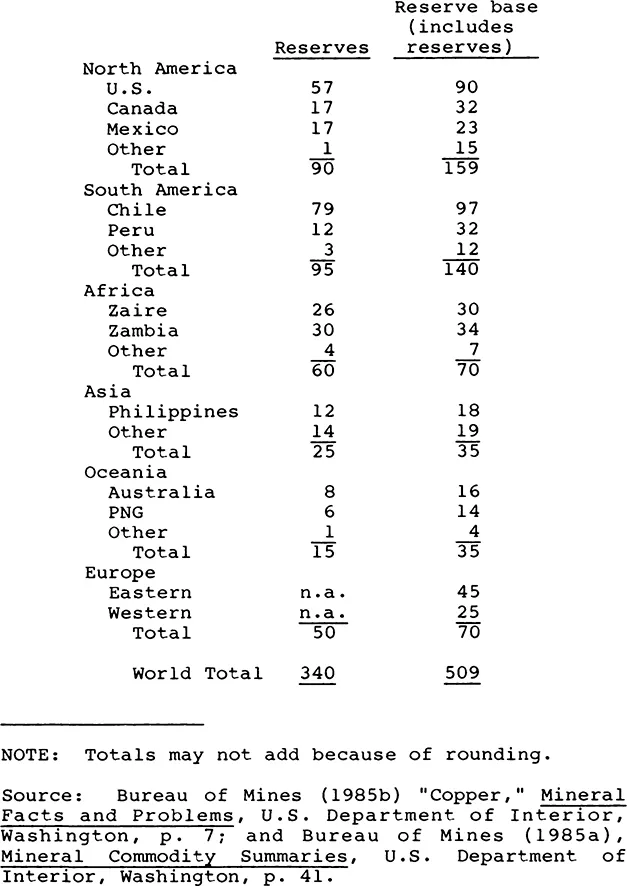

World copper reserves and the reserve base (as of 1985) are estimated to be 340 million mt and 509 million mt, respectively (Table 1.1). About 32 percent of the world reserve base is located in developed countries; 59 percent in developing countries; and 9 percent in Eastern Europe. World resources of copper are estimated at 2.3 billion mt, of which 1.6 billion mt are land-based and 0.7 billion mt are in deep-sea nodules. The estimate of copper in deep-sea nodules is much less reliable than that for land-based resources for two reasons. First, lifting and extracting seabed nodules is not yet economical, although it is likely to become so in the next century. Second, sufficient exploration may reveal much larger quantities of nodules than have been discovered thus far.

Table 1.1

World Copper Reserves and Reserve Base (million metric tons)

World Copper Reserves and Reserve Base (million metric tons)

World copper consumption has been growing at just under 2 percent per year. Assuming this rate of growth continues, the reserve base of 509 million mt would be sufficient to satisfy demand for another thirty-six years. World resources estimated at 2.3 billion mt would be sufficient to supply world demand for nearly 90 years, assuming a 2 percent rate of growth. Although it is not possible to estimate the rate of growth in demand for the next century, it seems unlikely the world will exhaust its copper resources for many decades to come.

Actually, the consumption life of an exhaustible mineral has little practical significance. Resources are never fully exhausted since increasing scarcity results in higher prices which in turn moderates demand. Higher prices induce the use of substitutes and stimulate R&D for both substitution and conservation in use. At the same time, higher prices stimulate the search for new reserves and make profitable the production of lower-grade deposits. Thus as reserves are depleted, dynamic forces are set in motion that prevent exhaustion of a mineral. As is discussed in Chapter 3, there are several substitutes for copper in nearly every use, and advances in materials technology are continually producing new substitutes and conservation methods.

WORLD PRODUCTION AND CONSUMPTION

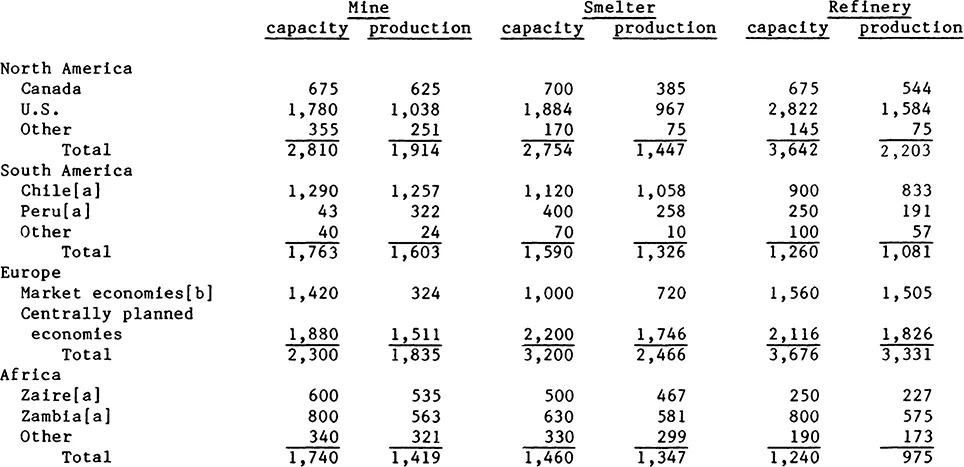

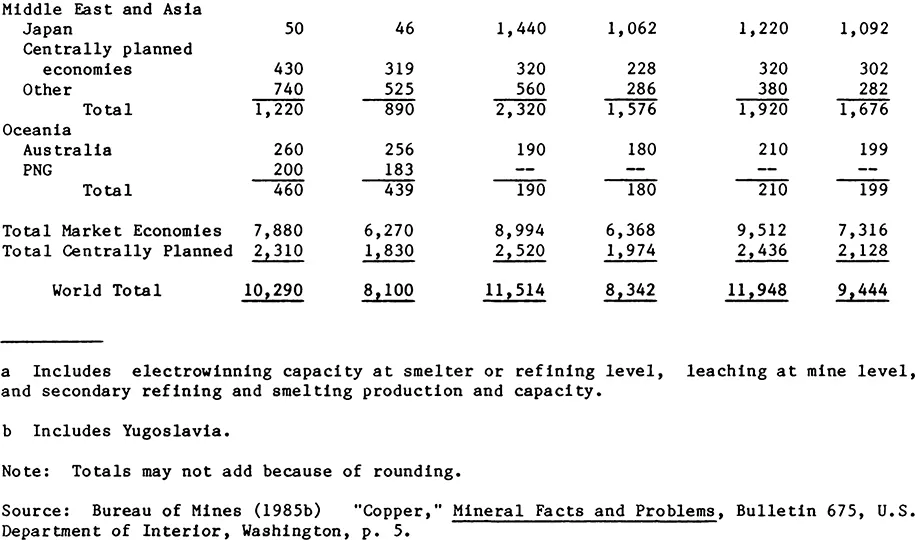

In 1983 annual world mine copper capacity totaled 10.3 million mt, but world production was only 8.1 million mt. The difference between capacity and production is largely due to excess capacity in developed countries; there was much less excess in developing countries. In this same year 28 percent of world mine output was in the developed countries; 49 percent in the developing countries; and 22 percent in the centrally planned economies (the Soviet Bloc plus China). World smelting capacity and production are somewhat higher than mine capacity and production because some of the copper smelted is produced from scrap (secondary copper). Refining capacity and production are still higher because some secondary copper is refined with primary (from ores) (see Table 1.2). Developed country smelting and refining capacity is considerably larger than mine capacity since a portion of the mine output of developing countries is processed in the U.S., Western Europe and Japan.

Table 1.2

World Copper Capacity and Production, 1983 ('000 metric tons)

World Copper Capacity and Production, 1983 ('000 metric tons)

World consumption of refined copper totaled 9.1 million mt in 1983; this amount included about 1.2 million mt of secondary copper. The developed countries accounted for about 64 percent of total world consumption; the Soviet Bloc and China about 26 percent; and the developing countries about 10 percent. However, it is expected that consumption will grow more rapidly in the developing countries than in the rest of the world. The developing countries have been growing somewhat faster in terms of per capita income than the rest of the world, and a larger portion of their income is expected to be be spent for durable goods containing copper.

STAGES IN PRODUCTION

As is the case with most minerals, the copper industry is divided into major production stages: (1) exploring; (2) mining and milling; (3) concentrating; (4) smelting; (5) refining; and (6) semifabricating. Some copper companies operate at only one or two stages, while most large firms are integrated through all six stages.[7]

Exploration

In contrast to methods employed in the last century by prospectors who depended on surface observations and samples gathered with pick and shovel, exploration has become highly complex using sophisticated technology. Subsurface deposits are located by “telegeological” or “remote sensing” techniques using aircraft or satellites; by chemical analysis of elements found in rocks, soil or streambed sediments; and by electronic equipment that can detect mineral characteristics by measuring magnetic and conductivity conditions and radioactivity. For example, the large Ok Tedi copper/gold deposit in PNG was discovered through analysis of streambed samples taken many miles from the mountain where the deposit is located. Evidence of mineral deposits has been found by LANDSAT imagery provided by satellites and by side-looking radar or photography where conventional methods are inadequate. Modern exploration is carried on by teams of experts that include geologists, geochemists, and geophysicists.

There are several stages in exploration, each having a specific goal. The goal may be to find a mineable deposit of a specific mineral or to find deposits of unspecified minerals; or it may be to learn more about a known deposit. The search for new deposits (called “grass roots” exploration), usually begins with a review of the geological and mining literature on an area, followed by a variety of aerial and ground reconnaissance and mapping designed to identify one or more potential prospects. Once a prospect has been identified, the area is drilled to obtain samples for assaying and metallurgical testing. If the sample shows ore suitable for mining, intensive exploration by systematic close-space drilling and collecting of bulk samples is undertaken to estimate the volume and location pattern of ore in the deposit. Until reserves are measured and their location known, it is not possible to determine whether mining would be profitable.

Feasibility Study

Before a decision is made to construct mine and processing facilities, a feasibility study must be made based on information on the orebody, estimates of capital and operating costs, and projections of product prices. For a large mine, a feasibility study may cost $25 million or more, and require preparation of engineering data covering all aspects of the project—the mine and plant, infrastructure, and facilities that limit environmental damage. All the elements of the cash flow analysis must be estimated and the cash flow simulated from projected information to determine the internal rate of return (IRR) from the project under various product price, cost and tax assumptions. A financial plan, including an estimate for debt financing, is contained in the feasibility study. On the basis of the feasibility study the investor decides whether the probability-adjusted rate of return on equity capital is sufficient to warrant an investment.

Mine Construction

Construction of large copper mines in both developed and developing countries is usually undertaken by international engineering and construction firms, such as Bechtel Civil and Minerals, Inc., and Morrison and Knudsen. Modern open-pit copper mines require investment of several hundred million dollars and three to five years to construct. The several components of construction—mine preparation, crushing mills, concentrators, highways and/or railroads, utilities, and facilities for mine waste disposal—must be coordinated so that operations can begin on schedule. Even a loss of a few months can significantly increase construction costs due to interest on borrowed funds.

Mining and Milling

Most porphyry copper mines are open-pit operations. The deposit is drilled and blasted and the ore hauled to crushing mills in large trucks...

Table of contents

- Cover Page

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- Author's Preface

- Abbreviations

- Definition of Country Areas

- List of Tables and Figures

- Chapter 1: Survey of the World Copper Industry

- Chapter 2: Recent Changes in Copper Production, Trade and Industrial Organization

- Chapter 3: Consumption and the Slowdown in Demand

- Chapter 4: Prices, Costs and the Competitive Structure of the Industry

- Chapter 5: Third World Copper Industries: Development and Outlook

- Chapter 6: Government Regulations and International Issues Relating to Copper

- Chapter 7: Technological Innovation

- Chapter 8: The Future of the World Copper Industry: Summary and Conclusions

- Bibliography

- Index