![]()

Chapter One

Introduction - The Nature of The Scam

Purchasing scams and purchasing professionals

When I talk about purchasing scams to purchasing professionals, they tend to know exactly what I mean. During the early years of a purchasing person's career, time is usually spent in processing low-value transactions - using cheap, inexperienced staff is one of the ways of keeping the cost of processing such purchases within reasonable limits. During this time, they will frequently come across examples of the various scams described in this book - bogus invoices, solicitations that look like invoices, deliveries of unordered goods. In various forms these occur in every sector of commerce and industry.

The scepticism that seems to be an in-built element of the character of the typical purchasing professional picks out most of these scams. The curiosity and eye for detail which also seem to be part of the mindset of such people drive them into reading the fine print that many others would overlook. Buried within the fine print is the truth about the nature of the deal on offer - it has to be there to provide some sort of defence for the scam merchant from the charge of fraud.

If channelled through a professional procurement unit, therefore, I believe that most purchasing scams would be detected. The scam merchants know this and their target is therefore the non-professional buyer with delegated purchasing responsibilities. This is sort of person that spends 5 or 10 per cent of their time buying. Such people would never consider themselves a buyer; they have never had a day's training in buying, and will tend to think that buying is the same as shopping. Sometimes the target of the scam merchant is the clerk or secretary (if they are part-time or temporary, so much the better for the scam merchant); on other occasions it is the Finance Director or Managing Director, particularly in the case of smaller companies. No one with the power to commit the company's money is safe from the attention of the perpetrators of these scams.

Decentralization and devolvement - the way in for scam merchants

A major management trend in recent decades has been the decentralization and devolvement of responsibilities. One of the side effects of this trend has been the explosion in the number of staff of every discipline who incorporate the role of part-time buyer within their job.

Decentralization and devolvement of responsibilities are not inherently bad. Blindly following the trend without understanding the consequences is, however, a recipe for disaster, and imagining that it can be applied to the purchasing function without controls, training, improved systems and coordination will have the scam merchants out there rubbing their hands with glee.

Companies that think that they are eliminating risk by limiting junior staff to £1000 or £500 spend limits on each transaction are misguided. Certainly, the risk of the employee committing fraud for such a small return is low. However, scam merchants are quite happy to take £300-400 from you in return for very little, especially when they know that there are thousands more companies out there whose systems are just as lax as yours.

So what is a purchasing scam?

My definition is 'a mechanism by which unscrupulous people take advantage of naive purchasers and lax business systems to extract unreasonable sums of money for goods or services which are less than the customer expected'.

It is important to note that usually this practice is carried out in such a way that the scam merchant can attempt to claim that it is entirely legal. If a rogue spots a situation within which an innocent servant of a negligent organisation can be duped, who can be surprised by the result? And who is responsible - the rogue's desire to make easy money, the employee for their ignorance and carelessness, or the employer for permitting money to be paid out with no evidence of anything worthwhile in return?

Some might argue that the law and its enforcement officers are at fault for not being able to prevent the scam merchants from trading. But the principle of 'caveat emptor' (let the buyer beware) applies. If the scam merchant states the nature of the deal quite clearly in the documentation, who is really to blame when the buyer does not read the information put in front of them?

In defence of all the past victims of scams, it is probably fair to point out that scam merchants are pretty adept at the art of deception. This is not usually deception in the criminal sense (as we shall see below, scam merchants studiously try to avoid being vulnerable to the charge of criminal deception). Rather, it is deception as practiced by the conjuror; a smoke and mirrors act designed to confuse, to deflect the victim's attention from reality. Examples of this are documents that look like invoices but are not really invoices at all (see Chapters 3 and 4). The objective of the act is to lull the victim into paying a higher price than the market rate, often by creating confusion and making the buyer think that they are getting a bargain.

My definition of a scam differs a little from the dictionary definition because I am trying very hard to distinguish between a scam and a fraud. The Oxford English Dictionary is particularly unhelpful in this regard since its definition of 'scam' is 'to perpetrate a fraud; to cheat, trick or deceive', whereas, according to the OED, 'fraud' is 'to defraud, cheat or deceive'. It is a little difficult to spot the difference between die two definitions. Other dictionaries are more helpful; Chambers defines a scam as 'a scheme for making money by dishonest means' whereas fraud is 'the crime of obtaining money or some other benefit by deliberate deception'. Thus the distinction is made between a scam (which is a scheme) and fraud (which is a crime).

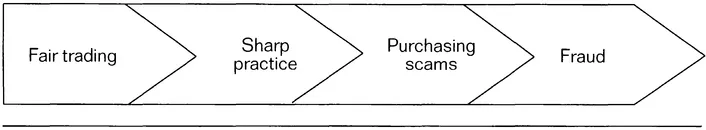

Figure 1.1 Continuum of business practice

By my definition, the scam fits somewhere in the continuum of business practice shown in Figure 1.1. Fair trading is what happens when a supplier charges their customer a price which reflects the effort, risk and resources that go into providing goods or services and yields a profit margin which is not excessive. It is impossible to say what constitutes an excessive profit margin because the effort, risk and resources will vary with every transaction.

Most transactions are fair - they have to be because in most industries competition creates rival suppliers who will undercut each other to earn a fair profit but who would not be able to sustain a business if they consistently traded in a way that yielded less than a fair profit.

Sharp practice occurs when suppliers exercise their knowledge of the cost of goods or services to them (the supplier) and the value of those goods or services to you (the customer) to price the goods or services at such a level that the return that they get for their effort, risk and resources is disproportionately high. Thus sharp practice falls short of a 'scam' by actually delivering what the customer thought they were going to get, albeit at a higher price than they need have paid if their knowledge of the market was better.

The scam takes this questionable activity of the supplier one step further. When a scam takes place, the scam merchant knows that the buyer does not realize the true value of what is being offered and actively exploits the buyer's ignorance. Thus, not only does the buyer not recognize that they are not getting good value but they usually have no real concept of what they are buying, if indeed they realize that they are entering a purchasing agreement at all.

In order to protect themselves, the scam merchant must try to achieve this without employing what the courts would recognize as deceit or misrepresentation - otherwise they would clearly be straying into the 'fraud' area of the diagram above. Scam merchants will try to build for themselves a legal defence in anticipation of the inevitable complaints and investigations. They have no need to commit prosecutable fraud; there are enough part-time buyers willing to commit their employers' funds to the purchase of useless or grossly overpriced goods or services. You should note that perpetrators of the Nigeria scam (Chapter 5) do not play by these rules or indeed any others.

Fraud involves deception or misrepresentation but scams can cover a range of practices that a reasonable person would see as unacceptable or objectionable. The law in most countries does not fully control trading malpractice of the kind described in this book because laws tend to be created with an attempt at avoiding paternalism and taking into account the actual or prospective impact on the victims. Businesses have been seen as being able to look after themselves against the unconscionable practices of the scam merchants. Also, if they fall prey to these practices the impact is generally relatively small financially.

Fraud is not specifically defined in English statute. The courts decide the point at which dishonest conduct becomes fraud. Scam merchants who stray over the line into the fraud area leave themselves open to prosecution under the Theft Act of 1968. Section 15 of this Act covers obtaining property or pecuniary advantage through deception. A person who by any deception dishonestly obtains property belonging to another with the intention of permanently depriving the other of it commits an arrestable offence. This is why the true scam merchant spells out exactly what they are doing in the small print of their documentation to avoid the accusation of deception. Some of the practices I describe in this book do stray into the area of fraud. This is inevitable, given the very grey area between a fraud and a scam.

Consumer scams

The range of purchasing scams covered in this book is limited to those perpetrated on businesses. A whole plethora of other scams are perpetrated on the consumer, but it would be impossible to detail all of them in this volume. Examples of consumer scams include:

- Counterfeit goods, although these too can be a problem for business, particularly in areas such as software (where annual industry losses to counterfeiting are estimated as $ 10-15 billion per annum) and high-value (for example, aerospace) components.

- Pyramid selling, the traditional name for what is now often more politely referred to as multi-level marketing, network marketing or multilevel franchising. This can be legitimate business but it often does not involve the transfer of a legitimate product or service in return for money paid out, in which case it is illegal.

- Share pushing, often perpetrated on the small business owner/manager but anyone else suspected of a reasonable level of personal wealth may be targeted by salespeople promoting shares in obscure companies about which they have inside information which they are prepared to share with the investor/victim/sucker.

- Chain letters - sometimes these are a moneymaking scam, but more often they are simply a nuisance. One version claimed (honestly) to raise money for a leading hospital for children. The hospital is still trying to stop it because it is such an embarrassingly wasteful means of raising funds. In the UK, most chain letters involving money are illegal under the Lotteries and Amusements Act. In the US a similar chain letter cascaded through the Internet alleging (wrongly) that 3 cents would be given to The American Cancer Society every time the message was forwarded.

- The Ponzi scheme (named after its pioneer Charles Ponzi) is a combination of share pushing, multi-level marketing and a chain letter in which someone sells shares in their 'company'. The first group of people to buy are rewarded with generous 'dividends' and tell all their friends to buy more shares. This goes on until the pyramid has grown so large that the people at the bottom cannot get anything and the person at the top gets a lot.

I also will not cover dodgy timeshare salespeople, home-working scams (for example, stuffing envelopes), garages that 'clock' second-hand cars, 'cowboy builders' or any of the scams aimed primarily at the domestic consumer or 'shopper' (as opposed to 'purchaser'). The reason for omitting such 'consumer' scams from this book is that so many other sources of information, guidance and protection are available to the consumer that they should not really need to read about them here in a book which is primarily intended to help businesses and business people. If consumers fail to notice the television programmes, press reports and police warnings about the sort of activities listed above, then the Office of Fair Trading or the local Trading Standards Office or some similar equivalent watchdog will be concerned to protect their interests.

A recent White Paper issued under the auspices of the UK Department of Trade and Industry (note Trade and Industry) entitled 'Modern Markets: Confident Consumers' focused almost exclusively on 'domestic consumers' and included various measures to deal with 'rogue traders' but nothing that I could identify as dealing with the scams on business purchasers that are described in this book. The White Paper aimed to 'benefit all consumers but the government will focus in particular on the needs of those with less developed consumer skills, those who are socially excluded and those on low incomes who can least afford to make a bad purchase.' I would translate this as 'if you run a small (or large) business and an unscrupulous person scams you out of a few hundred pounds then you are on your own and we are going to do little or nothing to deter them doing it again to somebody else.' This has been pretty much the case whichever political party has been in power.

This judgement may be a little harsh given that the White Paper also states that 'the government wants to know whether small business should be protected by current consumer law' - which would be a help. Also helpful would be the government plans for: 'a power for the courts to grant injunctions against specific practices carried out by specified traders; a power for the courts to ban from trading for a period of time those traders with a history of disregarding their legal obligations; a power for the Secretary of State for Trade and Industry to make orders by secondary legislation specifying that certain practices which have been shown to be harmful should be made illegal; the power to seek injunctions and banning orders will be made available to local authorities as well as the Office of Fair Trading.'

Currently, the same level of information and protection that is available to the domestic consumer is not available to people in business and the small businessperson in particular may not have the resources to research what is going on.

This book also concentrates on scarns perpetrated on purchasing people rather than those by purchasing people. It is not unknown for companies to set themselves up in business, acquire goods on credit then dispose of the goods rapidly before going out of business without ever paying the creditors. This is often referred to by the term 'long firm fraud' and can involve the fraudster in the acquisition of several businesses. The reason for acquiring a variety of businesses is that they can give each other references when these are requested by suppliers in order to extend credit. Alternatively, the crook may acquire an established but struggling business. Such a business will provide ready-made goodwill and references. Using this vehicle, the operator of the 'long firm fraud' obtains supplies (for resale, but which will not be paid for), company cars (to be stolen) and loans. You could sometimes obtain protection from this sort of fraud by using a good credit-reference agency, but these fraudsters will do their best to make sure that their business passes this test.

Telesales

A lot of the scams that are the subject of this book are driven by telesales, that is, sales over the telephone. Most telephone sales calls are made by legitimate businesses offering value-for-money goods or services. However, the rest include some highly dubious investment opportunities and the sort of misrepresented products and services described in some of the following chapters. For both the legitimate business and the scam merchant, everyone who has a phone is a prospect, whether or not you become a victim depends on your response to the calls.

However the telesales person got your name (and it is ridiculously easy), they can make the assumption that you are receptive to a bargain, you have sympathy for people in need and that (in all likelihood) you are greedy. The deal that you are offered by a scam merchant will seek to exploit one or more of these characteristics.

Scam merchants promoting their deals through telesales may well tell lies, they will charm, they will frighten, and if helpful to their cause they will bully and harass. Scam merchants are more likely than legitimate salespeople to switch into the hard-sell mode. However, they are usually very good at it. They get lots of practice and you get very little practice at fending them off.

You may be interested to know that it has been...