- 270 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Management Buy-Outs

About this book

This book, originally published in 1985, examines the practical effects of management buy-outs in terms of improvements in financial and managerial performance and sets them in their general theoretical context. It opens by considering buy-outs from the standpoint of economic analysis, entrepreneurship and the wider economic implications for industrial restructuring. It goes on to look at the effects of buy-outs in practice in a range of case studies developed by the authors. These consider the financial, economic and managerial impacts. Finally, it discusses the implications of management buy-outs for government policy and presents some general conclusions. This title will be of interest to students of business studies and management.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Management Buy-Outs by Michael Wright,John Coyne in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

The Buy-Out Phenomenon

I. Introduction

The management buy-out is without doubt a major part of the current industrial and commercial scene. It is a means of effecting a change of ownership from absentee shareholders, or a parent group, to those currently managing the enterprise, which has grown rapidly in popularity over the past six years. There is little doubt that there have always been instances where management have bought their own companies, but what makes the current growth of buy-outs significant is the extent to which those numbers have grown and continue to grow, the way in which venture capital suppliers are looking specifically to finance such deals, and the positive mood of encouragement which permeates all the way down from government. The name “management buy-out” is newer than the concept, indeed many of the early phase of managers had completed the deal only to be told some time later than they had conducted a buy-out. So, what are the specific characteristics which constitute a buy-out?

II. What is A Buy-Out?

For a buy-out to have taken place requires that some representatives of the management of the company, usually a small buy-out team, have negotiated to purchase the company from its current owners (including the receiver) and organised the finance to support the purchase. The transfer of ownership should be completed with the former owners having no substantial further ownership interest in the newly formed company. The management team, on average about four in number, are required to supply part of the purchase price from personal funds, and will usually have a substantial equity stake in the company. The management buy-out must be distinguished from other means by which a new independent company may arise from an existing entity and which tend to have some characteristics in common. A ‘leveraged’ buy-out, a term much used on the American scene, is where a company is bought-out using loan capital and is thus highly geared but it is not usually the existing management that makes the purchase. A ‘hive down’ is where a company may transfer selected assets to a new company which it then registers as an independent entity prior to sale, but again the management would not necessarily be purchasers when it is eventually sold. Finally, a ‘spin-off is where a new company is formed by employees, often using assets and experience already acquired whilst working for a parent company. A spin-off often takes only part of the personnel, and part of any assets whilst the company from which it is spun-off continues. Thus, though it may have some of the management it does not constitute the sale of a complete entity. Spin-offs have been particularly common in high technology areas, or where sub-contracting is a feature of the operation and the new company often trades quite heavily with the parent from which it emerged.(1) The specific details on how management buy-out transfers may be undertaken and the consequent financial arrangements are the subject of Chapter 2. The size, shape and involvement of the buy-out teams is discussed in Chapter 5.

The essential difference between the bought-out company before and after the transfer is the extent to which the ownership and all the motivational consequences which flow from it, have been put firmly together. Those managers at the head of the company, once they own a controlling or substantial equity interest in the company, have a great personal incentive to ensure that it succeeds; at best in order to enhance personal wealth, and at worst to safeguard their often substantial personal investment in the company. As Keith Meadows, managing director of DPCE, the first management buy-out to get a full listing on the Stock Exchange, has said of his company's success:

‘Without the buy-out we would not have achieved what we did because the motivation would not have been the same.’(2)

The act of buying-out releases management from previous constraints, and enables them to make decisions, and exercise financial judgements totally on their own. The decisions they make will be determined by the nature of their financing commitments, and their attitude to risk, but philosophically what is important is that they are arrangements which they have chosen.

Gordon Warrington, chairman and chief executive of Welco sums up the feeling when he says,

‘We would not have done as well without the buy-out. [Sales up 50%, large loss turned into large profit!] What we have now is the freedom to take decisions and take risks.’

That freedom to act is a recurrent theme throughout management buy-outs. The phenomenon has placed new emphasis on the role of the entrepreneur in industry, adding new credibility and new respect.

Thus, the management buy-out remarries ownership and control within industry, and encourages independent, entrepreneurial decision making. These issues are discussed in a wider context in Chapter 3.

The size of the buy-out team organising the purchase and taking equity stakes obviously varies depending upon the size of the company and the desires of those involved. In some instances the entire workforce has been invited to take part and under such circumstances the term employee buy-out is used. In the strictest sense a management buy-out, insofar as managers are a specific sub-group of employees, is a sub-set of employee buy-outs although the latter are more rare. The best known of the employee buy-outs is the National Freight Consortium which by its sheer size (23,000 employees, £53.5m price) attracted a great deal of popular attention. A similar, though generally unpublicised transfer took place when British Victaulic bought-out from British Steel, and issues arising from employee involvement in both cases are examined in Chapter 8, Case 7. It is unusual, even when offered the opportunity, for all the employees in a company to take an equity stake. For reasons no doubt directly related to personal wealth and a lack of experience of the financial world employees tend to be hesitant about committing themselves, and where they do so it is for modest sums. It is important to emphasise that in those instances where employees do subscribe it gives them no rights in law other than those of a conventional ordinary shareholder. It is not a passport giving them rights to participate in management, nor does it set them apart from other employees who may not have subscribed when it comes to the exercise of day-to-day workloads and the acceptance of authority. Management buy-outs with some employee involvement, and fully fledged employee buy-outs must in no way be confused with worker cooperatives. In a cooperative the principles of organisation, decision making, and the distribution of rewards follow a distinct pattern which is unlike the ‘conventional capitalist’ firm. The buy-outs are wholly within the conventional pattern of UK limited companies. The management buy-out should therefore be seen as an extra dimension in the evolution of a traditional industrial economy, strengthening the principles of enterprise on which it is based, rather than being a departure from it. That this form of evolution has developed in the late 1970s and continued apace during the economic recession is a function of the growth of buy-out opportunities, and the availability of finance during this period.

III. A Developing Marketplace

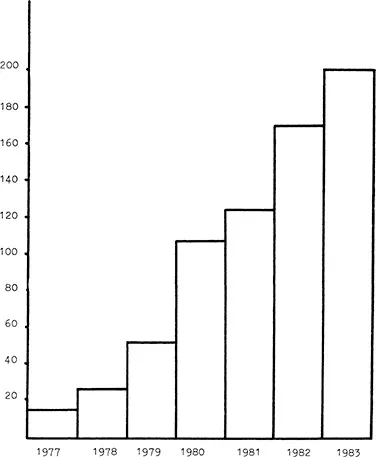

The growth in numbers of buy-outs is recorded in Figure 1.A. This has been compiled from the records of those financial institutions known to be financing deals, and has been cross-referenced through examination of press releases. In both respects there are possibilities for error. First, the number of bodies financing buy-outs has increased over time, so any trawl may not pick up all those providing finance. This problem is becoming more acute as the phenomenon receives wider publicity and attracts new providers of finance. The press release cross-reference can rectify some of these problems but there are sufficient circumstances under which no publicity is given to the deal for this to be an imperfect check. Nevertheless, the estimates are as precise as it is possible to make them for the period up to 1983. The difficulties are increasing over time, particularly as more ways are being found to finance the buy-out process with greater initiatives in recent times from commercial banks and the factoring companies. In addition, the creation of funds under the government's Business Expansion Scheme, and the development of the private Over The Counter Market, have both given added impetus and greater flexibility to the market.

Fig. 1.A The Growth of Management Buy-outs: Number of Buy-outs per Year

Source: Authors’ survey of the lending institutions and the Financial Times.

In total, the five year period 1979–1983 has seen 650–700 buy-outs, including the staff buy-outs and probably involves something of the order of £750–850m of assets changing hands (at current prices). A feature of the early buy-outs was the size of the discount on net assets which management were often able to negotiate which may be justified on the grounds that the management team itself represents an important part of the assets. For the West Midlands, for example, it has been estimated that the typical discount in an engineering buy-out was 45%. (3) The size of any discount will obviously vary considerably depending upon the relative bargaining strength of the parties. As this market has evolved, as the successes of the early buy-outs have been publicised, and as new financiers have entered the market the size of discounts have tended to be eroded by the operation of conventional market forces. There is also a belief that many of the ‘best’ deals, where the management could extract the most favourable discounts, have been identified and completed so that increasingly the new deals have to be bid away from the current owners. Nevertheless, there is little indication that the number of buy-outs is beginning to fall yet. There is still a growing awareness of the opportunities and advantages which buy-outs can offer, not only to the managers for whom it represents the chance to own their own busines, but also to the boards of groups of companies which may see the buy-out route as an extra option in their own strategies for reshaping their business. For any buy-out to take place a desire and opportunity to buy has to be matched by a desire to sell, and these issues are discussed in Chapter 2, Sections II and III, and Chapter 3, Section V.

In the normal course of business development the processes of acquisition and diversification, and the equally important divestment and disintegration, will produce a fluidity in the economy which we would expect to continue to generate buy-out opportunities. There is no limit to the number of deals that could be done in sight yet, especially when one considers that if 1000 deals have been done it only represents a tiny fraction of the total stock of companies. The buy-out is not simply a phenomenon of the recession which has brought it to prominence. It is the result of a complex of forces which have been working their way through industry - the need for efficiency, the frustration of entrepreneurship, changes in company law, a favourable climate of encouragement from government, and developments in the venture capital market - which have all contributed to the emergence of the phenomenon and caused it to evolve.

The complexity and diversity of the buy-out marketplace is one of its most significant features and it has become increasingly varied over time. It is therefore unlikely that any two buy-outs will be the same in terms of size, financing arrangements, reasons for sale etc. The market has displayed great versatility in accommodating a wide variety of circumstances, and some of these arrangements are outlined in Chapter 2, Sections V and VI.

One aspect of the market's diversity and evolution can be seen in the growth of financing institutions. The traditional lender, and market leader has been the Industrial and Commercial Finance Corporation (ICFC) the subsidiary of Investors in Industry (3i) responsible for lending to small companies. In the late 1970s they pioneered the management buy-out as part of their portfolio of lending to smaller companies and were encouraged to develop the market by the relative success of their early lending where failure rates were substantially lower than in equivalent lending to entirely new start-ups. As deals were proposed that fell outside the funding levels which they could handle they became involved increasingly in syndicated deals and many of their co-lenders became significant contributors in their own right, each trying to find for itself a specialist and attractive niche in the market. In 1982 and 1983 ICFC were involved in approximately 40–50% of all deals but have been joined by a host of other major lenders notably County Bank and Midland Equity, with Barclays Development Capital and Citicorp looking for the larger end of the market. The entry of new lenders, not usually involved in venture capital provision, such as commercial banks, local authorities, and pension funds are almost daily adding variety and new dimensions to the market.

Complexity is added with respect to the type of company and market in which a buy-out may take place. There is virtually no sector of British industry, private or public, where a buy-out could not take place. As is demonstrated by the breadth of industrial coverage of the firms in this study most parts of industry, whether expanding or declining, whether making a product or providing a service, may provide appropriate conditions. The general characteristics of the buy-outs which comprise this study and which are considered to be a reasonably representative cross section of the entire market are discussed in detail in Chapter 4. Though the general focus of this study is the private sector, and whilst the most highly represented sector is manufacturing, there is every reason to regard the management buy-out as an important option within the general framework of privatisation favoured by the present government. Buy-out teams have attempted to buy part of the hotels group from British Rail, and were active in the sale of Sealink. There are many parts of British nationalised industries which might lend themselves to either a management buy-out or an employee buy-out.(4)

IV. The Issues

The study of management buy-outs provides an almost unique opportunity to examine some important issues in the performance of companies and the economy. These issues are both general, for example the role of buy-outs in the process of change in an economy-, and specific,...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Contents

- List of Tables

- List of Figures

- Preface/Acknowledgements

- 1. The Buy-Out Phenomenon

- 2. Practical Aspects of Management Buy-Outs

- 3. Economic Aspects of Management Buy-Outs

- 4. General Characteristics of Management Buy-Outs

- 5. Managerial Aspects of Management Buy-Outs

- 6. Industrial Relations and The Buy-Out

- 7. Performance in Management Buy-Outs

- 8. Case Studies

- 9. Concluding Remarks

- Index