The Business of Mining

The Mining Business, Uncertainty, Project Variables and Risk, Royalty Agreements, Pricing and Contract Systems, and Accounting for the Extractive Industry

- 68 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Business of Mining

The Mining Business, Uncertainty, Project Variables and Risk, Royalty Agreements, Pricing and Contract Systems, and Accounting for the Extractive Industry

About this book

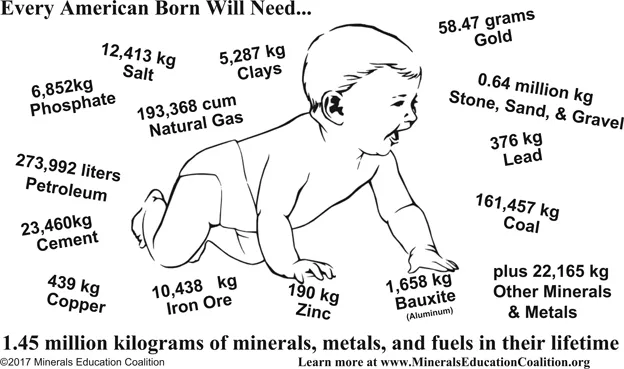

The Business of Mining complete set of three Focus books will provide readers with a holistic all-embracing appraisal of the analytical tools available for assessing the economic viability of prospective mines. Each volume has a discrete focus. This first volume presents an overview of the mining business, followed by an analysis of project variables and risk, an overall coverage of the royalty agreements, pricing and contract systems followed by a final chapter on accounting standards and practises for the minerals industry.

The books were written primarily for undergraduate applied geologists, mining engineers and extractive metallurgists and those pursuing course-based postgraduate programs in mineral economics. However, the complete series will also be an extremely useful reference text for practicing mining professionals as well as for consultant geologists, mining engineers or primary metallurgists.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

1

Overview of the mining business

- Stone Age – pre 4000 BC

- Bronze Age – 4000 BC to 1500 BC

- Iron Age – 1500 BC to about 1800 AD

- Steel Age – 1800 to about 1945

- Nuclear Age – post 1945.

Extractive industries

- Coal mining

- Oil and gas production

- Metalliferous mining

- Industrial minerals.

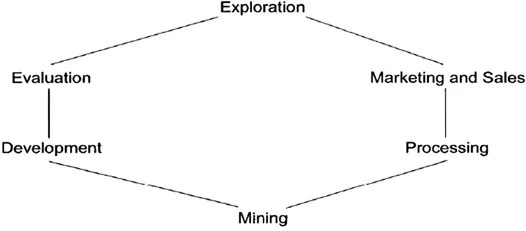

- Literature review – This involves reviewing published data available from, say, the country’s geological survey or equivalent and any data from previous exploration activity.

- Prospecting – This is the first stage of exploration and generally involves considerable hard work by geologists (‘foot slogging’ frequently).

- Exploration – Once a target location has been identified, the exploration of it to establish its viability is undertaken, keeping costs as low as possible in case it proves uneconomic. Prospecting and exploration are the domains of geologists and geophysicists.

- Development – Development involves the construction of the mine site including access, provision of services, any processing facility, the mine access and future waste handling/disposal systems.

- Exploitation – This involves the production of the saleable product from the mine. Development and exploitation are the domain of the mining engineer and metallurgist.

- Reclamation/rehabilitation – This needs to be detailed and future funding generally obtained before development can start and is a key part of the permitting process as is the environmental impact study with its protections.

Exploration

- The likely future demand for the commodity, factoring in such unknowns as future disruptive technology trends and the possible use and/or development of alternative materials.

- The likely future supply of the commodity as existing producers may cost-effectively expand production or potential new producers may bring economically more attractive production onto the market.

- The local availability and cost of labour and services.

- The likely future trends in royalties and taxes, as well as requirements around local equity participation.

- The political and social stability.

- Sovereign risk

- The exploration potential of the area

- The likely costs of exploration and any subsequent mine development

- Access to the product market.

- Legislation governing exploration and mining activities.

- Policies governing corporate taxation and mineral royalties.

- Legislation governing equity participation by either one or both of local and government bodies.

- Regulations governing the funding of foreign owned business ventures.

- Ability to repatriate capital through dividends or other means unimpeded and without penalty.

Project risks

| Risk | Activity | Source of Finance |

| | ||

| Very High | Exploration | Seed Capital |

| Very High | Scoping Study | Venture Capital |

| High | Pre-Feasibility Study | Venture Capital |

| High | Feasibility Study | Venture and/or Equity Capital |

| Moderate | Mine Development | Equity and/or Project Loan |

| Normal | Mine Production | Cashflows or Short-Term Loans |

Project financing

- Gauge the market’s economic attractiveness of the commodity being considered.

- Examine all possible project alternatives.

- Identify those aspects of the project that are critical to its feasibility.

- Explore whether the project proposal would be attractive to a particular investor or investor group in order to meet the expense of carrying out a detailed feasibility study.

- Conceptual design costs to ±30%

- Pre-feasibility costs to ±20%

- Feasibility costs to ±10%.

- Existing cashflows (if the company has other operations)

- Equity finance, including convertible loans

- Debt finance

- Commodity loans.

Table of contents

- Cover

- Half Title

- Series Page

- Title

- Copyright

- Contents

- Foreword by the vice-chancellor of Curtin University

- Foreword by the editor

- About the authors

- 1 Overview of the mining business

- 2 Uncertainty, project variables and risk

- 3 Royalty pricing, agreements and contract systems in mining

- 4 Accounting for the extractive industry