eBook - ePub

Introduction to the Accounting Process

- 152 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Introduction to the Accounting Process

About this book

Introduction to the Accounting Process brings clarity to to the process of setting up an accounting system, including a basic explanation of how to enter numbers into the system manually. The clear structure of the book provides students with good insight into the basics of accounting.

The book consists of four parts:

- designing an accounting system

- special entries and frequently occurring themes such as VAT, clearing of invoices and discounts

- international aspects of accounting, including ratio analysis

- an integrated case enabling students to show their knowledge in practice

The simple structure and concise nature of the book, combined with a useful companion website, will help students to improve on any deficiencies in the subject.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

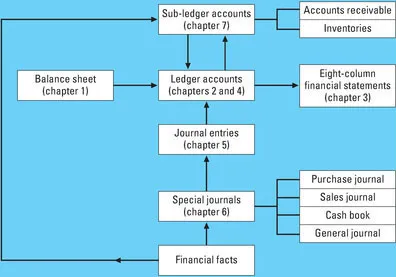

Part I The accounting system

A balance sheet shows assets and liabilities. Each firm prepares a balance sheet once a year to show stakeholders the firm’s financial position. After the balance sheet has been prepared, subsequent financial facts will mean it has to be changed.

This part of the book will show how financial facts will be recorded in order to prepare a new balance sheet at the end of the year. This balance sheet will then show the starting position for the following accounting year.

The following chapters are included in this part:

- 1 Balance sheet

- 2 Ledger accounts

- 3 Eight-column financial statements

- 4 Closing the ledger accounts

- 5 Journal entries

- 6 Special journals

- 7 Sub-ledger accounts

1

Balance sheet

Balance sheet

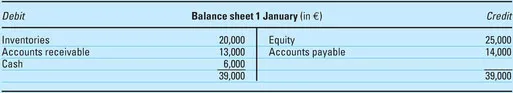

Each accounting process starts with a balance sheet.

A balance sheet shows assets and liabilities at a certain moment. The real values of these assets and liabilities can be determined by listing what the firm possesses.

Assets

Liabilities

Credit side

Assets are mentioned on the debit side of the balance sheet (left), liabilities or debt on the credit side (right).

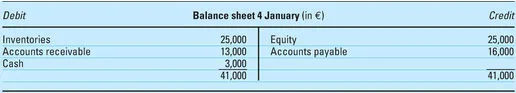

Figure 1.1

Additional information:

Accounts receivable

Accounts receivable are customers who purchased goods on account; the number on the balance sheet shows the total receivable from these customers.

Accounts payable

Accounts payable are suppliers from whom the firm purchased goods on account; the amount shows the total payable to these suppliers.

Equity

Equity: this is a special sort of liability; it is the amount the owner of the firm would receive if the company were to be liquidated. Assets will then be sold, debt will be paid and the remainder is for the owner. If the real values of assets and liabilities equal the amounts on the balance sheet, the remainder equals equity. However, it is not a debt in the real sense of the word. If the firm’s administration is separate from the owner’s private administration, then it is easy to consider equity as the firm’s debt to the owner. (This is known as the ‘business theory’.) A balance sheet needs to balance, which means the debit total needs to equal the credit total.

A balance sheet shows the firm’s financial position at one moment. Each time something happens that may influence one or more items on the balance sheet, a new balance sheet will develop. The effect of financial facts on the balance sheet is as follows:

Figure 1.2

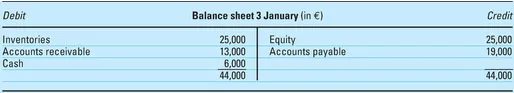

Example 1.1

| 3 January | Purchased on account products with a value of €5,000. |

The ‘inventories’ account will increase by €5,000 and the ‘accounts payable’ account by €5,000 as well. The new balance sheet is as follows:

Figure 1.3

Both debit and credit sides increase by €5,000; the balance sheet stays in balance.

Example 1.2

| 4 January | Paid cash to a supplier: €3,000. |

The ‘cash’ account will decrease by €3,000 and the ‘accounts payable’ account will decrease by €3,000 as well.

Figure 1.4

The equilibrium remains here as well: both sides of the balance sheet decrease by the same amount.

Example 1.3

| 5 January | Sold products on account for €6,000. These products had a purchase price of €4,000. |

The ‘accounts receivable’ account will increase by €6,000; the ‘inventories’ account will decrease by €4,000. The difference between the sales price and the purchase price is the gross profit.

The owner is entitled to receive this gross profit; the company’s ‘debt’ ...

Table of contents

- Cover

- Half Title

- Title

- Copyright

- Table of contents

- Introduction

- Part I The accounting system

- Part II Special entries

- Part III International aspects of accounting

- Part IV

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Introduction to the Accounting Process by C.A.M. Klerks-van de Nouland,H.J.M van Sten-van 't Hoff,A. Tressel in PDF and/or ePUB format, as well as other popular books in Business & Accounting. We have over one million books available in our catalogue for you to explore.