Major participant categories and their functions

There are 10 entertainment industry participant categories, each with its fundamentally crucial and independent functions, each reliant on the others for their survival and all with whom producers have relationships. The most prosperous companies in each category are successful, in large measure, because they sustain a perspective of how the whole industry operates, continually sharpen their individual participation, some of them stabilizing their positions by successfully operating in more than one area.

This perspective includes the view that (1) the entertainment industry is a consumer-product business, (2) each participant contributes to and relies on other participants, and (3) audiences, in their various target definitions, are each project’s most important participants.

In their order of importance, here are the 10 categories of participants:

- Audiences

- Distributors

- Independent Producers

- Retailers and Licensed Media

- International Territories

- Financing Participants

- Distributor Subcontractors

- Production Talent and Subcontractors

- Ancillary Media and Licensees

- Major Consumer Brands

Participant category 1: audiences

Audiences are the highest priority participant category because they provide the income. Without them, there is no industry.

After discovering a story they want to tell, it is highly beneficial for producers to ask two audience questions:

- By order of dominance, who are this project’s unique target audiences? The answer to this question enables a producer to discover the size, entertainment consumption, and media-use profile of each of the project’s target audiences—in the project’s primary global release territory and in each of the project’s other major territories. Together, these are each project’s audience universe. Knowing the sheer size of this audience, their branding triggers, consumption profiles, and lifestyles become core elements used in branding the project, engaging its audiences, planning and forecasting the project’s development, production, and earnings.

- How have these audiences responded to at least five projects released in the prior five years that are most similar to the project being considered? The composite of these becomes this project’s comparable or antecedent model. These projects should be chosen because they are most like (in order of importance) the subject project’s emotional drivers in its anticipated advertising and marketing campaign, as well as its above-the-line talent (director and lead cast), story, and genre. The discovery of these comparable projects provides producers crucial understanding in the branding of the subject project and enables them to most accurately project its gross receipts, the producer’s share of gross receipts, release strategies, brand partners that should be considered, and other valuable information.

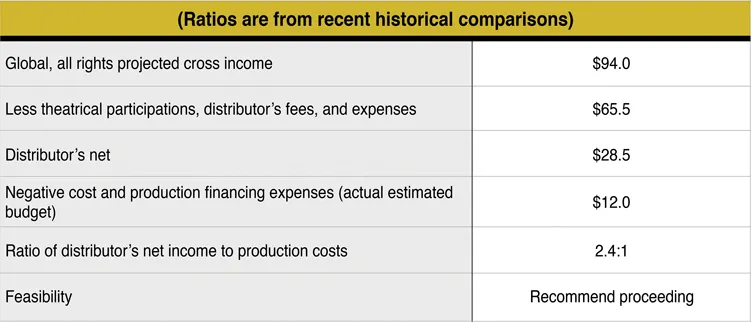

Internal Greenlight Analysis

The answers to these two questions provide a project’s income and distribution cost prospective that, when combined with the project’s estimated production costs, allow producers to determine whether this project has a sufficiently high success probability to proceed with its development. This is a producer’s internal greenlight process.

Producers determine the earnings-to-cost ratio that each of their projects must meet or exceed to be greenlit. It is common among seasoned successful producers to use a two-to-one earnings-to-cost ratio.

For instance, if a project’s audience profiles and project comparables point to earnings high enough to be twice the project’s projected all-in production cost (its earnings-to-cost ratio is two-to-one), this producer would continue with development. If a project’s target audiences lack dynamic consumption profiles or are too small or difficult to reach in comparison to the project’s costs, the producer should pass rather than proceed. The project should only be kept if earnings potentials can be increased, production costs diminished or enough of each to render it feasible.

To be consistently profitable/successful, producers must be as committed to their business criteria as they are to their creative. Both must be satisfied.

The specific methods of obtaining and analyzing this information and a complete explanation of obtaining a project’s internal greenlight are presented in later chapters, especially Chapters 2 and 14. The following diagram demonstrates the fundamental economics of this process.

Figure 1.1 The Project’s Internal Greenlight Analysis (in millions)

Audience Orientation

Producers find it beneficial to understand and use the terms, reports, and culture employed by global advertising agencies and reporting entities in their unique territories, such as Nielsen Media Research, TV By The Numbers, Ad Age, and MPAA in the U.S. Being well exercised in this culture is essential to understanding their reports and is especially beneficial in a producer’s relationships with global distributors, product placement and premium tie-in brand representatives, advertising agencies, public relations and promotion companies.

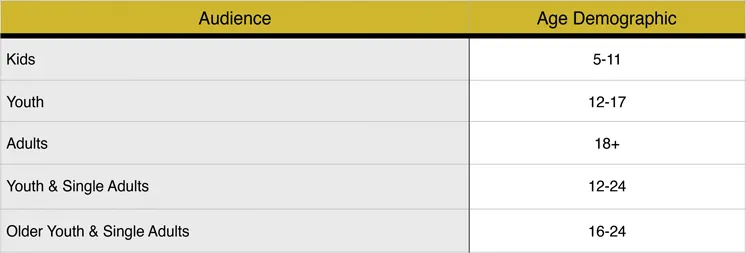

Audiences in most global territories are categorized demographically by age as follows: kids 5 to 11, youth 12 to 17, and adults 18 to 24, 18 to 34, 25 to 34, 25 to 44, 25 to 54, 45-plus, and 55-plus. Audiences are also identified and evaluated by lifestyles, such as active adults, affluent adults, educated adults, inner-city youth, working women, and so on.

Excellent, easy-to-use audience research analysis tools and databases in the largest global territories (such as Arbitron and Nielsen in the United States; see Chapter 16 for information sources) are available to producers at reasonable costs or are accessible through major advertising agencies and media planning and buying companies. These online audience research tools allow target audiences to be searched, sorted, and identified by an extensive array of demographic and lifestyle search criteria. The lifestyle options are broad, the data are reliable, and the reports are exceptionally useful for audience quantifying and qualifying.

For example, you can sort a given territory’s major metros by women 18 to 34 who are college graduates, watch streamed media at least three hours per week, download music at least once a week, and comment on social media at least three times a week. The requested report can reveal how many are in this audience universe, where their population concentrations are, what are their consumption profiles for the various media, which programs they watch at least once a week, and so on.

Becoming conversant with this information and the sources from which it is derived can be highly beneficial, as the application of this information becomes a powerful tool for producers who will be reviewing and/or originating prospective release strategies, early stage marketing campaigns, media buys, and projecting projects’ earnings.

Figure 1.2 Primary Audience Age Demographic Categories

Distributor-Pitch Preparation

Each distributor relies on its own data, exclusive and open market sources of information, evaluation processes, and experience to determine which projects they will release and how they will do so. Also, though most of the projects they release come from independent producers, these are chiefly from production entities with whom they have long-standing, multi-project relationships and are equity partners in addition to being their distributors for certain global territories and media. Further, they are used to most of the other independent producers who approach them to be capable in pitching the creative tenets of their projects, but being unfamiliar with the mind-bending sophistication of branding and releasing projects in the world’s global territories.

It is important for producers to understand that for projects distributors are interested in, they will perform their own well-honed market analysis. However, they will be both intrigued by and extend a possibly broader, more valuable relationship to producers who can point to their projects’ target audiences, comparable projects, and potential branding partners and strategies.

Pitching projects to distributors, after having first fulfilled their internal greenlights, empowers producers to present the fundamental core information essential for distribution executives to evaluate their interest. This information includes the project’s audiences, recently released comparable projects, and estimated gross receipts in the distributor’s territory. Producers armed with this information are in the strongest position possible to both present and negotiate from the distributors’ perspectives.

Chapter 2 reviews ways to present this information appropriately to receive optimal positive distributor responses.

Participant category 2: distributors

Just as audiences are each project’s primary business consideration, so are distributors each project’s second most important participant, as they are the project’s connection to its audiences.

Each project’s major distributors, marketing and sales companies in its global territories, establish its brand presence to its respective target audiences and to the various media through whom they distribute.

In the United States, the major distributors are 20th Century Fox, NBCUniversal, Disney, Paramount, Sony, Warner Bros., and Lionsgate. Each of these is a full-service studio in the traditional definition, except for Lionsgate, which only lacks a studio lot. These seven majors are global all-rights distributors, able to distribute worldwide to every theatrical, nontheatrical, and ancillary market. And they are the prominent U.S. theatrical, streaming, and home entertainment distributors for major U.S. independent producers.

In addition to the major studios are the following distribution outlets:

1. Independent theatrical distributors.

There are several strong independent theatrical distributors, three of which are owned by major distributors (Sony Pictures Classics, Fox Searchlight, and Focus Features). One of the largest and best-operated of the independents is STX Entertainment. The largest of these are all-rights distributors. A group of new or repositioned veteran distributors are now filling the shoes left by studio divisions chiefly concentrating on wide releases. These include Roadside Attractions, IFC, Magnolia Pictures, the Samuel Goldwyn Company, A24, The Weinstein Company, The Orchard, and Bleecker Street who are especially adept at releasing niche/special-handling titles.

2. Direct international territory distributors.

The largest of these are studios within their respective international territories, which produce and direct-distribute to all the major media in their territories and who also sell their projects’ rights globally. These distributors are presented in Chapter 3.

3. International Sales Agents (ISA).

The largest of these organizations finance and co-produce some of their own projects, in addition to acquiring projects and licensing international rights and distribution services for their independent producers’ projects. These include FilmNation, IM Global, Myriad Pictures, Voltage Pictures, and Highland Film Group.

4. Producers’ representative organizations.

These organizations plan and execute sales to ISAs or distributors in international territories, and they may also plan and engage all U.S. rights sales of their independent producer clients’ projects. Among these are the major agencies including CAA, ICM, WME, and companies such as Cinetic Media and Gillen Group.

5. Television syndication companies.

These companies plan and carry out sales to television stations, cable television networks, and the cable and satellite television systems. Major U.S. television syndication companies, most of whom also do international television syndication, include Warner Bros. Television (WBTV), 20th Television (20TV), ABC Syndication, CBS Television Distribution, Sony Pictures Television, and Lionsgate Home Entertainment.

6. Publishers.

These entities are discussed in more detail in Chapter 5 and primarily include book publishers who are either republishing novels associated with projects being released or publishing new novels based on original screenplays; graphic novels, comic book, coloring book, and workbook publishers who create and release books coordinated with project releases; and paper-based role-playing and other game publishers who create and distribute their respective products timed with project releases.

7. Ancillary rights sales companies.

These organizations, examined in Chapter 5, include companies specializing in merchandising, in-flight, scholastic, ships-at-sea, and other sales and marketing.