eBook - ePub

Market Opportunity Analysis

Text and Cases

- 280 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Market Opportunity Analysis

Text and Cases

About this book

The key to success in business is planning. And the key to successful planning is using a proven format to analyze your product's marketability

Market Opportunity Analysis: Text and Cases guides you step-by-step through the complicated process of determining the feasibility of marketing a new product or service. As financial market

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Introduction to Assessing

Business Opportunities

Chapter 1

Assessing Business Opportunities: An Overview

The Importance of Opportunity Analysis

The twenty-first century has ushered in an era of business that is perhaps one of the most challenging in history. Markets for many products have weakened; major firms face some of their most critical financial crises; international competition for major product categories is at an all-time high; and financial markets are in an upheaval due to interest rate changes, uncertainty over future rates, and shifting government policies on tax decreases, increases, and deficit spending. These are only some of the most obvious environmental factors business managers must cope with.

Although these changes have wreaked havoc in many industries, they have also caused many managers to reevaluate the basis of success in their own industries, and in business in general. Many realized that the key to success is planning—not just on a short-term basis, but on a time scale that is long-run or strategic in orientation.

This book concentrates on opportunity analysis, which is an intricate part of the strategic planning process. It covers not only how opportunity analysis relates to strategic planning, but also presents the techniques that can be used to carry out opportunity analysis. Thus, it is oriented toward building analytical skills for an individual manager by describing what should be done and how to do it.

Factors Influencing Feasibility Analysis

The strategic alternatives of an enterprise are influenced by a number of factors. The factors are of three types: external, financial, and internal. External factors include market size, competition, technology, inflation and the economy, government regulations, political conditions, social change, and nature.

External Considerations

Market size. The size and makeup of markets for goods and services influence the nature of the opportunities an organization faces. The growth and longevity of markets influence not only whether opportunities will be pursued but also the level of commitment a firm will make to pursue an opportunity.

Competition. Some companies and some markets focus corporate strategy and strategic planning around the behavior or anticipated behavior of their competitors.

Technology. Major technological advances create opportunities for companies prepared to capitalize on them. The computer chip, electronic transistor, and synthetic fibers have all led to minor revolutions in their respective markets.

Inflation and the economy. After several decades of stable prices, inflation became a definite factor for planners in the 1970s. The basic economic conditions of a nation will determine the range of opportunities available to organizations. Conditions such as inflation, money supply, interest rates, and cash flow problems are part of the economic circumstances that confront firms today and require appropriate strategic planning. Even the largest and most powerful corporations encounter problems.

Government regulations. The role of government has increased in the regulation of economic life in all major industrial nations. It influences many phases of marketing, including distribution, advertising, price policy, product design, and consumer use. Although government regulations present both restraints and opportunities, their side effects have often been higher costs. Pollution control devices, reporting requirements, tax policy (windfall tax), safety policy, and other government controls and regulations have added costs to the industry and the consumer. Evaluation of past and proposed legislation is an essential part of strategic planning for all organizations.

Political conditions. The introduction of political risk should be an essential part of any organization’s strategic planning. The oil crisis of 1974 and general political instability have altered the state of the art of planning within many companies depending upon unstable supplies of raw materials. A part of the international business environment that is unavoidable today is the potential uncertainty of political events. The overthrow of Saddam Hussein in Iraq; the continuing conflict in Northern Ireland; some fifteen to twenty wars, border clashes, and guerilla conflicts in Africa; and many other problems in various parts of the world have increased anxiety regarding the role of political risk in overseas investment. Strategic planners frequently use the word “turbulent” to describe the environment within which today’s multinational companies must operate.

Social change. Social change presents opportunities as well as hazards to business enterprises. These influences change rather slowly over time; however, they can ultimately have a severe impact on the economic viability of a company. Social change can have a radical impact on the behavior of important groups of consumers. For example, technological innovation must be assimilated by the consumer in order to become economically viable. Although the technology is available for a checkless economic environment, society has not completely embraced it. Major research efforts are constantly tracking social changes and attempting to evaluate their impact on business. Since many important social changes move at a slow pace, businesses often fail to identify the significance of the change to their activities until it is too late to mitigate the damage or capitalize on the opportunity.

Nature. Droughts, floods, blizzards, earthquakes, hurricanes, and other natural events can all have important impact on business. In many cases, the capricious acts of nature are unpredictable but they represent environmental factors that require proper scenario planning.

Financial Considerations

Financial considerations reflect the financial impact of alternatives in terms of revenue estimates, cost estimates, and return on investment (ROI). They must reflect both the size of the investment needed to effectively compete in a market and the potential returns associated with that investment.

Revenue estimates. Revenue estimates provide the essential data needed to assess the impact of market entry by a new competitor. If a firm is considering entering an existing market it must assess its chances of attaining a given market share and thus a specific stream of revenues. The estimate of sales revenues along with cost estimates provide the essential data for pro forma analysis of an opportunity.

Cost estimates. Cost estimates reflect the level of costs that will be associated with the revenues generated by a proposed venture. All costs should be estimated to accurately reflect the income or cash flows that will be produced by an opportunity.

Return on investment (ROI). Given the estimates of future revenues and costs, the next step in financial analysis is the analysis of return on investment. Two concerns are present here: (1) the level of investment needed to compete effectively, and (2) the profitability potentials available given the investment level. In other words, “How much money will it take to pursue an alternative?” and “What type of earning can be produced?”

Internal Considerations

Internal considerations include: (1) purpose, (2) corporate objectives, and (3) resources.

Purpose. A statement of purpose or mission is management’s expression of the nature of the organization. It answers the following questions: “What kind of organization are we?” and “What kind of organization do we want to be?” The definition of purpose or mission becomes the guiding force in strategic decisions because what we do should be a function of what we are.

Corporate objectives. A mission statement proposes to answer the question of what we are, and corporate objectives answer the question: “What do we want to accomplish?” Objectives become the specific ways a firm accomplished its organizational mission. These objectives also become the standard by which organizational effectiveness is judged. Effectiveness is measured by the firm’s success in accomplishing its stated objectives.

Resources. The resources of an organization are the enabling factors that allow a firm to accomplish objectives. Resources are composed of the people, money, machinery, facilities, etc. a company either possesses or has the ability to acquire. Its people base and material asset base represent an organization’s capabilities for pursuing opportunities.

Thus, external factors define the nature of the opportunity, the financial considerations tell us the financial impact of the opportunity, and the internal factors determine whether a firm should pursue an opportunity (mission and objectives) and whether it is capable (resources) of pursuing an opportunity.

What is Opportunity Analysis?

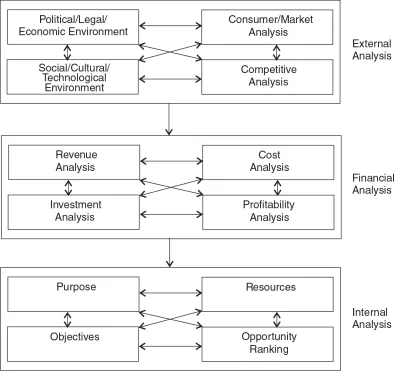

Opportunity analysis is the process of defining the exact nature of the opportunities available in an organization’s operating environment in terms of external, financial, and internal considerations. Figure 1.1 presents an overview of this process in terms of the steps involved in the analysis.

Figure 1.1. The opportunity assessment process.

As this diagram depicts, opportunity analysis is a comprehensive analysis of all aspects of an alternative before decisions are made to pursue it. The results of such an analysis put the decision maker in a position of having a strong data base from which to choose among the various alternatives present in the environment in line with financial and internal considerations that are specified by management.

The analysis begins with a detailed study of the environment in which the proposed business would operate. This includes not only the legal, political, economic, social, cultural, and technological environment but also market size, growth trends, and consumers’ attitudes and behavior. It also involves a study of current and potential competitors who may be going after the same customers you propose to attract. These factors are external to the organization or person contemplating the new venture and therefore a great deal of diligence is required for a thorough analysis of these factors. This usually involves a substantial commitment of time and money to collect the information used in the analysis.

If this analysis indicates that these factors are favorable to the potential business, then an analysis of the financial implications of the opportunity should be undertaken. The financial analysis is the key to determining the potential profitability of the business and the expected ROI. The results of this analysis provide the information which can be used to attract investors and/or lenders who may be approached to obtain capital for the venture.

The final area of analysis involves a study of internal factors which affect the decision to pursue a given opportunity. The organization’s or individual’s purpose, objectives, and resources must be analyzed in relation to the proposed opportunity. An opportunity, even a potentially profitable one, may not “fit” with the purpose, the objectives, or the resources of the organization. Such opportunities are forgone for others that do “fit.”

As Figure 1.1 emphasizes, a thorough study of the opportunity is completed before a decision is made to pursue it. Rushing into a decision without the type of analysis described in this book greatly magnifies increases the chances of failure. Although failures cannot be completely eliminated because of unforeseen circumstances, the chance of success can be greatly enhanced by thoroughly assessing the opportunities before commitments are made. A 1990 article dealing with factors that lead to failure listed “guessing instead of digging” as the number one way to scuttle a new business.1

Plan of the Book

Part I presents the foundation for opportunity analysis, which is strategic planning. Chapters 1 and 2 provide the framework from which opportunity analysis can be viewed as an integral part of the strategic management process.

Part II contains two chapters that deal with externa...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright

- Contents

- Preface

- Part I: Introduction to Assessing Business Opportunities

- Part II: External Analysis

- Part III: Financial Analysis

- Part IV: Internal Analysis

- Cases

- Case 1. Watercrest Park

- Case 2. Superior Electrical Contractors: Residential Services Division

- Case 3. Gateway Medical Waste Transport of Colorado

- Case 4. National Foundations, Inc.

- Case 5. Mildred’s Caddy

- Case 6. Jay’s Travel Trailer Park

- Case 7. The Box Factory, Inc.

- Case 8. Central Bank: Automatic Teller Machines

- Case 9. Jill’s House of Cakes

- Case 10. Sound Communications, Inc.

- Appendix A. Secondary Data Sources for Assessing Market Opportunities

- Appendix B. Sample Market Opportunity Analysis Report

- Notes

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Market Opportunity Analysis by Robert E Stevens,David L Loudon,Philip K Sherwood,John Paul Dunn in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.