![]()

Chapter 1

The Healthcare Industry: Challenges and Opportunities

National health expenditure growth is expected to average 5.6 percent annually from 2016 to 2025, according to a report published by Health Affairs and authored by the Centers for Medicare & Medicaid Services’ (CMS) Office of the Actuary (OACT). These projections do not assume potential legislative changes over the projection period. What continues to be shocking to most healthcare observers is the fact that, despite the growth rate, there is no evidence that the overall patient experience has improved. The report also projects the healthcare share of gross domestic product (GDP) to rise from 17.8 percent in 2015 to 19.9 percent by 2025. According to the report, for 2016, total health spending was projected to have reached nearly $3.4 trillion, a 4.8 percent increase from 2015. The report also found that, by 2025, federal, state, and local governments are projected to finance 47 percent of national health spending, a slight increase from 46 percent in 2015. The challenges and opportunities facing the healthcare industry include the following:

Healthcare Cost and Sustainability

The calls for reform grow increasingly louder as the global healthcare sector continues to be besieged by unprecedented change. Providers, payers, governments, and other stakeholders experiment with various business and operating models in efforts to deliver effective, efficient, and equitable care. These responses are fueled by many factors, including aging and growing populations; the proliferation of chronic diseases; an increasing focus on patient experience, quality of care, and value; informed and empowered consumers; and innovative treatments and technologies—all of which are leading to rising costs and an increase in spending for care delivery. In addition, the trend toward universal healthcare is likely to accelerate growth in numerous markets. However, the pressure to reduce costs, increase efficiency and effectiveness, and demonstrate value will continue to mount.

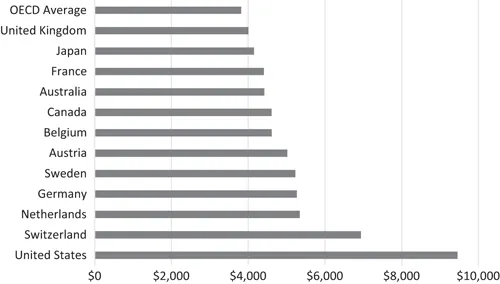

On average, other wealthy countries spend about half as much per person on health than the United States spends. As would be expected, wealthy countries like the United States tend to spend more per person on healthcare and related expenses than lower-income countries. However, even as a high-income country, the United States spends more per person on health than comparable countries. Health spending per person in the United States was $9,451 in 2015—2022 percent higher than Switzerland, the next highest per capita spender (Sawyer and Cox, 2017). While the United States has much higher total spending as a share of its economy, its public expenditures alone are in line with other countries. In 2015, the United States spent about 8.4 percent of its GDP on health out of public funds—essentially equivalent to the average of other comparable countries. However, private spending in the United States is much higher than any comparable country: 8.6 percent of the U.S.’s GDP, compared to 2.4 percent on average for other nations (Figure 1.1). According to the Centers for Medicare & Medicaid Services, U.S. healthcare spending grew 4.3 percent in 2016, reaching $3.3 trillion or $10,348 per person. As a share of the nation’s GDP, health spending accounted for 17.9 percent.

Figure 1.1 Total health expenditures per capita, U.S. dollars, PPP adjusted, 2015.

The expenditure for Australia was estimated.*

Because health spending is closely associated with a country’s wealth, Figure 1.1 compares the United States to similar OECD countries—those that have above-median national incomes (as measured by GDP) and above-median income per person. The average amount spent on health per person in comparable countries ($4,908) is just over half that of the United States ($9,451). The average per capita health expense in the OECD overall (including smaller and lower-income countries) is significantly lower at $3,814 per person, or 40 percent of that spent in the United States.

The Aging Population in the United States

The two main variables shaping the healthcare landscape in the next few decades are the age structure of the overall population and the composition of the older population (age, gender, race, and ethnicity). The change in these characteristics over the next three to four decades will dramatically shape the healthcare landscape. Between 2010 and 2050, the United States is projected to experience rapid growth in its older population. In 2050, the number of Americans aged 65 and older is projected to be 88.5 million, more than double its projected population of 40.2 million in 2010. The Baby Boomers are largely responsible for this increase in the older population, as they began crossing into this category in 2011 (Vincent and Velko, 2010).

As the U.S. population ages, the older demographic’s racial and ethnic makeup is also expected to change. Many experts expect an increase in the proportion of the older population that is Hispanic and an increase in the proportion that is a race other than White. As 2050 approaches, it is believed that the oldest age categories will grow concerning numbers and proportions. This changing age structure will significantly affect families, patient-provider encounters, patient experiences, and society as a whole. Here are some of the ways the patient experience might be affected:

■ Younger physicians (providers) would have to rethink how best to interact with an older population. The amount of time allowed per patient may also need to be reexamined. The norm of 15 minutes per follow-up patient and 30–45 minutes per new patient may no longer work. Today, it might take as much as three to five minutes for an elderly patient to make his/her way into a doctor’s office and get settled. A seemingly simple request from a provider like, “Can I see all the medications you’re currently taking?” may take six to seven minutes to address with an elderly patient. Providers usually count on a comfortable mix of younger and older patients to achieve their average visit duration. However, when most of one’s patients are 65 and older, that becomes unrealistic.

■ With the current projections indicating a growing Hispanic population in the United States, healthcare providers would have to be more bilingual, more culturally sensitive, and reflect a more diversified staff. How provider offices communicate with patients could become a vital part of their business strategy. Other far-reaching implications include an examination of the number of Hispanic or Spanish-speaking providers produced.

■ Often, significant growth in the aging population implies an increase in chronic conditions and the need to address end-of-life issues.

The Growing Trend of Retail Healthcare

Between 2000 and 2006, when the first retail clinics emerged and quickly proliferated, traditional healthcare providers raised concerns about quality and protecting their market share. Meanwhile, the ability to get affordable and convenient treatment for minor illnesses such as coughs and sore throats became a welcome change with patients. The majority (91 percent) of patients who recently used a retail clinic reported that they were “satisfied” or “very satisfied” with their visit, according to an April 17, 2017, retail clinic survey from healthcare market researcher Kalorama Information.

Given the growing popularity and convenience of these retail healthcare delivery systems, many healthcare organizations have embraced that concept through partnerships with or the creation of storefront clinics, standalone walk-in and urgent care clinics, and supplemental telemedicine services. Retail giants like CVS and Walgreens are pushing further into care delivery, continuing to pressure traditional providers to increase access to care. The real question is: how will shifting the spectrum of care from hospitals to lower-cost sites affect the patient experience?

While the scope of services and delivery methods continue to evolve, what these on-demand healthcare services consistently have in common are convenience, affordability, and access. All three are vital to the patient experience. Doctors will be required to step up their efforts to optimize the patient experience, beyond measuring patient satisfaction.

Although some organizations were reluctant to embrace the retail movement, this disposition is changing. Since 2009, Springfield, Missouri-based CoxHealth has maintained a presence at numerous Walmart Supercenters. To date, CoxHealth runs five Walmart walk-in clinics and one clinic at a Hy-Vee grocery store. While Medicare and Medicaid also reimburse services provided at retail clinics, self-pay patients are expected to pay at the time of service. All prices are provided up front.

For the medium ground between assessing bug bites and performing surgery, urgent care centers provide relief without the wait or expense of going to the emergency department (ED). As they have become more widespread, so has their popularity. According to a study by Accenture, visits to urgent care centers rose 19 percent from 2010 to 2015. There are nearly 7,400 urgent care centers and counting in the United States, according to the Urgent Care Association of America.

One of the chief concerns of the opponents of retail healthcare is the quality of services offered. In the early retail clinic days, physicians’ organizations, including the American Medical Association (AMA) and American College of Physicians (ACP), were especially vocal about the trend’s potential downsides, including patient safety risks, damage to the physician-patient relationship, and the business threat to physician practices. In June 2017, the AMA House of Delegates adopted a policy that states that any individual, company, or other entity that establishes or operates retail health clinics should follow certain guidelines.

Among other things, delegates said that retail clinics should help patients without primary care providers (PCPs) obtain one; use electronic health records (EHRs) to transfer records to PCPs, with patient consent; and use local physicians as medical directors or supervisors of retail clinics. AMA delegates also stated that retail clinics should not “expand their scope of services beyond minor acute illnesses” such as a sore throat, common cold, flu symptoms, cough, or sinus infection. Similarly, the ACP released a position paper in 2015 that reflected an evolved marketplace in which the largely nurse practitioner (NP)-staffed clinics and primary care offices could coexist and even collaborate. The thrust of the new recommendations urged that retail clinics serve only as a backup alternative to primary care.

Nonetheless, many retail clinics that originally handled a short list of minor illnesses and injuries now play a role in chronic care management and more. CVS Health, for example, announced new MinuteClinic services for women’s health, skin care, and travel health assessments. Walgreens, in the meantime, has begun tackling mental health through an online screening questionnaire.

Retailers and grocery chains alike are expanding their operations to capture the value that the changing healthcare industry is creating. Adapting to the needs and wants of their customers, more pharmacy operations are demonstrating an increased focus within the health and wellness space. These companies’ evolution is assisting them in gaining a competitive advantage over their customers.

Telemedicine and Virtual Healthcare

Telemedicine and virtual healthcare are very quickly becoming a mainstay in the healthcare field. When it comes to short-term, self-limited needs, telemedicine and virtual medicine offer viable options for meeting consumers’ demands. They help consumers avoid having to call a medical office to make an acute care appointment; they obviate the need to drive to the office, sit in a crowded waiting room, and eventually be seen. This convenience can be especially appealing to a generation accustomed to doing everything with mobile devices, from texting to booking and checking in for flights. Patients needn’t take time off work or school to visit the clinic for consultations, follow-up appointments, lab results, or post-operative guidance. Physicians have more time in their schedules for new patients and those who must be seen in person.

Telemedicine...