![]()

Pan-European Food Market Segmentation: An Application to the Yoghurt Market in the EU

Carlotta Valli

Rupert J. Loader

W. Bruce Traill

Carlotta Valli is a Doctoral Student, Rupert J. Loader is Lecturer in Food Economics and Marketing, and W. Bruce Traill is Professor of Food Management and Marketing, all with the Department of Agricultural and Food Economics, The University of Reading, UK.

SUMMARY. An increasingly competitive international environment makes it necessary for firms to focus more and more on cross-country consumer segments. This increases the importance of international market segmentation and the need to develop new research approaches. The aim of this work is to present some of the results of a yoghurt segmentation study across Europe based on an innovative consumer measure explaining motivation to food choice, and to discuss the strategic implications of cross-country segments. The segmentation exercise identifies four pan-European segments with respect to yoghurt. The approach used for market segmentation proves to have important strategic implications, especially for the development of standardized product positioning concepts and communication strategy. [Article copies available for a fee from The Haworth Document Delivery Service: 1-800-342-9678. E-mail address: getinfo@ha worthpressinc. com <Website: http://www.haworthpressinc.com>]

KEYWORDS. Market segmentation, pan-European, yoghurt, means-end chains, marketing strategies

1 Introduction

Market segmentation is mainly applied to domestic markets. International market segmentation has probably not received similar attention, despite the internationalization of competition largely resulting from falling trade barriers that makes it necessary for firms to focus on international strategies. As has been noted by Traill (1997) much of this growth in international trade is intra-industry trade which relies on cross-country segments of consumers. In an increasingly competitive international environment, and with technological innovation enabling manufacturers to develop a wide product mix, it is important for these firms to be able to understand the similarities and differences in consumption patterns among consumers in their various target markets.

The purpose of this paper is two-fold. Firstly, the authors intend to stress the strategic importance of international segmentation, using the EU market as an example and the food sector as a case study. Second, a pan-European segmentation study based on an innovative measure of consumer-product relations is presented, applied to a selected food product, yoghurt. The potential strategic implications of pan-European consumer segments for food companies are also briefly discussed.

Section 2 discusses the importance of developing new approaches to market segmentation with respect to international food markets. In Section 3 the reasons for choosing the European yoghurt market for the segmentation study are discussed. Section 4 presents the development of the pan-European market segmentation exercise and discusses the results. In Section 5 the strategic implications of cross-country segments at the managerial and public policy level are discussed. Finally, Section 6 presents conclusions and some issues for future research.

2 International Segmentation of EU Food Markets

Given the heterogeneity of most markets, segmentation strategies allow for the identification of homogeneous groups of consumers likely to respond in similar ways to a particular marketing mix. For firms operating in an international environment accurate market segmentation assumes a key role given differences among countries due to cultural, socio-economic and political conditions. In a number of cases macro variables such as economic indicators, geographic location, political status and religion have been used to segment international markets to obtain “country segments” (Jain, 1990, 358-368; Baalbaki and Malhotra, 1993). The limitations of such studies are that they do not account for variation within countries and, in ignoring culture and history, create unlikely bedfellows such as Japan and Austria (e.g., Helsen et al., 1993). Their usefulness in predicting consumption is therefore limited.

The emerging Single European Market, encouraged by the elimination of trade barriers, stimulates market competition and requires firms operating in this market to base decisions on the dictates of a range of European consumers. Questions therefore arise as to whether the EU can be treated as one homogeneous market, or whether nation states maintain their own individual patterns of consumption. This leads to the question of whether pan-European segments exist, and if so how such segments can be identified and their characteristics described.

The debate on the globalization of consumer markets has produced a number of studies investigating the convergence of such consumption patterns. In the food sector, Herrmann and Roder (1995) study the convergence of food consumption in the OECD countries by analyzing the demand trend for food nutrients. Gil et al. (1995) investigate the relationship between economic development and food consumption trends in the EU, testing the convergence towards a common diet with respect to calorie intake. Both studies conclude that signs of convergence are present, although the convergence process could be a very slow one. However, convergence in consumption patterns does not mean uniformity, especially if convergence is measured on nutrient intake rather than actual product consumption. Askegaard and Madsen (1995) investigate the homogenization of food cultures within Europe by grouping regions according to respondents’ attitudes towards foods and eating behavior. It seems that culture remains an important separating factor, with not only countries but also regions likely to maintain their own identities with respect to food consumption behavior.

Attitude and behaviors common to consumers across Europe mainly refer to the search for convenience, more variety in foods, better and consistent quality of food products and concern over health (Steenkamp, 1996; Uhl, 1993; Leeflang and van Raaij, 1995). Grunert et al. (1993) have created a tool to measure food-related lifestyles based on consumers’ attitudes towards food, ways of shopping, cooking and eating behavior. Subsequently, Brunso et al. (1996) have used this instrument to segment food consumers in four EU countries. The study concludes that there are grounds to justify cross-country consumer segments with respect to food-related lifestyle, although consumers belonging to a particular segment would not necessarily show preference for the same type of food products.

In this paper an alternative segmentation procedure is used, based on means-end chains. The statistical methodology for market segmentation based on means-end chains was developed in the context of the EU funded AIR project “A Consumer-Led Approach to Foods in the EU: Development of Comprehensive Market-Oriented Strategies” by ter Hofstede, Steenkamp and Wedel (1997b). The main aims of the research project are to improve international market segmentation strategy in a pan-European context with respect to food products, and to identify new market opportunities for selected foods. Here, we present the segmentation results for yoghurt, which are based on a survey of about 4,000 consumers in 11 EU countries, and discuss their relevance as predictors of consumption behavior and as tools for firms wishing to target pan-European yoghurt market segments.

3 The European Yoghurt Market

An in-depth analysis of the market was based on market intelligence literature (Euromonitor, 1996; Retail Business, 1996; Mintel, 1995; Rabobank, 1994) supported by a number of interviews with marketing professionals in manufacturing companies, retail chains and trade organizations in four EU countries.

The consumption of dairy products in the EU follows a regional pattern, although a trend in the preference towards fresh, low-fat and perceived healthy products is evident throughout. As a consequence, the consumption of skimmed milk, yoghurt and fresh cheese has increased, whereas butter consumption has decreased. The overall demand for dairy products is expected to increase moderately in the EU, but the market for yoghurt and other value-added products is likely to grow faster thanks to the possibility for differentiation and new product development (Eurostat, 1995). The yoghurt market in particular has been characterized by consistent growth throughout the 1980s in most EU countries, and represents one of the most dynamic components of the dairy sector.

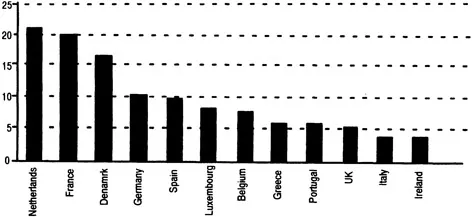

The recent growth of yoghurt consumption in mature markets (e.g. France) indicates that there are still market opportunities to be identified and exploited. Another factor suggesting untapped demand opportunities is the difference in the quantities consumed across the EU countries. Yoghurt consumption in the EU averages around 10 kg per capita per year (Euromonitor, 1996) ranging from about 5 kg in Italy and Ireland to over 20 kg in the Netherlands (see Figure 1).

The EU yoghurt market as a whole is dominated by a few multinational companies that account for about 60% of the total market and either produce yoghurt in, or export it to, a number of European countries. Medium to large companies serve either national or regional markets and their activities increasingly relate to the supply of retailers’ private labels. Other small to medium companies have to take advantage of the remaining market opportunities. For these companies, the identification of regional, national or crossnational segments, which may be too small to be of interest to the large companies, could be of considerable importance. They may include niche markets, which the SMEs are well equipped, and flexible enough, to work in.

FIGURE 1 Annual Yoghurt Consumption in the EU, 1994 (kg per capita)

Demographic factors are a major influence on yoghurt consumption. In particular, consumption appears to be high among the younger age groups, women, households with children, and the higher strata of income and education levels. In general, consumer preference for yoghurt appears to be mainly dictated by the perceived healthiness of the product on the one hand and taste on the other, although significant differences do exist across countries. The marketing professionals interviewed unanimously attribute such differences to culture and tradition, which are considered responsible for different preferences with respect to various yoghurt characteristics (e.g., mild/sour taste, thick/thin texture, pack-size, consumption occasions), as well as consumption levels.

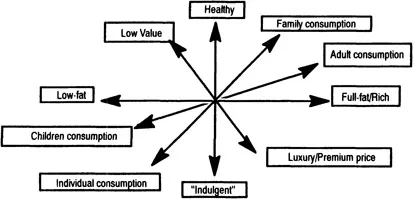

The yoghurt market shows a high degree of product differentiation, either by yoghurt attributes or by the information given to the consumer through advertising. The spectrum of product differentiation includes the characteristics shown in Figure 2.

The market also shows a high level of product adaptation activity, although core product innovation appears rather modest and new products seem to result mainly from reformulation, new flavors and new packaging. Growth through new product development is mainly expected in the indulgence/luxury end of the market, but the “health” factor remains important, and the market for low-fat, probiotic and organic products1 is expected to grow in the future.

FIGURE 2 Dimensions of Yoghurt Differentiation

The price of yoghurt differs significantly from country to country due to different pack sizes, retail structure, private labels’ share of the market, manufacturing structure, the level of market competition, and advertising expenditure. Industry interviewees identified several main bases for competition in the market, namely price, quality, access to distribution and good relationships with retailers, eff...