![]()

Part 1

Business Case

Future-proofing against natural capital shocks

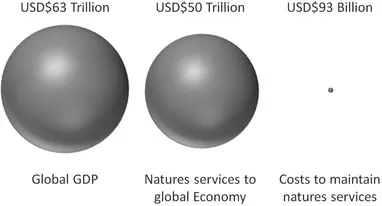

FIGURE 1. Comparison of global GDP, economic value of natures services and costs to maintain (per annum).

NATURAL CAPITAL – the critical systems and resources nature provides – underpins the successful functioning of our economy, businesses and societal wellbeing. However, much of this capital, for example, freshwater, forests and biodiversity are being depleted at an alarming rate and critical support systems such as the ability to regulate climate and flood defences are failing. The social and economic value of natural capital is vast, yet it is not adequately captured in the market. According to the Chartered Institute of Management Accounting (CIMA) and EY, ‘Natural Capital is the Elephant in the Boardroom – it is invisible in the vast majority of corporate decisions, accounts and economic models.’1 This is one of the causes of its ongoing degradation.

As illustrated in Figure 1, very conservative estimates of economic value provided by nature’s services to the global economy are $US50 trillion/ year compared to global GDP $US63 trillion/year. In comparison, a relatively small $93 billion is estimated as needed to preserve natural capital (figures are for 2010).2 This puts the scale in context.

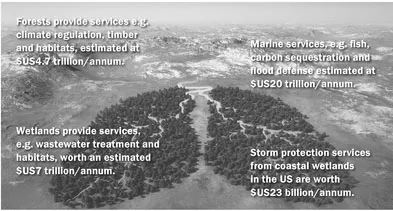

Examples of economic values estimated for a selection of nature’s services is in Figure 2.

FIGURE 2. Estimated market values for a sample of nature’s services (base years vary).3 SOURCE: Image from Shutterstock, used under standard Content Usage Agreement

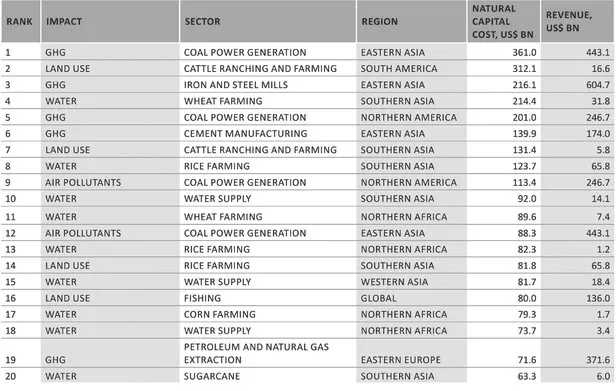

The global cost of environmental damage from business activities such as water pollution, loss of fertile land, soil erosion, drought, overfishing and deforestation is estimated at over $US6 trillion.4 This is estimated to rise to $US28 trillion by 20505 if ‘business as usual’ continues. If Mother Nature sent an invoice, estimates for the cost of the top 100 environmental externalities from business to the global economy/annum are over $US4 trillion according to a study from the Natural Capital Coalition.6 This includes costs from GHG emissions, pollution, land conversion, waste and water use from primary business sectors across world regions. The top 20 sectors with highest costs and regions most impacted are illustrated in Figure 3.

FIGURE 3. Ranking of the top 20 sectors and regions with the highest natural capital cost. The largest impact is noted. SOURCE: Natural Capital at Risk - Top 100 Externalities of Business, p. 28. Copyright ©Truoostfor Natural Capital Coalition (www.naturalcapitalcoalition.org), 15 April 2013

The study estimated that the profits of many high impact sectors would be wiped out if these costs were accounted for. While there are many assumptions and uncertainties built into the calculations of these costs, the important message is the urgent financial rationale for reducing natural capital risk. If these externalities were internalized through regulation, taxation or markets, many sectors annual profits would not cover the bill.

The future shock for business is the potential for profit to be wiped out as natural capital is internalized through regulation, taxation and markets. Companies who act now to future-proof are better positioned to manage and thrive in a future ‘resource-constrained’ world.

Our current economic and business models assume an infinite supply of natural resources and functioning ecosystems. This is flawed. One of the main drivers for integrating natural capital considerations in business is to understand the risks and opportunities from growing resource scarcity, malfunctioning ecosystems and increasingly erratic weather events associated with climate change. This is particularly the case for sectors with high natural capital dependencies, for example, food, energy generation, extractives, forestry, water utilities, pharmaceuticals and tourism.7 For example, an estimated 25–50 percent of the pharmaceutical market is derived from nature’s genetic diversity.8 It is estimated the Earth is losing one major drug every two years due to natural capital degradation.9 The Corporate Eco Forum (www.corporateecoforum.com/ valuing-natural-capital-initiative/) describes the backlog of debt this stripping of assets is causing:

A new kind of global debt crisis is brewing—this time, due to decades of over-borrowing from our planet’s natural capital asset base. At risk are critical life-support systems that are also the lifeblood of our global economy. Farsighted business leaders grasp what’s at stake. They see the business logic in taking action today – both to avert tomorrow’s on-balance-sheet risks, as well as to seize new revenue opportunities available to companies that generate environmentally restorative solutions. P.J. SIMMONS, CO-FOUNDER AND CHAIR, CORPORATE ECO FORUM

Business case for corporations

Measuring the environmental and social impacts of businesses is largely mainstream. Measuring its dependencies on natural capital stocks and services is not. Measuring both impacts and dependencies gives a holistic picture of risks and opportunities. Financially valuing these further translates this ‘non–financial’ information into ‘financial’. This common language can play an important role in communicating and prioritizing sustainability at the CFO and board level. It can enable the most significant or ‘material’ (in financial accounting language) to be understood in commercial terms and the implications for the company and its wider business model.

Materiality – issues that substantively affect the organization’s ability to create value over the short, medium and long term.10

For a corporation, delaying the measurement and management of natural capital carries a significant business risk for availability of key raw materials,

Valuing impacts and dependencies in financial terms translates ‘non–financial’ information into ‘financial’ information. This common language plays an important role in communicating and prioritizing sustainability at the CFO and board level.

associated price volatility and maintaining competitive advantage. For example, by analysing natural resource risk, associated price volatility and other sustainability improvements implemented, Unilever (www.unilever.com/images/pDF_generator_-_Greenhouse_gases _tcm_13-365028.pdf) estimates savings of €300 million ($US370 million) in avoided costs since 2008 (figures for 2012).11 On the positive side, financial valuation of natural capital costs and benefits also informs decisions on capital allocation, new investments, market opportunities and return on investment. For example, The Dow Chemical Company (Dow) integration of financial valuation of wetland services identified Net Present Value (NPV) savings of $US282 million for implementing a constructed wetland instead of an effluent treatment plant over the project’s lifetime, plus a wide range of non-financial biodiversity benefits. The UK’s largest property and landowner, The Crown Estate determined their Windsor Estate delivers £4.4 million ($US6.6 million) per annum gross external benefit using their Total Contribution approach to measure their environmental, social and economic value. More generally, measuring the costs and benefits of sustainability in business demonstrate their financial business case. Marks and Spencer (M&S) have shown their Plan A (now Plan A 2020) sustainability programme has delivered financial savings of £465 million ($US701million) plus wider benefits including staff motivation, brand enhancement and supply chain resiliency over the seven years it has been operating (see The Crown Estate, Dow and M&S case examples in Chapter 2).

A survey of 26 business early adopters on natural capital12 identified their rationale for early action as being much better positioned than other companies to manage and thrive in a future ‘resource-constrained world’. First mover advantage has also been a motivation, for example, PUMA’s (part of Kering Group; www.kering.com/en/sustainability/environmentalpl) early leadership example of an Environmental Profit & Loss account monetizing their environmental impacts across the supply chain.13

Several business case rationales from early adopters are described.

Dow believes that valuing nature makes good business sense. Valuing natural capital and ecosystem services helps Dow make better business decisions for Dow, for our communities, and for the planet we share. MARK WEICK, DIRECTOR, SUSTAINABILITY PROGRAMS AND ENTERPRISE RISK MANAGEMENT, THE DOW CHEMICAL COMPANY

Sustainability is both a moral and commercial imperative – in short, there is a business case for going green. ADAM ELMAN, GLOBAL HEAD OF DELIVERY – PLANA, MARKS & SPENCER PLC

For me sustainability is a central driving factor behind our strategy and our long-term commercial success. Total Contribution has helped us to take a more rounded look at how we measure the value this creates – going beyond just the numbers and fulfilling the old adage, we treasure what we measure. ALISON NIMMO, CEO, THE CROWN ESTATE

Of course, the bounty of nature is priceless. But the unfortunate effect of our seeing these inputs to well-being as incalculable has been that they are treated as free. That ...