![]()

CHAPTER 1

“The first thing to understand is that you do not understand.”

—Søren Kierkegaard

CHAPTER OBJECTIVES

This chapter will:

• Present the historical context of international business and establish the role of multinational corporations in the current business environment

• Describe the various operating advantages and disadvantages facing the multinational corporation

The quote above by the Danish philosopher Kierkegaard was intended for a philosophical interpretation, but the quote could just as easily apply to international business. Countless businesses have failed in their international expansion effort because they did not heed these words. For students as well as for business professionals, the successful entry into foreign markets must come with the realization that everything is not necessarily the same as in the domestic market. This first chapter will provide examples of some companies that have been successful by learning how to successfully compete in today’s global marketplace. But first, the subject of international business must be discussed in its historical context.

CURRENT SCOPE AND HISTORICAL ANTECEDENTS

In the world of business in the twenty-first century, vast business interrelationships span the globe. Far more than ever before, products, capital, and personnel are becoming intertwined as business entities increasingly consider their market areas as global rather than simply domestic or even foreign. More and more companies, some of which have annual sales levels larger than the gross national product of some countries, consider every corner of the globe a feasible source of raw materials and labor or a new market possibility.

As business has expanded across national borders, it has been followed by banks and financial institutions to meet the need for capital for investment and operations around the world. Financial markets have also become intricately linked, and movements and changes in the US stock market have a direct impact on equity markets in other parts of the world.

Today, only a naive businessperson would believe that an enterprise can grow and prosper entirely within the confines of its domestic market borders. The phenomenon of global expansion is not only for large corporations, as evidenced by the success of Germany’s Mittelstand. These are medium-sized, family-owned businesses that have experienced much success in exporting in recent years. Domestic business must at least be aware of international sources of competition, because they are an ever-present and growing threat as international business relationships become increasingly intricate and complex. The source of these changes in the dynamics of world markets and economies is international business activity being pursued around the globe.

WHAT IS INTERNATIONAL BUSINESS?

In its purest definition, international business is described as any business activity that crosses national boundaries. The entities involved in business can be private, governmental, or a mixture of the two. International business can be broken down into four types: foreign trade, trade in services, portfolio investments, and direct investments.

In foreign trade visible physical goods or commodities move between countries as exports or imports. Exports consist of merchandise that leaves a country. Imports are those items brought across national borders into a country. Exporting and importing constitute the most fundamental, and usually the largest, international business activity in most countries.

In addition to tangible goods, countries also trade in services, such as insurance, banking, hotels, consulting, and travel and transportation. The international firm is paid for services it renders in another country. The earnings can be in the form of fees or royalties. Fees are generated through the satisfaction of specific performance and can be earned through long- or short-term contractual agreements, such as management or consulting contracts. Royalties accrue from the use of one company’s process, name, trademark, or patent by someone else.

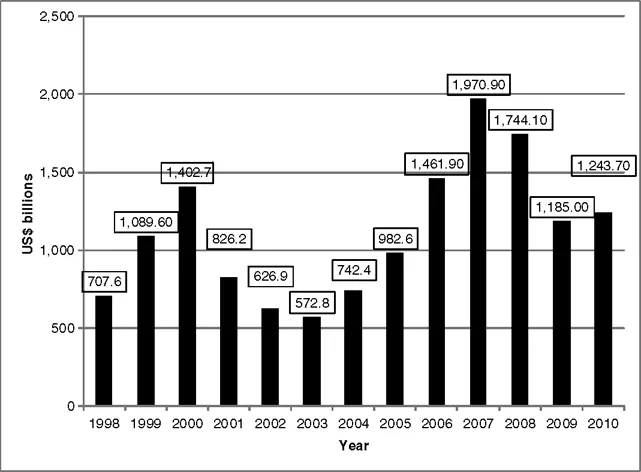

Figure 1.1 World FDI Inflows, 1998–2010

One example of a fee situation is the turnkey operation, in which a foreign government or enterprise hires the expertise appropriate to starting a new concern, plant, or operation. The turnkey manager goes into the foreign environment and gets an operation up and running by designing the plant, setting up equipment, and training personnel to take over. The foreign firm then takes over the reins of management and continues operating the facility. Alternatively, a firm can earn royalties from abroad by licensing the use of its technology, processes, or information to another firm or by selling its franchise in overseas markets.

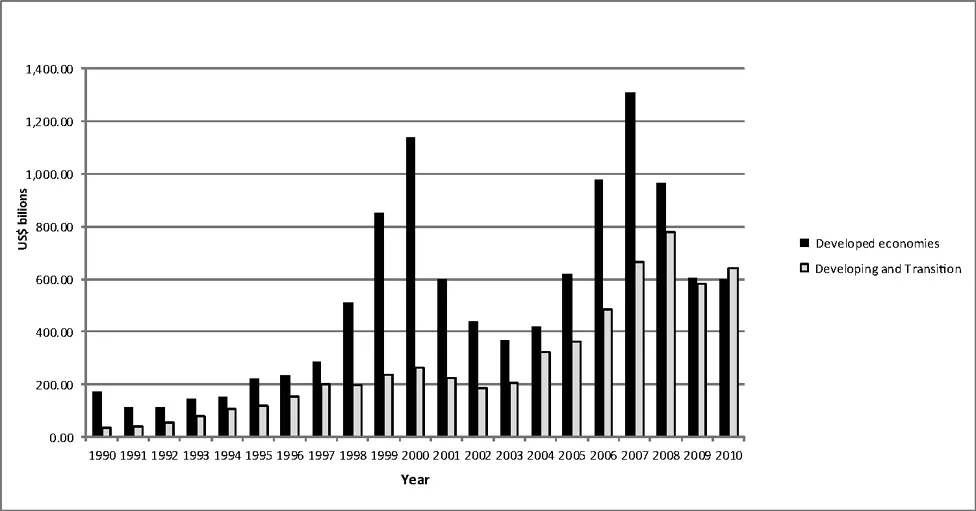

Portfolio investments are financial investments made in foreign countries. The investor purchases debt or equity in the expectation of nothing more than a financial return on the investment. Resources such as equipment, time, or personnel are not contributed to the overseas venture. Direct investments are differentiated by much greater levels of control over the project or enterprise by the investor. The level of control can vary from full control, when a firm owns a foreign subsidiary entirely, to partial control, as in arrangements such as joint ventures with other domestic or foreign firms or a foreign government. The methods of conducting international business will be discussed more thoroughly in subsequent chapters. As is illustrated in Figure 1.1, the level of foreign direct investment (FDI) peaked at $1.970 trillion in 2007, the year of the global economic downturn. Since 2007, FDI growth has slowed the most in developed economies. While the developed economies in Europe were the leading destination of FDI prior to the 2007 financial crisis, FDI has decreased from $895 billion in 2007 to $313 billion in 2010. Combined developing and transitioning economies’ FDI peaked in 2008 at $778.9 billion, while developed economies FDI slowed to $965 billion. As illustrated in Figure 1.2, more FDI is now flowing to developing and transition economies than flowing to developed economies.1

Source: Inward and outward foreign direct investment flows, annual, 1990–2010, UNCTAD Stat, http://www.unctadstat.unctad.org/ReportFolders/reportFolders.aspx.

Figure 1.2 FDI Inflows Developed vs. Developing and Transition

BRIEF HISTORY OF INTERNATIONAL BUSINESS

International business is not new, having been practiced around the world for thousands of years, although its forms, methods, and importance are constantly evolving. In ancient times, the Phoenicians, Mesopotamians, and Greeks traded along routes established in the Mediterranean. Commerce continued to grow throughout history as sophisticated business techniques emerged, facilitating the flow of goods, resources, and funds between countries. Some of these business methods included the establishment of credit for exchange, banking, and pooling of resources in joint stock ventures during the Renaissance period. This growth was further stimulated by colonization activities in the seventeenth and eighteenth centuries, which provided the maritime nations with rich resources of raw materials as well as enormous potential markets in the new worlds.

The Industrial Revolution further encouraged the growth of international business by providing methods of production for mass markets and more efficient methods of utilizing raw materials. As industrialization increased, greater and greater demand was created for supplies, raw materials, labor, and transportation. The flow and mobility of capital also increased as higher production provided surplus income, which was, in turn, reinvested in further production domestically or in the colonies. The technological developments and inventions resulting from the Industrial Revolution accelerated and smoothed the flow of goods, services, and capital between countries.

By the 1880s the Industrial Revolution was in full swing in Europe and the United States, and production grew to unprecedented levels, abetted by scientific inventions, the development of new sources of energy, efficiencies achieved in production, and new forms of transportation, such as domestic and international railroad systems. Growth continued in an upward spiral as mass production met and surpassed domestic demand, pushing manufacturers to seek enlarged, foreign markets for their products. It led ultimately to the emergence of the multinational corporation (MNC) as a new organizational entity in the international business world.

In more modern times, the creation of the internet as an electronic commerce platform and the ever-expanding capacity of telecommunications and technology have contributed to an increased expectation for product and service quality and availability throughout the world. As global markets become increasingly interconnected, the benefits of integration have become more obvious, as have the pitfalls of the increased speed of transactions. The current form of international business is a continuation of globalization that began long ago, with no end in sight for its future march of progress.

THE MULTINATIONAL CORPORATION

During its early stages, international business was conducted in the form of enterprises that were owned singly or in partnerships. As the size of organizations grew with industrialization and need for capital by companies increased, corporations began to displace privately held firms. These corporations had the distinct advantage of being entities with a separate legal identity, consequently limiting the liability of the principals or owners. At the same time, by issuing shares of stock, the corporation could tap an enormous pool of excess funds held by potential individual investors.

With the emergence of the multinational enterprise in the late 1800s and...