- 212 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Q&A Company Law

About this book

Routledge Q&As give you the tools to practice and refine your exam technique, showing you how to apply your knowledge to maximum effect in assessment. Each book contains essay and problem-based questions on the most commonly examined topics, complete with expert guidance and model answers that help you to:

Plan your revision and know what examiners are looking for:

-

- Introducing how best to approach revision in each subject

-

- Identifying and explaining the main elements of each question, and providing marker annotation to show how examiners will read your answer

Understand and remember the law:

-

- Using memorable diagram overviews for each answer to demonstrate how the law fits together and how best to structure your answer

Gain marks and understand areas of debate

-

- Providing revision tips and advice to help you aim higher in essays and exams

-

- Highlighting areas that are contentious and on which you will need to form an opinion

Avoid common errors:

-

- Identifying common pitfalls students encounter in class and in assessment

The series is supported by an online resource that allows you to test your progress during the run-up to exams. Features include: multiple choice questions, bonus Q&As and podcasts.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Q&A Company Law by Mike Ottley in PDF and/or ePUB format, as well as other popular books in Law & Financial Law. We have over one million books available in our catalogue for you to explore.

Information

1

Formation of Companies and Consequences of Incorporation

Introduction

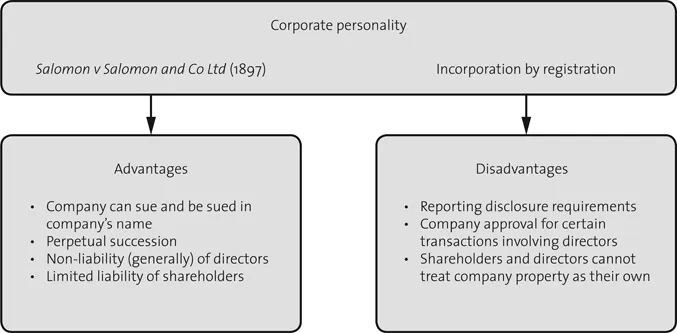

Questions are rarely set solely upon the rules relating to the formation of companies. However, in tackling questions on the consequences of incorporation, some appreciation of the rules of formation (and the different types of company) is appropriate. Factors which might influence the decision to incorporate, the effects of incorporation and ‘lifting the veil’ are common areas for questions. Questions involving ‘lifting the veil’ generally require some form of critical analysis rather than a mere recitation of decisions. Another, broader type of question regularly encountered involves advice about incorporation and running of companies and possible types of investment in a company either in general or for specified persons (e.g. a brilliant, but non-business minded, inventor). Material relating to formation should also be incorporated in questions relating to the different legal regime applicable to public and private (particularly quasi-partnership) companies and general questions about disclosure.

The law relating to promoters and pre-incorporation contracts can be regarded as part of the formation of a company. Questions on promoters may be linked with the liability of directors and a question could combine a pre-incorporation contract with a post-incorporation contract. However, the increasing use of ‘off-the-shelf’ companies for small private companies renders promoters and pre-incorporation contracts of diminishing importance. Some courses may require students to be familiar with methods of raising capital – such material is likely to form a small part of a problem or be examined by means of a simple essay which merely demands a competent recitation of facts; but, obviously, every question setter has their own hobbyhorse(s).

Checklist

Students should be familiar with:

- ■ how a company can be formed and the different types of company;

- ■ advantages and disadvantages of incorporation;

- ■ effects of incorporation;

- ■ circumstances in which the separate legal personality of a company can be disregarded, both at common law and by statute (particularly fraudulent and wrongful trading);

- ■ promoters, particularly their duties and rights;

- ■ liability for pre-incorporation contracts.

Students should be aware that related issues which could be linked to questions based on this area include:

- ■ the distribution of power within a company;

- ■ enforcement of the articles of association;

- ■ liability and/or protection of directors/investors, including disqualification of directors;

- ■ restructuring of share capital.

Question 1

Do the advantages of incorporation compensate for the bureaucracy involved in running a company?

How to Read this Question

A relatively, straightforward essay question, demanding an assessment of the significance of incorporation.

How to Answer this Question

A question such as this – a variant on the very well-worked theme of the advantages and disadvantages of incorporation – can only be tackled by someone who knows the material. It is very difficult to score high marks on such a question, since there is little scope for anything but a neat summary of the advantages of incorporation and a further summary of the bureaucratic requirements alluded to – a rare question where a list might be beneficial.

Answer Structure

The advantages and disadvantages of setting up a company.

Answer

Incorporation of an existing or projected enterprise (not necessarily a business) can be achieved either by forming a company in compliance with the procedure laid down in the Companies Act (CA) 2006 or by buying a pre-existing company ‘off-the-shelf’ (the latter procedure accounts for about 60% of ‘formations’). In either case, to incorporate a company, s 9 CA 2006 requires the delivery, to the Registrar of Companies, of a memorandum of association (s 8 CA 2006), an application for registration (ss 9–12 CA 2006) and a statement of compliance (s 13 CA 2006). Articles of association are also required to be registered, by virtue of s 18 CA 2006. The content of the articles, which are the company’s internal rules, are determined by the founders of the company. If articles are not registered or the articles that are registered do not exclude or modify the ‘default’ articles of the Companies (Model Articles) Regulations 2008 for different types of companies, the default articles will apply (s 20 CA 2006).1 Previously, the default articles were Table A of the CA 1985, if the company was limited by shares. The advantage of purchasing an off-the-shelf company is that the company already exists and there is no delay between deciding to form a company and the company coming into existence through the registration process; there is merely a transfer of shareholding. This obviates the problem of pre-incorporation contracts and the possibility of having stationery printed bearing a name which, by the time the company is registered, has been taken by another company. However, an off-the-shelf company would not have been formed with the specific requirements of the promoters in mind and alterations of the articles might be required. For most people interested in forming (or buying) a company, the appropriate form of company will be a private company limited by shares (ss 3(1), 3(2) and 4(1) CA 2006).

The UK has traditionally had more companies than other European countries of comparable size (there are more than two million limited companies registered in Great Britain and more than 300,000 new companies are incorporated each year). What are the attractions of incorporation? The principal advantage of incorporation, from which a variety of benefits flow, is that a company is a distinct legal entity with rights and duties independent of those possessed by its shareholders, directors and employees. In consequence, for example, business conducted in the name of a registered company is separate from the personal affairs of the human beings who act for the company, and separate also from the affairs of any other business that those human beings may conduct on behalf of another registered company. Corporate personality was created by statute in the first half of the nineteenth century, but the full significance of this provision was not appreciated until the famous case of Salomon v Salomon and Co Ltd in 1897.

In Salomon,2 S converted his existing, successful business into a limited company, of which he was the managing director. S valued his business at £39,000 (an honest but optimistic valuation) and received from the company, in discharge of this sum, a cash amount, a debenture (which is an acknowledgement of a debt) and 20,001 £1 shares out of an issued share capital of £20,007. S’s wife and five children each held one of the remaining issued shares (seven being the minimum number of shareholders at that date), probably as his nominee. The company went into insolvent liquidation within a year with no assets to pay off the unsecured creditors. The issue for the courts was whether S was liable for the company’s unpaid debts. The House of Lords, reversing the Court of Appeal, held that the company had been properly formed and was a legal person in its own right, separate from S, notwithstanding his dominant position within the company. The company was not S’s agent and, consequently, S’s liability was to be determined solely by reference to the CA 1862. The Act required a shareholder to contribute to the debts of a company only where he held shares in respect of which the full nominal value had not been paid. S had paid for his shares, in full, by transferring the business to the company, so he had no liability to the creditors of the company. Thus, the Salomon case established that legal personality would be recognised even where one shareholder effectively controlled the company and had fixed the value of the assets used to pay for those shares.3

The effects of separate legal personality are many and include the following:

- a company can sue and be sued in its own name;

- a company has perpetual succession. A company cannot die simply because all its shareholders are dead, although it can be wound up or struck off the register by the Registrar of Companies if it appears to be moribund. Because a company exists, unless and until it is wound up or deregistered, property, once transferred to the company, remains the property of the company, to do with as it pleases;

- the shareholders, directors and employees are not liable for criminal or tortious acts committed by the company, although they may incur personal liability concurrent with that of the company. For example, a company might, through the combined acts or omissions of several employees, establish and operate an unsafe system of work which caused the death of an employee. The company would be liable but an individual director or employee would not be liable unless he was personally negligent or the company was acting as an agent or employee of that individual;

- the shareholders, directors and employees are not liable on (nor can they enforce) contracts entered into by the company. As with criminal and tortious liability, an individual may incur personal liability concurrent with that of the company if he also enters into the contract. Furthermore, where the company acts as the agent of an individual, the individual is liable under the normal rules of agency;

- a company may be formed with limited liability (s 3(1) CA 2006). Limited liability allows the members of a company to limit their responsibility for a company’s debts. Liability may be limited to a predetermined sum, payable on winding up (a company limited by guarantee – s 3(3) CA 2006), or to the nominal value of the shares held, unless this sum has been paid by the current or a former shareholder (a company limited by shares – s 3(2) CA 2006). Since most shares are issued fully paid, shareholders have, effectively, no liability for the company’s debts;

- where a company has transferable shares, ownership of the company can be split or transferred without affecting the company itself;

- formation of a company may bring financial benefits. For example, a company can raise money to create floating charges and, perhaps, to minimise the tax liability of the shareholders.4

There are drawbacks to separate legal personality, in that the property of the company, not being that of the members, cannot be insured by a member and the company cannot claim on an insurance effected by a person on property which he then owned but subsequently transferred to the company (see Macaura v Northern Assurance (1925)). Moreover, the assets of the company are the property of the company and a shareholder, even a controlling shareholder, cannot simply help himself to the company’s cash. In addition, there is a limited number of situations where Parliament or the courts have decreed that corporate personality should be ignored, for example, where the directors have engaged in fraudulent or wrongful trading, they can incur personal liability under ss 213–214 of the Insolvency Act (IA) 1986. But what bureaucratic drawbacks are there to incorporation? In return for the advantages of incorporation, Parliament requires the observation of mandatory rules on the operation of a company. These rules are lengthy and complex and there can be no doubt that, in most companies, many administrative rules, for example on the conduct of meetings, are largely ignored. Perhaps in recognition of the widespread lack of use of some of the rules, the government reduced the administrative burden on companies, especially smaller companies, by the passing of the CA 2006. The CA 2006 permits a private company, for instance, to dispense with the holding of annual general meetings and to pass written resolutions by a bare or three-quarters majority.

Such reforms are small measures, and even with the passing of the Companies Act 2006 on certain administrative aspects of the formation and running of companies, there is still an immense amount of law imposing obligations upon companies, shareholders and directors which would not apply to a sole trader or to an ordinary partnership. These obligations fall into four broad groups:

- (a) Much of company administration is subject to statute (CA 2006) and there are rules relating to directors and the company secretary (ss 154–259 and ss 270–280 CA 2006, respectively, although a private company is no longer required to have a company secretary). The conduct of meetings of shareholders and directors...

Table of contents

- Cover

- Half Title

- Title

- Copyright

- Contents

- Table of Cases

- Table of Legislation

- Guide to the Companion Website

- Introduction

- 1 Formation of Companies and Consequences of Incorporation

- 2 The Company and Insiders

- 3 The Company and Outsiders

- 4 Directors

- 5 Shareholders and their Rights

- 6 Share Capital

- 7 Loan Capital

- 8 Administering the Company and Corporate Insolvency

- Index