![]() PART I

PART I

COMPLIANCE CONTEXT![]()

1

Regulation and Risk

Risk and Regulation

The effective management of the risk that is an inevitable part of business is vital if business operations are to be successful. This applies at all levels, from the smallest to the largest of transactions: failure to manage risk effectively can result in failure to achieve business aims and ultimately lead to failure of the business itself.

One means of managing risk is to put in place measures to ensure business is transacted in a particular way and thereby reduce the likelihood of potential risks being realised. These measures might take many forms, one of which is regulation. Regulation might be derived directly from within the business itself through internal systems and controls that reflect the aims of the business, or be imposed by external parties who have wider responsibilities than just the particular element of which the business is a part.1 Regulations of whichever type place distinct restrictions on the way in which business can be carried out. This can have both positive and negative consequences. Consider this example:

Internal or external requirements that activities be carried out within certain parameters might result in the business being viewed more positively by its customers, but these requirements might be at an additional cost to the business. This could be viewed as a negative, particularly if the business considers the costs to exceed the benefits gained from positive customer perception, which would especially be the case if those benefits were effectively unmeasurable. In response to this, those businesses subject to external regulation might challenge the regulations as being unfair, which might then impact on the aims of the internal or external regulators who implemented them in the first place.

Balancing the impact of regulation is therefore an important consideration for both regulators and regulated alike, with consequences for the practical management of both regulatory and compliance risk.

Regulation, Risk and the Financial Services Industry

The financial services industry is a significant worldwide business, providing jobs for millions and generating billions in monetary terms for the world economy.2 At both a global and national level, the industry plays a significant role in practical day-to-day operations, offering an environment in which business can be transacted. It is not unreasonable to take the view that without the opportunities afforded by financial services to the many parties involved, business in the form we recognise today – personal, public, national, international, global – would not be possible. Financial services are a core component of modern business activity.

Underpinning all of this is a complex web of regulation, intended to support the goals of the industry and ensure operations within it are transacted effectively and in an acceptable manner. As to what is acceptable and who the arbiters of this should be, this is not solely the preserve of the financial services industry itself. Due to the nature of this industry and its role both within business and the world economy, its operations have a broad range of influence. Its activities impact on us all and therefore have systemic implications. The potential for such extensive, system-wide impact across a range of markets, the economy or society as a whole heightens the need to manage the risks inherent within this industry. Therefore the role of regulation in this market has widespread significance for many, not only those directly involved.

Regulation

In order to appreciate the relevance of regulatory and compliance risk management in this broader context and, in turn, appreciate the role of the Compliance function itself, it is necessary to consider the purpose of regulation and the needs of participants within the regulatory environment from which regulation emerges.

Although it is a term open to interpretation, regulation for the purposes of this text is taken to mean ‘a rule or directive made and maintained by an authority and/or the action or process of regulating or being regulated’. Specific definitions vary, but ask the average individual, who will undoubtedly have been subject to regulation in one form or another (such as, for example, ‘Do not park here: Subject to a Fine!’ or ‘Your tax return must be returned on time or you will be subject to penalty’ and so on), and they will certainly be able to hazard a guess as to what regulation signifies: namely, statements or instructions either to do or not to do something, at pain of falling foul of certain requirements and being penalised as a result. Consequently, regulation can have quite negative connotations, with its overtones of control and restriction.

But take a step back and think: where would we be without it? In a world with no rules in which each and every one of us could do exactly as we wished, when we wished, what would the consequence be both for ourselves and for everyone else? Would the result be roundly positive for us all? Is it likely that we could all do as we pleased without our choices affecting others? Or would the result be something more akin to chaos? As with many things in life, the true outcome would likely be some combination of both. Historically, however, given the needs of the many, rather than the few, the latter experience has tended to prevail. As a consequence, sets of ‘rules’ to govern behaviour have been introduced. These rules have either developed organically as equitable agreement has been reached between the parties involved about particular behaviours or requirements, or alternatively have been implemented through the use of force (violent or otherwise). Society has then further developed these rules, either formally through laws, or informally through accepted social norms. Although deeper consideration of this interesting subject is beyond the scope of this text, the emergence of rules, guidelines and accepted practice is of relevance to our discussion and should be borne in mind. All of these factors support the fundamental purpose of regulation, which is intended to impose some form of order on interactions, reflecting the mutual goals, whatever these might be, of the participants (or, as they are increasingly known, the stakeholders) involved.

Agreements as to the way in which matters will be transacted have continued to develop for different aspects of life over many thousands of years. Business operations have of course been subject to the same process. Broadly, such agreements are concerned with managing the interests of those involved, helping to ensure that all, ideally, have an equal opportunity to achieve their aims. In simple terms the ideal transaction goals could be described as follows:

• Seller – wishes to sell a particular product or service and, in doing so, receive fair and adequate recompense (profit) for the resources utilised to produce it.

• Buyer – wishes to purchase a particular product or service and, in doing so, make fair and adequate payment for it.

Inevitably, aspects of this ‘simple’ exchange will be open to interpretation. The goals of each party will likely not necessarily be as idealised in the commercial environment as might be wished or as are presented in this scenario. In addition, there are of course other influences on each transaction (and indeed other stakeholders to it). These issues will be explored shortly. But if we extrapolate the key aims and desires of the parties to this simplified transaction, it provides us with a simple summary of what regulation is intended to achieve, essentially:

• Creating an agreed set of rules and requirements, known to each party.

• Providing clarity and openness, thus encouraging fairness and equality.

If a transaction was undertaken on this basis, what would the outcome be? If it allows each party to transact with more confidence, it will encourage participation. This will in turn encourage more participation, more buying and selling, and so the cycle continues. This promotion of confidence in the market, whichever market that happens to be, encourages wider participation than might otherwise be the position if such agreements (that is, regulation) as to the way in which the transaction should be undertaken were not in place.

Stakeholders in Regulation

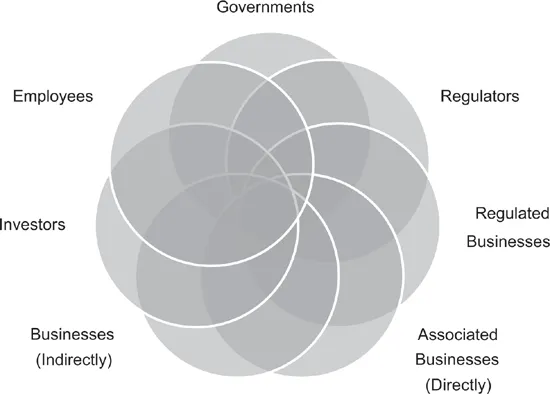

When we speak of stakeholders in the regulatory environment, who exactly are we referring to? Think about those who have an interest in it, who are affected by the actions that take place within it and the decisions that support these. The diagram on the following page provides a simplified overview of the main groups that we might consider as stakeholders in regulation.

The aims and objectives of these stakeholders and the consequent impact of their activities on the regulatory environment will be explored in Chapter 2. For now, think about how the creation and support of confidence in, and trust of, the market for all stakeholders underpins the purpose of regulation.

Figure 1.1 Stakeholders in the regulatory environment

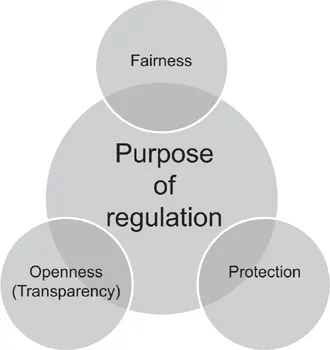

Considering the purpose of regulation in the context of the aims and objectives of these stakeholders, the key characteristics of an effective regulatory environment could be described as follows:

Figure 1.2 Purpose of regulation

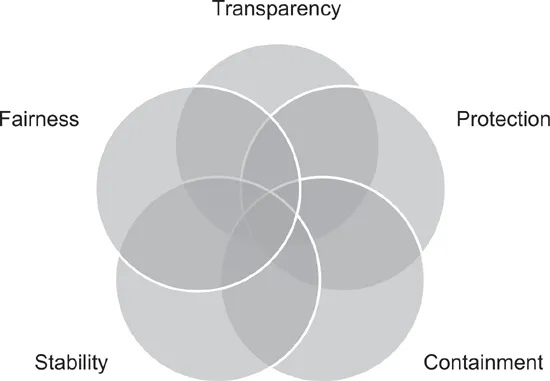

Of course, depending upon the market and its significance (itself an important point, which we will come back to shortly) other key aims might be:

• the containment of problems arising within the market, so they do not impact on other parties, both within and outside of it;

• ensuring the health (business, financial and so on) of all involved (particularly those with significant influence or power), so that other participants in the market (particularly those less knowledgeable or powerful) are not harmed.

Upon incorporating these additional objectives, a more accurate depiction of the characteristics of an effective regulatory environment might be as follows:

Figure 1.3 Expanded aims of regulation

These objectives, with varying emphasis depending upon the particular market or sector referred to, lie at the heart of the regulatory objectives of regulators in jurisdictions across the world, a point we will explore further in Chapter 2. In the meantime, let’s look at the implications of these characteristics as we consider their relevance for the development of regulation.

Structuring a Regulated Market

Before proceeding further, it is worth emphasising that the introduction of regulation into a market will not of course remove all risk from it. Nor is it intended to do so. Given the inherent nature of risk and indeed of the market itself, this would be an impossible goal, doomed to failure from the outset. To understand the reason for this, we need to appreciate that risk does not operate in isolation; it is inextricably linked with reward. Risk and reward exist as two sides of the same coin and without the opportunity to gain reward there is no reason to take risk in business. This is a fundamental principle of market economics; the reward-seeker is at the same time the risk-taker. This applies to both parties involved in the transaction as they both seek to exchange something they have for something they do not. However, in participating in the transaction, both parties want to maximise their reward and minimise their risk, which would be fine if both parties participated from a position of equality. In reality, there is invariably inequality between them, which enables one to enjoy disproportionate rewards at the expense of the other suffering disproportionate risk. But what regulation can do, through emphasising transparency, fairness and protection, is level the playing field between the different participants by setting out the ‘rules of the game’. At the very least those intent on participating will then appreciate what they are becoming involved in. In doing so, regulation of whichever form encourages market stability and contributes to the means by which negative issues arising can be effectively contained, limiting impact on the wider environment.

Nevertheless, the existence of regulation to provide structure to a market does not directly equate to an equal understanding of it for all participants, for how could it? Within many markets, except perhaps the most basic, some participants will be deemed expert and others amateur; there will thus always exist a strong element of unevenness in such environments. The development of legislation needs to take this into account, whilst accepting that with or without regulation there will always be asymmetries of knowledge. Regulation seeks to manage such inequalities to a greater degree than would otherwise exist, with its focus on creating a fair environment through transparency of requirements and, in doing so, protect consumers and the markets themselves.

There are many who would argue that formal regulation is unnecessary.3 Such arguments maintain that the market, in whichever area ...